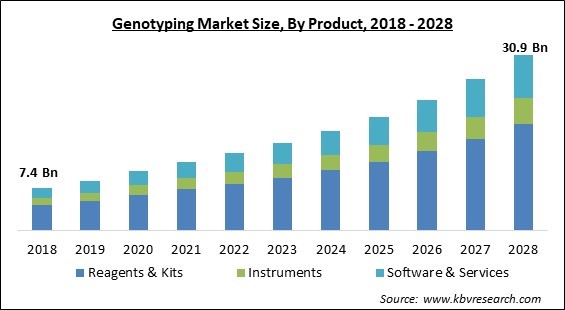

The Global Genotyping Market size is expected to reach $30.9 billion by 2028, rising at a market growth of 14.7% CAGR during the forecast period.

Genotyping is a technique used to detect minor genetic abnormalities that can contribute to significant phenotypic changes, such as physical distinctions that distinguish individuals from one another and pathological changes that underpin disease. It has a wide range of applications in basic science, medicine, and agriculture.

By comparing DNA sequences to other sequences, the genotyping test is a widely used method for identifying DNA sequence and genetic composition. Modern genotyping assays include several key properties, such as high efficiency, operational flexibility, and accessibility to several parameters in a single test. Increased funding by governments of various nations to promote genotyping assay methodologies, increased cases of chronic and genetic disorders around the world.

Genetic mutations such as single nucleotide variants, copy number variants, and major structural alterations in DNA can all be investigated through genotyping. On a molecular level, high-throughput genomic technologies like next-generation sequencing (NGS) and microarrays can provide a better knowledge of disease etiology. Genotyping data analysis systems may examine results for thousands of indicators and probes and identify sample abnormalities, revealing the functional implications of genetic diversity.

In the medical field, genotyping is used to diagnose to prevent the spread of tuberculosis (TB). Initially, genotyping was only used to verify tuberculosis pandemic but, with the advancement of genotyping technology, it can now accomplish much more. Due to advances in genotyping technology, it was discovered that in various tuberculosis cases, infected individuals living in the same house, were not genuinely linked. Due to socio-epidemiological aspects, universal sequencing revealed complex transmission dynamics. As a result, polymerase chain reactions (PCR) were developed, allowing for speedier tuberculosis testing. This approach of quick detection is utilized to avoid tuberculosis. Whole-genome sequencing (WGS) enabled the identification of TB strains, which could subsequently be placed on a historical cluster map.

Technological developments, the rising prevalence of cancer and genetic abnormalities, and increased R&D investment for precision medicine research are all contributing to the expansion. Furthermore, the COVID-19 pandemic had a favorable impact on the genotyping market, as increased demand for COVID-19 genotyping kits resulted in the pandemic. The pandemic of COVID-19 has had an enormous influence on the Genotyping business. SNP genotyping is being used to detect SARS-CoV-2 variations, which is increasing market growth. For example, Helen Harper et al. discovered that PACE (PCR Allele Competitive Extension) SNP genotyping techniques provide useful viral genotype detection for SARS-CoV-2 positive samples in a paper published in the PLOS ONE Journal in February 2021.

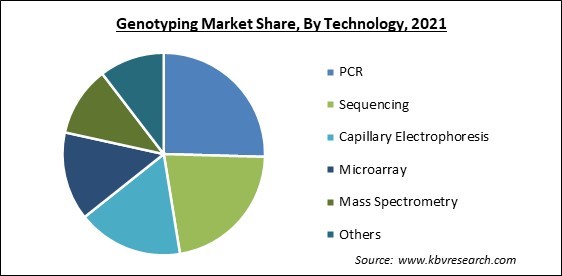

Miniaturization, automation, and lower total costs of DNA sequencing have all been enabled by technological improvements, as well as increased flexibility and the introduction of multi-parameter testing. This has aided in expanding the uses and accessibility of DNA sequencing, allowing clinicians to concentrate on higher-level decisions such as selecting and prioritizing therapeutic targets through various genotyping studies. This has enhanced the use of PCR, sequencing, capillary electrophoresis, and microarrays in domains including drug development and clinical research. Researchers have been able to take use of the most modern technology improvements in SNP identification due to their ability to find vast numbers of SNP markers.

Pharmacogenomics, diagnostic research, personalized medicine, and forensics are all potential uses for genotyping platforms. This technique is also suitable for a variety of veterinary applications, food hygiene, and atmospheric testing in distant places and industrial settings. Human diagnostics and pharmacogenomics now have substantial marker potential since these segments require large-scale genotyping analysis due to the need for better treatment choices and the high prevalence of the disease. NGS is being adapted for this purpose, with businesses like QIAGEN and Freenome (US) collaborating to create NGS-based assays for precision medicine.

