Germany Video on Demand (VoD) Market Size, Share & Trends Analysis Report By Deployment Model, By Offering, By Solution Type (OTT, Pay TV, and IPTV), By Platform Type, By Content-Type, By Monetization Model, By Vertical. and Forecast, 2023 - 2030

Published Date : 29-Oct-2024 |

Pages: 93 |

Report Format: PDF + Excel |

COVID-19 Impact on the Germany Video on Demand (VoD) Market

The Germany Video on Demand (VoD) Market size is expected to reach $19.5 Billion by 2030, rising at a market growth of 11.2% CAGR during the forecast period.

Germany's video on demand (VoD) market has grown significantly recently. As one of the largest industries in Europe, Germany has become a battleground for various streaming platforms seeking to capture a share of the burgeoning VoD industry. One of the key drivers of the video on demand (VoD) market in Germany is the increasing penetration of high-speed internet and the proliferation of connected devices. With more households accessing reliable internet connections and smart TVs, Germans are turning to VoD platforms as a convenient and flexible way to access a wide range of content.

According to the International Trade Administration, television remains a highly popular medium in Germany, with 72% of the population tuning in daily as of 2020. The video on demand (VoD) market in Germany has experienced remarkable growth in recent years, with 81% of German households subscribing to VoD services in 2021, a significant increase from 51% in 2017.

Furthermore, the rise of original content production by streaming giants has significantly driven subscriber growth in the German video on demand (VoD). These platforms have invested heavily in creating original series and movies tailored to local tastes, attracting a diverse audience base. Additionally, the availability of a vast library of content, including movies, TV shows, documentaries, and exclusive productions, has contributed to the increasing adoption of VoD services in Germany.

The COVID-19 pandemic has profoundly impacted Germany's video on demand (VoD) market, accelerating the shift toward digital consumption of entertainment content. With lockdowns and social distancing measures in place, consumers have turned to streaming platforms as a primary source of entertainment while staying at home. This surge in demand for VoD services has prompted streaming platforms to ramp up their content offerings and invest in new productions to cater to the growing audience.

Market Trends

Increasing adoption of digital media consumption

The video on demand (VoD) market in Germany has been experiencing a significant surge in digital media consumption in recent years. One of the primary drivers behind the increasing adoption of digital media consumption in Germany is the widespread availability of high-speed internet connections. With expanding broadband networks and the rollout of advanced mobile data services, German consumers now have easier access to streaming platforms and online content.

Moreover, the proliferation of internet-connected devices, such as smartphones, tablets, smart TVs, and gaming consoles, has further fueled the growth of digital media consumption in Germany. These devices provide German users multiple avenues to access streaming services, allowing for greater flexibility and convenience in consuming content.

According to the International Trade Administration, with an impressive smartphone penetration rate of 82% in Germany, widespread accessibility to digital devices exists, setting the stage for a flourishing digital environment. This prevalence of smartphones aligns with the escalating adoption of digital media consumption, particularly evident in Germany's expanding video on demand (VoD) market.

Another factor contributing to the rising popularity of digital media consumption is the increasing number of streaming platforms and subscription-based services available in the German industry. Major international players like Netflix, Amazon Prime Video, and Disney+ have expanded their presence in Germany, offering subscribers a wide range of content choices.

Additionally, local players and broadcasters have also launched their streaming services, catering to the specific preferences of German audiences. Therefore, he surge in digital media consumption in Germany is propelled by factors like widespread high-speed internet access, the proliferation of internet-connected devices, and the growing availability of diverse streaming platforms and subscription services.

Growing popularity of subscription-based OTT services

The German industry for subscription-based over-the-top (OTT) services in video on demand (VoD) market has experienced significant growth in recent years. One of the key drivers behind the rise of subscription-based OTT services in Germany is the convenience they offer consumers. Subscribers have access to a vast library of content they watch anytime, anywhere, and on any device with an internet connection.

Moreover, the quality of content on these platforms has improved significantly, with many subscription-based OTT services investing heavily in original programming and exclusive content rights. This investment has led to diverse content options catering to various interests and demographics, further attracting subscribers to these platforms. Another factor contributing to the popularity of subscription-based OTT services in Germany is their competitive pricing and value proposition compared to traditional cable and satellite TV subscriptions.

