Int'l : +1(646) 600-5072 | query@kbvresearch.com

Int'l : +1(646) 600-5072 | query@kbvresearch.com

Published Date : 02-Sep-2024 |

Pages: 74 |

Formats: PDF |

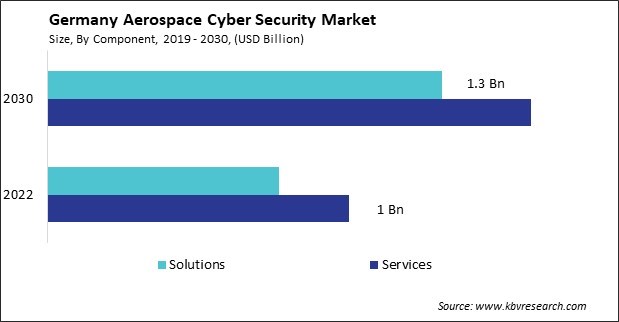

The Germany Aerospace Cyber Security Market size is expected to reach $3 Billion by 2030, rising at a market growth of 6.6% CAGR during the forecast period.

Germany's aerospace cyber security market has witnessed substantial growth and evolution in recent years. As one of the leading players in aerospace technology and innovation, Germany has been actively investing in strengthening its cyber security measures to protect critical aerospace infrastructure and systems from cyber threats. Furthermore, the German government has proactively addressed cyber security concerns in the aerospace sector through regulatory frameworks and initiatives aimed at enhancing cyber. This has created a conducive environment for cyber security innovation and collaboration, driving the growth of Germany's aerospace cyber security market.

The need for robust cybersecurity solutions has become more pronounced with the rapid integration of advanced technologies such as artificial intelligence and the Internet of Things (IoT). According to Germany Trade & Invest, the Internet of Things (IoT) expenditure in Germany is anticipated to surpass EUR 35 billion, with IoT-generated revenue poised to double from EUR 22.5 billion in 2018 to a projected EUR 45 billion by 2023. The aerospace sector in Germany encompasses various segments including commercial aviation, defense, space exploration, and unmanned aerial vehicles (UAVs), all vulnerable to cyber-attacks due to their reliance on interconnected digital systems.

The COVID-19 pandemic has profoundly impacted the aerospace industry in Germany. The unprecedented disruption caused by the pandemic has forced aerospace companies to reassess their priorities and allocate resources more efficiently, including investments in cyber security. While the immediate focus has been ensuring business continuity and addressing operational challenges posed by the pandemic, the long-term implications of COVID-19 on aerospace cyber security remain uncertain.

However, the pandemic has highlighted the importance of resilience and agility in the face of unforeseen disruptions, underscoring the need for robust cyber security measures to protect critical aerospace infrastructure and systems. As the aerospace industry in Germany continues to recover and adapt to the new normal, cyber security will remain a top priority.

In Germany, the aerospace sector is undergoing a profound transformation driven by digitalization and connectivity. According to the International Trade Administration, Germany has the third-largest aerospace industry, with revenues hitting EUR 39 billion in 2022. With the increasing reliance on wireless communication systems in aircraft and ground infrastructure, the demand for robust cybersecurity measures has surged significantly. The integration of wireless technologies in aerospace operations brings unprecedented convenience and efficiency.

One of the primary drivers fueling the demand for wireless security in the German aerospace cyber security market is the rapid expansion of the Internet of Things (IoT) ecosystem within aviation infrastructure. Moreover, the proliferation of unmanned aerial vehicles (UAVs) and autonomous aircraft is amplifying the importance of wireless security in the aerospace domain. These remotely operated platforms rely heavily on wireless communication links for command and control functions, navigation, and payload delivery.

Furthermore, the interconnected nature of modern aerospace systems necessitates a holistic approach to cybersecurity, encompassing airborne and ground-based components. This includes securing wireless networks at airports, air traffic control centers, and maintenance facilities against cyber threats like malware, phishing attacks, and denial-of-service (DoS) incidents. Therefore, the evolution of wireless technology in the German aerospace sector underscores the critical need for robust cybersecurity measures to safeguard airborne and ground-based operations against emerging cyber threats.

