Int'l : +1(646) 600-5072 | query@kbvresearch.com

Int'l : +1(646) 600-5072 | query@kbvresearch.com

Published Date : 15-May-2024 |

Pages: 84 |

Formats: PDF |

The Germany Ammonium Sulfate Market size is expected to reach $99.85 Million by 2030, rising at a market growth of 7.2% CAGR during the forecast period. In the year 2022, the market attained a volume of 294.12 Kilo Tonnes, experiencing a growth of 6.5% (2019-2022).

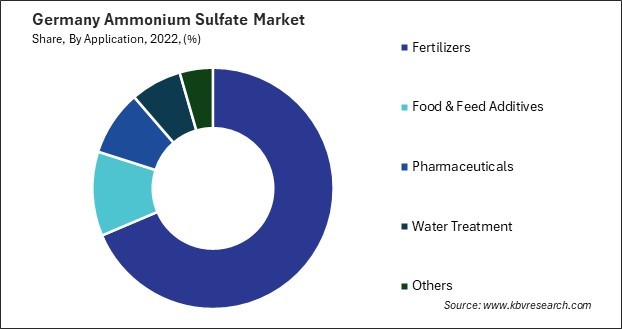

The ammonium sulfate market in Germany has witnessed significant growth over the years, driven by various factors such as its extensive use in agriculture, industrial applications, and increasing demand for fertilizers. Germany, one of Europe's leading agricultural producers, has a substantial demand for fertilizers like ammonium sulfate to enhance soil fertility and crop yield. Agriculture remains the primary sector driving the demand for ammonium sulfate in Germany. With a strong focus on sustainable agriculture practices and maximizing crop productivity, farmers in Germany regularly utilize fertilizers containing ammonium sulfate to provide essential nutrients like nitrogen and sulfur to their crops.

Additionally, the increasing adoption of advanced farming techniques, including precision agriculture, further fuels the demand for fertilizers in the country. Furthermore, ammonium sulfate is extensively used in various industrial applications, including chemicals, pharmaceuticals, and food processing. Its versatility as a raw material in industrial processes contributes to its steady demand across different sectors. Industries in Germany rely on high-quality ammonium sulfate for manufacturing processes, which adds to its industry growth.

The COVID-19 pandemic has significantly impacted various sectors, including the fertilizer industry and the ammonium sulfate market in Germany. During the pandemic's initial phases, supply chain disruptions, logistical challenges, and labor shortages posed significant challenges to the fertilizer industry in Germany. Restrictions on movement and lockdown measures implemented to curb the spread of the virus resulted in disruptions in the transportation of raw materials and finished products, affecting the overall supply chain of fertilizers. However, despite these challenges, the agricultural sector remained resilient in Germany, as farming activities were deemed essential to ensure food security.

The pharmaceutical industry's expansion within the ammonium sulfate market in Germany reflects a strategic response to evolving industry dynamics and increasing demand for pharmaceutical products. As one of the leading economies in Europe, Germany boasts a robust pharmaceutical sector characterized by advanced research capabilities, a skilled workforce, and a strong regulatory framework.

Ammonium sulfate is a key component in various pharmaceutical processes, including protein purification, facilitating the precipitation and isolation of target proteins. The expansion of the pharmaceutical industry in the German ammonium sulfate market is driven by the need for high-quality ingredients in drug formulation. With the growing emphasis on biopharmaceuticals and personalized medicine, the demand for purified proteins for therapeutic use has surged in Germany, prompting pharmaceutical companies to invest in technologies that utilize ammonium sulfate for efficient protein purification.

According to Germany Trade & Invest, Germany stands as a prominent global hub for pharmaceutical production, boasting a substantial increase in production volume, reaching EUR 34.6 billion in 2021 with a remarkable 6.9 % year-on-year growth. The subsequent year, 2022, witnessed a notable surge in pharmaceutical industry sales within Germany, marking a 5.4 % increase and reaching EUR 56.5 billion at ex-manufacturer prices.

