Int'l : +1(646) 600-5072 | query@kbvresearch.com

Int'l : +1(646) 600-5072 | query@kbvresearch.com

Published Date : 20-May-2024 |

Pages: 95 |

Formats: PDF |

The Germany NDT and Inspection Market size is expected to reach $1.3 Billion by 2030, rising at a market growth of 8.7% CAGR during the forecast period.

Germany's NDT and inspection market represents a crucial sector within the country's industrial landscape. As one of the leading manufacturing nations globally, Germany has a robust demand for NDT and inspection services across diverse industries such as automotive, aerospace, energy, and manufacturing. The automotive industry of the German economy heavily relies on NDT for quality control during production. With Germany being home to several renowned automobile manufacturers and suppliers, the demand for advanced NDT technologies remains consistently high.

According to the International Trade Administration, by 2025, an impressive 84% of German manufacturers are gearing up to channel EUR 10 billion annually into integrating smart manufacturing technologies. This substantial investment encompasses various sectors, with the automotive industry earmarking approximately 1.2 billion annually. Similarly, machinery & equipment and construction sectors are set to allocate 1.5 billion. Within this landscape, Germany's NDT and inspection market are positioned to witness significant growth and adoption, fueled by these substantial investments in advanced manufacturing technologies.

Moreover, the energy industry, including both conventional and renewable energy sectors, presents significant opportunities for NDT and inspection services. With Germany's ambitious targets for renewable energy deployment, there is a growing need for inspecting and monitoring infrastructure such as wind turbines, solar panels, and transmission lines. Furthermore, the country's extensive network of pipelines for oil, gas, and other fluids requires regular inspection to prevent leaks and ensure operational efficiency.

The COVID-19 pandemic has undoubtedly impacted Germany's NDT and inspection market, albeit with both challenges and opportunities. The initial phase of the pandemic saw disruptions in industrial activities, including temporary shutdowns of manufacturing facilities and construction projects, leading to a decline in demand for NDT services. Moreover, travel restrictions and social distancing measures posed logistical challenges for on-site inspection activities, forcing companies to adopt remote inspection solutions where feasible.

In Germany, the NDT and inspection market are witnessing a significant surge in the adoption of visual testing methods. One key driver is the country's robust manufacturing sector, which spans automotive, aerospace, engineering, and other high-tech industries. With Germany being a global leader in manufacturing, there is a heightened emphasis on quality control and assurance throughout the production process. Visual testing techniques offer a non-intrusive yet highly effective means of detecting surface defects, weld discontinuities, and other anomalies in manufactured components.

Moreover, Germany's stringent regulatory standards further incentivize the adoption of advanced inspection methodologies. Companies operating within the country must comply with strict quality and safety regulations, particularly in the automotive and aerospace industries, where component integrity is paramount. Visual testing is crucial for meeting these regulatory requirements while ensuring product reliability and safety.

Additionally, the advent of innovative technologies is driving the evolution of visual testing capabilities in the German industry. Advanced imaging techniques, such as digital microscopy and remote visual inspection systems, enable inspectors to achieve higher precision and efficiency in defect detection. These technologies are increasingly integrated into automated inspection processes, enhancing productivity and reducing inspection times. Therefore, the surge in visual testing adoption in Germany's NDT and inspection market is driven by robust manufacturing, stringent regulatory standards, and innovative technology advancements.

The NDT and inspection market is undergoing a notable shift towards sustainability in Germany. With a robust industrial sector and a strong commitment to environmental stewardship, German companies are increasingly integrating sustainable practices into their NDT and inspection processes. One significant aspect driving this change is the country's stringent environmental regulations. Germany has long been at the forefront of environmental legislation, with laws and standards prioritizing sustainability across industries.

Moreover, Germany's reputation as a global leader in technology and innovation plays a pivotal role. Companies within the NDT and inspection market are leveraging cutting-edge technologies to develop sustainable solutions tailored to the specific needs of German industries. Furthermore, German businesses are growing awareness of the importance of corporate social responsibility (CSR). Many companies actively seek NDT and inspection partners who share their commitment to sustainability.

The renewable energy sector in Germany has experienced significant growth in recent years, driving the demand for NDT and inspection services tailored to the unique requirements of renewable energy infrastructure. This has led to the development of specialized inspection techniques and technologies designed to assess the condition of wind turbines, solar panels, and other renewable energy assets while minimizing environmental impact in Germany.

