Germany Contingent Workforce Management Market Size, Share & Industry Trends Analysis Report By Type (Flexible Staffing and Permanent Staffing), By Industry, Outlook and Forecast, 2022 - 2028

Published Date : 27-Mar-2024 |

Pages: 88 |

Report Format: PDF + Excel |

COVID-19 Impact on the Germany Workforce Management Market

The Germany Workforce Management Market size is expected to reach $1 billion by 2030, rising at a market growth of 8.5% CAGR during the forecast period.

The rising need for workforce management tools in Germany is being driven by two key factors: regulatory compliance and the adoption of AI and automation. These factors are shaping the workforce management market in Germany, influencing the demand for advanced solutions that can address the complexities of managing a modern workforce while ensuring compliance with labor laws and regulations.

The country has strict labor laws and regulations governing various aspects of employment, including working hours, overtime, and leave entitlements. Workforce management tools that offer features such as accurate time tracking, scheduling optimization, and reporting capabilities are crucial for businesses to ensure compliance with these regulations while managing their workforce effectively.

Moreover, as businesses seek to improve efficiency and productivity, they are turning to AI-powered workforce management solutions that can automate repetitive tasks, analyze data to make informed decisions and optimize workforce planning. AI and automation technologies enable businesses to streamline their workforce management processes, reduce manual effort, and make more data-driven decisions, which is particularly important in a competitive industry like Germany.

Businesses are looking for solutions to help them navigate complex regulatory environments while leveraging technology to improve their operational efficiency and competitiveness. As a result, workforce management providers in Germany are focusing on developing innovative solutions that combine compliance capabilities with AI-driven insights to meet the evolving needs of businesses in the country's dynamic business landscape.

Market Trends

Increasing number of SMEs in Germany

Germany has seen a steady increase in small and medium-sized enterprises (SMEs) in recent years, contributing significantly to the country's economy and business landscape. The nation has a well-established infrastructure to support SMEs, including access to financing through banks and government-backed programs, business development support services, and favorable regulations for starting and running a business. This supportive environment has encouraged individuals to start their businesses and has contributed to the growth of the SME sector.

Additionally, Germany's strong industrial base and focus on innovation have created opportunities for SMEs to thrive. Many SMEs in Germany operate in specialized industries, leveraging their expertise and innovation to compete domestically and internationally. Furthermore, technological advancements have played a significant role in growing SMEs in Germany. The digitalization of business processes, the rise of e-commerce, and the adoption of advanced technologies such as artificial intelligence and automation have provided SMEs with new opportunities to grow their reach and improve their operations.

The increasing number of SMEs in Germany is driving a growing demand for workforce management tools tailored to small and medium-sized businesses' specific needs and challenges. These tools are crucial in helping SMEs optimize their workforce, improve operational efficiency, and ensure compliance with regulations, ultimately contributing to their growth and success in the dynamic German business landscape.

Expanding automotive & manufacturing sector in Germany

The automotive and manufacturing sectors are major employers in Germany, providing millions of jobs directly and indirectly. The expansion of these sectors leads to increased demand for skilled labor, ranging from engineers and technicians to administrative and support staff. This expansion contributes to overall employment levels and drives demand for workforce management tools that can help these industries efficiently manage their workforce, optimize productivity, and ensure compliance with labor regulations.

Germany's automotive and manufacturing sectors are major contributors to the country's exports, with products ranging from automobiles and machinery to industrial equipment and components. Expanding these sectors can lead to increased international trade and business opportunities, which require workforce management tools to support global operations, manage international teams, and facilitate cross-border collaboration.

According to the International Trade Administration, in 2025, 84 percent of German manufacturers are poised to channel significant investments, totaling EUR 10 billion (USD 10.52 billion) annually, into the integration of smart manufacturing technologies. This commitment to technological advancement extends across various sectors, with the automotive industry earmarking approximately EUR 1.2 billion per year, machinery and equipment alongside plant engineering and construction at a noteworthy EUR 1.5 billion.

