Int'l : +1(646) 832-2886 | query@kbvresearch.com

Int'l : +1(646) 832-2886 | query@kbvresearch.com

Published Date : 17-May-2024 |

Pages: 91 |

Formats: PDF |

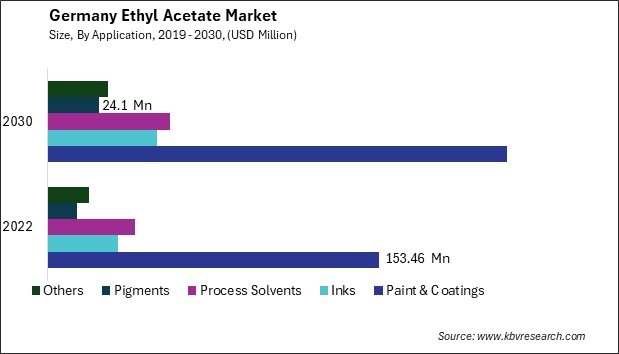

The Germany Ethyl Acetate Market size is expected to reach $372.35 Million by 2030, rising at a market growth of 4.7% CAGR during the forecast period. In the year 2022, the market attained a volume of 187.63 Kilo Tonnes, experiencing a growth of 3.9% (2019-2022).

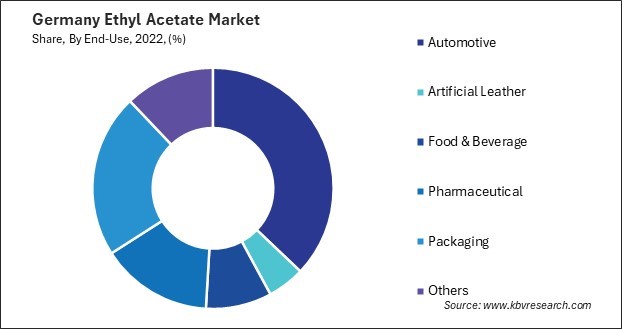

The ethyl acetate market in Germany holds significant importance within the chemical industry, reflecting a crucial component of various sectors such as pharmaceuticals, food and beverage, coatings, adhesives, and cosmetics. In recent years, the ethyl acetate market in Germany has witnessed steady growth, driven by several factors including industrial expansion, technological advancements, and evolving consumer preferences.

Moreover, ethyl acetate finds extensive use in producing paints, coatings, and adhesives due to its excellent solvent properties and ability to evaporate quickly, leaving behind a smooth and glossy finish. Additionally, it serves as a key ingredient in manufacturing perfumes, cosmetics, and personal care products, owing to its pleasant odor and compatibility with various ingredients. Furthermore, the ethyl acetate market in Germany is influenced by technological advancements that enhance production processes and product quality. Manufacturers continuously invest in research and development activities to optimize production techniques, improve yield, and reduce production costs.

The COVID-19 pandemic has also significantly impacted the ethyl acetate market in Germany, as it disrupted supply chains and led to fluctuations in demand across various end-use industries. During the initial phases of the pandemic, lockdown measures and restrictions on mobility resulted in reduced industrial activity, leading to a decline in demand for ethyl acetate. However, as economies gradually reopened and demand started to recover, the ethyl acetate market witnessed a rebound, albeit slower than pre-pandemic levels. Additionally, the pandemic has underscored the importance of resilience and adaptability in supply chains, prompting manufacturers to reassess their strategies to mitigate future disruptions.

The pharmaceutical industry in Germany has experienced a significant rise in demand for ethyl acetate, a versatile solvent widely used in various pharmaceutical applications. Germany's pharmaceutical sector is renowned for its innovation, research, and development capabilities. As a hub for pharmaceutical innovation, the country consistently invests in cutting-edge technologies and processes to enhance drug discovery, development, and manufacturing. The pharmaceutical industry in Germany has emerged as a significant global center for production, experiencing a substantial rise in production volume.

According to Germany Trade & Invest, in 2021, the pharmaceutical industry saw remarkable growth, with production reaching EUR 34.6 billion, marking a 6.9% increase compared to the previous year. Similarly, in 2022, there was a notable surge in pharmaceutical industry sales within Germany, achieving a 5.4% increase and reaching EUR 56.5 billion at ex-manufacturer prices. This upward trend mirrors the rise in the ethyl acetate market within Germany's pharmaceutical sector.