With OTT services, German consumers access a more extensive content library at a fraction of the cost of traditional pay-TV subscriptions. This affordability has made OTT services an attractive option for budget-conscious consumers. Thus, the combination of convenience, quality content, and competitive pricing has fueled the rapid growth of subscription-based OTT services in the German video on demand (VoD) market.

Competition Analysis

In the German video on demand (VoD) market, several companies have emerged as significant players, offering a diverse range of content and services to cater to the preferences of local audiences while competing with international platforms. Maxdome, operated by ProSiebenSat.1 Media SE, is one of Germany's oldest and most established VoD platforms, offering a comprehensive catalog of movies, TV series, and exclusive content. The company leverages its parent company's extensive network of television channels and production studios to provide subscribers access to popular German TV shows, international hits, and Hollywood blockbusters. With flexible subscription options, competitive pricing, and a focus on local content, Maxdome remains a prominent player in the video on demand (VoD) market.

Another notable player in the video on demand (VoD) market is Sky Deutschland, a subsidiary of Comcast Corporation, which offers a range of subscription-based streaming services, including Sky Ticket and Sky Go. Sky Deutschland provides subscribers access to live sports, movies, TV series, and exclusive content from Sky's premium channels, such as Sky Atlantic and Sky Cinema. With its emphasis on premium entertainment and live events, Sky Deutschland appeals to sports fans, movie buffs, and TV enthusiasts in Germany, further enriching the video on demand (VoD) market.

WAKANIM is a niche VoD platform that focuses exclusively on anime content, catering to the passionate anime community in Germany. As the German subsidiary of WAKANIM SAS, the platform offers a curated selection of Japanese anime series and movies, with subtitles available in German and other languages. WAKANIM distinguishes itself by licensing popular titles directly from Japanese studios and providing simulcast episodes shortly after airing in Japan, attracting anime enthusiasts with fresh and high-quality content.

In addition to these major players, several other companies contribute to the diversity and competitiveness of the German video on demand (VoD) market. Streaming services such as Apple TV+, Disney+, and Joyn offer unique content libraries, features, and subscription models to attract and retain subscribers. Furthermore, traditional broadcasters and media companies have launched their streaming platforms, providing consumers additional options for on-demand entertainment. Companies in the video on demand (VoD) market continuously invest in original programming, user experience enhancements, and strategic partnerships to differentiate their offerings and attract subscribers.

List of Key Companies Profiled

- Netflix, Inc.

- com, Inc.

- Google LLC (Alphabet Inc.)

- The Walt Disney Company

- Apple, Inc.

- Comcast Corporation

- Sony Corporation

- Kaltura, Inc.

- Muvi

- Reliance Industries Limited

Germany Video on Demand (VoD) Market Report Segmentation

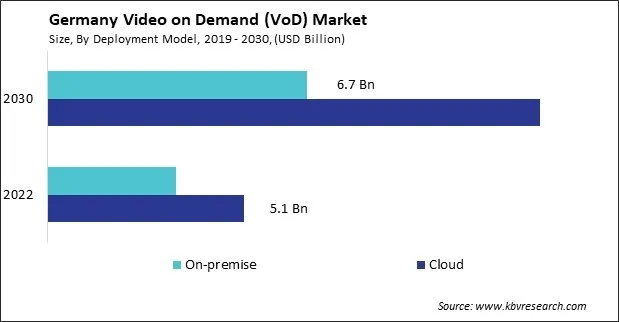

By Deployment Model

- Cloud

- On-premise

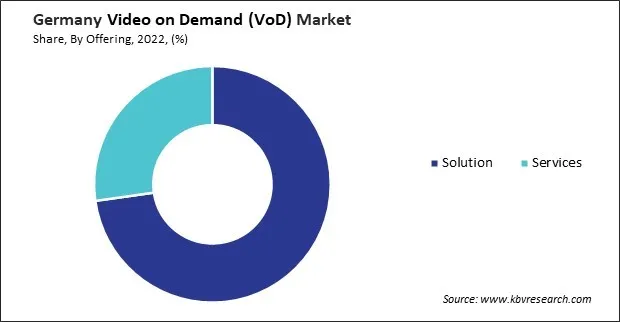

By Offering

- Solution

- OTT

- Pay TV

- IPTV

- Services

By Platform Type

- Smartphones

- Tablets/Laptops

- Smart TVs

- Others

By Content-Type

- Movies

- TV Shows/Web Series

- Music

- Educational/Fitness Programs

- Others

By Monetization Model

- Subscription Video on Demand (SVoD)

