Germany Polyurethane Market Size, Share & Trends Analysis Report By Raw Material (Polyols, Toluene Di-isocyanate, Methylene Diphenyl Di-isocyanate, and Others), By Application, By Product, and Forecast, 2023 - 2030

Published Date : 29-Oct-2024 |

Pages: 98 |

Formats: PDF |

COVID-19 Impact on the Germany Polyurethane Market

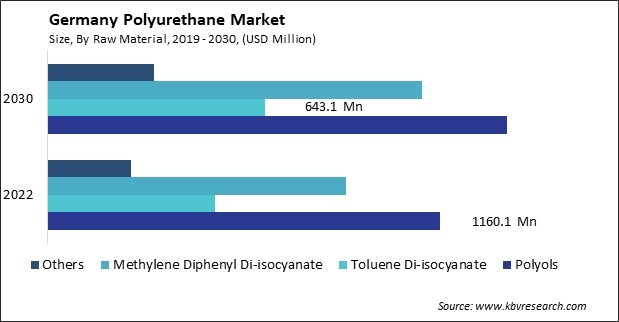

The Germany Polyurethane Market size is expected to reach $3.4 Billion by 2030, rising at a market growth of 2.7% CAGR during the forecast period. In the year 2022, the market attained a volume of 952.8 Kilo Tonnes, experiencing a growth of 1.9% (2019-2022).

The polyurethane market in Germany has witnessed significant growth over the past few years. Germany, one of Europe's largest economies, plays a crucial role in the polyurethane market, with a strong presence of manufacturers, suppliers, and consumers. The automotive industry is one of the key drivers of the polyurethane market in Germany. Polyurethane is extensively used to manufacture automotive components such as seat cushions, bumpers, insulation materials, and interior trim.

According to Germany Trade & Invest, German automobile manufacturers produced over 15.6 million vehicles in 2021. Notably, Germany emerged as the European leader in car production, with German plants producing more than 3.1 million passenger cars and 351,000 commercial vehicles in 2021. With Germany being a hub for automotive manufacturing, the demand for polyurethane in this sector remains robust.

Additionally, the furniture and bedding sector represents another significant polyurethane market in Germany. Polyurethane foam is commonly used to produce mattresses, sofas, chairs, and other furniture items due to its comfort, resilience, and versatility. Furthermore, the increasing emphasis on energy efficiency and sustainability has led to the adoption of polyurethane insulation materials in buildings, contributing to the industry's growth.

Technological advancements have also played a crucial role in driving innovation and expanding the application areas of polyurethane in Germany. Manufacturers are continuously investing in research and development to enhance the performance characteristics of polyurethane products, making them more versatile and environmentally friendly. Moreover, the introduction of bio-based and eco-friendly polyurethane materials has gained traction in response to growing environmental concerns.

The COVID-19 pandemic has significantly impacted the polyurethane market in Germany, disrupting supply chains, leading to fluctuations in demand, and causing production shutdowns in various industries. The automotive sector, in particular, experienced a sharp decline in demand as automotive production was temporarily halted during lockdowns, reducing the consumption of polyurethane-based materials. Similarly, the construction industry faced challenges due to project delays and restrictions on construction activities, affecting the demand for polyurethane insulation and coatings.

Market Trends

Increasing adoption in the electronics industry

In recent years, the electronics industry in Germany has witnessed a significant uptick in adopting polyurethane, a versatile polymer renowned for its exceptional properties. One key driver behind the increasing adoption of polyurethane in the electronics sector is its remarkable versatility. Polyurethane exhibits a wide range of desirable properties, including high strength, flexibility, resistance to abrasion, and excellent insulation capabilities.

Furthermore, the evolving landscape of the electronics industry has fueled the demand for innovative materials such as polyurethane. With the proliferation of electronic devices across diverse industries, there is a growing need for materials that deliver superior performance while meeting stringent regulatory standards. Polyurethane's ability to address these requirements has positioned it as a preferred choice for manufacturers seeking to enhance the quality and durability of their electronic products.

In Germany, renowned for its engineering prowess and commitment to innovation, the adoption of polyurethane in the electronics industry has been particularly pronounced. German companies have been at the forefront of developing advanced polyurethane formulations and integrating them into various electronic applications. This leadership has not only bolstered the competitiveness of German electronics manufacturers but has also contributed to the country's reputation as a hub for technological excellence.

