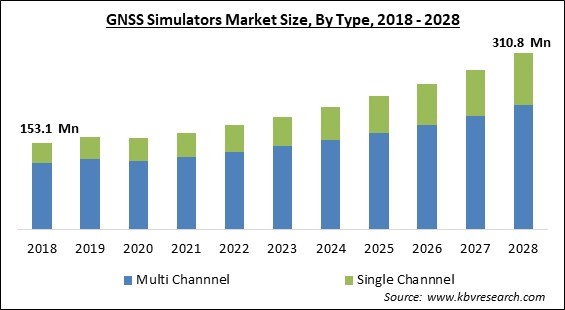

The Global GNSS Simulators Market size is expected to reach $310.8 million by 2028, rising at a market growth of 9.2% CAGR during the forecast period.

Global Navigation Satellite Systems (GNSS) consist of a constellation of Earth-orbiting satellites that communicate their locations in space and time, networks of ground control stations, and receivers that compute ground positions via trilateration. All modes of transportation employ GNSS, including space stations, aviation, marine, rail, road, and mass transit. Positioning, navigation, and timing (PNT) play a crucial role in several fields, including telecommunications, law enforcement, land surveying, emergency response, precision agriculture, agriculture, mining, finance, and scientific research.

They are used to govern computer networks, air traffic, and power grids, among other applications. Although GNSS satellites differ in age and design, their primary function is consistent. The satellites emit two carrier waves known as L1 and L2 in the L-Band. The satellite sends information to the ground through carrier waves. The majority of GNSS receivers consist of an antenna and a processing unit. While the antenna receives satellite signals, the processing unit interprets them.

For the receiver to identify its location, it must acquire data from at least three satellites. GNSS satellites circle the Earth at a medium-orbit height once every 11 hours, 58 minutes, and 2 seconds. Each satellite delivers encoded signals with precise orbital information and an atomic clock's highly accurate time stamp. The time information transmitted by the satellite is coded so that a receiver may continually identify the time the signal was sent.

The signal comprises information that a receiver utilizes to compute the satellites' positions and adapt for precise placement. The time difference between the time of the received signal and the broadcast time is used by the receiver to calculate the distance or range between the receiver and the satellite. When the receiver knows its precise location relative to each satellite, it transforms that position into a set of Earth-based coordinates and provides the result as latitude, longitude, and altitude.

COVID-19 has crippled the manufacturing industry. Initially, it affected primarily the emerging region, but as time passed, its impacts began to be felt around the world, with several nations imposing lockdowns. Volunteers from the Slovakian business Sygic and other technological companies developed a mobile application to restrict the spread of the COVID-19 virus. Using GNSS and Bluetooth sensors, the system determined whether the user had come into touch with an infected individual within the preceding 14 days. As in the upcoming years the GNSS simulators would see a decent growth.

Consumer IoT refers to the environment of consumer gadgets and devices that are networked. It is a primary technical driver for the market for GNSS simulators. GNSS is one of the core technologies that underpin the Internet of Things and the vast majority of linked urban environments. GNSS enables real-time tracking, timing, navigation, and other aspects of machine-to-machine communication, which serves as the foundation for IoT device management. The relevance of GNSS in IoT is summed up by the capacity of devices to determine their location and the location of other units nearby, as well as the ability to compile the data into meaningful information.

Countries like the United States, the United Kingdom, and Australia issue permits or licenses for commercial UAV operations. UAVs are equipped with GNSS chips for the tracking, recording, and transmission of real-time data. The Federal Aviation Administration (FAA) has authorized the use of sub-25-pound UAVs below 400 feet by law enforcement organizations. The agencies may employ UAVs for training, but they must demonstrate their proficiency before being awarded operating permissions. Companies have created GNSS-integrated UAVs adapted for various uses to track their whereabouts continually.

It is difficult to locate significant digital infrastructure that does not utilize GNSS. The absence of modern digital infrastructures, such as internet access and ICT infrastructure, is a significant barrier impeding the adoption of digital, location-based business models and services. Low-income developing countries face several persistent challenges, including underdeveloped digital infrastructure, limited digital competencies among consumers and workers inadequate financial support, a weak regulatory environment, and low levels of trust in digital transactions among consumers, businesses, and governments.

On the basis of Type, the GNSS Simulators Market is divided into Single channel and Multi-channel. The multi-channel segment garnered the highest revenue share in the GNSS simulators market in 2021. The second form of RF simulator contains many channels and is frequently referred to as a constellation simulator. It offers coherent modeling of several satellite signals in a predetermined operational environment. This sort of equipment is utilized extensively in R&D, as well as in virtually all design, production, and post-sale testing.

By Receiver, the GNSS Simulators Market is classified into GPS, Galileo, GLONASS, BeiDou, and Other Receivers. The beidou segment witnessed a substantial revenue share in the GNSS simulators market in 2021. BeiDou began as Beidou-1, a geostationary Asia-Pacific local network that has since been deactivated. In China, the second version of BeiDou-2 began operational in December 2011. It is envisaged that BeiDou-3 will consist of thirty MEO satellites and five geostationary satellites (IGSO).

