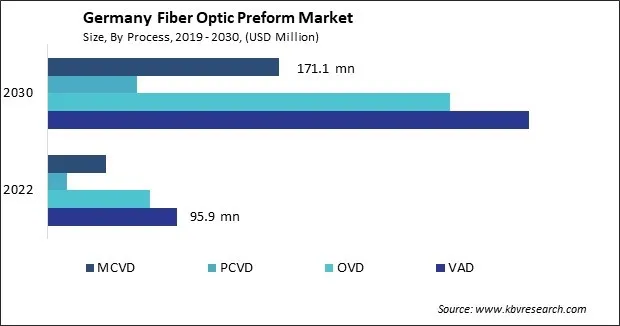

The Germany Fiber Optic Preform Market size is expected to reach $890.7 million by 2030, rising at a market growth of 18.7% CAGR during the forecast period.

The German market for fiber optic preforms has grown significantly in recent years due to the increasing number of data-intensive applications, the emergence of Industry 4.0, and the growing dependence on digital technologies. The market size reflects the nation's position as a technology leader, with a steady increase in investment to expand and upgrade existing fiber optic preform networks. Government initiatives have been instrumental in expanding fiber optic preform networks across Germany. Programs such as the Gigabit Germany project underscore the commitment to providing gigabit-speed internet access to a substantial portion of the population.

These initiatives aim not only to foster digital inclusion but also to support economic growth, innovation, and competitiveness on a global scale. The unique topographical features of rural Germany present challenges and opportunities in expanding the fiber optic preform market. The varied landscapes, including hilly terrains and remote villages, demand innovative deployment strategies. Community-driven initiatives, where residents actively participate in the planning and implementation of broadband network projects, have gained traction. This not only fosters a sense of ownership but also ensures that the broadband networks align with the specific needs of each community.

Germany hosts several significant operators that offer effective competition in the broadband networks sectors; the German mobile industry is driven by mobile data, with the number of mobile broadband network subscribers having increased rapidly in 2022, with LTE now effectively being available universally, considerable progress has recently been made in building out 5G networks.

Moreover, Germany has one of the largest ICT sectors in the world and the single largest software industry in Europe, with around 100,000. Prominent corporations, including SAP, Microsoft, Apple, Dell, Adobe, IBM, and Oracle, hold substantial portions of the market. Based on data from the International Trade Administration, the IT subsectors generated the following subsector revenues in 2022: USD 45.3 billion for services, USD 34.9 billion for IT hardware, and USD 34.1 billion for software. Consistent growth has been observed in the IT sector's total revenue, projected to reach USD 141.6 billion in 2023 from USD 76.4 billion in 2007. Consequently, the German ICT sector drives the demand for fiber optic preform.

Germany's fiber optic preform market is experiencing a transformative wave driven by its profound integration into industrial applications, marking a paradigm shift in how manufacturing and automation processes are orchestrated. A notable facet of the German industrial fiber optic preform market is the strong emphasis on research and development. Industry players and research institutions collaborate intensively to innovate and address the industrial context's specific challenges. This includes developing fiber optic preform solutions capable of withstanding harsh environmental conditions prevalent in industrial settings, ensuring the durability and longevity of the infrastructure.

Furthermore, integrating fiber optics preform market into industrial applications aligns with Germany's commitment to sustainability. As Industry 4.0 drives energy-efficient and resource-conscious manufacturing, fiber optic preform is eco-friendly. Their low power consumption and reduced environmental impact compared to traditional copper-based alternatives resonate with the broader goals of sustainable industrial practices. Thus, Germany's fiber optic preform market is undergoing a transformative phase with a focus on industrial integration driven by robust research and development initiatives.

The expansion of rural broadband networks in Germany represents a significant and unique facet of the fiber optic preform market, reflecting the nation's commitment to ensuring that even remote communities can access high-speed internet connectivity. This initiative, driven by the recognition that robust broadband infrastructure is an economic imperative and essential for fostering social inclusion and regional development, has gained prominence in recent years.

Germany's rural broadband expansion, often facilitated by the fiber optic preform market, responds to the challenges posed by the digital divide. The German government has played a pivotal role in driving the expansion of rural broadband networks. Various funding programs and initiatives have been launched to incentivize telecommunications providers to invest in the deployment of fiber optic preforms in underserved areas. Public-private partnerships have also been instrumental, leveraging the strengths of both sectors to overcome the economic challenges associated with reaching sparsely populated regions.

