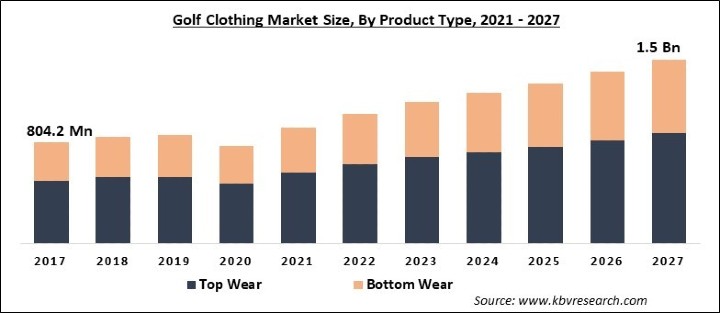

The Global Golf Clothing Market size is expected to reach $1.5 billion by 2027, rising at a market growth of 8% CAGR during the forecast period. Golf clothing comprises several accessories that are useful for players while playing golf. The items that come under the list of accessories are golf gloves, golf wear & golf gear, golf balls, shoe club, club head cover, putters, wedges, ball markers, cart, towels, and others. The target customers of this market are only golf players and these players are regular customers of golf clothing. The necessary part of these apparel is the golf shoe as without perfect shoes players will not be able to play golf properly.

The manufacturers of golf apparel strive hard to make footwear of the best quality for the players who are taking part in the tournament of golf. Utilization of ordinary shoes while playing golf may increase the chances of getting hurt as they are not suitable for playing. In addition, manufacturers are designing golf shoes using material that allows air to pass through them and making the shoes breathable. For example, Gore-Tex lining shoes are designed in such a way that it allows feet to breathe by stopping feet sweating and absorbing moisture.

Due to the sudden outbreak of the COVID-19 pandemic, the growth of the golf clothing market has been hampered. Many tournaments were postponed or cancelled due to the imposition of lockdown and other kinds of restrictions. In addition, the golf clothing market witnessed a decline in the sale of golf apparel as the sports complexes & stadiums were closed and state sports activities were halted due to the pandemic. These factors are responsible for declining the demand for golf apparel and thus, hampered the growth of the golf clothing market.

The COVID-19 pandemic has a negative impact on the sports sector. The major factor accountable to decrease the market growth of golf clothing is the cancellation of the sports tournaments around the world. Due to the cancellation of the tournaments, there is a decrease in participation, which further led to the decline in the sale of golf apparel. The decreasing rate of sales is accountable to hamper the market growth of golf clothing across the globe.

As the golf sport is becoming popular among the population, the young and old generation is getting attracted towards it. As the number of players is increasing in this field, the demand for golf apparel, golf gloves, and golf shoes is also increasing. Also, golfers require various golf clubs that have different functions. The clubs are found in different materials such as irons, putters, hybrids, wedges, and woods.

The trend of playing golf is increasing as people are suffering from obesity and trying to reduce its effect. Also, people desire to remain fit and healthy even at their older age is motivating them to adopt different kinds of sports including golf so that they can remain physically as well as psychologically healthy and fit, thereby they prefer to play golf. The desire of people to stay fit and their growing interest in golf sport is pushing the market growth of golf clothing.

During the COVID-19 pandemic, various industries witnessed a slowdown in the supply chain across the globe. The pandemic continued to decrease the growth of several industries as they witnessed a significant decline in the demand for the products. The government imposed severe restrictions on traveling due to which the supply chain experienced disruptions and hampered the growth of the market.

Based on User, the market is segmented into Women, Men and Kids. The men segment acquired the largest market share in 2020 and is anticipated to witness the similar kind of trend even during the forecast period.

Based on Product Type, the market is segmented into Top Wear and Bottom Wear. The top wear segment obtained the maximum revenue share of the golf clothing market in 2020 and is anticipated to continue its dominance over the forecast years. The factor accountable for augmenting the opportunities for the manufacturers operating in the markets is the launch of nanotechnology and microfibers.

