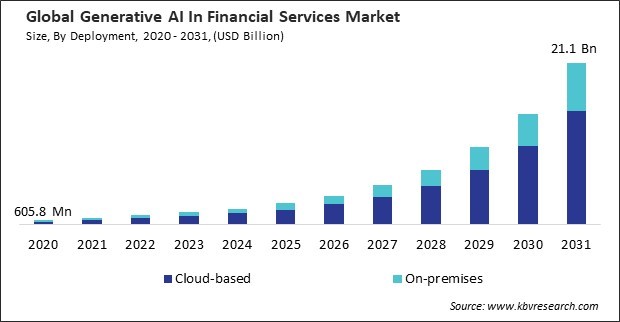

“Global Generative AI In Financial Services Market to reach a market value of 21.1 Billion by 2031 growing at a CAGR of 38.8%”

The Global Generative AI In Financial Services Market size is expected to reach $21.1 billion by 2031, rising at a market growth of 38.8% CAGR during the forecast period.

Many countries in the Asia Pacific are experiencing significant digital transformation in their financial sectors, with increased investment in AI technologies. This trend is evident in countries like China, India, and Singapore, where financial institutions leverage Generative AI to enhance services and improve operational efficiencies. Thus, the Asia Pacific region would acquire 26% of the total market share by 2031.

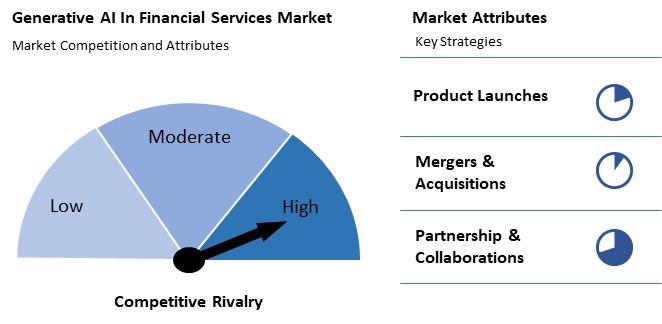

The major strategies followed by the market participants are Partnerships as the key developmental strategy to keep pace with the changing demands of end users. For instance, In May, 2024, Oracle Corporation announced a partnership with Accenture, a global consultancy firm, to develop generative AI solutions. Leveraging Oracle Cloud Infrastructure, the two companies aimed to improve efficiency, resilience, and customer experiences, focusing initially on digital finance transformation and expanding to other industries. Moreover, In August, 2024, Accenture PLC signed a partnership with S&P Global, a capital market company. The partnership aimed to drive generative AI innovation in financial services.

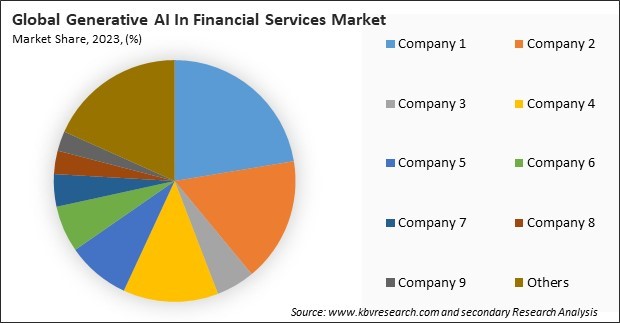

Based on the Analysis presented in the KBV Cardinal matrix; Microsoft Corporation and Google LLC are the forerunners in the Market. In May, 2024, Microsoft Corporation teamed up with, an IT company, to launch GenAI-powered cognitive assistants for financial services: Wipro GenAI Investor Intelligence, Investor Onboarding, and Loan Origination. These solutions, powered by Azure OpenAI, aim to enhance market intelligence, accelerate onboarding, and streamline loan origination, providing personalized and efficient service to clients. Companies such as Amazon Web Services, Inc., Oracle Corporation, IBM Corporation are some of the key innovators in Market.

The volume of data generated in the financial sector has surged dramatically due to digital transactions, customer interactions, and regulatory requirements. In addition, Generative AI technologies offer sophisticated analytical capabilities that can identify patterns, trends, and correlations within financial data that may not be apparent through traditional analytical methods. In conclusion, the rising demand for advanced analytics and insights drives the market's growth.

