Int'l : +1(646) 832-2886 | query@kbvresearch.com

Int'l : +1(646) 832-2886 | query@kbvresearch.com

Published Date : 20-May-2024 |

Pages: 99 |

Formats: PDF |

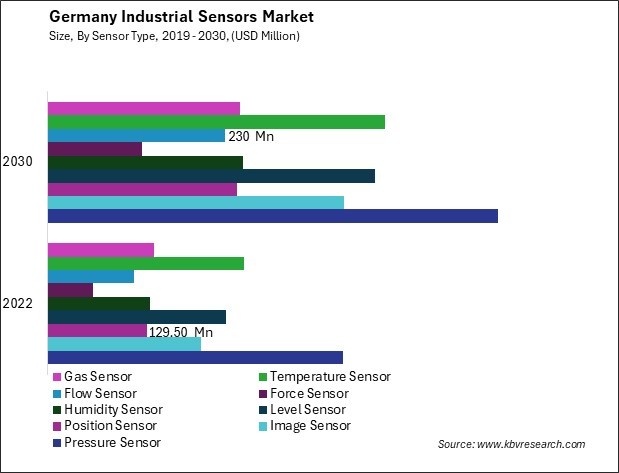

The Germany Industrial Sensors Market size is expected to reach $2.9 Billion by 2030, rising at a market growth of 7.6% CAGR during the forecast period. In the year 2022, the market attained a volume of 9090.1 thousand units, experiencing a growth of 10.1% (2019-2022).

The industrial sensors market in Germany stands at the forefront of technological innovation, playing a pivotal role in the nation's industrial landscape. Renowned for its engineering prowess and commitment to precision manufacturing, Germany has established itself as a global leader in adopting and developing industrial sensor technologies. With an increasing emphasis on sustainability and energy efficiency, sensors are pivotal in ensuring that industrial processes align with Germany's commitment to environmental responsibility.

German industries, ranging from automotive to manufacturing, leverage diverse sensors to enhance efficiency, quality control, and overall productivity. The automotive sector of the German economy extensively employs sensors for applications such as collision avoidance, adaptive cruise control, and autonomous driving technologies. The demand for specialized sensors, including those for temperature, pressure, and vibration monitoring, has steadily risen in Germany. These sensors cater to the specific needs of industries such as pharmaceuticals, chemicals, and energy.

German companies are exploring ways to process data at the network's edge, reducing latency and enhancing real-time decision-making capabilities. This trend is particularly relevant in applications where instant response and minimal delay are critical, such as smart manufacturing and autonomous systems. The rise of edge computing is influencing the design and capabilities of industrial sensors market.

The COVID-19 pandemic has presented both challenges and opportunities for the industrial sensors market in Germany. The initial disruptions caused by lockdowns and supply chain interruptions led to a temporary slowdown in manufacturing activities. However, the pandemic also accelerated the adoption of digital technologies, including sensors, to ensure resilience and adaptability in the face of unforeseen challenges. Remote monitoring solutions became imperative during lockdowns, with industrial sensors enabling companies to monitor equipment and processes from a distance.

In recent years, Germany has witnessed a significant expansion in the pharmaceutical industry, with a parallel surge in the demand for advanced industrial sensors. This symbiotic relationship is underpinned by Germany's reputation as a global pharmaceutical hub and its commitment to innovation in manufacturing processes. As pharmaceutical companies in Germany continue to invest in cutting-edge technologies and processes, the industrial sensors market has become a critical enabler of efficiency, quality, and compliance in the manufacturing landscape.

According to Germany Trade & Invest, Germany stands as a prominent global hub for pharmaceutical production, boasting a substantial increase in production volume, reaching EUR 34.6 billion in 2021 with a remarkable 6.9 percent year-on-year growth. The subsequent year, 2022, witnessed a notable surge in pharmaceutical industry sales within Germany, marking a 5.4 % increase and reaching EUR 56.5 billion at ex-manufacturer prices. This robust growth in Germany's pharmaceutical sector indicates the nation's pivotal role in the global pharmaceutical landscape.

One of the key drivers of the expansion in the pharmaceutical industry is the increasing focus on precision medicine and personalized therapies. This necessitates advanced manufacturing techniques and real-time monitoring, where industrial sensors are pivotal. From temperature and pressure sensors ensuring optimal manufacturing conditions to sophisticated monitoring systems ensuring adherence to strict regulatory standards, the integration of industrial sensors has become integral to pharmaceutical production processes.