As Germany continues to prioritize expanding rural broadband networks, the role of fiber optic preform becomes increasingly pivotal. The scalability, reliability, and future-proof nature of fiber optic preform infrastructure ensure that rural areas are included in the digital age. This initiative aligns with broader European Union objectives for digital inclusion and sustainable development, reflecting a comprehensive approach to leveraging technology for the benefit of all citizens, regardless of their geographical location.

The fiber optic preform market in Germany is characterized by intense competition among crucial players vying for dominance in a landscape driven by the rising demand for high-speed internet connectivity, advancements in digital technologies, and a national focus on expanding broadband infrastructure. Several companies have emerged as significant competitors, each contributing to the dynamic and evolving nature of the German fiber optic preform market.

Major telecommunications companies play a pivotal role in shaping Germany's fiber optic preform market. Companies like Deutsche Telekom AG and Vodafone Germany are key players, leveraging their extensive infrastructure and strategic initiatives to capture a significant market share. The presence of regional players, including 1&1 Drillisch AG and M-net Telekommunikations GmbH, adds diversity to the competitive landscape. Additionally, infrastructure providers like Deutsche Glasfaser contribute to the market by focusing on building fiber optic preform market in underserved areas.

Deutsche Telekom AG, a telecommunications giant, is a major player in the German fiber optic preform market. Leveraging its extensive infrastructure, Deutsche Telekom has been at the forefront of deploying fiber optic preform in the nationwide market. The company's fiber-to-the-home (FTTH) initiatives aim to deliver ultra-fast broadband directly to residences, catering to the escalating consumer demand for high-speed internet. Deutsche Telekom's strategic investments and commitment to enhancing network capabilities position it as a formidable competitor to capture market share.

Vodafone Germany, another key player, has been actively expanding its fiber optic footprint, intensifying the competition in the market. The acquisition of Unitymedia has significantly bolstered Vodafone's position, allowing the company to offer high-speed broadband services to a broader customer base. Vodafone's emphasis on delivering gigabit-speed internet and its integration of fiber optics into its broader telecommunications portfolio contribute to its competitive edge.

1&1 Drillisch AG, a major telecommunications and internet service provider, has also made significant inroads into Germany's fiber optic preform market. The company's focus on offering competitive broadband packages, including high-speed fiber-optic-based plans, has garnered attention in the highly competitive consumer market. As a disruptor, 1&1 Drillisch AG is pivotal in shaping pricing strategies and service offerings, contributing to the competitive dynamics.

Regional players, such as M-net Telecommunications GmbH, have carved out niches in specific areas, intensifying competition at the local level. M-net has been expanding its fiber optic preform market networks in Bavaria, focusing on providing high-quality services to businesses and residential customers. The regional competition adds a layer of complexity, with localized players often tailoring their strategies to meet the needs of their respective markets.

International players like Telefónica Deutschland are also actively participating in the competition. Telefónica's integration of fiber optics into its broader telecommunications infrastructure and services reflects a global approach to meeting the demands of the digital age. The company's investments in network modernization contribute to the overall competitiveness of Germany's fiber optic preform market. In addition to traditional telecommunications companies, infrastructure providers like Deutsche Glasfaser are instrumental in shaping the competitive landscape. Deutsche Glasfaser focuses on building fiber optic preform market infrastructure in underserved areas, contributing to the government's initiatives to bridge the digital divide.

By Process

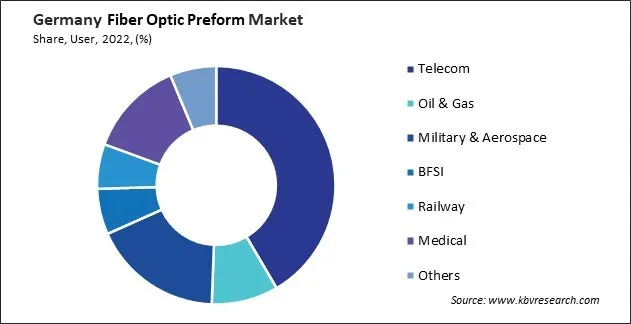

By End-user

By Type

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.