Furthermore, the growing emphasis on sustainability and environmental responsibility has prompted manufacturers to seek eco-friendly alternatives in their production processes. As sustainability becomes a key consideration in material selection, the eco-friendly profile of polyurethane positions it favorably in the German electronics industry. Therefore, polyurethane's versatile properties and innovative applications have propelled its widespread adoption in Germany's electronics industry, bolstering both performance standards and environmental sustainability.

Rising adoption of polyurethane in the footwear sector

The footwear industry in Germany has witnessed a significant shift towards adopting polyurethane (PU) materials, owing to their numerous advantages over traditional materials like rubber and leather. One of the key drivers behind the rising adoption of polyurethane in the footwear sector is its superior performance characteristics. PU-based footwear provides excellent cushioning and shock absorption, offering wearers enhanced comfort and support. Additionally, PU materials can be molded into various shapes and designs, allowing greater creativity and customization in footwear production.

Another factor contributing to the popularity of polyurethane in the footwear industry is its sustainability profile. PU materials can be recycled and reused, reducing the environmental impact of footwear production. Furthermore, PU-based footwear typically has a longer lifespan than traditional materials, leading to less frequent replacements and lower resource consumption. In addition to performance and sustainability benefits, polyurethane offers cost advantages for footwear manufacturers. PU materials are often more affordable than traditional alternatives like leather, allowing German companies to produce high-quality footwear at competitive prices.

Moreover, technological advancements in PU manufacturing processes have further fueled the adoption of polyurethane in the footwear sector. Innovations such as injection molding and 3D printing enable manufacturers to produce intricate designs and complex structures more efficiently and precisely. These advancements have revolutionized the way footwear is produced, enabling faster turnaround times and increased product innovation. Hence, the rising adoption of polyurethane in the German footwear industry, driven by its superior performance, sustainability, and technological advancements, marks a significant evolution in footwear manufacturing towards innovation and environmental responsibility.

Competition Analysis

The polyurethane market in Germany is a significant segment within the chemical and materials industry, with a wide range of applications across sectors. One of the major players in the German polyurethane market is Covestro AG, a global leader in high-performance polymers and materials. Covestro manufactures various polyurethane raw materials, including polyols, isocyanates, additives, and formulated systems. These materials are used in insulation, adhesives, coatings, elastomers, and flexible foams.

Another significant contributor to the German polyurethane market is Wanhua Chemical Group Co., Ltd., which has a strong presence in producing raw materials and systems. Wanhua Chemical manufactures polyols, isocyanates, and additives in various polyurethane applications, including insulation, coatings, adhesives, and sealants. The company's commitment to quality, reliability, and customer satisfaction has established it as a trusted supplier in the German polyurethane market, serving customers across industries with innovative and sustainable solutions.

Furthermore, Hennecke GmbH, headquartered in Sankt Augustin, Germany, specializes in polyurethane processing equipment and technologies. Hennecke designs and manufactures machinery for producing polyurethane foam, including mixing, metering, and dispensing systems. The company's equipment is used by manufacturers worldwide to produce a wide range of polyurethane products, from automotive parts and furniture to insulation panels and footwear. With a focus on precision engineering, reliability, and efficiency, Hennecke supports the growth and competitiveness of the German polyurethane industry.

In addition to these major players, several other companies contribute to the competitiveness and innovation of the German polyurethane market. Companies such as Covestro Deutschland AG, LANXESS AG, and Huntsman Corporation are in Germany, supplying polyurethane raw materials, additives, and formulated systems to meet customer needs. These companies leverage their chemistry, engineering, and manufacturing expertise to develop tailored polyurethane solutions that address specific performance requirements and regulatory standards. By collaborating with customers, industry partners, and research institutions, these companies drive innovation and shape the future of polyurethane materials and applications in Germany.

List of Key Companies Profiled

- ArcelorMittal S.A.

- thyssenkrupp AG

- BASF SE

- Covestro AG

- The Dow Chemical Company

- Huntsman Corporation

- Lanxess AG

- Mitsui Chemicals, Inc.

