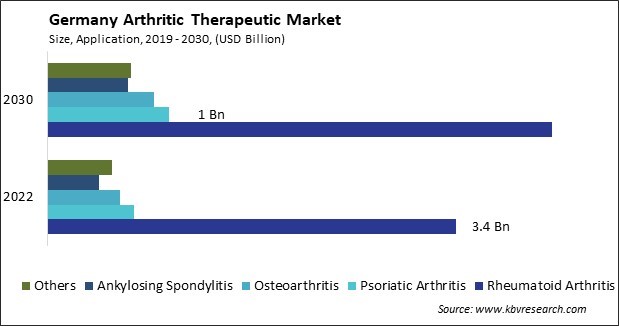

The Germany Arthritic Therapeutic Market size is expected to reach $7.5 Billion by 2030, rising at a market growth of 3.5% CAGR during the forecast period.

The arthritic therapeutic market in Germany is a significant sector within the healthcare industry, catering to the needs of millions of individuals suffering from various forms of arthritis. One key factor shaping the arthritic therapeutic market in Germany is the country's aging population. According to the National Library of Medicine, as of 2022, 18.6 million people in Germany are 65 and older, including 6.1 million who are 80 years and older. With advancing age being a primary risk factor for arthritis, the prevalence of this condition is expected to rise, driving demand for innovative treatment options and healthcare services tailored to the needs of older adults.

In response to the increasing burden of arthritis, pharmaceutical companies in Germany are investing in research and development (R&D) to discover and develop novel therapies. According to Germany Trade & Invest, Germany stands as a prominent global hub for pharmaceutical production, boasting a substantial increase in production volume, reaching EUR 34.6 billion in 2021. Biologic drugs, which target specific immune system components involved in the inflammatory process, have emerged as a significant area of focus.

Moreover, the German regulatory framework, overseen by the Federal Institute for Drugs and Medical Devices (BfArM) and the Paul Ehrlich Institute (PEI), plays a crucial role in shaping the arthritic therapeutic market. Stringent regulatory standards ensure pharmaceutical products' safety, efficacy, and quality, fostering trust among healthcare professionals and patients. Furthermore, non-pharmacological interventions, including physical therapy, occupational therapy, and lifestyle modifications, are integral to arthritis management in Germany.

However, the COVID-19 pandemic has also impacted the arthritic therapeutic market in Germany. The disruption caused by the pandemic, including lockdowns and restrictions on healthcare services, has led to delays in diagnosis and treatment for many arthritic patients. Furthermore, concerns about visiting healthcare facilities during the pandemic have affected patient engagement and adherence to treatment regimens. Pharmaceutical companies have also faced challenges in conducting clinical trials and launching new products amidst the pandemic-related restrictions.

The healthcare industry in Germany has witnessed significant expansion within the arthritic therapeutic market. According to the International Trade Administration, Germany's healthcare sector generates an economic footprint of EUR 775 billion, or roughly 12 % of Germany's GDP. In 2022, the gross value added to the healthcare industry was EUR 439.6 billion. One key aspect of expanding the arthritic therapeutic market is the development and availability of advanced pharmaceutical treatments.

Furthermore, advancements in medical technology have revolutionized the diagnosis and monitoring of arthritis in Germany. Imaging techniques such as X-rays, magnetic resonance imaging (MRI), and ultrasound play a crucial role in accurately assessing joint damage and disease progression. Additionally, wearable devices and digital health platforms enable remote monitoring of symptoms and adherence to treatment plans, facilitating personalized care for arthritis patients.

Moreover, there has been a surge in the adoption of non-pharmacological interventions and complementary therapies to complement traditional medical treatments. Physiotherapy, occupational therapy, and hydrotherapy are commonly utilized non-pharmacological approaches for managing arthritis symptoms in Germany. Thus, the arthritic therapeutic market in Germany has seen remarkable growth driven by advancements in pharmaceutical treatments and the integration of non-pharmacological interventions, leading to enhanced patient care and management.

