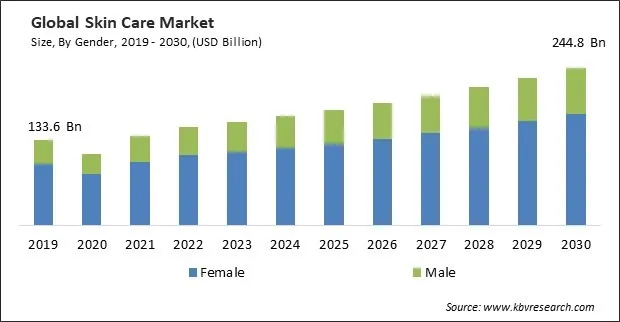

The Global Skin Care Market size is expected to reach $244.8 billion by 2030, rising at a market growth of 6.2% CAGR during the forecast period. In the year 2022, the market attained a volume of 13,507.5 million units, experiencing a growth of 6.2% (2019-2022).

The increased demand for sun protection products is attributable to heightened awareness of the detrimental impacts of UV radiation. Thus, the Creams & Moisturizers segment acquired $65,075.4 million in 2022. Consumers are incorporating sunscreen and sun care products into their daily routines to prevent sun damage, including sunburn and the development of skin conditions. People are increasingly adopting skincare routines to prevent skin concerns like sun damage, premature aging, and acne. This preventive approach drives the consistent use of skincare products, contributing to market growth.

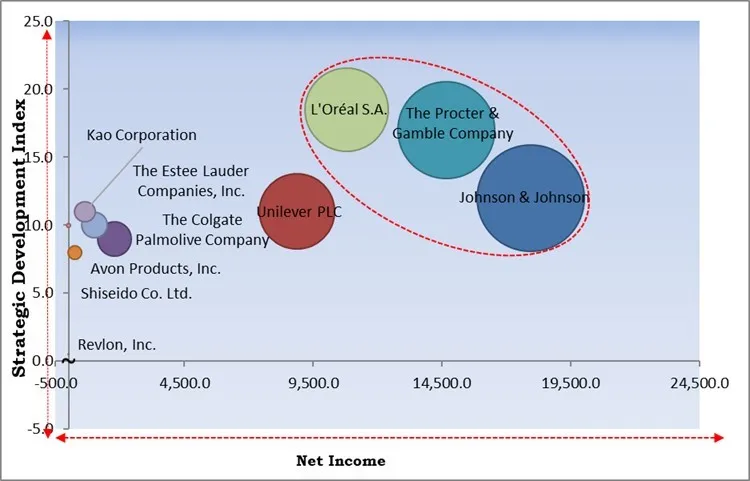

The major strategies followed by the market participants are Mergers & Acquisition as the key developmental strategy to keep pace with the changing demands of end users. For instance, In August, 2023, Kao Corporation and its subsidiaries, Kao Australia Pty. Limited and Kao USA Inc., acquired the Bondi Sands brands, including Bondi Sands Australia Pty Ltd., expanded its portfolio with Bondi Sands, a leading Australian company in self-tanning, suncare, skincare, and body products. Additionally, In April, 2023, L'Oréal came into an agreement with Natura &Co to acquire Aesop. Through this acquisition, L’Oréal would increase its footprint in the high-end, natural beauty product area and broaden its presence across China.

Based on the Analysis presented in the KBV Cardinal matrix; The Procter & Gamble Company, Johnson & Johnson and L'Oréal S.A. are the forerunners in the Skin Care Market. In, December, 2022, Johnson & Johnson acquired Abiomed, a leading medical device company specializing in developing and manufacturing advanced heart recovery and support technologies. Through this acquisition, Johnson & Johnson would be able to broaden its offerings in the rapidly growing cardiovascular sector by incorporating heart recovery solutions into our globally leading Biosense Webster electrophysiology business. Companies such as Unilever PLC, The Estee Lauder Companies, Inc., and Kao Corporation are some of the key innovators in Skin Care Market.