Furthermore, Germany's emphasis on Industry 4.0, the fourth industrial revolution characterized by smart manufacturing, has propelled the adoption of state-of-the-art sensors. Thus, Germany's flourishing pharmaceutical industry has synergized with the growing demand for advanced industrial sensors, driven by a commitment to innovation, precision medicine, and adherence to Industry 4.0 principles.

In Germany, the industrial sensors market is experiencing a notable surge in the adoption of level sensors, marking a pivotal shift in manufacturing and industrial processes. One key driver behind the rising adoption of level sensors in Germany is the country's strong emphasis on industrial automation and Industry 4.0 principles. German industries actively integrate smart technologies to optimize production processes and improve productivity.

Moreover, stringent environmental regulations in Germany necessitate accurate monitoring of liquid levels in various industrial sectors, such as chemicals, pharmaceuticals, and manufacturing. Level sensors aid German companies in adhering to these regulations by preventing overflows and leaks and ensuring responsible resource management. This focus on environmental sustainability aligns with Germany's commitment to green practices and responsible industrial growth.

In the context of Germany's manufacturing landscape, the level sensors widespread application across diverse sectors, including chemical processing, automotive manufacturing, and pharmaceuticals. German chemical industries leverage these sensors to ensure accurate monitoring of liquid levels during various production processes, thereby adhering to stringent quality standards and regulatory requirements.

Germany's robust research and development ecosystem further supports the evolution of level sensor technologies. Furthermore, Germany's commitment to sustainability and environmental responsibility is reflected in the adoption of level sensors. These sensors assist industries in monitoring and managing fluid levels, preventing spills and overflows that have detrimental environmental impacts. Hence, Germany's industrial sensors market is witnessing a surge in level sensor adoption driven by a commitment to Industry 4.0, environmental regulations, and a focus on sustainable and responsible industrial practices.

The industrial sensors market in Germany is a dynamic and thriving sector, playing a crucial role in the country's advanced manufacturing landscape. Within this dynamic industry, Siemens AG stands as a stalwart. Renowned for its comprehensive range of industrial sensors, Siemens is a German multinational conglomerate that has been a key player in shaping the country's industrial landscape. Leveraging its expertise in automation and digitalization, Siemens provides sensors that cater to a wide array of applications, from manufacturing to energy management.

SICK AG, a German sensor manufacturer, has a global footprint and significantly contributes to the country's industrial sensors market. Specializing in factory and logistics automation sensor solutions, SICK's products enhance the precision and reliability of industrial processes. The company's emphasis on sustainability and resource efficiency resonates with Germany's commitment to environmental responsibility.

Another German giant, Bosch is deeply entrenched in the industrial sensors market. Bosch's commitment to technological advancement is evident in its sensor solutions, which find applications in automotive, manufacturing, and smart infrastructure. The company's emphasis on innovation aligns with Germany's reputation for precision engineering and high-quality manufacturing.

WAGO, with its focus on automation technology, is a key player in the industrial sensors market. The company's offerings include sensor and actuator interfaces facilitating seamless communication within industrial systems. WAGO's products contribute to the development of smart factories, aligning with Germany's push towards Industry 4.0.

In the realm of temperature and pressure sensors, Endress+Hauser holds a prominent position. Specializing in process automation, this German company provides advanced sensor solutions tailored to the unique requirements of industries such as chemicals, food and beverage, and pharmaceuticals. Endress+Hauser's sensors contribute to the optimization of industrial processes, ensuring both reliability and efficiency.

IFM Electronic GmbH, a German sensor and automation company, is known for its broad portfolio of industrial sensors. The company's products are crucial in monitoring and controlling various parameters in industrial processes, aligning with the country's focus on precision engineering and technological excellence. Through their innovative sensor solutions, these companies contribute to the efficiency of industrial processes and solidify Germany's position as a key player in the global industrial landscape.

By Sensor Type

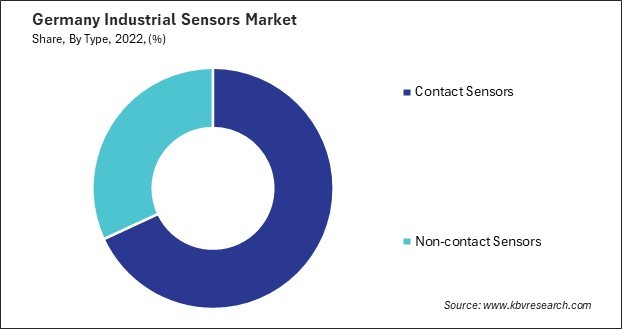

By Type

By End User