Additionally, expanding the automotive and manufacturing sectors often involves complex supply chains that span multiple regions and countries. Effective supply chain management requires sophisticated workforce management tools that can help businesses optimize staffing levels, track production processes, and coordinate activities across the supply chain to ensure timely delivery and quality control. Thus, Germany's expanding automotive and manufacturing sectors are driving the demand for advanced workforce management tools that can support their growth, address industry-specific challenges, and help them remain competitive in the global industry.

Competition Analysis

The workforce management market in Germany is characterized by several key players offering a wide range of services tailored to the wants of businesses across various industries. These companies provide workforce management software, consulting services, and related technologies to help organizations optimize their workforce operations, enhance productivity, and ensure compliance with labor regulations. Some of the notable participants in the workforce management market in Germany include SAP SE, Software AG, Kronos Incorporated, ADP, Oracle Corporation, Microsoft Corporation, Zucchetti GmbH, Plan4U, Quinyx, Fresenius Netcare GmbH, Atoss Software AG, Zywave (formerly ESIS GmbH), etc.

One of the major participants in the German workforce management market is SAP SE, a global leader in enterprise software. SAP offers comprehensive workforce management solutions that integrate with its broader suite of business applications, providing businesses in Germany with tools for managing their workforce efficiently and effectively.

Oracle Corporation is another significant player in the German industry, providing cloud-based workforce management solutions that cater to the needs of businesses of all sizes. Oracle's workforce management offerings include features for time tracking, scheduling, and labor analytics designed to help businesses in Germany optimize their workforce productivity and compliance with labor regulations.

Kronos Incorporated, a global provider of workforce management, also has a presence in the German industry. Kronos offers a range of workforce management tools that help businesses in Germany manage their workforce more effectively, improve operational efficiency, and ensure compliance with labor laws and regulations.

Local providers such as Atoss Software AG, headquartered in Munich, also play a significant role in the German workforce management market. Atoss offers workforce management solutions tailored to the specific needs of businesses in Germany, including solutions for time and attendance management, workforce scheduling, and demand-oriented workforce deployment.

In addition to these key players, several other companies contribute to the diversity and competitiveness of the German workforce management market. These participants offer a variety of solutions and services, reflecting the dynamic nature of workforce management in Germany and the evolving needs of businesses in the country's diverse industries.

List of Key Companies Profiled

- ActiveOps PLC

- EG Workforce Solutions

- Sisqual Workforce Management, Lda.

- UKG, Inc.

- SAP SE

- Oracle Corporation

- WorkForce Software, LLC

- NICE Ltd.

- Infor, Inc. (Koch Industries)

- Blue Yonder Group, Inc. (Panasonic Holdings Corporation)

Germany Workforce Management Market Report Segmentation

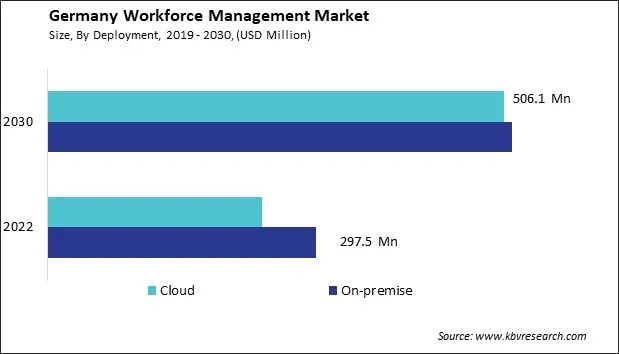

By Deployment

- On-premise

- Cloud

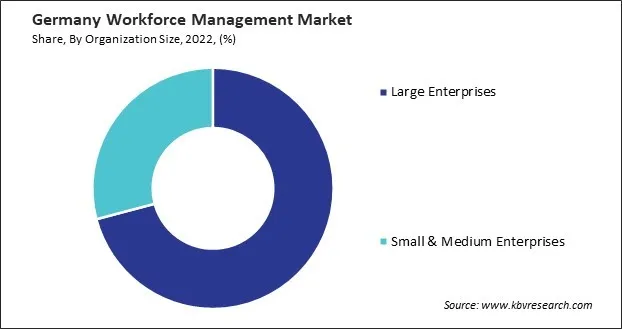

By Organization Size

- Large Enterprises

- Small & Medium Enterprises

By Solution

- Time & Attendance Management

- Workforce Scheduling

- Embedded Analytics

- Absence Management

- Others

By Application

- BFSI

- Automotive & Manufacturing

- Academia

- Healthcare

- Government

- Retail

- Others

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 Germany Workforce Management Market, by Deployment

