Germany 3D Imaging Market Size, Share & Trends Analysis Report By Component (Hardware (3D Display, 3D Camera, 3D Scanner, Others), Software, and Services), By Software Deployment Type (On-premise, and Cloud), Outlook and Forecast, 2023 - 2030

Published Date : 19-Mar-2024 |

Pages: 106 |

Formats: PDF |

COVID-19 Impact on the Germany 3D Imaging Market

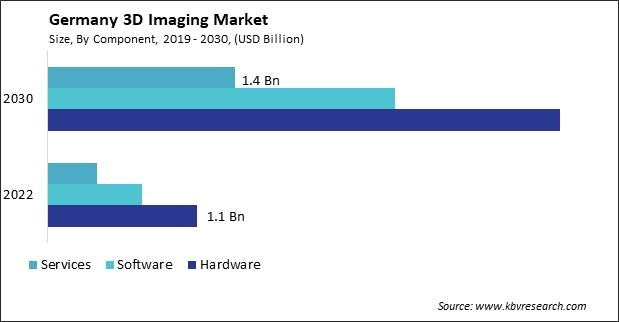

The Germany 3D Imaging Market size is expected to reach $7.7 billion by 2030, rising at a market growth of 17.4% CAGR during the forecast period.

The 3D imaging market in Germany is experiencing robust growth, driven by a combination of technological advancements, increasing industrial applications, and a growing demand for innovative solutions across various sectors. Germany's industrial manufacturing landscape has integrated 3D imaging for quality control, product design, and prototyping. The automotive industry, a cornerstone of the German economy, utilizes 3D imaging for design optimization, virtual testing, and production streamlining.

In Germany the entertainment and gaming industries have contributed to the growth of the 3D imaging market. Virtual and augmented reality applications leverage 3D imaging to create immersive experiences, impacting the gaming sector and sectors like architecture, education, and tourism. Additionally, the demand for 3D imaging in geospatial mapping and urban planning is growing. Germany's commitment to sustainable development and smart city initiatives has led to increased use of 3D mapping technologies for city modeling, infrastructure planning, and environmental monitoring.

The COVID-19 pandemic has further accelerated the adoption of 3D imaging technologies in Germany. In the medical field, 3D imaging has played a crucial role in diagnosing and monitoring COVID-19 cases, facilitating more accurate assessments of lung damage and aiding in treatment planning. The need for contactless and efficient solutions has driven the implementation of 3D imaging in various sectors, such as retail, where virtual shopping experiences have gained popularity.

Market Trends

Growing Demand for Advanced Medical Imaging Techniques

Germany has emerged as a key player in adopting medical imaging, particularly in the burgeoning 3D imaging market. The country's healthcare sector has witnessed a paradigm shift by integrating advanced imaging technologies and revolutionizing diagnostics and treatment planning. This evolution is primarily attributed to the concerted efforts of healthcare providers and technology developers, making Germany a focal point for 3D imaging innovations.

The adoption of 3D imaging in Germany has significantly improved diagnostic accuracy and precision. Medical professionals benefit from enhanced visualization, providing more detailed and comprehensive insights into anatomical structures. This, in turn, contributes to better-informed decision-making processes in areas such as surgical planning, oncology, and cardiovascular interventions.

Moreover, Germany's robust healthcare infrastructure plays a pivotal role in the widespread implementation of 3D imaging. Well-equipped hospitals and diagnostic centers nationwide have embraced these advanced imaging techniques, ensuring patient accessibility throughout the healthcare system. This accessibility has fueled the demand for 3D imaging solutions, making them integral to routine medical practices.

According to the International Trade Administration, Germany's medical device industry is a highly lucrative segment within the global healthcare industry, boasting an annual revenue of approximately USD 42 billion, constituting a substantial 25% share of in Europe. Healthcare imports in Germany reached EUR 154 billion, underlining the nation's significant role in the medical equipment sector.

One of the driving factors behind this growth is the increasing digitalization of the health economy. This technological shift significantly impacts adopting advanced medical imaging techniques in the 3D imaging market. The Hospital Future Act, enacted in October 2020, has allocated substantial funds – EUR 3 billion from the federal government and an additional EUR 1.3 billion from state funding – to modernize and digitalize the German hospital system. Therefore, Germany's leadership in adopting 3D imaging within its healthcare sector reflects a transformative shift in diagnostic capabilities, fostering informed decision-making and precision across various medical disciplines.