- Tosoh Corporation

- Eastman Chemical Company

Germany Polyurethane Market Report Segmentation

By Raw Material

- Polyols

- Toluene Di-isocyanate

- Methylene Diphenyl Di-isocyanate

- Others

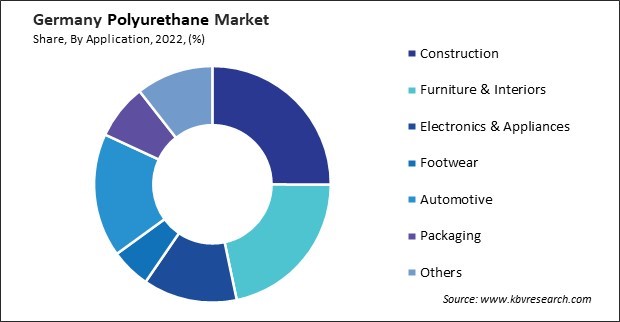

By Application

- Construction

- Furniture & Interiors

- Electronics & Appliances

- Footwear

- Automotive

- Packaging

- Others

By Product

- Rigid Foam

- Flexible Foam

- Coatings

- Adhesives & Sealants

- Elastomers

- Others

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 Germany Polyurethane Market, by Raw Material

1.4.2 Germany Polyurethane Market, by Application

1.4.3 Germany Polyurethane Market, by Product

1.5 Methodology for the research

Chapter 2. Market Overview

2.1 Introduction

2.1.1 Overview

2.1.1.1 Market Composition and Scenario

2.2 Key Factors Impacting the Market

2.2.1 Market Drivers

2.2.2 Market Opportunities

2.2.3 Market Restraints

2.2.4 Market Challenges

2.2.5 Market Trends

2.3 Porter Five Forces Analysis

Chapter 3. Strategies Deployed in Polyurethane Market.