The adoption of connected technologies in aircraft systems has witnessed a significant surge in Germany's aerospace cyber security market. As aviation systems become increasingly digitized and interconnected, the need to safeguard these systems against cyber threats has become paramount. One of the key drivers behind the increased adoption of connected technologies in aircraft systems is the pursuit of improved operational efficiency and enhanced passenger experience. Airlines and aircraft manufacturers in Germany are leveraging connected technologies to gather real-time data on various aspects of flight operations, including engine performance, fuel efficiency, and maintenance requirements.

Furthermore, the aerospace industry in Germany is investing heavily in advanced cybersecurity solutions tailored specifically for aviation systems. These solutions encompass a range of measures, including robust encryption protocols, intrusion detection systems, and anomaly detection algorithms. Additionally, there is a growing emphasis on cybersecurity training and awareness programs to educate aviation personnel about the risks and best practices for safeguarding connected aircraft systems.

Moreover, regulatory bodies such as the European Aviation Safety Agency (EASA) are actively working to establish comprehensive cybersecurity guidelines and standards for the aviation industry. These regulations ensure that aircraft manufacturers and operators adhere to strict cybersecurity protocols to mitigate the risks associated with connected technologies. Thus, the surge in connected technologies in aircraft systems in Germany is driving significant investment in cybersecurity measures to enhance operational efficiency and passenger safety.

In Germany, the aerospace industry is renowned for its innovation and precision engineering, and as digitalization continues to transform the sector, cybersecurity has become a critical consideration. One prominent player in the German aerospace cyber security market is Airbus Defence and Space. As a division of Airbus Group, Airbus Defence and Space specializes in providing advanced cybersecurity solutions for aerospace and defense applications. The company offers a comprehensive suite of cybersecurity services, including threat intelligence, security consulting, and incident response. Airbus Defence and Space's cybersecurity solutions leverage cutting-edge technologies to protect aerospace systems and data from cyber threats, ensuring the resilience of critical infrastructure and operations.

Another key player in Germany's aerospace cyber security market is Rohde & Schwarz Cybersecurity. Rohde & Schwarz Cybersecurity is a leading provider of cybersecurity solutions for various industries, including aerospace. The company offers a portfolio of cybersecurity products and services tailored to aerospace customers' needs, including network security, endpoint protection, and secure communications. Rohde & Schwarz Cybersecurity's solutions help aerospace companies detect, prevent, and respond to cyber threats effectively, ensuring critical systems and information integrity and security.

Diehl Defence is also a significant player in the German aerospace cyber security market. Diehl Defence is a defense and aerospace company specializing in developing and manufacturing advanced defense systems and technologies. The company offers a range of cybersecurity solutions for aerospace applications, including secure communications, data encryption, and threat detection. Diehl Defence's cybersecurity offerings are designed to meet the stringent requirements of aerospace customers, providing them the confidence to operate in a secure and resilient environment.

In addition to these major players, several smaller companies in Germany are actively involved in providing cybersecurity solutions for the aerospace industry. These companies play a vital role in addressing the unique cybersecurity challenges faced by the aerospace industry in Germany, helping to protect sensitive data, critical systems, and intellectual property from cyber threats. Hence, Germany's strong aerospace industry and commitment to cybersecurity make it a significant player in the global aerospace cyber security market. By partnering with leading cybersecurity providers, German aerospace companies enhance their cyber resilience and safeguard operations in an increasingly interconnected world.

By Component

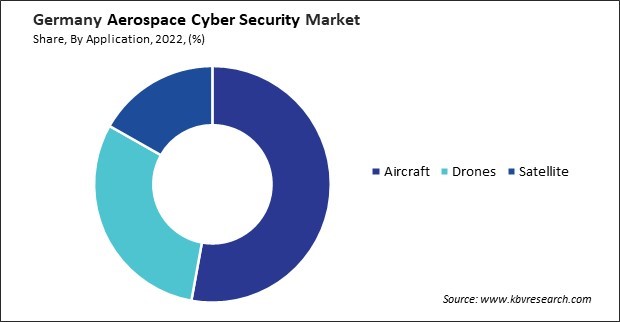

By Application

By Deployment

By Type