Int'l : +1(646) 600-5072 | query@kbvresearch.com

Int'l : +1(646) 600-5072 | query@kbvresearch.com

Published Date : 15-Feb-2024 |

Pages: 92 |

Formats: PDF |

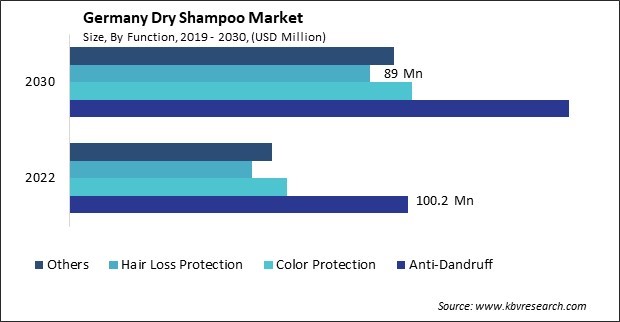

The Germany Dry Shampoo Market size is expected to reach $434.4 million by 2030, rising at a market growth of 5.8% CAGR during the forecast period. In the year 2022, the market attained a volume of 15,430.5 thousand units (100 ml) experiencing a growth of 5.6% (2019-2022).

The dry shampoo market in Germany presents a dynamic landscape characterized by consumer preferences for convenience, sustainability, and diverse formulations. As a key segment within the broader personal care industry, dry shampoos have gained significant traction in Germany, catering to consumers' evolving lifestyles and priorities.

Sustainability and eco-consciousness have become integral aspects of consumer choices in Germany, and this trend extends to the dry shampoo market. Brands respond to the demand for environmentally friendly options by incorporating natural and organic ingredients, biodegradable formulations, and sustainable packaging. Due to the eco-conscious mindset of German consumers, dry shampoo businesses are responding to this trend by highlighting their dedication to clean and environmentally friendly beauty.

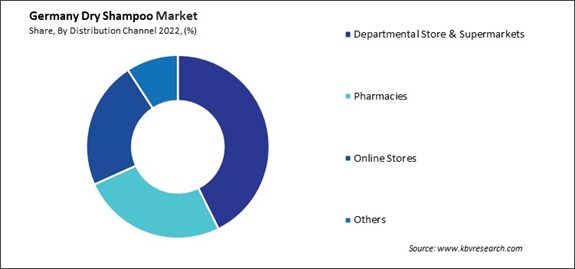

The e-commerce industry for the dry shampoo market in Germany offers consumers unparalleled convenience and a variety of options. Major online platforms and dedicated beauty websites host extensive brands, formulations, and customer reviews, empowering shoppers to make informed decisions. E-commerce retailers in Germany are capitalizing on digital marketing strategies, influencer collaborations, and personalized recommendations to enhance customer engagement. German consumers seeking the most recent innovations and a streamlined shopping experience in the dry shampoo market have increasingly opted to utilize the e-commerce sector due to its streamlined delivery services and secure payment options.

The International Trade Administration states that the total sales were predicted to reach USD 141.2 billion in 2022, which translates to an increase of 11% over 2021. Germany's internet population is predicted to rise to 68.4 million in 2025. The nation had the third-highest rate of e-commerce penetration in the world, with 80 percent of the market.

The dry shampoo market in Germany is experiencing a pronounced shift towards products incorporating natural and organic ingredients. The discerning German consumer, renowned for prioritizing sustainability and health-conscious choices, is driving this demand. Natural dry shampoos, devoid of harmful chemicals and synthetic additives, are gaining traction as consumers seek cleaner and eco-friendly alternatives. This development is consistent with the larger trend toward eco-friendly beauty and wellness, in which consumers are becoming more conscious of how personal care items affect their health and the environment. German consumers are drawn to the transparency of natural ingredients, valuing products that promote a healthier scalp and hair without compromising on ethical and environmental considerations.

The German dry shampoo market's demand for natural and organic ingredients reflects a paradigm shift in consumer preferences. Brands and manufacturers respond by innovating formulations emphasizing sustainability, biodegradability, and cruelty-free practices. This surge in eco-consciousness extends beyond the desire for personal well-being to a broader commitment to environmental responsibility. In light of consumers' proactive pursuit of products that reflect their values, the dry shampoo market's natural and organic segment is poised to experience consistent expansion. Hence, as the industry continues to evolve, companies are recognizing the need to adapt and cater to the increasing demand for clean, green, and natural alternatives, shaping the landscape of the dry shampoo market in Germany.

In the diverse German dry shampoo market, customization plays a pivotal role in catering to various hair types. Recognizing the unique needs of German consumers, brands have embraced a tailored approach to formulation and marketing. For those with fine hair, formulations focus on providing volume without weighing down strands, often incorporating lightweight ingredients like rice starch. Additionally, brands have introduced variants with oil-absorbing properties to address concerns of excessive oiliness in finer hair textures.

Conversely, the market offers specialized dry shampoos for individuals with thicker or curly hair that prioritize moisture retention. These formulations commonly include hydrating components like argan oil or aloe vera to combat dryness and maintain hair health. Brands emphasize the importance of residue-free formulas to avoid any compromise on the natural texture of curly or coarse hair. Therefore, the German dry shampoo market showcases a commitment to addressing the distinct needs of various hair types. Customization is evident in formulation and marketing strategies, ensuring consumers can confidently choose products tailored to their specific hair textures and concerns.

The dry shampoo market in Germany is marked by intense competition as established players and innovative newcomers vie for a share in this dynamic and evolving sector. Recognizing the discerning nature of German consumers when it comes to personal care products, brands are strategically positioning themselves to offer convenience and formulations that align with the country's penchant for high-quality and effective solutions.

Key industry players like Schwarzkopf, Batiste, and Garnier have long been influential in shaping the beauty landscape in Germany. They leverage their brand reputation and extensive distribution channels to maintain a stronghold in the dry shampoo market. Schwarzkopf, a brand under the Henkel umbrella, brings its legacy of hair care expertise to the industry, offering a range of dry shampoos that cater to different hair types and concerns. Batiste, an international player, has made significant inroads by introducing a variety of formulations, including scented options and specialty variants, capturing the attention of German consumers seeking diversity in their dry shampoo choices. Garnier, focusing on blending natural ingredients with effective formulations, appeals to the environmentally conscious segment, contributing to the brand's competitive edge.

In addition to these industry giants, emerging brands are making strides in the German industry by introducing innovative formulations and marketing strategies that resonate with evolving consumer preferences. Niche players such as "Less is More" and "Dust & Cream" are gaining attention by focusing on natural and sustainable formulations, aligning with the rising demand for clean beauty and eco-friendly options.

Private-label and store brands from major retailers like DM and Rossmann contribute to the competitive dynamics by offering budget-friendly alternatives. These products often compete based on price and accessibility, attracting cost-conscious consumers without compromising quality. Private-label options in major retail chains add a layer of competition, compelling branded products to distinguish themselves through innovation and unique selling propositions.

Furthermore, the German dry shampoo market is witnessing the entry of international players seeking to establish a foothold. Global brands such as L'Oréal and Unilever are leveraging their extensive portfolios and marketing expertise to capture the attention of German consumers. These multinational giants introduce a variety of dry shampoo formulations, often incorporating elements from their broader beauty and personal care offerings.

By Function

By Distribution Channel

By End User

BY Type