Germany Photoelectric Sensors Market Size, Share & Industry Trends Analysis Report By Technology, By Application (Automotive, Electronics & Semiconductor, Packaging, Military & Aerospace, and Others), Outlook and Forecast, 2023 - 2030

Published Date : 26-Mar-2024 |

Pages: 87 |

Formats: PDF |

COVID-19 Impact on the Germany Photoelectric Sensors Market

The Global Photoelectric Sensors Market size is expected to reach $148.22 million by 2030, rising at a market growth of 4.5% CAGR during the forecast period. In the year 2022, the market attained a volume of 2,082.36 thousand units, experiencing a growth of 4.6% (2019-2022).

The photoelectric sensors market in Germany has witnessed significant growth and innovation, driven by the country's robust industrial sector and commitment to technological advancements. Photoelectric sensors play a key role in automation and control systems, enabling precise and reliable detection of objects, distances, and colors. As Germany continues to be a global leader in manufacturing and Industry 4.0 initiatives, the demand for advanced sensing technologies like photoelectric sensors is rising.

The stringent safety standards in the German industries also drive the adoption of photoelectric sensors for personnel and equipment protection. These sensors are employed in safety systems to detect the presence of personnel in hazardous areas, ensuring compliance with occupational safety regulations. The reliability and responsiveness of the photoelectric sensors make them integral components in ensuring a safe working environment across various industrial sectors.

As the photoelectric sensors market in Germany continues to grow, there is a parallel focus on research and development to introduce innovative sensor technologies. Miniaturization, increased sensing range, and the integration of artificial intelligence are some trends shaping the evolution of photoelectric sensors. German sensor manufacturers are actively investing in R&D to stay at the forefront of technological advancements and cater to the evolving needs of industries.

Germany's robotics and automation (R&A) industry has been a key driver for adopting photoelectric sensors, contributing to the nation's leadership in advanced manufacturing. German manufacturers in sectors such as automotive, machinery, and electronics heavily rely on these sensors for their precision, reliability, and versatility in diverse applications. Companies within this sector continually invest in research and development to deploy state-of-the-art sensor solutions, further solidifying the role of photoelectric sensors as integral components in Germany's advanced and interconnected manufacturing landscape.

According to the Germany Trade and Invest, Germany's robotics and automation (R&A) industry has enjoyed unprecedented success over the last decade, almost doubling turnover from 2010 to 2019. The first signs of post-coronavirus recovery are being felt, with the sector forecasting a turnover of EUR 13.4 billion in 2021. The robotics and automation (R&A) sector in Germany have generated a turnover of EUR 13.4 billion in 2021, according to the VDMA Robotics + Automation Association. As the R&A industry in Germany continues to grow, the demand for advanced sensor technologies, including photoelectric sensors, is likely to escalate, further driving innovation in this sector.

Market Trends

Demand Rising for Logistics and Warehousing

The demand for logistics and warehousing in the photoelectric sensors market in Germany has experienced a significant upswing, driven by the nation's robust manufacturing industry and increasing adoption of automation technologies. Photoelectric sensors are crucial in industrial automation, providing reliable detection and measurement capabilities. The need for adequate logistics and warehousing infrastructure has intensified as German industries continue to integrate these sensors into their processes for enhanced efficiency and precision.

In response to the growing demand, logistics and warehousing providers in Germany are strategically expanding their capabilities to accommodate the storage, transportation, and distribution of photoelectric sensors. The emphasis is on increasing storage capacity and optimizing supply chain processes to ensure timely and secure delivery. This surge in demand reflects the broader trend of Industry 4.0 adoption in Germany, where smart manufacturing and automation technologies are reshaping traditional production methods. The logistics and warehousing sector's adaptability to support the evolving needs of the photoelectric sensors market positions Germany as a key player in the global industrial automation landscape. Therefore, as Industry 4.0 advances, the logistics and warehousing sector's ability to efficiently handle photoelectric sensors contributes significantly to Germany's position as a leader in industrial automation.

