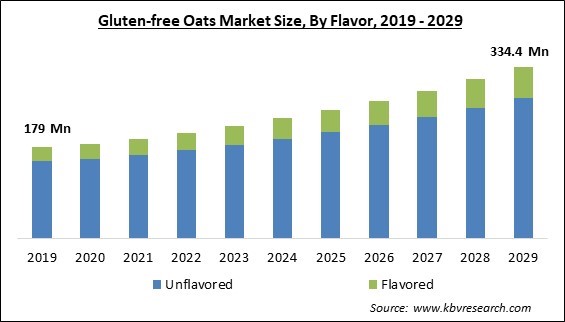

The Global Gluten-free Oats Market size is expected to reach $334.4 million by 2029, rising at a market growth of 7.3% CAGR during the forecast period.

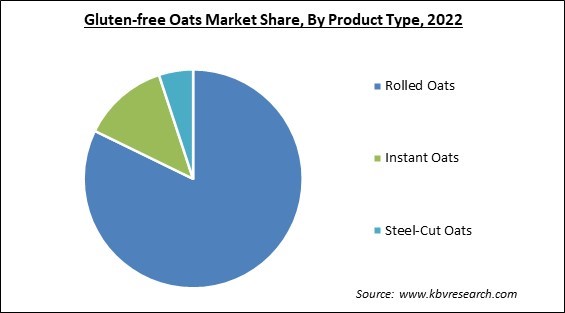

Rolled oats are the majorly consumed gluten-free oats as these are simple to prepare. Thereby, Roalled Oats generated $169.4 million revenue in the market in 2022. Nowadays, wheat grain has been modified to produce crops that are more drought-resistant and bake easier, the incidence of gluten intolerance is rapidly increasing around the world. Because people are now consuming more wheat products than ever, stomachs have not adjusted to these changes as rapidly. Additionally, persons who constantly follow diets are vitamin deficient. They obstruct the body's capacity to control immunological cells. These eating plans prevent the immune system from fighting gluten irritants. Some of the factors impacting the market are the increasing popularity of veganism, health advantages associated with oats consumption, and limitation in oats consumption.

The majority of the world is transitioning towards diets based on plants. In recent years, the term vegan has shifted to plant-based, making this diet more appealing to a broader spectrum of individuals. Nowadays, it is so simple to locate plant-based substitutes for anything. Even more, restaurants offer or have raised the number of plant-based options and products on their menus. In comparison to enriched or refined carbohydrates, steel-cut or rolled oats (the kind that is unsweetened and unflavored) have a low glycemic index rating. Different studies have shown that They can avoid energy peaks and valleys. Slow-releasing carbs from oatmeal help manage blood sugar levels and maintain enduring energy. It is projected that these variables will hasten the expansion of the gluten-free oats market during the forecasted period.

However, only celiac disease patients who are in remission, and even then, only in moderation, are advised to consume oats. It has been discussed that some oat kinds can be immunogenic (toxic) to celiac patients, and some may experience unfavorable immunological reactions to oat proteins. Oat should be eliminated from the diet if a negative immunological reaction is linked to oat eating or if anti-tissue transglutaminase autoantibodies rise. This will limit their uptake, restricting market expansion.

Based on product Type, the gluten-free oats market is segmented into rolled oats, steel-cut oats and instant oats. The rolled oats segment dominated the gluten-free oats market with maximum revenue share in 2022. This is due to the increased production and consumption of rolled oats in important regions. Oatmeal breakfast bowls, baked dishes, and other recipes call for rolled oats, which are simple to prepare. Also, consumers are looking for convenient and adaptable items to use in their cooking and food preparation as hectic lifestyles grow more common, which is expected to propel the segment's growth.

On the basis of flavor, the gluten-free oats market is divided into flavored and unflavored. The flavored segment procured a substantial revenue share in the gluten-free oats market in 2022. This is because they are high in fiber & protein, simple to prepare, and available in various flavors. Market players are continuously introducing new flavors and combinations to fulfil consumer demand, like apple cinnamon, blueberry, and maple brown sugar. In addition, the rise of e-commerce has made it much easier for customers to purchase various flavored oats from various brands, which has fueled the segment's growth.

By distribution channel, the gluten-free oats market is classified into supermarkets & hypermarkets, convenience stores, online retail and others (specialty stores). The supermarkets & hypermarkets segment witnessed the largest revenue share in the gluten-free oats market in 2022. This is due to the fact that manufacturers are making investments in research and development to enhance the quality and flavor of their products, as well as to create novel gluten-free oat-based products. This has resulted in the introduction of new gluten-free oat-based products, such as munchies, granola, and breakfast cereals, which have drawn consumers and fueled the segment's growth.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 206.1 Million |

| Market size forecast in 2029 | USD 334.4 Million |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2029 |

| Revenue Growth Rate | CAGR of 7.3% from 2023 to 2029 |

| Number of Pages | 197 |

| Number of Table | 350 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Product Type, Flavor, Distribution Channel, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the gluten-free oats market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Europe region registered the maximum revenue share in the gluten-free oats market in 2022. This is owing to the significant market for gluten-free oats, with regional countries demonstrating significant demand for gluten-free goods, including oats. The European market is driven by the rising prevalence of gluten-related disorders, the growing consumer awareness of gluten-free diets, and the expanding health consciousness.

Free Valuable Insights: Global Gluten-free Oats Market size to reach USD 334.4 Million by 2029

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Bob’s Red Mill Natural Foods, Inc., General Mills, Inc., PepsiCo, Inc. (The Quaker Oats Company), Thrive Market, Inc., B&G Foods, Inc., Cargill, Incorporated, Glebe Farm Foods Limited, Bakery On Main, Purely Elizabeth, LLC, and Nature’s Path Foods, Inc.

By Product Type

By Flavor

By Distribution Channel

By Geography

The Market size is projected to reach USD 334.4 million by 2029.

Health advantages associated with oats consumption are driving the Market in coming years, however, Limitation in oats consumption restraints the growth of the Market.

Bob’s Red Mill Natural Foods, Inc., General Mills, Inc., PepsiCo, Inc. (The Quaker Oats Company), Thrive Market, Inc., B&G Foods, Inc., Cargill, Incorporated, Glebe Farm Foods Limited, Bakery On Main, Purely Elizabeth, LLC, and Nature’s Path Foods, Inc.

The Online Retail segment has shown the high growth rate of 7.5% during (2023 - 2029).

The Unflavored segment is leading the Market by Flavor in 2022 thereby, achieving a market value of $273.4 Million by 2029.

The Europe segment dominated the Global Gluten-free Oats Market by Region in 2022 and would continue to be a dominant market till 2029; thereby, achieving a market value of $116.1 Million by 2029.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.