Adoption Of 3D Imaging in Consumer Electronics

In Germany, the adoption of 3D imaging technology in consumer electronics has experienced significant growth, transforming the industry and enhancing user experiences. The 3D imaging market in Germany has seen a surge in popularity across various consumer electronic devices, including smartphones, cameras, and gaming consoles. The adoption of 3D imaging in consumer electronics in Germany is driven by several factors that contribute to its success in the industry. One notable aspect is the strong emphasis on technological innovation and engineering excellence in the German consumer electronics industry. German manufacturers have been at the forefront of cutting-edge imaging technologies, and the integration of 3D capabilities aligns with the country's commitment to staying at the forefront of technological advancements.

Smartphones with advanced 3D imaging capabilities have gained traction in the German industry. These devices offer features such as 3D facial recognition for secure authentication, depth-sensing cameras for improved photography, and AR applications for a more interactive user experience. Integrating 3D imaging in smartphones has become a key differentiator for manufacturers, driving consumer preferences toward devices that offer cutting-edge visual technologies.

Additionally, the increasing popularity of virtual and augmented reality applications has fueled the demand for 3D imaging in Germany. The gaming and entertainment industries have witnessed a paradigm shift by incorporating 3D imaging, providing users with more immersive and realistic experiences. German consumers, known for their tech-savvy preferences, are quick to adopt these advanced features, further propelling the growth of the 3D imaging market. Thus, Germany's consumer electronics industry has embraced 3D imaging technology, with smartphones leading the way as key devices boasting advanced features.

Competition Analysis

The 3D imaging market in Germany is characterized by a robust ecosystem of companies that leverage cutting-edge technologies to meet the demands of diverse industries. Siemens AG, a German multinational conglomerate, is a major player in the 3D imaging market, particularly in the healthcare sector. Siemens Healthineers, a subsidiary of Siemens AG, specializes in medical imaging technologies. The company provides advanced 3D imaging solutions, including CT scans and MRI systems, contributing to the precision and efficiency of diagnostic processes in German healthcare institutions.

Carl Zeiss, a renowned German optics and optoelectronics company, has a significant presence in 3D imaging. The company is known for its high-quality optical instruments and imaging solutions in various applications, such as microscopy, industrial metrology, and medical imaging. Carl Zeiss's innovations contribute to advancing 3D imaging technologies in Germany.

EOS GmbH specializes in industrial 3D printing solutions, particularly in additive manufacturing. The company's 3D printers are widely used in the automotive, aerospace, and medical industries, enabling the production of complex and customized components. EOS's contributions to 3D printing technology significantly impact the manufacturing landscape in Germany.

FARO Technologies has a strong presence in Germany, offering 3D measurement and imaging solutions. The company's metrology tools, including laser scanners and coordinate measuring machines, cater to the needs of the automotive, construction, and architecture industries. FARO's German operations contribute to precise 3D measurements and quality control in manufacturing processes.

TRUMPF, a German family-owned company, is a key player in the manufacturing and laser technology sector. The company's laser systems are integral to various 3D imaging applications, including laser cutting and welding. TRUMPF's innovations support advancing 3D imaging technologies in manufacturing processes across Germany. These companies are instrumental in pushing the boundaries of technology, driving innovation, and shaping the future of 3D imaging applications.

List of Key Companies Profiled

- GE HealthCare Technologies, Inc.

- Autodesk, Inc.

- STMicroelectronics N.V.

- Panasonic Holdings Corporation

- Sony Corporation

- Trimble, Inc.

- Koninklijke Philips N.V.

- Dassault Systemes SE

- Adobe, Inc.

- Google LLC (Alphabet Inc.)

Germany 3D Imaging Market Report Segmentation

By Component

- Hardware

- 3D Display

- 3D Camera

- 3D Scanner

- Others

- Software

- Software Type

- 3D Modeling Software

- 3D Scanning Software

- 3D Layout & Animation Software

- 3D Visualization & Rendering Software

- Image Reconstruction Software

- Others

- Software Deployment Type

- On-premise

- Cloud

- Services

- Software Type

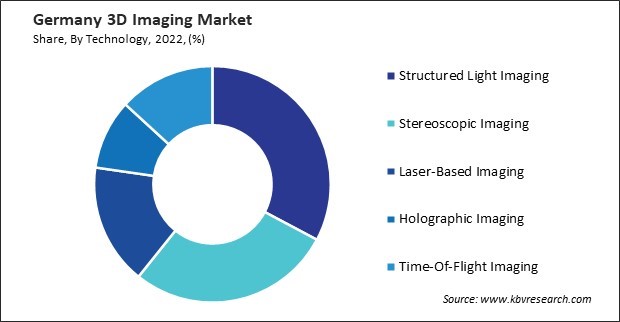

By Technology

- Structured Light Imaging

- Stereoscopic Imaging

- Laser-Based Imaging

- Holographic Imaging

- Time-Of-Flight Imaging

By Vertical

- Automotive

- Government & Defense

- Architecture & Construction

- Healthcare & Lifesciences

- Media & Entertainment

- Manufacturing

- Retail & eCommerce

- Aerospace & Defense

- Others

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 Germany 3D Imaging Market, by Component