The clean beauty movement aligns with the demand for natural and organic skincare products. Consumers seek products with transparent ingredient lists, avoiding potentially harmful chemicals, synthetic fragrances, and artificial colours. Clean beauty has become synonymous with skincare choices that prioritize safety and health. Consumers are more informed about the ingredients used in skincare products. There is a growing awareness of potential skin irritants and the environmental impact of certain ingredients. As a result, individuals are actively seeking products with clear and transparent ingredient labelling, fostering trust in the brand.

Integrating technology in skincare devices, such as facial cleansing brushes, LED therapy devices, and smart skincare tools, has attracted consumers looking for advanced and tech-driven solutions. This innovation contributes to market growth and consumer engagement. Technologies such as microcurrents and ultrasound in skincare devices enhance the penetration of skincare products into the skin. These devices offer superior removal of impurities, dead skin cells, and makeup, promoting a more thorough and efficient skincare routine. Technological advancements in microneedling devices enhance safety, precision, and user comfort, making them more accessible to consumers. Technological advancements in skincare devices have been a pivotal factor in driving the growth of the market.

Skincare brands often encounter issues related to counterfeiting and imitation of their products. Counterfeit skincare products pose risks to consumer safety and damage the reputation of authentic brands. Counterfeit skincare products may contain unauthorized or substandard ingredients, posing potential health risks to consumers. Counterfeit products erode consumer trust in legitimate skincare brands. When consumers unknowingly purchase counterfeit items and experience adverse effects, it can damage the reputation of the authentic brand associated with the imitation. Consumers applying these products to their skin may unknowingly expose themselves to substances that can cause allergic reactions, skin irritation, or other health issues. Thus, counterfeit products and brand imitation can slow down the growth of the market.

By gender, the market is bifurcated into female and male. The male segment covered a considerable revenue share in the market in 2022. Developing diverse skincare products tailored to men's unique skin concerns, such as shaving irritation, oiliness, and anti-aging, can drive innovation and provide consumers with a wider array of choices. Providing educational content about skincare benefits and routines tailored to men can empower them to make informed decisions about their skincare. This education can stimulate demand and promote brand loyalty. Many men prefer straightforward and convenient skincare routines. Brands that offer simplified yet effective products, possibly with multi-functional benefits, can appeal to men seeking hassle-free solutions.

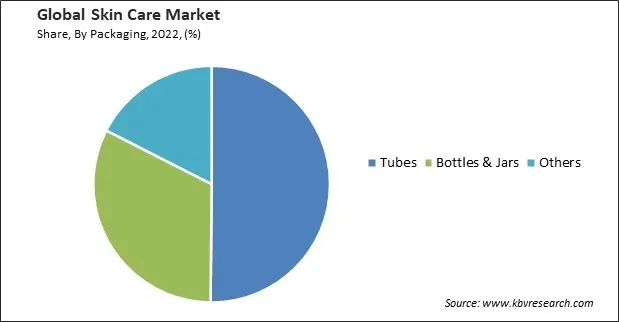

Based on packaging, the market is categorized into tubes, bottles & jars, and others. In 2022, the tubes segment witnessed the highest revenue share in the market. Tubes provide a hygienic way to dispense skincare products without direct contact with the contents. This can be particularly important for products that require a clean and germ-free application, such as creams and ointments. Tube packaging helps protect skincare products from exposure to air and light, preserving the freshness and efficacy of active ingredients. This can be especially crucial for formulations sensitive to environmental factors. Advancements in tube technology, such as airless pumps and nozzles, can further enhance the user experience. These innovations can improve product shelf life, reduce waste, and provide a more controlled application.

