“Global Gluten Free Products Market to reach a market value of USD 12.9 Billion by 2030 growing at a CAGR of 9.5%”

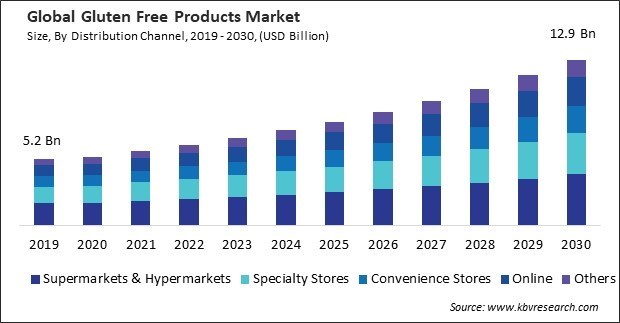

The Global Gluten Free Products Market size is expected to reach $12.9 billion by 2030, rising at a market growth of 9.5% CAGR during the forecast period.

North America has experienced a heightened awareness of gluten-related disorders, such as celiac disease and gluten sensitivity. Therefore, the region captured $2,342.6 million revenue in the market in 2022. This has prompted established and emerging brands to expand their gluten-free product offerings to cater to specific dietary needs. Therefore, the segment will witness enhanced growth in the upcoming years.

The major strategies followed by the market participants are Product Launches as the key developmental strategy to keep pace with the changing demands of end users. For instance, In Aug, 2023, Chobani LLC launched Chobani Oatmilk Pumpkin Spice, a creamy, dairy-free oat drink with pumpkin spice flavor. Ideal for fall, it's vegan-friendly and rich in calcium, offering quality and flavor without compromise. Additionally, In October, 2022, General Mills Inc. introduced its first peanut-free facility products, offering peace of mind for sensitive consumers. Among them are Annie’s and Cascadian Farm granola bars, including the Oats & Honey and Chocolate Drizzle varieties, which are USDA-certified organic and gluten-free.

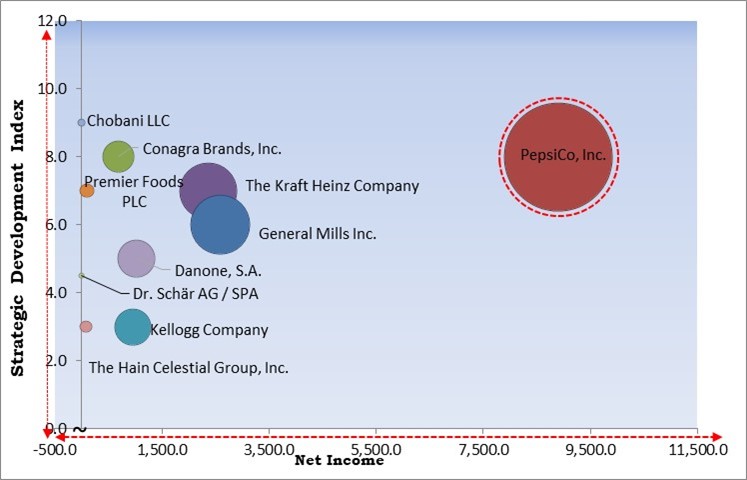

Based on the Analysis presented in the KBV Cardinal matrix; PepsiCo, Inc. is the forerunner in the Market. Companies such as The Kraft Heinz Company, General Mills Inc., Conagra Brands, Inc. are some of the key innovators in Market. For Instance, in April, 2022, The Kraft Heinz Company introduced HEINZ DIP & CRUNCH, a unique product combining sauce and potato crunchers for enhanced burger enjoyment. Simply dip the burger, add the crunchers, and elevate burger night with two tangy flavors.

Social media platforms serve as accessible and widespread channels for information dissemination. Health influencers leverage these platforms to raise awareness about gluten-related disorders, the benefits of gluten-free living, and the availability of gluten-free products. These platforms facilitate the formation of supportive communities, creating a sense of belonging and encouraging individuals to embrace gluten-free lifestyles. Hence, these aspects will help in the expansion of the market.

Additionally, the food industry has diversified its product offerings to include a wide range of gluten-free alternatives. This includes gluten-free versions of traditionally gluten-containing products such as bread, pasta, cereals, snacks, and baked goods. Consumers can conveniently browse and purchase gluten-free items from various brands, with the added advantage of home delivery. This online accessibility further expands the reach of gluten-free products. Thus, these factors will propel the demand for gluten free products in the upcoming years.

Gluten provides a unique elasticity to dough, contributing to the structure and texture of baked goods. Achieving the same structural integrity and elasticity level in gluten-free products is challenging. Formulating gluten-free products requires alternative binding agents to prevent crumbling and maintain the desired consistency, adding complexity to the ingredient selection process. Thus, these factors will reduce demand for gluten free products in the upcoming years.