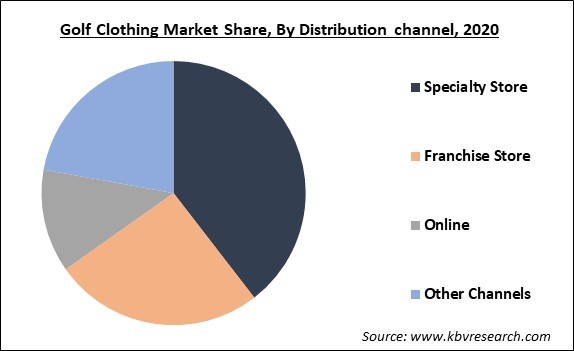

Based on Distribution Channel, the market is segmented into Specialty Store, Franchise Store, Online and Other Channels. The online segment is expected to exhibit the fastest growth rate in the golf clothing market during the forecast period. In contrast, customers prefer to do shopping from online platforms as they are easy to access and customers can easily compare the products at different platforms. Further, online platforms also offer heavy discounts on sports apparel and goods due to which, the sale of golf clothing is constantly witnessing an upsurge.

| Report Attribute | Details |

|---|---|

| Market size value in 2020 | USD 773.7 Million |

| Market size forecast in 2027 | USD 1.5 Billion |

| Base Year | 2020 |

| Historical Period | 2017 to 2019 |

| Forecast Period | 2021 to 2027 |

| Revenue Growth Rate | CAGR of 8% from 2021 to 2027 |

| Number of Pages | 200 |

| Number of Tables | 353 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling, Competitive Landscape |

| Segments covered | User, Product Type, Distribution Channel, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. North America dominated the golf clothing market by acquiring the largest market share in 2020. A large number of people are interested in taking part in golf, especially in the US, which is attributed to the increase in the demand for golf clothing and hence, is accountable to augment the growth of the golf clothing market in this region.

Free Valuable Insights: Global Golf Clothing Market size to reach USD 1.5 Billion by 2027

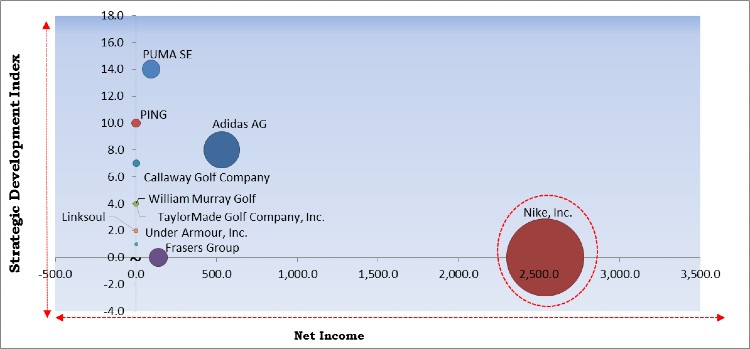

The major strategies followed by the market participants are Partnerships. Based on the Analysis presented in the Cardinal matrix; Nike, Inc. is the major forerunners in the Golf Clothing Market. ompanies such Callaway Golf Company, Under Armour, Inc., Linksoul as are some of the key innovators in the market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Frasers Group, Callaway Golf Company, Adidas AG, Nike, Inc., PUMA SE, Under Armour, Inc., Linksoul, PING, TaylorMade Golf Company, Inc., and William Murray Golf.

By User

By Product Type

By Distribution Channel

By Geography

The golf clothing market size is projected to reach USD 1.5 billion by 2027.

Increased utilization of golf apparel and equipment as they offer health benefits are driving the market in coming years, however, decline in the production rate due to severe restrictions on the supply chain limited the growth of the market.

Frasers Group, Callaway Golf Company, Adidas AG, Nike, Inc., PUMA SE, Under Armour, Inc., Linksoul, PING, TaylorMade Golf Company, Inc., and William Murray Golf.

The expected CAGR of the golf clothing market is 8% from 2021 to 2027.

Due to the cancellation of the tournaments, there is a decrease in participation, which further led to the decline in the sale of golf apparel. The decreasing rate of sales is accountable to hamper the market growth of golf clothing across the globe.

The North America market dominated the Global Golf Clothing Market by Region in 2020.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.