- Transactional Video on Demand (TVoD)

- Advertising-Support Video on Demand (AVoD)

- Free Ad-Supported Streaming TV (FAST)

- Others

By Vertical

- Media & Entertainment

- Government & Public Sector

- Education

- Healthcare & Lifesciences

- BFSI

- Others

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 Germany Video on Demand (VoD) Market, by Deployment Model

1.4.2 Germany Video on Demand (VoD) Market, by Offering

1.4.3 Germany Video on Demand (VoD) Market, by Platform Type

1.4.4 Germany Video on Demand (VoD) Market, by Content-Type

1.4.5 Germany Video on Demand (VoD) Market, by Monetization Model

1.4.6 Germany Video on Demand (VoD) Market, by Vertical

1.5 Methodology for the research

Chapter 2. Market Overview

2.1 Introduction

2.1.1 Overview

2.1.1.1 Market Composition and Scenario

2.2 Key Factors Impacting the Market

2.2.1 Market Drivers

2.2.2 Market Restraints

2.2.3 Market Opportunities

2.2.4 Market Challenges

2.2.5 Market Trends

Chapter 3. Competition Analysis - Global

3.1 Market Share Analysis, 2022

3.2 Porter’s Five Forces Analysis

Chapter 4. Germany Video on Demand (VoD) Market

4.1 Germany Video on Demand (VoD) Market by Deployment Model

4.2 Germany Video on Demand (VoD) Market by Offering

4.2.1 Germany Video on Demand (VoD) Market by Solution Type

4.3 Germany Video on Demand (VoD) Market by Platform Type

4.4 Germany Video on Demand (VoD) Market by Content-Type

4.5 Germany Video on Demand (VoD) Market by Monetization Model

4.6 Germany Video on Demand (VoD) Market by Vertical

Chapter 5. Company Profiles – Global Leaders

5.1 Netflix, Inc.

5.1.1 Company Overview

5.1.2 Financial Analysis

5.1.3 Research & Development Expense

5.1.4 SWOT Analysis

5.2 Amazon.com, Inc.

5.2.1 Company Overview

5.2.2 Financial Analysis

5.2.3 Segmental Analysis

5.2.4 SWOT Analysis

5.3 Google LLC (Alphabet Inc.)

5.3.1 Company Overview

5.3.2 Financial Analysis

5.3.3 Segmental and Regional Analysis

5.3.4 Research & Development Expense

5.3.5 SWOT Analysis

5.4 The Walt Disney Company

5.4.1 Company Overview

5.4.2 Financial Analysis

5.4.3 Segment and Regional Analysis

5.4.4 Recent strategies and developments:

5.4.4.1 Partnerships, Collaborations, and Agreements:

5.4.4.2 Product Launches and Product Expansions:

5.4.5 SWOT Analysis

5.5 Apple, Inc.

5.5.1 Company Overview

5.5.2 Financial Analysis

5.5.3 Regional Analysis

5.5.4 Research & Development Expense

5.5.5 SWOT Analysis

5.6 Comcast Corporation

5.6.1 Company Overview

5.6.2 Financial Analysis

5.6.3 Segmental and Regional Analysis

5.6.4 SWOT Analysis

5.7 Sony Corporation

5.7.1 Company Overview

5.7.2 Financial Analysis

5.7.3 Segmental and Regional Analysis

5.7.4 Research & Development Expenses

5.7.5 Recent strategies and developments:

5.7.5.1 Partnerships, Collaborations, and Agreements:

5.7.6 SWOT Analysis

5.8 Kaltura, Inc.

5.8.1 Company Overview

5.8.2 SWOT Analysis

5.9 Muvi

5.9.1 Company Overview

5.9.2 SWOT Analysis

5.10. Reliance Industries Limited

5.10.1 Company Overview

5.10.2 Financial Analysis

5.10.3 Segmental Analysis

5.10.4 Research & Development Expenses

5.10.5 SWOT Analysis

TABLE 2 Germany Video on Demand (VoD) Market, 2023 - 2030, USD Million

TABLE 3 Germany Video on Demand (VoD) Market by Deployment Model, 2019 - 2022, USD Million

TABLE 4 Germany Video on Demand (VoD) Market by Deployment Model, 2023 - 2030, USD Million

TABLE 5 Germany Video on Demand (VoD) Market by Offering, 2019 - 2022, USD Million