1.4.2 Germany Workforce Management Market, by Organization Size

1.4.3 Germany Workforce Management Market, by Solution

1.4.4 Germany Workforce Management Market, by Application

1.5 Methodology for the research

Chapter 2. Market Overview

2.1 Introduction

2.1.1 Overview

2.1.1.1 Market composition and scenario

2.2 Key Factors Impacting the Market

2.2.1 Market Drivers

2.2.2 Market Restraints

Chapter 3. Competition Analysis - Global

3.1 KBV Cardinal Matrix

3.2 Recent Industry Wide Strategic Developments

3.2.1 Partnerships, Collaborations and Agreements

3.2.2 Product Launches and Product Expansions

3.2.3 Acquisition and Mergers

3.3 Top Winning Strategies

3.3.1 Key Leading Strategies: Percentage Distribution (2019-2023)

3.3.2 Key Strategic Move: (Partnerships, Collaborations & Agreements: 2022, Feb – 2023, Nov) Leading Players

3.4 Porter’s Five Forces Analysis

Chapter 4. Germany Workforce Management Market

4.1 Germany Workforce Management Market by Deployment

4.2 Germany Workforce Management Market by Organization Size

4.3 Germany Workforce Management Market by Solution

4.4 Germany Workforce Management Market by Application

Chapter 5. Company Profiles – Global Leaders

5.1 ActiveOps PLC

5.1.1 Company Overview

5.1.2 Financial Analysis

5.1.3 Segmental and Regional Analysis

5.1.4 SWOT Analysis

5.2 Sisqual Workforce Management, Lda.

5.2.1 Company Overview

5.2.2 SWOT Analysis

5.3 UKG, Inc.

5.3.1 Company Overview

5.3.2 Recent strategies and developments:

5.3.2.1 Partnerships, Collaborations, and Agreements:

5.3.2.2 Product Launches and Product Expansions:

5.3.2.3 Acquisition and Mergers:

5.3.3 SWOT Analysis

5.4 SAP SE

5.4.1 Company Overview

5.4.2 Financial Analysis

5.4.3 Segmental and Regional Analysis

5.4.4 Research & Development Expense

5.4.5 Recent strategies and developments:

5.4.5.1 Partnerships, Collaborations, and Agreements:

5.4.5.2 Acquisition and Mergers:

5.4.6 SWOT Analysis

5.5 Oracle Corporation

5.5.1 Company Overview

5.5.2 Financial Analysis

5.5.3 Segmental and Regional Analysis

5.5.4 Research & Development Expense

5.5.5 Recent strategies and developments:

5.5.5.1 Product Launches and Product Expansions:

5.5.5.2 Acquisition and Mergers:

5.5.6 SWOT Analysis

5.6 WorkForce Software, LLC

5.6.1 Company Overview

5.6.2 Recent strategies and developments:

5.6.2.1 Product Launches and Product Expansions:

5.7 NICE Ltd.

5.7.1 Company Overview

5.7.2 Financial Analysis

5.7.3 Segmental and Regional Analysis

5.7.4 Research & Development Expenses

5.7.5 Recent strategies and developments:

5.7.5.1 Acquisition and Mergers:

5.7.6 SWOT Analysis

5.8 Infor, Inc. (Koch Industries)

5.8.1 Company Overview

5.8.2 Recent strategies and developments:

5.8.2.1 Partnerships, Collaborations, and Agreements:

5.8.2.2 Acquisition and Mergers:

5.8.3 SWOT Analysis

5.9 Blue Yonder Group, Inc. (Panasonic Holdings Corporation)

5.9.1 Company Overview

5.9.2 Financial Analysis

5.9.3 Segmental and Regional Analysis

5.9.4 Research & Development Expense

5.9.5 Recent strategies and developments:

5.9.5.1 Partnerships, Collaborations, and Agreements:

5.9.5.2 Product Launches and Product Expansions:

5.9.5.3 Acquisition and Mergers:

5.9.6 SWOT Analysis

TABLE 2 Germany Workforce Management Market, 2023 - 2030, USD Million