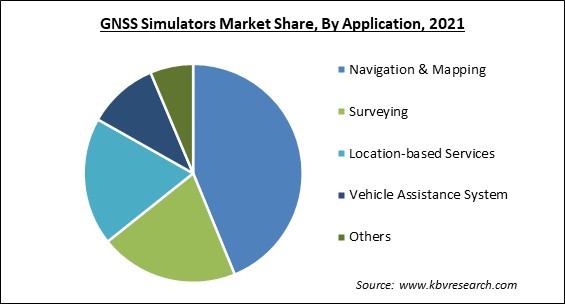

Based on the Application, the GNSS Simulators Market is bifurcated into Navigation & Mapping, Surveying, Location-based Services, Vehicle Assistance System, and Other Applications. The vehicle assistance system segment registered a significant revenue share in the GNSS simulators market in 2021. The development of Spirent software was motivated by the automobile industry's increased demand for realistic location, navigation, and timing testing for sensor fusion. Test labs must be able to mix the Wi-Fi, camera, lidar, radar, inertial, and GNSS data that powers advanced driver-assistance system (ADAS) features and enhanced infotainment systems, as customers exert growing pressure on automakers to implement these functions.

Based on the Component, the GNSS Simulators Market is segmented into Hardware, Software, and Services. The hardware segment acquired the highest revenue share in the GNSS simulators market in 2021. The HIL simulator, which might be a car or a flight simulator operated by an operator, generates location data in addition to kinetic parameters such as velocity, acceleration, and jerk, and optionally attitude data in the form of yaw, pitch, and roll angles. This information is sent to the SMBV through SCPI remote control instructions. A GNSS receiver receives the latest GNSS signal and calculates a location.

By Service Type, the GNSS Simulators Market is fragmented into Professional Services and Managed Services. The professional service segment procured the largest revenue share in the GNSS simulators market in 2021. Because specialized services is a defining professional services are essential to a customer's successful journey to results, it is crucial to explore some reasonable questions. Especially when the convergence of services and the blurring of formerly distinct divisions continues apace. Customers can also receive professional services from businesses or corporations.

Based on the Vertical, the GNSS Simulators Market is fragmented into Military and Defense, Automotive, Consumer Electronics, Marine, Aerospace, and Other Verticals. The military & defense segment garnered the largest revenue share in the GNSS simulators market in 2021. It is because in a military setting, GNSS systems are frequently employed to provide time for communications systems, since this enables efficient and cost-effective network synchronization to offer secure voice and data transmissions.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 170.4 Million |

| Market size forecast in 2028 | USD 310.8 Million |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 9.2% from 2022 to 2028 |

| Number of Pages | 374 |

| Number of Tables | 674 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Type, Receiver, Application, Component, Vertical, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the GNSS Simulators Market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific segment acquired a promising growth rate in the GNSS simulators market in 2021. The region's developing economies have collaborated with other areas to offer and improve GNSS technologies. This has benefited the market for GNSS simulators in Asia-Pacific since technology improvements and adaptation are easier and organizations can deliver better solutions to end users.

Free Valuable Insights: Global GNSS Simulators Market size to reach USD 310.8 Million by 2028

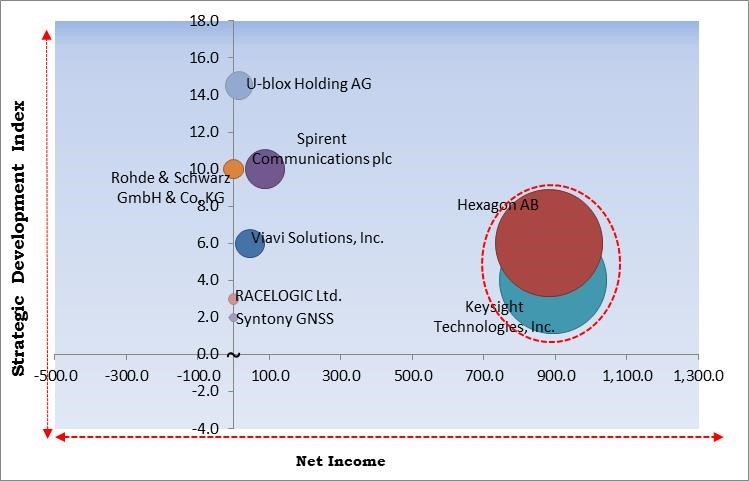

The major strategies followed by the market participants are Partnerships. Based on the Analysis presented in the Cardinal matrix; Keysight Technologies, Inc. and Hexagon AB are the forerunners in the GNSS Simulators Market. Companies such as U-blox Holding AG, Spirent Communications plc, Rohde & Schwarz GmbH & Co. KG are some of the key innovators in GNSS Simulators Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Spirent Communications plc, Keysight Technologies, Inc., Viavi Solutions, Inc., Hexagon AB, U-blox Holding AG, Rohde & Schwarz GmbH & Co. KG, Syntony GNSS, RACELOGIC Ltd., Averna Technologies, Inc. and Accord Software & Systems Private Limited.

By Type

By Receiver

By Application

By Component

By Vertical

By Geography

The global GNSS Simulators Market size is expected to reach $310.8 million by 2028.

The rapid adoption of consumer IoT devices are driving the market in coming years, however, Insufficient digital infrastructure of GNSS simulators restraints the growth of the market.

Spirent Communications plc, Keysight Technologies, Inc., Viavi Solutions, Inc., Hexagon AB, U-blox Holding AG, Rohde & Schwarz GmbH & Co. KG, Syntony GNSS, RACELOGIC Ltd., Averna Technologies, Inc. and Accord Software & Systems Private Limited.

The Navigation & Mapping market acquired the high revenue share in the Global GNSS Simulators Market by Application in 2021; thereby, achieving a market value of $126.9 million by 2028.

The GPS market is leading the Global GNSS Simulators Market by Receiver in 2021; thereby, achieving a market value of $166.3 million by 2028.

The North America market dominated the Global GNSS Simulators Market by Region in 2021; thereby, achieving a market value of $106.3 million by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.