Chapter 4. Germany Polyurethane Market

4.1 Germany Polyurethane Market by Raw Material

4.2 Germany Polyurethane Market by Application

4.3 Germany Polyurethane Market by Product

Chapter 5. Company Profiles – Global Leaders

5.1 ArcelorMittal S.A.

5.1.1 Company Overview

5.1.2 Financial Analysis

5.1.3 Segmental and Regional Analysis

5.1.4 Research & Development Expenses

5.1.5 SWOT Analysis

5.2 thyssenkrupp AG

5.2.1 Company Overview

5.2.2 Financial Analysis

5.2.3 Segmental and Regional Analysis

5.2.4 Research & Development Expenses

5.2.5 SWOT Analysis

5.3 BASF SE

5.3.1 Company Overview

5.3.2 Financial Analysis

5.3.3 Segmental and Regional Analysis

5.3.4 Research & Development Expense

5.3.5 Recent strategies and developments:

5.3.5.1 Partnerships, Collaborations, and Agreements:

5.3.5.2 Geographical Expansions:

5.3.6 SWOT Analysis

5.4 Covestro AG

5.4.1 Company Overview

5.4.2 Financial Analysis

5.4.3 Segmental and Regional Analysis

5.4.4 Research & Development Expenses

5.4.5 Recent strategies and developments:

5.4.5.1 Partnerships, Collaborations, and Agreements:

5.4.5.2 Product Launches and Product Expansions:

5.4.5.3 Acquisition and Mergers:

5.4.5.4 Geographical Expansions:

5.4.6 SWOT Analysis

5.5 The Dow Chemical Company

5.5.1 Company Overview

5.5.2 Financial Analysis

5.5.3 Segmental and Regional Analysis

5.5.4 Research & Development Expenses

5.5.5 Recent strategies and developments:

5.5.5.1 Partnerships, Collaborations, and Agreements:

5.5.6 SWOT Analysis

5.6 Huntsman Corporation

5.6.1 Company Overview

5.6.2 Financial Analysis

5.6.3 Segment and Regional Analysis

5.6.4 Research & Development Expense

5.6.5 Recent strategies and developments:

5.6.5.1 Acquisition and Mergers:

5.6.6 SWOT Analysis

5.7 Lanxess AG

5.7.1 Company Overview

5.7.2 Financial Analysis

5.7.3 Segmental and Regional Analysis

5.7.4 Research & Development Expenses

5.7.5 Recent strategies and developments:

5.7.5.1 Partnerships, Collaborations, and Agreements:

5.7.6 SWOT Analysis

5.8 Mitsui Chemicals, Inc.

5.8.1 Company Overview

5.8.2 Financial Analysis

5.8.3 Segmental and Regional Analysis

5.8.4 Research & Development Expenses

5.8.5 Recent strategies and developments:

5.8.5.1 Partnerships, Collaborations, and Agreements:

5.8.6 SWOT Analysis

5.9 Tosoh Corporation

5.9.1 Company Overview

5.9.2 Financial Analysis

5.9.3 Segmental and Regional Analysis

5.9.4 Research & Development Expenses

5.9.5 SWOT Analysis

5.10. Eastman Chemical Company

5.10.1 Company Overview

5.10.2 Financial Analysis

5.10.3 Segmental and Regional Analysis

5.10.4 Research & Development Expense

5.10.5 SWOT Analysis

TABLE 2 Germany Polyurethane Market, 2023 - 2030, USD Million

TABLE 3 Germany Polyurethane Market, 2019 - 2022, Kilo Tonnes

TABLE 4 Germany Polyurethane Market, 2023 - 2030, Kilo Tonnes

TABLE 5 Germany Polyurethane Market by Raw Material, 2019 - 2022, USD Million

TABLE 6 Germany Polyurethane Market by Raw Material, 2023 - 2030, USD Million

TABLE 7 Germany Polyurethane Market by Raw Material, 2019 - 2022, Kilo Tonnes

TABLE 8 Germany Polyurethane Market by Raw Material, 2023 - 2030, Kilo Tonnes

TABLE 9 Germany Polyurethane Market by Application, 2019 - 2022, USD Million

TABLE 10 Germany Polyurethane Market by Application, 2023 - 2030, USD Million

TABLE 11 Germany Polyurethane Market by Application, 2019 - 2022, Kilo Tonnes

TABLE 12 Germany Polyurethane Market by Application, 2023 - 2030, Kilo Tonnes

TABLE 13 Germany Polyurethane Market by Product, 2019 - 2022, USD Million

TABLE 14 Germany Polyurethane Market by Product, 2023 - 2030, USD Million

TABLE 15 Germany Polyurethane Market by Product, 2019 - 2022, Kilo Tonnes

TABLE 16 Germany Polyurethane Market by Product, 2023 - 2030, Kilo Tonnes

TABLE 17 key Information – ArcelorMittal S.A.

TABLE 18 Key Information – thyssenkrupp AG

TABLE 19 Key Information – BASF SE

TABLE 20 key information – Covestro AG

TABLE 21 Key Information – The Dow Chemical Company

TABLE 22 key Information – Huntsman Corporation

TABLE 23 Key Information – Lanxess AG

TABLE 24 Key Information – Mitsui Chemicals, Inc.

TABLE 25 Key Information – Tosoh Corporation

TABLE 26 Key Information – Eastman Chemical Company

List of Figures

FIG 1 Methodology for the research

FIG 2 Germany Polyurethane Market, 2019 - 2030, USD Million

FIG 3 Key Factors Impacting Polyurethane Market

FIG 4 Porter’s Five Forces Analysis – Polyurethane Market

FIG 5 Germany Polyurethane Market share by Raw Material, 2022

FIG 6 Germany Polyurethane Market share by Raw Material, 2030

FIG 7 Germany Polyurethane Market by Raw Material, 2019 - 2030, USD Million

FIG 8 Germany Polyurethane Market share by Application, 2022

FIG 9 Germany Polyurethane Market share by Application, 2030

FIG 10 Germany Polyurethane Market by Application, 2019 - 2030, USD Million

FIG 11 Germany Polyurethane Market share by Product, 2022

FIG 12 Germany Polyurethane Market share by Product, 2030

FIG 13 Germany Polyurethane Market by Product, 2019 - 2030, USD Million

FIG 14 SWOT Analysis: ArcelorMittal S.A.

FIG 15 SWOT Analysis: thyssenkrupp AG

FIG 16 Recent strategies and developments: BASF SE

FIG 17 SWOT Analysis: BASF SE

FIG 18 Recent strategies and developments: Covestro AG

FIG 19 SWOT Analysis: Covestro AG

FIG 20 SWOT Analysis: The Dow Chemical Company

FIG 21 SWOT Analysis: Huntsman Corporation

FIG 22 Swot Analysis: Lanxess AG

FIG 23 SWOT Analysis: Mitsui Chemicals, Inc.

FIG 24 SWOT Analysis: Tosoh Corporation

FIG 25 SWOT Analysis: Eastman Chemical Company