Int'l : +1(646) 600-5072 | query@kbvresearch.com

Int'l : +1(646) 600-5072 | query@kbvresearch.com

Published Date : 17-May-2024 |

Pages: 83 |

Formats: PDF |

The Germany Start Stop Technology Market size is expected to reach $210.19 Million by 2030, rising at a market growth of 5.5% CAGR during the forecast period.

Germany's start stop technology market has witnessed significant growth and evolution in recent years, reflecting both technological advancements and increasing environmental concerns. This innovative automotive feature, designed to automatically shut down and restart the engine to conserve fuel and reduce emissions during brief periods of idling, has gained considerable traction in the German automotive industry.

Germany, renowned for its robust automotive sector and commitment to sustainability, has emerged as a key hub for developing and adopting start stop technology. One of the primary drivers behind the growth of the start stop technology market in Germany is the escalating demand for fuel-efficient vehicles among environmentally-conscious consumers. With rising fuel prices and growing awareness of climate change, there has been a notable shift towards eco-friendly transportation options.

Moreover, stringent regulatory frameworks implemented by the German government and the European Union have propelled the integration of start-stop technology into new vehicles. Emission standards such as Euro 6 have incentivized automakers to adopt innovative technologies like start-stop systems to ensure compliance and avoid hefty fines. As a result, most new vehicles sold in Germany now come equipped with this feature as standard or optional equipment, further driving industry growth.

The COVID-19 pandemic has profoundly impacted the automotive industry, including the start stop technology market in Germany. The pandemic-induced economic downturn led to a temporary slowdown in vehicle production and sales, disrupting supply chains and causing uncertainty across the automotive sector. However, the crisis also underscored the importance of sustainability and fuel efficiency, prompting renewed interest in eco-friendly technologies like start-stop systems as automakers sought to align with evolving consumer preferences and regulatory requirements.

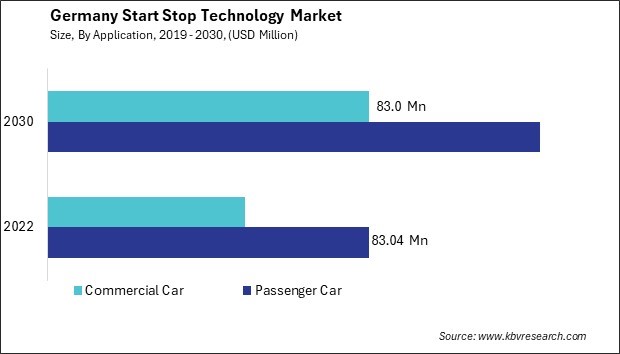

The German automotive industry is witnessing a notable surge in the demand for passenger cars equipped with start stop technology. One of the primary drivers behind the increasing adoption of start stop technology is the growing awareness and emphasis on environmental conservation. The demand for passenger cars equipped with start-stop technology in Germany has significantly contributed to the country's position as the leader in European car production.

According to the Germany Trade & Invest, in 2021, German plants manufactured over 3.1 million passenger cars and 351,000 commercial vehicles. Moreover, German OEMs specializing in passenger cars and light commercial vehicles generated nearly EUR 274 billion in revenue from foreign industries in 2021, marking a notable 10% surge compared to 2020. Amidst this growth, Germany's demand for passenger cars equipped with start-stop technology is poised to escalate. As a result, German automakers are likely to respond to this trend by integrating start stop technology into their vehicle offerings, further driving the expansion of this industry segment within Germany.

Moreover, the implementation of start stop technology aligns with Germany's ambitious goals to promote sustainability in transportation. As a leader in automotive innovation and engineering, German manufacturers have been at the forefront of developing and integrating advanced technologies to improve vehicle efficiency and performance. The adoption of start stop systems in passenger cars underscores the industry's commitment to sustainable mobility solutions and its proactive approach to meeting regulatory requirements.