The devices required for genotyping testing are costly, and their installation involves a large capital outlay. The qPCR systems range in price from USD 20,000 to USD 30,000, whereas dPCR systems range from USD 65,000 to USD 70,000 for manual dPCR and USD 100,000 for automated dPCR. NGS sequencers range in price from $19,900 to $1 million. The NovaSeq 5000 and NovaSeq 6000 sequencers from Illumina are priced at around USD 850,000 and USD 985,000, respectively. Genotyping instruments have a lot of advanced features and functions, hence they're expensive. Pharmaceutical companies and research institutes require a big amount for the installation of these systems, which necessitates large investments in a large amount of high genotyping machines.

Based on Product, the market is segmented into Reagents & Kits, Instruments, and Software & Services. The software & service segment recorded a substantial revenue share in the genotyping market in 2021. Due to the increased usage of software-based solutions by testing facilities and academic institutions, the software & services segment is expected to grow at a high rate. Bioinformatics enhances overall efficacy of sequencing procedures and aids in the avoidance of errors that might occur with standard sequencing methods. Agri genomics, animal livestock, human diseases, and microbes all benefit from these services.

Based on Application, the market is segmented into Diagnostics & Personalized Medicine, Agricultural Biotechnology, Pharmacogenomics, Animal Genetics, and Others. The Diagnostics & Personalized segment acquired the highest revenue share in the genotyping market in 2021. It is because of the expanding usage of genotyping products for investigation and the growing need for the identification of genetic illnesses, diagnostics and personalized medicine hold the largest proportion of the genotyping market. Personalized medicine involves the integration of genetic, molecular, and environmental variability into existing approaches to knowledge and management of illnesses.

Based on End Use, the market is segmented into Diagnostics & Research Laboratories, Pharmaceutical & Biopharmaceutical Companies, Academic Institutes, and Others. The Pharmaceutical & Biopharmaceutical segment witnessed a significant revenue share in the genotyping market in 2021. Increasing importance of pharmacogenomics in drug development, as well as FDA recommendations for pharmacogenomics investigations and genotyping in the drug discovery process, Pharmacogenomics is being used by companies to produce new medications. For example, Pfizer is studying the efficacy of Talazoparib in patients with somatic BRCA mutation-resistant metastatic breast cancer in a genotyping-based clinical trial.

Based on Technology, the market is segmented into PCR, Sequencing, Capillary Electrophoresis, Microarray, Mass Spectrometry, and Others. The PCR segment garnered the highest revenue share in the genotyping market in 2021. It is due to the Adoption of advanced diagnostic techniques is developing, as is the number of CROs, forensic and research laboratories, along with the prevalence of diseases including chronic diseases and genetic disorders. The typical approach for genetic analysis, polymerase chain reaction, is used in PCR genotyping. After amplifying DNA or RNA sequences using specified primers and electrophoresis to check for size and quality, they can be isolated and purified.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 12 Billion |

| Market size forecast in 2028 | USD 30.9 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 14.7% from 2022 to 2028 |

| Number of Pages | 292 |

| Number of Tables | 499 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Product, Technology, Application, End Use, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. The North America segment garnered the largest revenue share in the genotyping market in 2021. The growing use of advanced technologies, the presence of large pharmaceutical and biopharmaceutical businesses, proactive government policies, and advancements in healthcare infrastructure. Another important aspect contributing to the region's strong market share is the presence of big businesses and authorities investing in genotyping.

Free Valuable Insights: Global Genotyping Market size to reach USD 30.9 Billion by 2028

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include F. Hoffmann-La Roche Ltd., Danaher Corporation, Agilent Technologies, Inc., Thermo Fisher Scientific, Inc., Qiagen N.V., Illumina, Inc., Bio-Rad Laboratories, Inc., Eurofins Scientific Group, and Fluidigm Corporation.

By Product

By Application

By End Use

By Technology

By Geography

The global genotyping market size is expected to reach $30.9 billion by 2028.

Increased genotyping application areas are driving the market in coming years, however, the high cost of genotyping equipment growth of the market.

F. Hoffmann-La Roche Ltd., Danaher Corporation, Agilent Technologies, Inc., Thermo Fisher Scientific, Inc., Qiagen N.V., Illumina, Inc., Bio-Rad Laboratories, Inc., Eurofins Scientific Group, and Fluidigm Corporation.

The Reagents & Kits segment acquired maximum revenue share in the Global Genotyping Market by Product in 2021, thereby, achieving a market value of $18.6 billion by 2028.

The North America is the fastest growing region in the Global Genotyping Market by Region in 2021, and would continue to be a dominant market till 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.