Int'l : +1(646) 600-5072 | query@kbvresearch.com

Int'l : +1(646) 600-5072 | query@kbvresearch.com

Published Date : 17-May-2024 |

Pages: 78 |

Formats: PDF |

The Germany Thermoformed Plastics Market size is expected to reach $3.7 Billion by 2030, rising at a market growth of 3.7% CAGR during the forecast period. In the year 2022, the market attained a volume of 1604.3 Kilo Tonnes, experiencing a growth of 3.1% (2019-2022).

The thermoformed plastics market in Germany is a vital component of the country's manufacturing sector, characterized by innovation, technological advancement, and sustainability efforts. One of the key drivers of the thermoformed plastics market in Germany is the automotive industry. German automotive manufacturers and suppliers extensively utilize thermoformed plastics for interior components, exterior parts, and packaging due to their lightweight properties, durability, and design flexibility.

In addition, the healthcare sector is emerging as a significant consumer of thermoformed plastics in Germany. Medical device manufacturers utilize thermoformed plastics for components such as trays, housings, and enclosures due to their sterilizability, biocompatibility, and cost-effectiveness. With an aging population and growing healthcare expenditures, the demand for medical devices and equipment is expected to propel further the growth of the thermoformed plastics market in Germany.

According to the International Trade Administration, Germany's healthcare sector generates an economic footprint of EUR 775 billion, or roughly 12 % of Germany's GDP. In 2022, the gross value added to the healthcare industry was EUR 439.6 billion. This corresponds to 12.7 % of the gross value added of the overall German economy. The sector's growth is anticipated to continue, driven by factors such as an aging population and advancements in medical technology. Parallel to this, Germany's thermoformed plastics market is experiencing steady growth, fueled by demand from various industries, including healthcare.

The COVID-19 pandemic has significantly impacted the thermoformed plastics market in Germany. During the initial phases of the pandemic, the industry experienced disruptions in the supply chain, production slowdowns, and fluctuations in demand. However, as the healthcare sector faced unprecedented challenges, there was a surge in demand for thermoformed plastic products such as medical equipment and packaging for pharmaceuticals and personal protective equipment (PPE).

The e-commerce sector has been a significant growth driver in the thermoformed plastics market in Germany, revolutionizing how products are packaged, shipped, and delivered. The convenience and accessibility of online shopping have led to a surge in demand for thermoformed plastic packaging solutions. German consumers now expect their purchases to arrive intact and undamaged, driving the need for robust packaging materials that can withstand the rigors of transportation. Thermoformed plastics, such as polyethylene terephthalate (PET) and polyethylene (PE), offer excellent strength-to-weight ratios, ensuring that products remain secure during transit while minimizing shipping costs.

According to the International Trade Administration, in 2022, the e-commerce industry in Germany experienced robust growth, with total sales estimated at USD 141.2 billion, representing an impressive 11% increase compared to 2021. The online population in Germany is expected to climb from 62.4 million in 2020 to an estimated 68.4 million by 2025.

In 2022, the industry's online presence in Germany soared to a substantial 80%, securing its place as the third highest globally in terms of online industry penetration. As e-commerce continues to thrive and the online population in Germany expands, the thermoformed plastics market is poised for further growth and innovation to meet the evolving needs of the digital marketplace.

Moreover, the customization capabilities of thermoformed plastics have made them particularly appealing to e-commerce businesses seeking to enhance their brand identity and customer experience. German manufacturers easily tailor packaging designs to reflect brand aesthetics, incorporate logos, and create unique shapes and sizes that stand out on crowded digital shelves.

Furthermore, sustainability considerations have propelled the adoption of thermoformed plastics in the e-commerce sector. As German consumers become increasingly environmentally conscious, there is a growing demand for packaging materials that are recyclable, reusable, or made from renewable sources. Hence, the convergence of e-commerce trends, customization opportunities, and sustainability concerns has fueled the growth of thermoformed plastics in Germany's packaging industry, reshaping how products are delivered and perceived by consumers.