1.4.2 Germany 3D Imaging Market, by Technology

1.4.3 Germany 3D Imaging Market, by Vertical

1.5 Methodology for the research

Chapter 2. Market Overview

2.1 Introduction

2.1.1 Overview

2.1.1.1 Market Composition and Scenario

2.2 Key Factors Impacting the Market

2.2.1 Market Drivers

2.2.2 Market Opportunities

2.2.3 Market Restraints

2.2.4 Market Challenges

Chapter 3. Competition Analysis - Global

3.1 KBV Cardinal Matrix

3.2 Recent Industry Wide Strategic Developments

3.2.1 Partnerships, Collaborations and Agreements

3.2.2 Product Launches and Product Expansions

3.2.3 Acquisition and Mergers

3.3 Market Share Analysis, 2022

3.4 Top Winning Strategies

3.4.1 Key Leading Strategies: Percentage Distribution (2019-2023)

3.4.2 Key Strategic Move: (Product Launches and Product Expansions : 2020, Feb – 2023, Sep) Leading Players

3.5 Porter’s Five Forces Analysis

Chapter 4. Germany 3D Imaging Market

4.1 Germany 3D Imaging Market by Component

4.2 Germany 3D Imaging Market by Technology

4.3 Germany 3D Imaging Market by Vertical

Chapter 5. Company Profiles – Global Leaders

5.1 GE HealthCare Technologies, Inc.

5.1.1 Company Overview

5.1.2 Financial Analysis

5.1.3 Segmental and Regional Analysis

5.1.4 Research & Development Expenses

5.1.5 Recent strategies and developments:

5.1.5.1 Partnerships, Collaborations, and Agreements:

5.1.6 SWOT Analysis

5.2 Autodesk, Inc.

5.2.1 Company Overview

5.2.2 Financial Analysis

5.2.3 Regional Analysis

5.2.4 Research & Development Expenses

5.2.5 Recent strategies and developments:

5.2.5.1 Product Launches and Product Expansions:

5.2.6 SWOT Analysis

5.3 STMicroelectronics N.V.

5.3.1 Company Overview

5.3.2 Financial Analysis

5.3.3 Segmental and Regional Analysis

5.3.4 Research & Development Expense

5.3.5 Recent strategies and developments:

5.3.5.1 Partnerships, Collaborations, and Agreements:

5.3.6 SWOT Analysis

5.4 Panasonic Holdings Corporation

5.4.1 Company Overview

5.4.2 Financial Analysis

5.4.3 Segmental and Regional Analysis

5.4.4 Research & Development Expenses

5.4.5 Recent strategies and developments:

5.4.5.1 Product Launches and Product Expansions:

5.4.6 SWOT Analysis

5.5 Sony Corporation

5.5.1 Company Overview

5.5.2 Financial Analysis

5.5.3 Segmental and Regional Analysis

5.5.4 Research & Development Expenses

5.5.5 SWOT Analysis

5.6 Trimble, Inc.

5.6.1 Company Overview

5.6.2 Financial Analysis

5.6.3 Segmental and Regional Analysis

5.6.4 Research & Development Expenses

5.6.5 Recent strategies and developments:

5.6.5.1 Product Launches and Product Expansions:

5.6.6 SWOT Analysis

5.7 Koninklijke Philips N.V.

5.7.1 Company Overview

5.7.2 Financial Analysis

5.7.3 Segmental and Regional Analysis

5.7.4 Research & Development Expense

5.7.5 Recent strategies and developments:

5.7.5.1 Product Launches and Product Expansions:

5.7.6 SWOT Analysis

5.8 Dassault Systemes SE

5.8.1 Company Overview

5.8.2 Financial Analysis

5.8.3 Product Category and Regional Analysis

5.8.4 Research & Development Expense

5.8.5 Recent strategies and developments:

5.8.5.1 Partnerships, Collaborations, and Agreements:

5.8.5.2 Product Launches and Product Expansions:

5.8.5.3 Acquisition and Mergers:

5.8.5.4 Geographical Expansions:

5.8.6 SWOT Analysis

5.9 Adobe, Inc.

5.9.1 Company Overview

5.9.2 Financial Analysis

5.9.3 Segmental and Regional Analysis

5.9.4 Research & Development Expense

5.9.5 Recent strategies and developments:

5.9.5.1 Partnerships, Collaborations, and Agreements:

5.9.5.2 Product Launches and Product Expansions:

5.9.5.3 Acquisition and Mergers:

5.9.5.4 Geographical Expansions:

5.9.6 SWOT Analysis

5.10. Google LLC (Alphabet Inc.)

5.10.1 Company Overview

5.10.2 Financial Analysis

5.10.3 Segmental and Regional Analysis

5.10.4 Research & Development Expense

5.10.5 Recent strategies and developments:

5.10.5.1 Product Launches and Product Expansions:

5.10.6 SWOT Analysis

TABLE 2 Germany 3D Imaging Market, 2023 - 2030, USD Million

TABLE 3 Partnerships, Collaborations and Agreements– 3D Imaging Market

TABLE 4 Product Launches And Product Expansions– 3D Imaging Market

TABLE 5 Acquisition and Mergers– 3D Imaging Market

TABLE 6 Germany 3D Imaging Market by Component, 2019 - 2022, USD Million

TABLE 7 Germany 3D Imaging Market by Component, 2023 - 2030, USD Million

TABLE 8 Germany 3D Imaging Market by Hardware Component, 2019 - 2022, USD Million

TABLE 9 Germany 3D Imaging Market by Hardware Component, 2023 - 2030, USD Million

TABLE 10 Germany 3D Imaging Market by Software Type, 2019 - 2022, USD Million

TABLE 11 Germany 3D Imaging Market by Software Type, 2023 - 2030, USD Million

TABLE 12 Germany 3D Imaging Market by Software Deployment Type, 2019 - 2022, USD Million

TABLE 13 Germany 3D Imaging Market by Software Deployment Type, 2023 - 2030, USD Million

TABLE 14 Germany 3D Imaging Market by Technology, 2019 - 2022, USD Million

TABLE 15 Germany 3D Imaging Market by Technology, 2023 - 2030, USD Million

TABLE 16 Germany 3D Imaging Market by Vertical, 2019 - 2022, USD Million

TABLE 17 Germany 3D Imaging Market by Vertical, 2023 - 2030, USD Million

TABLE 18 Key Information – GE HealthCare Technologies, Inc.

TABLE 19 Key Information – Autodesk, Inc.

TABLE 20 Key Information – STMicroelectronics N.V.

TABLE 21 Key Information – Panasonic Holdings Corporation

TABLE 22 Key Information – Sony Corporation

TABLE 23 Key Information – Trimble, Inc.

TABLE 24 Key Information – Koninklijke Philips N.V.

TABLE 25 Key Information – Dassault Systemes SE

TABLE 26 Key Information – Adobe, Inc.

TABLE 27 Key Information – Google LLC

List of Figures

FIG 1 Methodology for the research

FIG 2 Germany 3D Imaging Market, 2019 - 2030, USD Million

FIG 3 Key Factors Impacting 3D Imaging Market

FIG 4 KBV Cardinal Matrix

FIG 5 Market Share Analysis, 2022

FIG 6 Key Leading Strategies: Percentage Distribution (2019-2023)

FIG 7 Key Strategic Move: (Product Launches and Product Expansions : 2020, Feb – 2023, Sep) Leading Players

FIG 8 Porter’s Five Forces Analysis - 3D Imaging Market

FIG 9 Germany 3D Imaging Market Share by Component, 2022

FIG 10 Germany 3D Imaging Market Share by Component, 2030

FIG 11 Germany 3D Imaging Market by Component, 2019 - 2030, USD Million

FIG 12 Germany 3D Imaging Market Share by Technology, 2022

FIG 13 Germany 3D Imaging Market Share by Technology, 2030

FIG 14 Germany 3D Imaging Market by Technology, 2019 - 2030, USD Million

FIG 15 Germany 3D Imaging Market Share by Vertical, 2022

FIG 16 Germany 3D Imaging Market Share by Vertical, 2030

FIG 17 Germany 3D Imaging Market by Vertical, 2019 - 2030, USD Million

FIG 18 SWOT Analysis: GE HealthCare Technologies, Inc.

FIG 19 SWOT Analysis: Autodesk, Inc.

FIG 20 SWOT Analysis: STMicroelectronics N.V.

FIG 21 SWOT Analysis: Panasonic Holdings Corporation

FIG 22 SWOT Analysis: Sony Corporation

FIG 23 Swot Analysis: Trimble, Inc.,

FIG 24 SWOT Analysis: Koninklijke Philips N.V.

FIG 25 Recent strategies and developments: Dassault Systemes SE

FIG 26 SWOT Analysis: Dassault Systemes SE

FIG 27 Recent strategies and developments: Adobe, Inc.

FIG 28 SWOT Analysis: Adobe, Inc.

FIG 29 SWOT Analysis: Google LLC