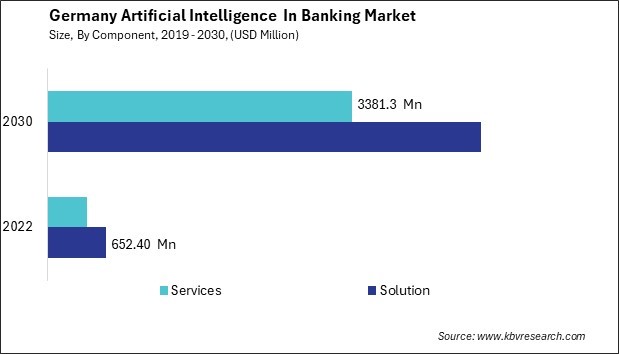

The Germany Artificial Intelligence In Banking Market size is expected to reach $8.2 Billion by 2030, rising at a market growth of 29.2% CAGR during the forecast period.

In Germany, integrating artificial intelligence (AI) into the banking sector is a pivotal driver of innovation, efficiency, and customer-centricity. Recent years have witnessed significant developments in AI technologies, transforming how banks operate, engage with customers, and manage risks. The German artificial intelligence in banking market is characterized by a strong emphasis on leveraging AI to enhance operational processes, offer personalized services, and ensure regulatory compliance.

One of the key areas where AI is making a significant impact is customer service and engagement. German banks are increasingly deploying AI-powered chatbots and virtual assistants to provide round-the-clock customer support, answer queries, and offer personalized recommendations. These AI-driven solutions enable banks to improve customer experience by providing timely and relevant assistance while reducing operational costs.

The BFSI sector in Germany is subject to strict regulatory requirements, which have also influenced technology acceptance. Financial institutions increasingly adopt technology solutions to ensure compliance with regulations such as GDPR (General Data Protection Regulation) and MiFID II (Markets in Financial Instruments Directive II). This includes the use of AI for data privacy and security measures.

Furthermore, AI is crucial in driving operational efficiencies and optimizing business processes within German banks. From automating routine tasks to optimizing resource allocation, AI technologies are helping banks streamline their operations and improve productivity. This focus on operational excellence enables German banks to stay agile and responsive in an increasingly competitive market.

In recent years, the German banking sector has witnessed a growing use of computer vision technologies to enhance operations. Computer vision, a branch of AI that enables machines to interpret and understand visual information from the real world, is being leveraged by German banks to improve security, streamline processes, and enhance customer experiences. German banks are deploying computer vision systems to monitor and analyze real-time video footage from ATMs, branches, and other banking facilities. These systems can detect suspicious activities, such as unauthorized access or tampering with equipment, and alert security personnel or trigger automated responses to mitigate potential risks.

Additionally, computer vision is being used to enhance the customer experience in the German banking sector. Some banks are implementing facial recognition technology, a subset of computer vision, for customer authentication purposes. This allows customers to access banking services securely and conveniently without needing physical identification documents or passwords. Moreover, the technology is being employed to improve the efficiency of document processing and verification in the German banking sector. Banks use computer vision algorithms to scan and analyze documents, such as IDs, passports, and financial forms, to automate the verification process. This speeds up the onboarding process for new customers and reduces the risk of errors associated with manual document processing.

The growing use of computer vision in the German banking sector is driving the evolution of the artificial intelligence in banking market by fueling demand for AI technologies, shaping solution offerings, and influencing market competitiveness. As computer vision continues to play a pivotal role in reshaping banking operations, its impact on the artificial intelligence in banking market is expected to remain significant, driving further innovation and growth in the industry.