In Germany, the arthritic therapeutic market is witnessing a notable shift towards non-invasive treatments, reflecting evolving patient preferences and advancing medical technologies. One significant driver of this preference is the increasing aging population in Germany. As individuals age, the prevalence of arthritis rises, leading to a higher demand for therapeutic solutions. Non-invasive options offer German patients a viable alternative that alleviates symptoms and improves quality of life without the need for surgical intervention.

Advancements in medical technology have also contributed to the popularity of non-invasive treatments for arthritis. Techniques such as ultrasound therapy, laser therapy, and radiofrequency ablation have emerged as effective means of managing arthritic pain and inflammation without the need for incisions or implants. These modalities offer targeted relief, often with fewer side effects than traditional surgical approaches, making them increasingly attractive to patients and healthcare providers in Germany.

Furthermore, the rise of personalized medicine has paved the way for tailored non-invasive treatment plans in arthritis management. Healthcare professionals in Germany now leverage genetic testing, imaging technologies, and other diagnostic tools to understand each patient's unique condition and tailor treatment strategies accordingly. Therefore, the increasing preference for non-invasive arthritis treatments in Germany, driven by factors such as an aging population and advancements in medical technology, underscores a shift towards more personalized and effective therapeutic approaches.

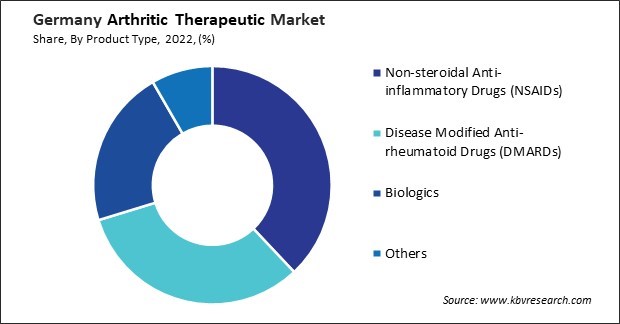

The arthritic therapeutic market in Germany is a significant component of the country's pharmaceutical and healthcare sector. One of the leading players in the German arthritic therapeutic market is Bayer AG. Bayer offers a range of medications for the treatment of arthritis, including nonsteroidal anti-inflammatory drugs (NSAIDs) such as Aleve (naproxen) and Voltaren (diclofenac). These medications help reduce inflammation and relieve pain associated with various forms of arthritis, providing patients with effective symptom management. Bayer's commitment to research and development ensures the continued innovation of arthritic therapeutics to address the evolving needs of patients in Germany.

Boehringer Ingelheim is actively involved in the German arthritic therapeutic market through its development and production of medications such as Mobic (meloxicam), a long-acting NSAID for treating osteoarthritis and rheumatoid arthritis. Mobic provides patients with extended relief from pain and inflammation, helping to improve joint function and mobility. Boehringer Ingelheim's focus on research and innovation underscores its dedication to advancing arthritis treatment options and meeting the needs of patients in Germany.

Another prominent contributor to the German arthritic therapeutic market is Merck KGaA. Merck manufactures medications such as Glucosamine and Chondroitin, commonly used as dietary supplements to support joint health and alleviate symptoms of osteoarthritis. Additionally, the company produces biological therapies such as Mavenclad (cladribine) for multiple sclerosis, which have potential applications in the treatment of certain forms of arthritis. Merck's diverse portfolio reflects its commitment to addressing various aspects of arthritis management and improving patient outcomes.

Bayer, Merck, and Boehringer Ingelheim are major pharmaceutical companies contributing to the German arthritic therapeutic market. Additionally, numerous smaller biotech firms, generic drug manufacturers, and research organizations are actively engaged in the development and production of arthritis medications and therapies. These companies are vital in driving innovation and expanding treatment options for individuals with arthritis in Germany.

By Application

By Product Type

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.