The thermoformed plastics market in Germany has witnessed a notable surge in the adoption of polyethylene, driven by several key factors contributing to its popularity and growth within the industry. Polyethylene's cost-effectiveness plays a pivotal role in its increasing adoption in Germany. Compared to other thermoforming materials like polystyrene or polypropylene, polyethylene often presents a more economical option without compromising quality or performance.

Furthermore, the growing emphasis on sustainability and environmental responsibility has propelled the demand for polyethylene in thermoformed plastics in Germany. Polyethylene is inherently recyclable, offering opportunities for closed-loop recycling and sustainable production practices. As environmental regulations become increasingly stringent and consumer preferences shift towards eco-friendly alternatives, the recyclability of polyethylene positions it as a preferred choice for thermoformed plastic packaging and products.

Additionally, advancements in polyethylene manufacturing processes and technologies have further bolstered its prominence in the thermoformed plastics market in Germany. Continuous innovation has led to developing enhanced polyethylene formulations with superior mechanical properties, improved impact resistance, and enhanced processability. Therefore, the surge in polyethylene adoption within Germany's thermoformed plastics market is fueled by its cost-effectiveness, sustainability advantages, and ongoing technological advancements, positioning it as a leading choice for packaging and product applications.

The thermoformed plastics market in Germany is a dynamic sector characterized by a wide range of companies operating across various segments. One notable player in the German thermoformed plastics market is RPC Group, a leading global manufacturer of rigid plastic packaging solutions. With a significant presence in Germany, RPC Group specializes in thermoformed packaging for food, beverage, pharmaceutical, and personal care applications. The company's expertise lies in producing customized packaging solutions that offer optimal protection, shelf appeal, and sustainability, meeting the stringent requirements of both brands and consumers.

Schur Flexibles Group is another key player contributing to the German thermoformed plastics market with its extensive portfolio of flexible packaging solutions. The company specializes in thermoforming films and laminates used in various applications, including food packaging, medical devices, and industrial products. Schur Flexibles Group's focus on quality, innovation, and customer satisfaction has earned it a reputation as a trusted partner among leading brands in Germany and beyond.

Another prominent company in the German thermoformed plastics market is ALPLA Group, renowned for its innovative packaging solutions across various industries. ALPLA's thermoformed plastic products encompass many applications, including bottles, containers, and trays. Leveraging advanced technology and sustainable materials, ALPLA focuses on delivering packaging solutions that are functional, attractive, and environmentally friendly, aligning with the growing demand for eco-conscious packaging options.

Bemis Company, Inc., a global leader in flexible and rigid packaging, is also a significant player in the German thermoformed plastics market. The company offers a comprehensive portfolio of thermoformed packaging solutions, catering to diverse sectors such as food and beverage, healthcare, and industrial. With a commitment to innovation and sustainability, Bemis continually invests in research and development to enhance product performance while minimizing environmental impact, ensuring its competitiveness in the industry.

In addition to these major players, the German thermoformed plastics market is home to many smaller and medium-sized companies specializing in niche applications and customized solutions. These companies often excel in providing tailored thermoformed products for specific industries or unique requirements, contributing to the overall diversity and competitiveness of the industry. Hence, the thermoformed plastics market in Germany is a dynamic and competitive landscape shaped by a diverse array of companies offering innovative and sustainable packaging solutions across various industries.

By Process

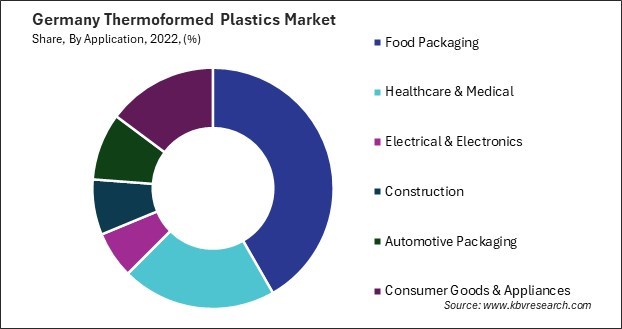

By Application

By Product