The Germany Payment Card Skimming Market size is expected to reach $379 Million by 2030, rising at a market growth of 8.1% CAGR during the forecast period.

The payment card skimming market in Germany has been a concern for both financial institutions and consumers. Despite efforts to enhance security measures, the prevalence of payment card skimming has been a persistent issue. Criminal organizations continuously evolve tactics to circumvent existing safeguards, making it challenging for authorities and financial institutions to stay ahead of the curve. The underground industry for skimming devices and stolen card data operates domestically and internationally, facilitated by sophisticated networks of cybercriminals.

One significant factor driving the payment card skimming market in Germany is the lucrative potential for financial gain. With a high volume of card transactions occurring daily across the country, criminals see ample opportunities to exploit vulnerabilities in payment systems. Additionally, the relatively advanced infrastructure and widespread adoption of electronic payment methods make Germany an attractive target for skimming operations.

Moreover, the need for uniform security standards across different payment systems and devices poses a significant challenge in combating card skimming. While measures such as EMV chip technology have helped mitigate some risks, legacy systems that rely solely on magnetic stripe data remain vulnerable to exploitation. Additionally, the proliferation of contactless payment methods introduces new avenues for potential exploitation if not properly secured.

The COVID-19 pandemic has also impacted the payment card skimming market in Germany. As lockdown measures were implemented to curb the spread of the virus, there was a notable shift towards online and contactless transactions, reducing the opportunities for physical card skimming at ATMs and point-of-sale terminals. However, this transition has also led to an uptick in cybercrime activity, with criminals increasingly targeting e-commerce platforms and exploiting vulnerabilities in digital payment systems. Furthermore, the economic strain caused by the pandemic drives individuals towards illicit means of income, potentially fueling the growth of underground industries for stolen card data.

In recent years, Germany has witnessed a significant shift towards card payments, marking a departure from traditional cash transactions. One of the primary reasons for the growth of card payment skimming in Germany is the proliferation of point-of-sale (POS) terminals and ATMs susceptible to tampering. Criminals install skimming devices discreetly on these machines, often undetected by German consumers, to harvest card data during legitimate transactions. Additionally, advancements in skimming technology have made it increasingly difficult to detect compromised devices, further exacerbating the problem.

Moreover, the rise of e-commerce and online shopping has created new avenues for card skimmers to exploit. According to the International Trade Administration, in 2022, the e-commerce industry in Germany experienced robust growth, with total sales estimated at USD 141.2 billion, representing an impressive 11% increase compared to 2021. In 2022, the industry's online presence in Germany soared to a substantial 80%, securing its place as the third highest globally in terms of online industry penetration. As more individuals embrace online shopping, the potential for fraudulent activities escalates, requiring robust security measures to mitigate risks effectively.

To address the rising threat of payment card skimming, stakeholders in Germany collaborate to implement comprehensive security measures. This includes investing in advanced fraud detection technologies, enhancing encryption protocols, and implementing strict regulatory frameworks to deter criminal activities.

Additionally, raising awareness among German consumers about the risks associated with card payments and educating them on best practices for safeguarding their financial information is crucial in combating card skimming effectively. Hence, Germany is actively bolstering security measures and promoting consumer awareness to safeguard against fraudulent activities in traditional and online payment transactions.

The rise of digital payment methods has significantly impacted the payment card skimming market in Germany, reshaping both the methods employed by criminals and the vulnerabilities they exploit. One notable trend is the proliferation of online skimming attacks targeting e-commerce websites and payment gateways. Cybercriminals deploy malicious code, often through compromised third-party scripts or plugins, to intercept payment information users enter during online transactions.

Moreover, the increasing adoption of contactless payment methods, such as NFC-enabled cards and mobile wallets, has introduced new opportunities for skimming attacks in Germany. Furthermore, the interconnected nature of digital payment ecosystems has facilitated the emergence of sophisticated cybercrime networks specializing in card fraud. These networks leverage dark web forums, online marketplaces, and encrypted communication channels to exchange stolen card data, tools, and expertise, enabling them to scale their operations and evade law enforcement detection.