Increase in the Automotive Industry

The automotive industry has been a significant driver of the photoelectric sensors market in Germany, experiencing a notable rise in recent years. With Germany being a global automotive powerhouse, the demand for photoelectric sensors has surged as automakers integrate advanced sensing technologies into their manufacturing processes. Photoelectric sensors play a crucial role in automotive applications, contributing to enhanced production line automation, precision, and safety. These sensors are utilized for object detection, quality control, and positioning, ensuring efficient and error-free assembly processes.

The rise in the industry in Germany has created a ripple effect across the photoelectric sensors market, leading to increased investments in research and development. As automakers strive to achieve higher levels of automation and adopt Industry 4.0 principles, the demand for innovative sensor solutions has intensified. Photoelectric sensors contribute to the optimization of production workflows, reducing downtime and improving overall efficiency. Furthermore, emphasizing electric vehicles and integrating smart technologies in modern vehicles further propels the demand for advanced sensing solutions.

According to the Germany Trade and Invest, Germany's automotive industry recorded a total revenue volume of EUR 410.9 billion in 2021 –equivalent to an eight percent increase in 2020 revenue. The domestic market accounted for over EUR 136.9 billion, with more than EUR 274 billion in turnover generated in foreign markets. Therefore, the burgeoning automotive sector in Germany continues to fuel the growth of the photoelectric sensors market, driving technological advancements and widespread adoption across the industry.

Competition Analysis

Germany is a key player in industrial automation, and several companies have contributed to the photoelectric sensors market. Based in Essen, Germany, ifm electronic GmbH is a well-known manufacturer of sensors and control systems for industrial automation. The company's product portfolio includes a variety of sensors, among them photoelectric sensors. These sensors are designed to meet the demands of modern industrial processes, contributing to increased efficiency and productivity.

Leuze electronic, headquartered in Owen, Germany, specializes in optoelectronic sensors and solutions for factory automation. The company's product range includes photoelectric sensors designed to enhance the performance of industrial processes. Similarly, Elobau, based in Leutkirch im Allgäu, Germany, manufactures sensors and control systems. The company's product range includes photoelectric sensors in object detection and distance measurement applications. Elobau's sensors find application in automotive, agriculture, and industrial automation industries.

Wenglor Sensoric is a company specializing in innovative sensor technologies. The company offers various sensors in automation and control systems across various industries, including photoelectric sensors. Wenglor's sensors are designed to meet the demands of modern industrial processes.

These local companies exemplify the strength and innovation present in Germany's photoelectric sensors market. Their contributions to industrial automation, precision manufacturing, and safety applications highlight the importance of local expertise in shaping the landscape of the photoelectric sensors market in Germany.

List of Key Companies Profiled

- Omron Corporation

- Panasonic Holdings Corporation

- Rockwell Automation, Inc.

- Eaton Corporation PLC

- Keyence Corporation

- Schneider Electric SE

- Autonics Corporation

- Sick AG

- Balluff GmbH

- IFM Electronics GmbH

Germany Photoelectric Sensors Market Report Segmentation

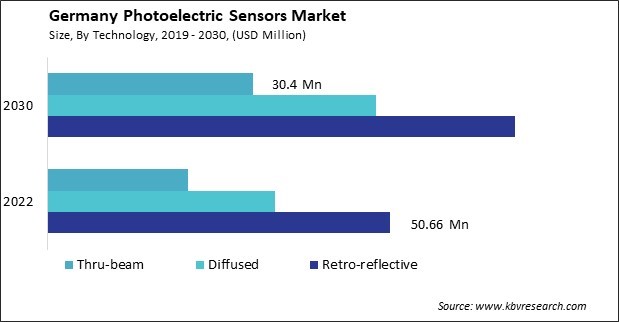

By Technology

- Retro-reflective

- Diffused

- Thru-beam

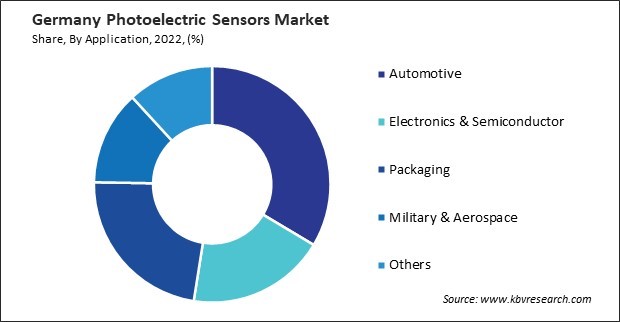

By Application

- Automotive

- Electronics & Semiconductor

- Packaging

- Military & Aerospace

- Others

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 Germany Photoelectric Sensors Market, by Technology