Modern consumers expect personalized financial services catering to their needs and preferences. They seek solutions that address their current financial situations and anticipate future requirements. With the insights generated by AI, financial institutions can rapidly innovate and customize their product offerings. Thus, increased focus on customer-centric financial solutions propels the market's growth.

The initial setup of Generative AI systems requires considerable financial investment. This includes the cost of acquiring advanced hardware, such as high-performance servers and GPUs, as well as specialized software and licenses. Integrating Generative AI solutions with existing financial systems and IT infrastructure can be complex and costly. Therefore, high implementation and operational costs are hampering the market's growth.

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Partnerships, Collaborations & Agreements.

On the basis of deployment, the market is segmented into on-premises and cloud-based. In 2023, the on-premises segment attained 28% revenue share in the market. Many financial institutions still prefer on-premises solutions for various reasons, particularly regarding data security and compliance.

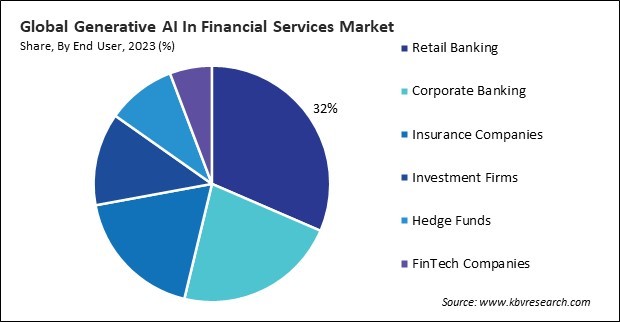

By end user, the market is divided into retail banking, corporate banking, insurance companies, investment firms, hedge funds, and FinTech Companies. The corporate banking segment procured 22% revenue share in the market in 2023. Corporate banks leverage Generative AI to manage complex transactions, assess credit risk, and enhance decision-making processes.

Based on application, the market is divided into risk management, fraud detection, credit scoring, forecasting & reporting, and customer service & chatbots. The fraud detection segment attained 23% revenue share in the market in 2023. Financial institutions increasingly leverage Generative AI to analyze transaction patterns and identify anomalies, enhancing their real-time capabilities to detect fraudulent activities.

Free Valuable Insights: Global Generative AI In Financial Services Market size to reach USD 21.1 Billion by 2031

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. In 2023, the North America region witnessed 42% revenue share in the market. North America, particularly the United States, boasts a robust technological ecosystem with significant AI research and development investments.

The competition in the generative AI market for financial services is intense, driven by fintech startups, tech giants, and established financial institutions. Key players focus on enhancing risk management, fraud detection, customer service, and personalized financial products, leveraging AI to streamline operations and deliver competitive advantages in a rapidly evolving industry.

| Report Attribute | Details |

|---|---|

| Market size value in 2023 | USD 1.6 Billion |

| Market size forecast in 2031 | USD 21.1 Billion |

| Base Year | 2023 |

| Historical Period | 2020 to 2022 |

| Forecast Period | 2024 to 2031 |

| Revenue Growth Rate | CAGR of 38.8% from 2024 to 2031 |

| Number of Pages | 277 |

| Tables | 393 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Market Share Analysis, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Deployment, Application, End User, Region |

| Country scope |

|

| Companies Included | Amazon Web Services, Inc., Google LLC, IBM Corporation, Intel Corporation, Microsoft Corporation, Salesforce, Inc., OpenAI, LLC, SAP SE, Oracle Corporation and Accenture PLC |

By Deployment

By End User

By Application

By Geography

This Market size is expected to reach $21.1 billion by 2031.

Rising demand for advanced analytics and insights are driving the Market in coming years, however, High implementation and operational costs restraints the growth of the Market.

Amazon Web Services, Inc., Google LLC, IBM Corporation, Intel Corporation, Microsoft Corporation, Salesforce, Inc., OpenAI, LLC, SAP SE, Oracle Corporation and Accenture PLC

The expected CAGR of this Market is 38.8% from 2024 to 2031.

The Retail Banking segment led the Market by End User in 2023; thereby, achieving a market value of $6.2 billion by 2031.

The North America region dominated the Market by Region in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $8.5 billion by 2031.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.

Drivers

Drivers

Restraints

Restraints

Opportunities

Opportunities

Challenges

Challenges