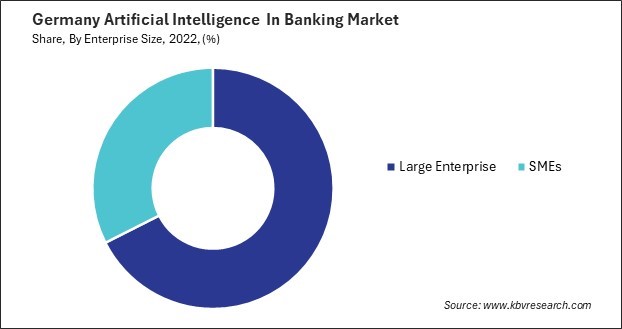

One of the key drivers behind the increasing focus on risk management is the evolving regulatory environment in Germany and the broader European Union. Regulatory bodies such as the European Central Bank (ECB) and the European Banking Authority (EBA) have been implementing stringent regulations to strengthen financial institutions' resilience and improve the financial system's overall stability. This has prompted large German BFSI companies to prioritize risk management to ensure compliance with regulatory standards and mitigate potential penalties.

Additionally, the complex and interconnected nature of global financial sectors has heightened the awareness of systemic risks, prompting large German BFSI companies to proactively manage and mitigate these risks. Factors such as geopolitical uncertainties, economic volatility, and technological disruptions have underscored the need for robust risk management frameworks to identify, assess, and mitigate various risks across different business lines and geographies.

Moreover, the increasing digitization of financial services and the growing prevalence of cyber threats have elevated the importance of operational risk management for large German BFSI companies. As digital technologies become more integrated into banking operations, the risk of cyber attacks, data breaches, and operational disruptions has increased significantly. This has prompted BFSI companies to invest in advanced risk management tools and cybersecurity measures to safeguard their operations and protect customer data.

According to "The State of IT Security in Germany in 2023," published by the Federal Office for Information Security in Germany, from 1 June 2022 to 30 June 2023, an average of 250,000 new malware variants became known daily. Additionally, during this period, around 21,000 infected systems were detected in Germany daily and reported by the BSI to German providers. The daily values fluctuated significantly. At the peak, 45,000 infected systems were reported. Therefore, by prioritizing risk management, companies aim to enhance their resilience, maintain financial stability, and meet the evolving needs of their stakeholders in an increasingly complex and interconnected global financial ecosystem. Thus, all these factors will aid in the expansion of the market.

In the German artificial intelligence in banking market, several companies play significant roles in shaping the adoption and application of AI technologies within the banking sector. These companies offer a wide range of AI solutions tailored to the specific needs of banks, including customer service automation, fraud detection, risk management, and data analytics.

One prominent player in the German market is SAP, a global leader in enterprise software solutions. SAP offers AI-powered banking solutions that help banks automate processes, personalize customer experiences, and optimize operations. This company's AI technologies leverage advanced analytics and machine learning to give banks actionable insights that drive informed decision-making and improve business outcomes.

Another key player in the German artificial intelligence in banking market is IBM, a leading AI and cognitive computing technology provider. This company offers AI solutions for banking that focus on areas such as regulatory compliance, fraud detection, and customer engagement. IBM's AI technologies, including its Watson platform, enable banks to harness the power of AI to enhance their risk management practices, improve customer interactions, and drive innovation.

Moreover, several German and European fintech startups significantly contribute to the artificial intelligence in banking market. These startups specialize in developing AI-powered solutions for various banking applications, including chatbots for customer service, predictive analytics for risk management, and personalized marketing tools. These startups often bring innovative ideas and agile development methodologies to the market, driving competition and innovation in the German banking sector.

Global technology companies like Microsoft and Google are also active in the German artificial intelligence in banking market, offering AI solutions that leverage their advanced technologies and cloud platforms. These companies provide banks access to cutting-edge AI capabilities, enabling them to develop and deploy AI-powered applications more efficiently and effectively.

Overall, the presence of these companies in the German artificial intelligence in banking market reflects the growing importance of AI technologies in the banking sector. As AI continues to evolve, these companies are expected to play a crucial role in driving innovation and shaping the future of banking in Germany through their AI-powered solutions and expertise.

By Component

By Enterprise Size

By Technology

By Application

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.