On the basis of distribution channel, the market is bifurcated into offline and online. The online segment garnered a significant revenue share in the market in 2022. Online shopping offers unparalleled convenience for consumers. They can browse and purchase skincare products from their homes anytime. This convenience factor is a significant driver of online sales. Online platforms allow skincare brands to showcase various products, providing consumers diverse choices. This is especially beneficial for brands with extensive product lines or those catering to specific skincare needs. The online segment enables brands to adopt a direct-to-consumer (DTC) model, bypassing traditional distribution channels. This can increase profit margins and connect the brand and its customers closer.

By product type, the market is segmented into creams & moisturizers, cleansers & face wash, powder, and others. In 2022, the creams & moisturizers segment registered the maximum revenue share in the market. Creams & moisturizers are essential for maintaining skin hydration. By emphasizing the importance of hydration, skincare brands can attract consumers who seek products to keep their skin healthy, plump, and radiant. Creams & moisturizers often include anti-aging ingredients such as retinol, peptides, and antioxidants. Expanding in this segment allows brands to tap into the growing demand for products that address fine lines, wrinkles, and other signs of aging. Creating creams and moisturizers specifically formulated for day and night use allows brands to offer comprehensive skincare routines. Day creams may focus on sun protection, while night creams can prioritize repair and rejuvenation.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 153.3 Billion |

| Market size forecast in 2030 | USD 244.8 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 6.2% from 2023 to 2030 |

| Number of Pages | 421 |

| Number of Table | 854 |

| Quantitative Data | Volume in Million Units, Revenue in USD Billion, and CAGR from 2019 to 2030 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Product Type, Gender, Packaging, Distribution Channel, Region |

| Country scope |

|

| Companies Included | The Colgate Palmolive Company, The Procter & Gamble Company (P&G), Johnson & Johnson, Unilever PLC, The Estee Lauder Companies, Inc., Shiseido Company Limited, Kao Corporation, Avon Products, Inc. (Natura & Co Holding SA), Revlon, Inc. (MacAndrews & Forbes), L'Oréal S.A. |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the market is analysed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the Asia Pacific region led the market by generating the highest revenue share. The Asia-Pacific region is culturally diverse, with each country having beauty standards and skincare traditions. Influences from traditional practices, such as Ayurveda, K-beauty, and traditional Chinese medicine, contribute to the richness of the skincare landscape. The growing middle-class population in many Asia Pacific countries has increased purchasing power.

Free Valuable Insights: Global Skin Care Market size to reach USD 244.8 Billion by 2030

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include The Colgate Palmolive Company, The Procter & Gamble Company (P&G), Johnson & Johnson, Unilever PLC, The Estee Lauder Companies, Inc., Shiseido Company Limited, Kao Corporation, Avon Products, Inc. (Natura & Co Holding SA), Revlon, Inc. (MacAndrews & Forbes), L'Oréal S.A.

By Gender (Volume, Million Units, USD Billion, 2019 to 2030)

By Packaging (Volume, Million Units, USD Billion, 2019 to 2030)

By Distribution Channel (Volume, Million Units, USD Billion, 2019 to 2030)

By Product Type (Volume, Million Units, USD Billion, 2019 to 2030)

By Geography (Volume, Million Units, USD Billion, 2019 to 2030)

This Market size is expected to reach $244.8 billion by 2030.

Growing demand for natural and organic products are driving the Market in coming years, however, Counterfeit products and brand imitation restraints the growth of the Market.

The Colgate Palmolive Company, The Procter & Gamble Company (P&G), Johnson & Johnson, Unilever PLC, The Estee Lauder Companies, Inc., Shiseido Company Limited, Kao Corporation, Avon Products, Inc. (Natura & Co Holding SA), Revlon, Inc. (MacAndrews & Forbes), L'Oreal S.A.

In the year 2022, the market attained a volume of 13,507.5 million units, experiencing a growth of 6.2% (2019-2022).

The Offline segment is leading the Market by Distribution Channel in 2022;there by, achieving a market value of $140.3 billion by 2030.

The Asia Pacific region dominated the Market by Region in 2022, and would continue to be a dominant market till 2030;there by, achieving a market value of $91.9 billion by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.