TABLE 6 Germany Video on Demand (VoD) Market by Offering, 2023 - 2030, USD Million

TABLE 7 Germany Video on Demand (VoD) Market by Solution Type, 2019 - 2022, USD Million

TABLE 8 Germany Video on Demand (VoD) Market by Solution Type, 2023 - 2030, USD Million

TABLE 9 Germany Video on Demand (VoD) Market by Platform Type, 2019 - 2022, USD Million

TABLE 10 Germany Video on Demand (VoD) Market by Platform Type, 2023 - 2030, USD Million

TABLE 11 Germany Video on Demand (VoD) Market by Content-Type, 2019 - 2022, USD Million

TABLE 12 Germany Video on Demand (VoD) Market by Content-Type, 2023 - 2030, USD Million

TABLE 13 Germany Video on Demand (VoD) Market by Monetization Model, 2019 - 2022, USD Million

TABLE 14 Germany Video on Demand (VoD) Market by Monetization Model, 2023 - 2030, USD Million

TABLE 15 Germany Video on Demand (VoD) Market by Vertical, 2019 - 2022, USD Million

TABLE 16 Germany Video on Demand (VoD) Market by Vertical, 2023 - 2030, USD Million

TABLE 17 Key Information – Netflix, Inc.

TABLE 18 Key Information – Amazon.com, Inc.

TABLE 19 Key Information – Google LLC

TABLE 20 Key information – The Walt Disney Company

TABLE 21 Key Information – Apple, Inc.

TABLE 22 key information – Comcast Corporation

TABLE 23 Key Information – Sony Corporation

TABLE 24 Key Information – Kaltura, Inc.

TABLE 25 Key Information – Muvi

TABLE 26 Key Information – Reliance Industries Limited

List of Figures

FIG 1 Methodology for the research

FIG 2 Germany Video on Demand (VoD) Market, 2019 - 2030, USD Million

FIG 3 Key Factors Impacting Video on Demand (VoD) Market

FIG 4 Market Share Analysis, 2022

FIG 5 Porter’s Five Forces Analysis - Video on Demand (VoD) Market

FIG 6 Germany Video on Demand (VoD) Market share by Deployment Model, 2022

FIG 7 Germany Video on Demand (VoD) Market share by Deployment Model, 2030

FIG 8 Germany Video on Demand (VoD) Market by Deployment Model, 2019 - 2030, USD Million

FIG 9 Germany Video on Demand (VoD) Market share by Offering, 2022

FIG 10 Germany Video on Demand (VoD) Market share by Offering, 2030

FIG 11 Germany Video on Demand (VoD) Market by Offering, 2019 - 2030, USD Million

FIG 12 Germany Video on Demand (VoD) Market share by Platform Type, 2022

FIG 13 Germany Video on Demand (VoD) Market share by Platform Type, 2030

FIG 14 Germany Video on Demand (VoD) Market by Platform Type, 2019 - 2030, USD Million

FIG 15 Germany Video on Demand (VoD) Market share by Content-Type, 2022

FIG 16 Germany Video on Demand (VoD) Market share by Content-Type, 2030

FIG 17 Germany Video on Demand (VoD) Market by Content-Type, 2019 - 2030, USD Million

FIG 18 Germany Video on Demand (VoD) Market share by Monetization Model, 2022

FIG 19 Germany Video on Demand (VoD) Market share by Monetization Model, 2030

FIG 20 Germany Video on Demand (VoD) Market by Monetization Model, 2019 - 2030, USD Million

FIG 21 Germany Video on Demand (VoD) Market share by Vertical, 2022

FIG 22 Germany Video on Demand (VoD) Market share by Vertical, 2030

FIG 23 Germany Video on Demand (VoD) Market by Vertical, 2019 - 2030, USD Million

FIG 24 SWOT Analysis: Netflix, Inc.

FIG 25 SWOT Analysis: Amazon.com, Inc.

FIG 26 SWOT Analysis: Google LLC

FIG 27 Recent strategies and developments: The Walt Disney Company

FIG 28 SWOT Analysis: The Walt Disney Company

FIG 29 SWOT Analysis: Apple, Inc.

FIG 30 SWOT Analysis: Comcast Corporation

FIG 31 SWOT Analysis: Sony Corporation

FIG 32 SWOT Analysis: Kaltura, Inc.

FIG 33 SWOT Analysis: Muvi

FIG 34 SWOT Analysis: Reliance Industries Limited