Germany Polycarbonate Market Size, Share & Trends Analysis Report By Product Type, By Application (Electrical & Electronics, Automotive & Transportation, Construction, Packaging, Consumer Goods, Medical Devices, Optical Media and Others), and Forecast, 2023 - 2030

Published Date : 29-Oct-2024 |

Pages: 77 |

Formats: PDF |

COVID-19 Impact on the Germany Polycarbonate Market

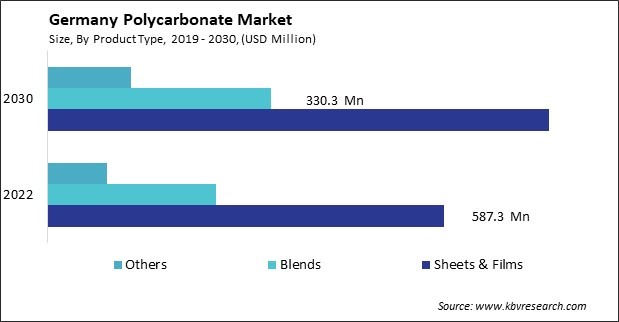

The Germany Polycarbonate Market size is expected to reach $1.2 Billion by 2030, rising at a market growth of 3.3% CAGR during the forecast period. In the year 2022, the market attained a volume of 241.5 Kilo Tonnes, experiencing a growth of 1% (2019-2022).

The polycarbonate market in Germany has witnessed significant growth over the past few years. The expanding automotive industry is one of the key drivers fueling the growth of the polycarbonate market in Germany. Polycarbonate is increasingly used in automotive applications, including exterior and interior parts, due to its lightweight nature and superior impact resistance to traditional materials like glass and metals. With Germany being a hub for automotive manufacturing, the demand for polycarbonate in the country has surged significantly.

According to the Germany Trade & Invest in 2021, Germany is Europe's biggest automotive industry, number one in production and sales terms, accounting for around 25% of all passenger cars manufactured and almost 20% of all new registrations. This prominence aligns with the increasing adoption of polycarbonate in Germany's automotive sector.

Furthermore, the construction sector is crucial in driving the demand for polycarbonate in Germany. Polycarbonate sheets are extensively used in construction applications, including roofing, skylights, and facades, due to their lightweight nature, high transparency, and excellent weatherability. The growing construction activities in Germany's residential and commercial sectors have significantly contributed to the increasing adoption of polycarbonate materials.

According to the Federal Ministry of the Interior and Community, in 2019, Germany's construction industry generated an output of roughly €430 billion. This remarkable growth sets the stage for the industry's expansion in the German polycarbonate market.

Moreover, technological advancements and innovations in polycarbonate manufacturing processes have further propelled the polycarbonate market's growth in Germany. Additionally, favorable government regulations and initiatives aimed at promoting sustainable and environmentally friendly materials have positively influenced the adoption of polycarbonate in Germany.

However, COVID-19 has significantly impacted the polycarbonate market in Germany, as it has disrupted supply chains, led to temporary shutdowns of manufacturing facilities, and caused a decline in demand from key end-use industries. The pandemic-induced lockdowns and restrictions have reduced German consumer spending, affecting the automotive, electronics, and construction sectors, which are major consumers of polycarbonate materials. Moreover, the growing emphasis on sustainability and the shift towards lightweight materials in the automotive and construction sectors will likely drive the demand for polycarbonate in the long term.

Market Trends

Increasing proliferation of smartphones

The polycarbonate market in Germany has witnessed a notable uptick in demand, primarily attributed to the increasing proliferation of smartphones. Smartphones have become ubiquitous in modern society, serving as essential communication, entertainment, and productivity tools. With advancements in technology and the introduction of new features, such as larger screens, improved cameras, and enhanced durability, German consumers are increasingly inclined to upgrade their devices more frequently.