The total revenue of biopharmaceuticals in Germany was EUR 12.7 billion in 2019. As the pharmaceutical industry in Germany continues its robust growth trajectory, it has spurred significant developments in related sectors. Ammonium sulfate, with its diverse applications in pharmaceutical production, including as a protein precipitant and in purification processes, is witnessing a growing industry in Germany. This expansion further underscores Germany's position as a leading global hub for pharmaceutical manufacturing, driving innovation and economic growth within the industry.

As pharmaceutical companies in Germany strive to enhance their products' stability, solubility, and bioavailability, ammonium sulfate emerges as a viable option due to its ability to modulate protein conformation and enhance drug dissolution rates. Thus, the pharmaceutical industry's expansion into the German ammonium sulfate market underscores a strategic response to the increasing demand for high-quality ingredients essential for advanced drug formulation and protein purification.

The ammonium sulfate market in Germany is witnessing a significant uptick in adopting water treatment processes, driven by various factors ranging from environmental concerns to regulatory mandates and industrial requirements. With increasing awareness about the detrimental impacts of pollution on ecosystems and human health, governmental bodies and private enterprises are emphasizing implementing water treatment solutions to mitigate contamination risks associated with ammonium sulfate production processes.

Moreover, stringent regulatory frameworks in Germany are compelling companies operating in the ammonium sulfate market to adhere to stringent water quality standards. Compliance with regulations necessitates implementing effective water treatment measures to ensure that discharge levels meet stipulated criteria and do not threaten the environment or public health. In Germany, water treatment is a critical enabler in ensuring the purity and integrity of water sources utilized in these processes, thereby enhancing product quality, process efficiency, and overall operational performance.

Furthermore, the industrial applications of ammonium sulfate necessitate high-quality water for various production processes, including fertilizer manufacturing, chemical synthesis, and industrial applications in Germany. As a result, industries reliant on ammonium sulfate increasingly integrate water treatment into their operations to optimize resource utilization and enhance product outcomes. Hence, the surge in water treatment adoption in Germany's ammonium sulfate market reflects a crucial response to environmental concerns, regulatory pressures, and the imperative for quality assurance across industrial applications.

The ammonium sulfate market in Germany is a vital segment of the broader chemical industry. One major player in the German ammonium sulfate market is BASF SE, a global leader in the chemical industry. BASF produces a wide range of chemicals, including fertilizers like ammonium sulfate. Leveraging its extensive research and development capabilities, BASF ensures the quality and effectiveness of its products to meet the needs of German farmers and agricultural businesses. With a commitment to sustainability and innovation, BASF contributes to advancing agriculture while minimizing environmental impact.

EuroChem Group AG is also a significant player in the German ammonium sulfate market. As one of the world's largest fertilizer producers, the company supplies ammonium sulfate and other fertilizers to agricultural industries worldwide, including Germany. Through its efficient production processes and global distribution network, the company ensures a reliable supply of high-quality fertilizers to meet the demands of German farmers and agribusinesses.

Another prominent participant in the German ammonium sulfate market is K+S Group, a leading supplier of mineral-based products, including fertilizers and salt. K+S Group operates several production facilities in Germany, producing ammonium sulfate as part of its fertilizer portfolio. With a focus on sustainable mining practices and product quality, K+S Group plays a vital role in supplying essential nutrients to German soils, supporting crop yields and agricultural productivity.

Furthermore, Helm AG, a diversified chemical company, is actively involved in distributing and marketing various chemical products, including fertilizers like ammonium sulfate. The company serves as a key intermediary between manufacturers and end-users, providing logistics, storage, and distribution services to ensure the efficient flow of products within Germany. With its extensive network and customer-focused approach, Helm AG contributes to the accessibility and availability of essential nutrients for German agriculture.

Moreover, Deutsche Ammoniumsulfat GmbH (DAS) is a domestic producer of ammonium sulfate, catering to the needs of German farmers and industrial users. DAS operates production facilities within Germany, ensuring a localized supply chain and timely delivery of products to customers across the country. Hence, these companies contribute to the growth and sustainability of Germany's agricultural sector while meeting the evolving needs of farmers, growers, and industrial users.

By Product

By Application