Furthermore, the increasing usage of digital payment methods has also prompted increased collaboration between financial institutions, payment processors, and cybersecurity firms to develop proactive measures for detecting and mitigating card skimming attacks. Therefore, the rise of digital payment methods in Germany has spurred innovation in cybercrime tactics, leading to a surge in online skimming attacks and the emergence of sophisticated fraud networks, driving collaboration among stakeholders to enhance security measures.

In Germany, the payment card skimming market presents a significant threat to consumers and businesses, necessitating implementing advanced cybersecurity measures to combat fraud. One prominent player in the payment card skimming market is Giesecke+Devrient (G+D). As a leading global provider of secure payment solutions, G+D offers a range of products and services to protect against card skimming and other forms of payment fraud. The company's expertise in encryption, authentication, and secure hardware technologies enables it to develop cutting-edge security solutions for payment terminals, ATMs, and other point-of-sale devices.

Another significant player in the German payment card skimming market is Wirecard AG. Wirecard is a leading digital payment solutions provider, offering a comprehensive suite of services to merchants, financial institutions, and consumers. The company's portfolio includes fraud detection and prevention tools, secure payment processing platforms, and tokenization services designed to mitigate the risk of card skimming and other cyber threats. By partnering with Wirecard, businesses in Germany implement robust security measures to protect against unauthorized access to payment data and ensure the integrity of electronic transactions.

Additionally, Secunet Security Networks AG is a key player in the German cybersecurity industry, specializing in IT security solutions for government agencies, enterprises, and critical infrastructure operators. Secunet's offerings include secure authentication, encryption, and network security solutions to protect against card skimming and other cyber threats. By leveraging Secunet's expertise, organizations in Germany strengthen their security posture and safeguard sensitive information from unauthorized access or tampering.

Furthermore, companies like Diebold Nixdorf and Wincor Nixdorf (now part of Diebold Nixdorf) play significant roles in the German payment card skimming market by providing secure hardware solutions for ATMs and self-service kiosks. These companies develop tamper-resistant designs, anti-skimming technologies, and secure encryption mechanisms to protect against card skimming attacks and ensure the integrity of cash withdrawal transactions. By incorporating these security features into their ATM networks, banks and financial institutions in Germany enhance customer trust and confidence in electronic banking services.

Moreover, companies such as Bundesdruckerei GmbH and Veridos GmbH specialize in providing secure identity and authentication solutions, including biometric identification technologies and eID cards, to prevent card skimming and identity theft. These companies collaborate with government agencies, financial institutions, and private enterprises to implement secure authentication mechanisms and protect against fraudulent activities.

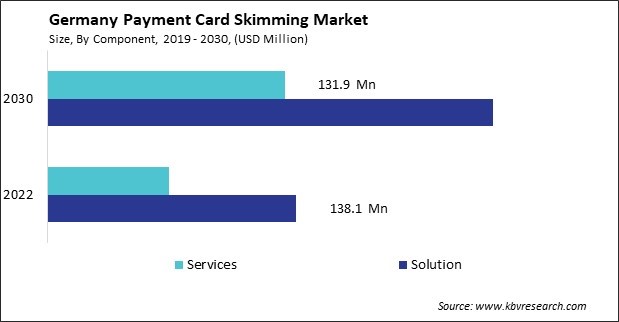

By Component

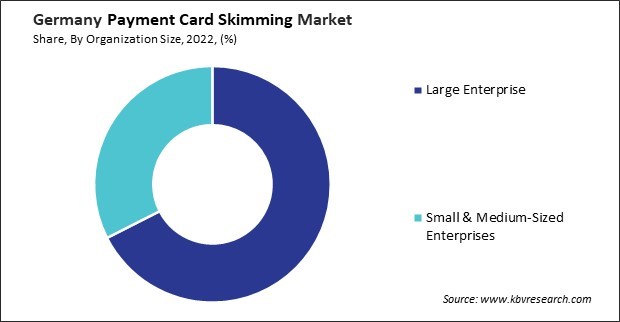

By Organization Size

By Deployment Type

By Application

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.