According to the International Trade Administration, the high smartphone penetration rate of 82% in Germany indicates widespread access to digital devices, laying the foundation for a thriving digital landscape. This parallels the escalating proliferation of smartphones within the polycarbonate market in Germany, indicating a similar trend toward widespread usage and availability in this sector.

One key reason for the preference for polycarbonate in smartphone manufacturing is its excellent properties, which make it ideal for use in mobile devices. Its high impact resistance helps protect delicate electronic components from damage due to accidental drops or impacts, ensuring the longevity of the device. Additionally, polycarbonate offers exceptional optical clarity, allowing for vibrant and sharp displays without compromising on durability. Moreover, polycarbonate's lightweight nature contributes to the sleek and ergonomic designs of modern smartphones, enhancing user experience and portability.

As German consumers increasingly prioritize aesthetics and comfort, manufacturers are leveraging polycarbonate's versatility to create sleek, slim, and stylish smartphones. Polycarbonate is recyclable, and German manufacturers are actively exploring ways to incorporate recycled materials into their production processes, thereby reducing the environmental footprint of smartphone manufacturing. Hence, the rising demand for polycarbonate in Germany, driven by the proliferation of smartphones, underscores its invaluable role in creating durable, stylish, and eco-friendly mobile devices.

Rising initiatives of sustainability and recycling

In Germany, sustainability and recycling have become increasingly prominent in the polycarbonate market due to growing environmental concerns and regulatory pressures. One significant initiative is the implementation of closed-loop recycling systems by polycarbonate manufacturers. These systems aim to collect used polycarbonate products, such as packaging materials and electronic components, and process them into high-quality recycled polycarbonate.

Furthermore, partnerships between industry players and recycling companies in Germany have been formed to develop innovative recycling technologies for polycarbonate. Additionally, research and development efforts are focused on improving the recyclability of polycarbonate products by exploring new chemical processes and additives that facilitate easier disassembly and recycling. Government regulations and incentives also play a crucial role in driving sustainability initiatives in the polycarbonate market. In Germany, policymakers have introduced measures to promote recycled materials and discourage single-use plastics.

Consumer awareness and demand for sustainable products have further accelerated these initiatives in the polycarbonate market. German consumers increasingly seek eco-friendly alternatives and are willing to support companies prioritizing sustainability. Thus, the German polycarbonate market is transforming, driven by sustainability efforts, innovative technologies, government regulations, and growing consumer demand for eco-friendly products.

Competition Analysis

The polycarbonate market in Germany is a significant segment within the country's chemical industry, characterized by a strong focus on innovation, quality, and sustainability. One of the foremost players in the German polycarbonate market is Covestro AG, a global leader in high-performance polymers and materials. Covestro produces a wide range of polycarbonate resins, sheets, and blends under its engineering plastics division, catering to automotive, electrical electronics, construction, and healthcare industries. The company's commitment to innovation and sustainability is reflected in its efforts to develop eco-friendly polycarbonate solutions and manufacturing processes, addressing the growing demand for sustainable materials.

Bayer AG, now part of Lanxess, has also significantly contributed to the German polycarbonate market. With a long history of polymer science and engineering expertise, Bayer has been at the forefront of polycarbonate innovation, introducing new grades and applications to meet evolving industry needs. While Lanxess has diversified its focus since acquiring Bayer's MaterialScience division, it continues to play a role in the polycarbonate market through its specialty chemicals and plastics segments.

Another major player in the German polycarbonate market is Evonik Industries AG, offering a range of specialty polymers and materials for diverse applications. Evonik's expertise in polymer chemistry and processing technologies enables it to develop innovative polycarbonate formulations that meet the stringent requirements of industries such as automotive, aerospace, and medical devices. The company's focus on sustainability and resource efficiency further reinforces its position as a provider of eco-friendly polycarbonate solutions.