Furthermore, government incentives and regulations promoting the adoption of fuel-efficient and low-emission vehicles have provided further impetus to integrating start stop technology in passenger cars. Incentives such as tax credits, subsidies, and preferential treatment in vehicle registration can incentivize manufacturers and consumers to embrace this technology, thereby driving its widespread adoption across the German automotive industry. Hence, the increasing demand for passenger cars with start stop technology underscores Germany's leadership in sustainable automotive solutions.

In Germany, the adoption of vehicles equipped with eco-friendly features, particularly start stop technology, has been steadily increasing in recent years. One of the primary drivers behind adopting vehicles with start stop technology is the growing awareness of environmental issues such as air pollution and climate change. With stricter emission regulations in place, both at the national and European Union levels, automakers are under pressure to reduce the carbon footprint of their vehicles.

Furthermore, the German government has been actively promoting the adoption of eco-friendly vehicles through various incentives and subsidies. This includes tax breaks for low-emission vehicles, as well as funding programs to support research and development in clean transportation technologies. These initiatives have encouraged consumers and automakers in Germany to invest in vehicles equipped with start-stop technology and other eco-friendly features.

Moreover, automakers in Germany have been actively incorporating start stop technology into their vehicle lineups as part of their broader efforts to meet regulatory requirements and consumer preferences. This technology is no longer limited to high-end or luxury vehicles. Still, it is increasingly offered as a standard or optional feature across various models and price points. Thus, the increasing adoption of vehicles with start-stop technology in Germany reflects a concerted effort by both government and industry to address environmental concerns and meet stringent emission regulations.

In Germany, the start stop technology market is a significant segment within the automotive industry, reflecting the country's commitment to sustainability and innovation in transportation. Bosch, a global leader in automotive technology, is at the forefront of the start stop technology market in Germany. The company's start stop systems are designed to seamlessly integrate with various vehicle models, providing reliable performance and fuel efficiency benefits. Bosch's expertise in engine management systems and battery technology enables it to deliver advanced start stop solutions that meet the stringent requirements of both automakers and consumers in Germany.

Another notable player in Germany's start stop technology market is Schaeffler Group, a global automotive and industrial supplier. Schaeffler's start-stop systems leverage the company's powertrain technology and mechatronics expertise to deliver reliable performance and durability. Schaeffler's solutions are designed to optimize engine idling periods and reduce fuel consumption, helping automakers comply with increasingly stringent emissions regulations in Germany and beyond.

Furthermore, ZF Friedrichshafen AG, a leading technology company in the automotive sector, is actively involved in developing start stop technology solutions for the German start stop technology market. ZF's start stop systems incorporate innovative features such as predictive functions and hybridization capabilities to enhance fuel efficiency and driving comfort. The company's focus on sustainability and electrification aligns with the growing demand for eco-friendly mobility solutions in Germany, driving the adoption of start stop technology in new vehicle models.

Additionally, Mahle GmbH, a renowned automotive supplier specializing in engine components and thermal management systems, plays a significant role in Germany's start stop technology market. Mahle's start stop systems are designed to optimize engine performance and reduce emissions by automatically shutting off the engine when the vehicle is stationary. The company's commitment to innovation and environmental sustainability underscores its contribution to advancing start stop technology in the German automotive industry. As the automotive industry continues to evolve towards electrification and sustainability, these companies play a crucial role in driving technological advancements and shaping the future of mobility in Germany.

By Application

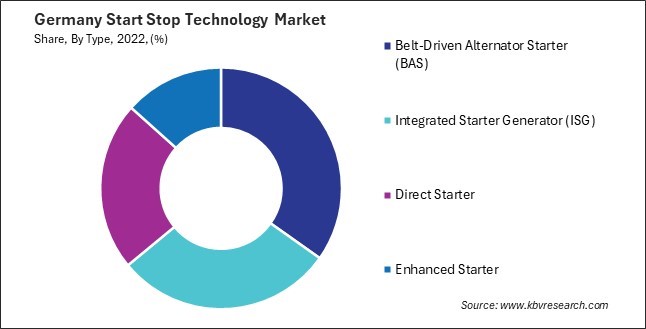

By Type