1.4.2 Germany Photoelectric Sensors Market, by Application

1.5 Methodology for the research

Chapter 2. Market Overview

2.1 Introduction

2.1.1 Overview

2.1.1.1 Market Composition and Scenario

2.2 Key Factors Impacting the Market

2.2.1 Market Drivers

2.2.2 Market Restraints

Chapter 3. Competition Analysis - Global

3.1 KBV Cardinal Matrix

3.2 Recent Industry Wide Strategic Developments

3.2.1 Partnerships, Collaborations and Agreements

3.2.2 Product Launches and Product Expansions

3.2.3 Acquisition and Mergers

3.3 Top Winning Strategies

3.3.1 Key Leading Strategies: Percentage Distribution (2019-2023)

3.3.2 Key Strategic Move: (Partnerships, Collaborations & Agreements : 2020, Jul – 2023, Oct) Leading Players

3.4 Porter’s Five Forces Analysis

Chapter 4. Germany Photoelectric Sensors Market

4.1 Germany Photoelectric Sensors Market by Technology

4.2 Germany Photoelectric Sensors Market by Application

Chapter 5. Company Profiles – Global Leaders

5.1 Omron Corporation

5.1.1 Company Overview

5.1.2 Financial Analysis

5.1.3 Segmental and Regional Analysis

5.1.4 Research & Development Expenses

5.1.5 SWOT Analysis

5.2 Panasonic Holdings Corporation

5.2.1 Company Overview

5.2.2 Financial Analysis

5.2.3 Segmental and Regional Analysis

5.2.4 Research & Development Expenses

5.2.5 Recent strategies and developments:

5.2.5.1 Product Launches and Product Expansions:

5.2.6 SWOT Analysis

5.3 Rockwell Automation, Inc.

5.3.1 Company Overview

5.3.2 Financial Analysis

5.3.3 Segmental and Regional Analysis

5.3.4 Research & Development Expenses

5.3.5 Recent strategies and developments:

5.3.5.1 Partnerships, Collaborations, and Agreements:

5.3.5.2 Acquisition and Mergers:

5.3.6 SWOT Analysis

5.4 Eaton Corporation PLC

5.4.1 Company Overview

5.4.2 Financial Analysis

5.4.3 Segmental and Regional Analysis

5.4.4 Research & Development Expense

5.4.5 Recent strategies and developments:

5.4.5.1 Acquisition and Mergers:

5.4.6 SWOT Analysis

5.5 Keyence Corporation

5.5.1 Company Overview

5.5.2 Financial Analysis

5.5.3 Regional Analysis

5.5.4 Research & Development Expenses

5.5.5 Recent strategies and developments:

5.5.5.1 Partnerships, Collaborations, and Agreements:

5.5.5.2 Product Launches and Product Expansions:

5.5.6 SWOT Analysis

5.6 Schneider Electric SE

5.6.1 Company Overview

5.6.2 Financial Analysis

5.6.3 Segmental and Regional Analysis

5.6.4 Research & Development Expense

5.6.5 Recent strategies and developments:

5.6.5.1 Partnerships, Collaborations, and Agreements:

5.6.5.2 Acquisition and Mergers:

5.6.6 SWOT Analysis

5.7 Autonics Corporation

5.7.1 Company Overview

5.7.2 SWOT Analysis

5.8 Sick AG

5.8.1 Company Overview

5.8.2 Financial Analysis

5.8.3 Segmental and Regional Analysis

5.8.4 Research & Development Expense

5.8.5 Recent strategies and developments:

5.8.5.1 Partnerships, Collaborations, and Agreements:

5.8.6 SWOT Analysis

5.9 Balluff GmbH

5.9.1 Company Overview

5.9.2 SWOT Analysis

5.10. IFM Electronics GmbH

5.10.1 Company Overview

5.10.2 Recent strategies and developments:

5.10.2.1 Partnerships, Collaborations, and Agreements:

5.10.3 SWOT Analysis

TABLE 2 Germany Photoelectric Sensors Market, 2023 - 2030, USD Million

TABLE 3 Germany Photoelectric Sensors Market, 2019 - 2022, Thousand Units

TABLE 4 Germany Photoelectric Sensors Market, 2023 - 2030, Thousand Units

TABLE 5 Partnerships, Collaborations and Agreements– Photoelectric Sensors Market

TABLE 6 Product Launches And Product Expansions– Photoelectric Sensors Market

TABLE 7 Acquisition and Mergers– Photoelectric Sensors Market

TABLE 8 Germany Photoelectric Sensors Market by Technology, 2019 - 2022, USD Million

TABLE 9 Germany Photoelectric Sensors Market by Technology, 2023 - 2030, USD Million

TABLE 10 Germany Photoelectric Sensors Market by Technology, 2019 - 2022, Thousand Units

TABLE 11 Germany Photoelectric Sensors Market by Technology, 2023 - 2030, Thousand Units

TABLE 12 Germany Photoelectric Sensors Market by Application, 2019 - 2022, USD Million

TABLE 13 Germany Photoelectric Sensors Market by Application, 2023 - 2030, USD Million

TABLE 14 Germany Photoelectric Sensors Market by Application, 2019 - 2022, Thousand Units

TABLE 15 Germany Photoelectric Sensors Market by Application, 2023 - 2030, Thousand Units

TABLE 16 Key Information – Omron Corporation

TABLE 17 Key Information – panasonic holdings corporation

TABLE 18 Key Information – Rockwell Automation, Inc.

TABLE 19 Key Information – Eaton Corporation PLC

TABLE 20 key information – Keyence Corporation

TABLE 21 Key Information – Schneider Electric SE

TABLE 22 Key Information – Autonics Corporation

TABLE 23 Key Information – Sick AG

TABLE 24 Key Information – Balluff GmbH

TABLE 25 Key Information – IFM Electronics GmbH

List of Figures

FIG 1 Methodology for the research

FIG 2 Germany Photoelectric Sensors Market, 2019 - 2030, USD Million

FIG 3 Key Factors Impacting photoelectric sensors market

FIG 4 KBV Cardinal Matrix

FIG 5 Key Leading Strategies: Percentage Distribution (2019-2023)

FIG 6 Key Strategic Move: (Partnerships, Collaborations & Agreements : 2020, Jul – 2023, Oct) Leading Players

FIG 7 Porter’s Five Forces Analysis - Photoelectric Sensors Market

FIG 8 Germany Photoelectric Sensors Market Share by Technology, 2022

FIG 9 Germany Photoelectric Sensors Market Share by Technology, 2030

FIG 10 Germany Photoelectric Sensors Market by Technology, 2019 - 2030, USD Million

FIG 11 Germany Photoelectric Sensors Market Share by Application, 2022

FIG 12 Germany Photoelectric Sensors Market Share by Application, 2030

FIG 13 Germany Photoelectric Sensors Market by Application, 2019 - 2030, USD Million

FIG 14 SWOT Analysis: Omron Corporation

FIG 15 SWOT Analysis: Panasonic Holdings Corporation

FIG 16 SWOT Analysis: Rockwell Automation, Inc.

FIG 17 SWOT Analysis: Eaton Corporation PLC

FIG 18 SWOT Analysis: KEYENCE CORPORATION

FIG 19 Recent strategies and developments: SCHNEIDER ELECTRIC SE

FIG 20 SWOT Analysis: Schneider Electric SE

FIG 21 SWOT Analysis: AUTONICS CORPORATION

FIG 22 SWOT Analysis: Sick AG

FIG 23 SWOT Analysis: BALLUFF GMBH

FIG 24 SWOT Analysis: IFM Electronics GmbH