Furthermore, stringent regulatory standards and quality requirements imposed by regulatory bodies such as the European Medicines Agency (EMA) necessitate using high-quality solvents in pharmaceutical manufacturing. Ethyl acetate meets these stringent criteria, ensuring pharmaceutical products' safety, efficacy, and purity. The pharmaceutical industry's adherence to strict quality standards has propelled the demand for ethyl acetate as a preferred solvent in drug formulation and manufacturing processes.

Moreover, Germany's growing emphasis on environmentally sustainable practices and green chemistry initiatives has led pharmaceutical companies to seek eco-friendly alternatives to traditional solvents. Thus, the surge in demand for ethyl acetate in Germany's pharmaceutical industry reflects the sector's commitment to quality and innovation.

The ethyl acetate market in Germany is experiencing a significant shift towards eco-friendly products, driven by growing environmental concerns, regulatory pressures, and consumer preferences for sustainable alternatives. With increasing awareness about the adverse effects of conventional chemical products on the environment and human health, there is a rising demand for eco-friendly alternatives in the German industry. Manufacturers and consumers seek sustainable solutions that minimize environmental impact without compromising performance.

One key driver of this trend is the stringent environmental regulations imposed by the German government and the European Union. Regulatory measures such as REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) and the VOC Directive have compelled industries to adopt cleaner production processes and reduce emissions of harmful substances, including ethyl acetate. Consequently, there is a growing preference for eco-friendly ethyl acetate formulations that comply with these regulations and offer lower VOC content.

Moreover, consumers in Germany are increasingly making informed purchasing decisions based on environmental considerations. The rise of eco-conscious consumerism has led to a surge in demand for products labeled as 'green,' 'sustainable,' or 'eco-friendly.' Manufacturers in the ethyl acetate market in Germany are responding to this demand by developing and commercializing eco-friendly formulations. Therefore, the ethyl acetate market in Germany is undergoing a significant shift towards eco-friendly products driven by regulatory pressures, growing environmental concerns, and consumer preferences for sustainable alternatives.

The ethyl acetate market in Germany is robust and characterized by several key players contributing to its growth and development. One of the major players in the German ethyl acetate market is BASF SE. Founded in 1865 and headquartered in Ludwigshafen, BASF is one of the world's largest chemical companies, with a diverse portfolio of products and services. The company produces ethyl acetate as a solvent for coatings, paints, and printing inks, among other applications. BASF's commitment to innovation and sustainability drives its leadership in the ethyl acetate market, ensuring the delivery of high-quality products that meet the evolving needs of its customers.

Evonik Industries AG is also a key player in the German ethyl acetate market. Headquartered in Essen, Germany, Evonik is a leading specialty chemicals company with a strong presence in Europe and beyond. The company produces ethyl acetate for diverse applications such as coatings, solvents, and pharmaceuticals. Evonik's commitment to sustainability and customer satisfaction underpins its competitiveness in the ethyl acetate market, driving innovation and continuous improvement in its products and processes.

Additionally, Merck KGaA is a notable participant in the German ethyl acetate market. Founded in 1668 and headquartered in Darmstadt, Germany, Merck is a global science and technology company in the healthcare, life sciences, and performance materials sectors. The company produces ethyl acetate for various applications, including pharmaceuticals, laboratory chemicals, and industrial solvents. Merck's focus on innovation and collaboration ensures the development of cutting-edge solutions that meet the needs of its diverse customer base.

Furthermore, Wacker Chemie AG is a significant player in the German ethyl acetate market. Based in Munich, Germany, Wacker Chemie is a leading manufacturer of silicones, polymers, and specialty chemicals. The company produces ethyl acetate for coatings, adhesives, and pharmaceuticals. Wacker Chemie's dedication to sustainability and technological excellence reinforces its position as a trusted supplier in the ethyl acetate market, delivering value-added solutions to its customers. These companies' commitment to innovation, sustainability, and customer satisfaction ensures the continued growth and development of the ethyl acetate market in Germany, driving competitiveness and fostering collaboration across the industry.

By Distribution Channel

By Application

By End Use