In addition to these major players, several other companies contribute to the competitiveness and innovation of the German polycarbonate market. Companies such as Lanxess AG, Teijin Limited, and Mitsubishi Engineering-Plastics Corporation have a presence in Germany, supplying polycarbonate resins, compounds, and specialty products to meet the diverse needs of customers across industries. By focusing on innovation, quality, and sustainability, these companies are driving the growth and evolution of the polycarbonate industry in Germany, contributing to economic development.

List of Key Companies Profiled

- Covestro AG

- SABIC (Saudi Arabian Oil Company)

- LOTTE Chemical Corporation (LOTTE Corp.)

- Teijin Limited

- Trinseo PLC

- Idemitsu Kosan Co., Ltd.

- LG Chem Ltd. (LG Corporation)

- RTP Company, Inc.

- CHIMEI Corporation

- Lone Star Chemical

Germany Polycarbonate Market Report Segmentation

By Product Type

- Sheets & Films

- Blends

- Others

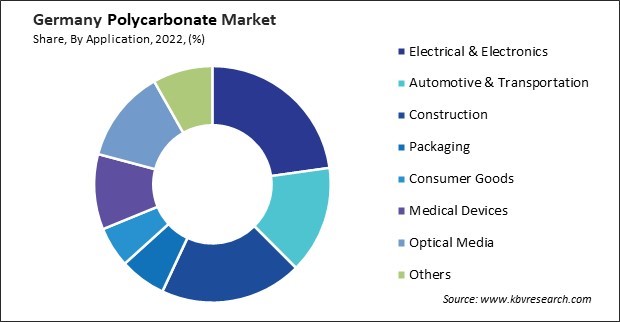

By Application

- Electrical & Electronics

- Automotive & Transportation

- Construction

- Packaging

- Consumer Goods

- Medical Devices

- Optical Media

- Others

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 Germany Polycarbonate Market, by Product Type