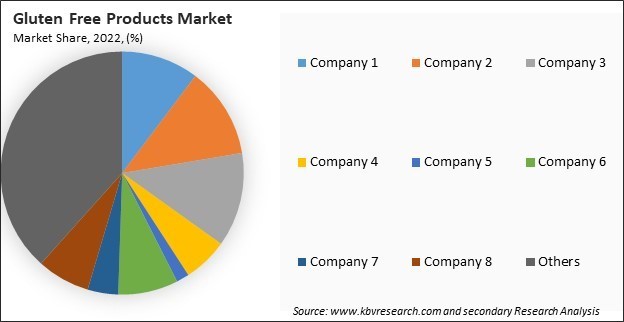

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Product Launches and Product Expansions.

On the basis of distribution channel, the market is divided into supermarkets & hypermarkets, specialty stores, convenience stores, online, and others. In 2022, the specialty stores segment witnessed a 24.45% revenue share in the market. Specialty stores focus on addressing the dietary preferences and needs of individuals with gluten-related disorders, such as celiac disease or gluten sensitivity. These stores curate products that are specifically formulated to be gluten-free, ensuring a safe and enjoyable shopping experience for those with gluten-related dietary restrictions. As a result, there will be increased demand in the segment.

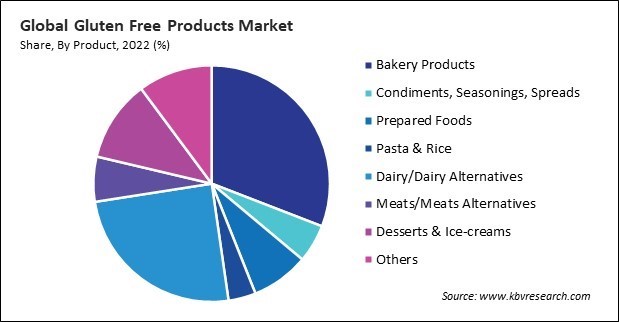

Based on product, the market is segmented into bakery products, dairy/dairy alternatives, meats/meats alternatives, condiments, seasonings, spreads, desserts & ice-creams, prepared foods, pasta & rice, and others. The bakery products segment dominated the market by generating 30.86% revenue share in 2022. The availability of gluten-free bakery products in mainstream retail channels has expanded significantly. Consumers can now easily find gluten-free bakery items alongside traditional products, making it more convenient to incorporate gluten-free options into their regular shopping routines. Thus, these factors will help in the growth of the segment.

Free Valuable Insights: Global Gluten Free Products Market size to reach USD 12.9 billion by 2030

By region, the market is segmented into North America, Europe, Asia Pacific, and LAMEA. In 2022, the Europe segment acquired a 29.78% revenue share in the market. Europe has been witnessing a growing awareness of health and wellness. Consumers are becoming more conscious of their dietary choices, seeking products perceived as healthier. Gluten-free products, often associated with a healthier lifestyle, might be gaining traction. Thus, these factors will boost the demand in the segment.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 6.3 Billion |

| Market size forecast in 2030 | USD 12.9 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 9.5% from 2023 to 2030 |

| Number of Pages | 254 |

| Number of Tables | 334 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Market Share Analysis, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Product, Distribution Channel, Region |

| Country scope |

|

| Companies Included | The Kraft Heinz Company, Kellogg Company, General Mills, Inc., PepsiCo, Inc., Chobani LLC, Premier Foods PLC, Danone S.A., The Hain Celestial Group, Inc., Conagra Brands, Inc., Dr. Schar AG / SPA |

By Distribution Channel

By Product

By Geography

This Market size is expected to reach $12.9 billion by 2030.

Rising incidence of gluten-related disorders are driving the Market in coming years, however, Taste and texture challenges with gluten free products restraints the growth of the Market.

The Kraft Heinz Company, Kellogg Company, General Mills, Inc., PepsiCo, Inc., Chobani LLC, Premier Foods PLC, Danone S.A., The Hain Celestial Group, Inc., Conagra Brands, Inc., Dr. Schar AG / SPA

The expected CAGR of this Market is 9.5% from 2023 to 2030.

The Supermarkets & Hypermarkets segment is leading the Market by Distribution Channel in 2022; there by, achieving a market value of $3.97 billion by 2030.

The North America region dominated the Market by Region in 2022, and would continue to be a dominant market till 2030; there by, achieving a market value of $4.4 Billion by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.

Drivers

Drivers

Restraints

Restraints

Opportunities

Opportunities

Challenges

Challenges