TABLE 3 Partnerships, Collaborations and Agreements– Workforce Management Market

TABLE 4 Product Launches And Product Expansions– Workforce Management Market

TABLE 5 Acquisition and Mergers– Workforce Management Market

TABLE 6 Germany Workforce Management Market by Deployment, 2019 - 2022, USD Million

TABLE 7 Germany Workforce Management Market by Deployment, 2023 - 2030, USD Million

TABLE 8 Germany Workforce Management Market by Organization Size, 2019 - 2022, USD Million

TABLE 9 Germany Workforce Management Market by Organization Size, 2023 - 2030, USD Million

TABLE 10 Germany Workforce Management Market by Solution, 2019 - 2022, USD Million

TABLE 11 Germany Workforce Management Market by Solution, 2023 - 2030, USD Million

TABLE 12 Germany Workforce Management Market by Application, 2019 - 2022, USD Million

TABLE 13 Germany Workforce Management Market by Application, 2023 - 2030, USD Million

TABLE 14 Key Information – ActiveOps PLC

TABLE 15 Key Information – SISQUAL Workforce Management, Lda.

TABLE 16 Key Information – UKG, Inc.

TABLE 17 Key Information – SAP SE

TABLE 18 Key Information – Oracle Corporation

TABLE 19 Key Information – WorkForce Software, LLC

TABLE 20 Key Information – NICE Ltd.

TABLE 21 Key Information – Infor, Inc.

TABLE 22 Key Information – Blue Yonder Group, Inc.

List of Figures

FIG 1 Methodology for the research

FIG 2 Germany Workforce Management Market, 2019 - 2030, USD Million

FIG 3 Key Factors Impacting Workforce Management Market

FIG 4 KBV Cardinal Matrix

FIG 5 Key Leading Strategies: Percentage Distribution (2019-2023)

FIG 6 Key Strategic Move: (Partnerships, Collaborations & Agreements: 2022, Feb – 2023, Nov) Leading Players

FIG 7 Porter’s Five Forces Analysis – Workforce management market

FIG 8 Germany Workforce Management Market Share by Deployment, 2022

FIG 9 Germany Workforce Management Market Share by Deployment, 2030

FIG 10 Germany Workforce Management Market by Deployment, 2019 - 2030, USD Million

FIG 11 Germany Workforce Management Market Share by Organization Size, 2022

FIG 12 Germany Workforce Management Market Share by Organization Size, 2030

FIG 13 Germany Workforce Management Market by Organization Size, 2019 - 2030, USD Million

FIG 14 Germany Workforce Management Market Share by Solution, 2022

FIG 15 Germany Workforce Management Market Share by Solution, 2030

FIG 16 Germany Workforce Management Market by Solution, 2019 - 2030, USD Million

FIG 17 Germany Workforce Management Market Share by Application, 2022

FIG 18 Germany Workforce Management Market Share by Application, 2030

FIG 19 Germany Workforce Management Market by Application, 2019 - 2030, USD Million

FIG 20 Swot Analysis: ActiveOps PLC

FIG 21 Swot Analysis: SISQUAL Workforce Management, Lda.

FIG 22 Recent strategies and developments: UKG, Inc.

FIG 23 Swot Analysis: UKG, Inc.

FIG 24 Recent strategies and developments: SAP SE

FIG 25 SWOT Analysis: SAP SE

FIG 26 Recent strategies and developments: Oracle Corporation

FIG 27 SWOT Analysis: Oracle Corporation

FIG 28 SWOT Analysis: NICE Ltd.

FIG 29 Recent strategies and developments: Infor Inc.,

FIG 30 SWOT Analysis: Infor, Inc.

FIG 31 Recent strategies and developments: Blue Yonder Group Inc.

FIG 32 SWOT Analysis: Blue Yonder Group, Inc.