1.4.2 Germany Polycarbonate Market, by Application

1.5 Methodology for the research

Chapter 2. Market Overview

2.1 Introduction

2.1.1 Overview

2.1.1.1 Market Composition and Scenario

2.2 Key Factors Impacting the Market

2.2.1 Market Drivers

2.2.2 Market Restraints

2.2.3 Market Opportunities

2.2.4 Market Challenges

2.2.5 Market Trends

2.3 Porter’s Five Forces Analysis

Chapter 3. Strategies Deployed in Polycarbonate Market

Chapter 4. Germany Polycarbonate Market

4.1 Germany Polycarbonate Market, by Product Type

4.2 Germany Polycarbonate Market, by Application

Chapter 5. Company Profiles – Global Leaders

5.1 Covestro AG

5.1.1 Company Overview

5.1.2 Financial Analysis

5.1.3 Segmental and Regional Analysis

5.1.4 Research & Development Expenses

5.1.5 Recent strategies and developments:

5.1.5.1 Geographical Expansions:

5.1.6 SWOT Analysis

5.2 SABIC (Saudi Arabian Oil Company)

5.2.1 Company Overview

5.2.2 Financial Analysis

5.2.3 Segmental and Regional Analysis

5.2.4 Recent strategies and developments:

5.2.4.1 Product Launches and Product Expansions:

5.2.5 SWOT Analysis

5.3 LOTTE Chemical Corporation (LOTTE Corp.)

5.3.1 Company Overview

5.3.2 Financial Analysis

5.3.3 Segmental and Regional Analysis

5.3.4 Research & Development Expenses

5.3.5 Recent strategies and developments:

5.3.5.1 Product Launches and Product Expansions:

5.3.6 SWOT Analysis

5.4 Teijin Limited

5.4.1 Company Overview

5.4.2 Financial Analysis

5.4.3 Segmental and Regional Analysis

5.4.4 Research & Development Expenses

5.4.5 SWOT Analysis

5.5 Trinseo PLC

5.5.1 Company Overview

5.5.2 Financial Analysis

5.5.3 Segmental and Regional Analysis

5.5.4 Research & Development Expenses

5.5.5 Recent strategies and developments:

5.5.5.1 Geographical Expansions:

5.5.6 SWOT Analysis

5.6 Idemitsu Kosan Co., Ltd.

5.6.1 Company Overview

5.6.2 Financial Analysis

5.6.3 Segmental and Regional Analysis

5.6.4 Research & Development Expenses

5.6.5 SWOT Analysis

5.7 LG Chem Ltd. (LG Corporation)

5.7.1 Company Overview

5.7.2 Financial Analysis

5.7.3 Segmental and Regional Analysis

5.7.4 Recent strategies and developments:

5.7.4.1 Product Launches and Product Expansions:

5.7.5 SWOT Analysis

5.8 RTP Company, Inc.

5.8.1 Company Overview

5.8.2 SWOT Analysis

5.9 CHIMEI Corporation

5.9.1 Company Overview

5.10. Lone Star Chemical

5.10.1 Company Overview

TABLE 2 Germany Polycarbonate Market, 2023 - 2030, USD Million

TABLE 3 Germany Polycarbonate Market, 2019 - 2022, Kilo Tonnes

TABLE 4 Germany Polycarbonate Market, 2023 - 2030, Kilo Tonnes

TABLE 5 Germany Polycarbonate Market, by Product Type, 2019 - 2022, USD Million

TABLE 6 Germany Polycarbonate Market, by Product Type, 2023 - 2030, USD Million

TABLE 7 Germany Polycarbonate Market, by Product Type, 2019 - 2022, Kilo Tonnes

TABLE 8 Germany Polycarbonate Market, by Product Type, 2023 - 2030, Kilo Tonnes

TABLE 9 Germany Polycarbonate Market, by Application, 2019 - 2022, USD Million

TABLE 10 Germany Polycarbonate Market, by Application, 2023 - 2030, USD Million

TABLE 11 Germany Polycarbonate Market, by Application, 2019 - 2022, Kilo Tonnes

TABLE 12 Germany Polycarbonate Market, by Application, 2023 - 2030, Kilo Tonnes

TABLE 13 key information – Covestro AG

TABLE 14 Key Information – SABIC

TABLE 15 Key Information – Lotte Chemical Corporation

TABLE 16 Key Information – Teijin Limited

TABLE 17 Key Information – Trinseo PLC

TABLE 18 Key Information – Idemitsu Kosan Co., Ltd.

TABLE 19 key information – LG Chem Ltd.

TABLE 20 Key Information – RTP Company, Inc.

TABLE 21 Key Information – CHIMEI Corporation

TABLE 22 Key Information – Lone Star Chemical

List of Figures

FIG 1 Methodology for the research

FIG 2 Germany Polycarbonate Market, 2019 - 2030, USD Million

FIG 3 Key Factors Impacting Polycarbonate Market

FIG 4 Porter’s Five Forces Analysis - Polycarbonate Market

FIG 5 Germany Polycarbonate Market share, by Product Type, 2022

FIG 6 Germany Polycarbonate Market share, by Product Type, 2030

FIG 7 Germany Polycarbonate Market, by Product Type, 2019 - 2030, USD Million

FIG 8 Germany Polycarbonate Market share, by Application, 2022

FIG 9 Germany Polycarbonate Market share, by Application, 2030

FIG 10 Germany Polycarbonate Market, by Application, 2019 - 2030, USD Million

FIG 11 SWOT Analysis: Covestro AG

FIG 12 SWOT Analysis: SABIC

FIG 13 SWOT Analysis: LOTTE Chemical Corporation

FIG 14 SWOT Analysis: Teijin Limited

FIG 15 SWOT Analysis: Trinseo PLC

FIG 16 Swot Analysis: Idemitsu Kosan Co., Ltd.

FIG 17 Swot Analysis: LG Chem Ltd.

FIG 18 Swot Analysis: RTP Company, Inc.