According to the International Trade Administration, the country has set ambitious targets to source 80% of its energy from renewables by 2030. By 2022, Germany had made significant progress, achieving 46% of this goal. Renewable sources constituted a substantial 42.3% share of the domestic energy mix. With stringent regulatory standards and a strong emphasis on quality assurance, the Japanese NDT and inspection market remains at the forefront of innovation and efficiency.

In addition, the German government's support for sustainable initiatives further accelerates this trend. Policymakers encourage businesses to adopt greener practices through incentives, grants, and subsidies, including NDT and inspection processes. Hence, Germany's NDT and inspection sector embraces sustainability as a core principle, driven by stringent regulations, technological innovation, corporate responsibility, and government support.

Germany is renowned for its engineering excellence and advanced technological solutions, making it a key player in the NDT and inspection market. The Fraunhofer Institute for Non-Destructive Testing (IZFP) is a leading company in the German NDT and inspection market. As one of the world's leading research institutions in the field of NDT, Fraunhofer IZFP conducts cutting-edge research and development to advance NDT technologies and methodologies. The institute collaborates closely with industry partners to develop customized inspection solutions tailored to specific needs, ranging from ultrasonic and electromagnetic testing to digital radiography and thermography.

Bosch Rexroth, a subsidiary of Bosch Group, is also a key player in the German NDT and inspection market, particularly in the field of industrial automation and drive technologies. The company offers a range of inspection systems and solutions for quality assurance and predictive maintenance, including vision systems, laser measurement technology, and vibration analysis. Their NDT solutions help optimize manufacturing processes, improve product quality, and ensure compliance with industry standards.

Another prominent German NDT and inspection market player is Siemens AG, a global powerhouse in industrial automation, digitalization, and electrification. Siemens offers a comprehensive portfolio of NDT solutions, including ultrasonic testing (UT), radiographic testing (RT), magnetic particle testing (MPT), and eddy current testing (ECT). With a focus on innovation and digitalization, Siemens leverages advanced technologies such as artificial intelligence (AI) and data analytics to enhance inspection efficiency, accuracy, and reliability.

In addition to these major players, Germany is home to numerous specialized NDT and inspection companies that cater to specific industry sectors. For example, Karl Deutsch Prüf- und Messgerätebau GmbH + Co KG specializes in ultrasonic testing equipment and solutions for automotive, aerospace, and manufacturing applications. The company's innovative products and customer-centric approach have earned them a reputation for excellence in the field of NDT.

Similarly, Rohmann GmbH is a leading provider of eddy current testing equipment and systems, serving automotive, aerospace, and electronics manufacturing industries. Rohmann's high-performance NDT solutions enable rapid and reliable detection of surface and subsurface defects, helping companies ensure product quality and reliability. With a diverse ecosystem of companies offering various NDT solutions and services, Germany remains at the forefront of advancements in non-destructive testing and inspection technologies, driving excellence and reliability across industries.

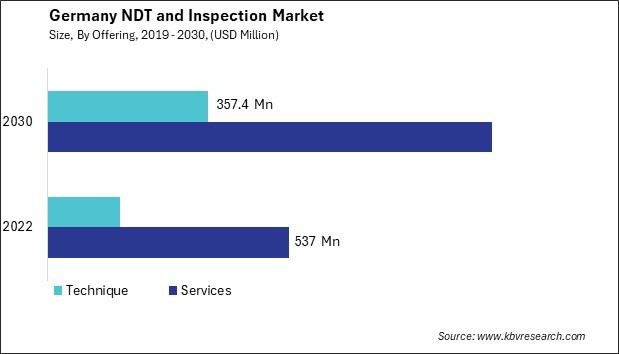

By Offering

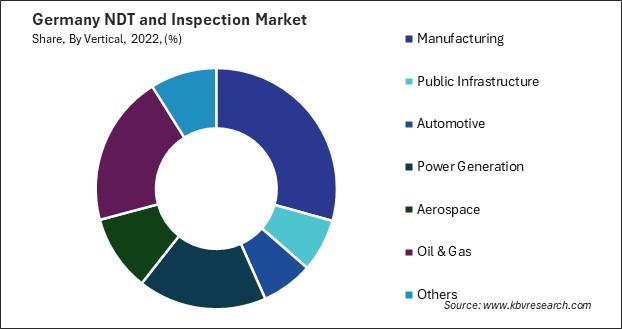

By Vertical