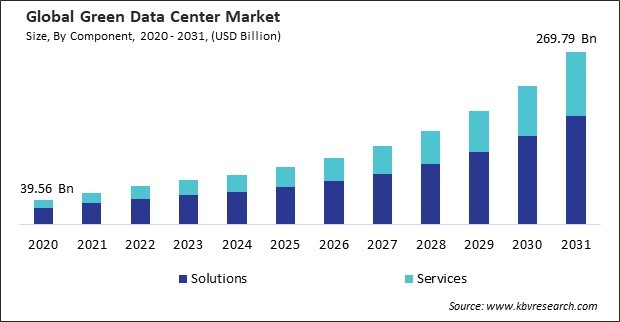

“Global Green Data Center Market to reach a market value of USD 269.79 Billion by 2031 growing at a CAGR of 19.2%”

The Global Green Data Center Market size is expected to reach $269.79 billion by 2031, rising at a market growth of 19.2% CAGR during the forecast period.

The IT & telecom sector relies heavily on data centers to support its expansive network infrastructure and data processing needs. With the exponential growth of data traffic and the increasing demand for cloud services, companies within this sector are investing significantly in energy-efficient and sustainable data center solutions to reduce operational costs and environmental impact. Hence, In 2023, the IT & telecom segment registered 31% revenue share in the market. This high level of investment and the critical nature of data center operations in IT & telecom contribute to this segment's dominant revenue share.

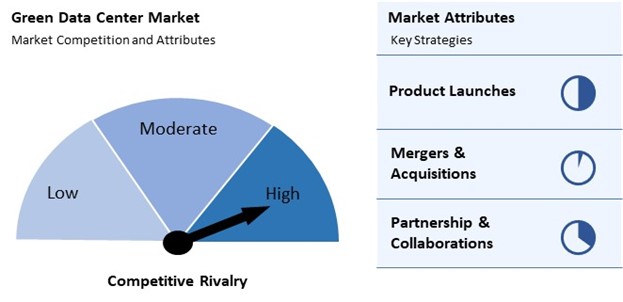

The major strategies followed by the market participants are Product Launches as the key developmental strategy to keep pace with the changing demands of end users. For instance, Dec-2024: Schneider Electric announced new AI-ready data center solutions, including liquid-cooled designs and the Galaxy VXL UPS, to address energy and sustainability challenges. In collaboration with NVIDIA, the solutions aim to optimize power efficiency and support AI workloads sustainably. Additionally, May-2024: Cisco Systems, Inc. launched its first Edge Data Centers in Indonesia, enhancing cybersecurity with Security Service Edge (SSE) capabilities. These centers align with local regulations, improve performance, and offer seamless, secure access for hybrid work environments and distributed organizations.

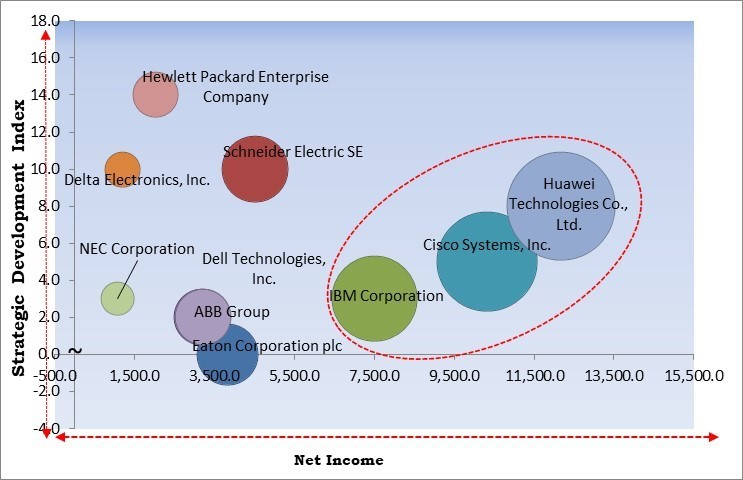

Based on the Analysis presented in the KBV Cardinal matrix; Huawei Technologies Co., Ltd., Cisco Systems, Inc. and IBM Corporation are the forerunners in the Green Data Center Market. In October, 2024, Huawei Technologies Co., Ltd. New-Generation All-Flash Data Center solution, launched at GITEX 2024, enhances data center performance, resilience, and energy efficiency. With innovations like diskless architecture and AI-powered storage, it supports sustainable, high-performance infrastructure for industries undergoing digital and intelligent transformation. Companies such as Schneider Electric SE, ABB Group and Eaton Corporation plc are some of the key innovators in Green Data Center Market.

Energy-efficient green data centers help reduce operational costs and improve organizations' long-term sustainability. As more companies seek to optimize their energy consumption while adhering to sustainability initiatives, green data centers are becoming a key driver of innovation in energy-efficient technologies for IT infrastructure. Thus, increasing demand for energy-efficient data storage solutions drives the market's growth.

As businesses and institutions adopt big data analytics and AI, the need for high-performance computing will continue to grow. Green data centers offering high performance while being energy-efficient will be critical in supporting these technologies, making them an integral part of digital transformation strategies for many industries. Therefore, demand for high-performance computing and data processing propels the market's growth.

For smaller businesses or organizations with tight budgets, the financial investment needed to build a green data center infrastructure may be prohibitive. While the long-term operational cost savings and environmental benefits are clear, the high initial capital outlay remains a key challenge. Companies must weigh these costs against the anticipated return on investment, often requiring longer timelines to achieve payback periods. However, the increasing availability of financial incentives, grants, and tax rebates from governments and regulatory bodies may help mitigate some of these upfront costs, encouraging more companies to invest in green data center solutions. In conclusion, the high initial capital investment for green data center infrastructure is hampering the market's growth.

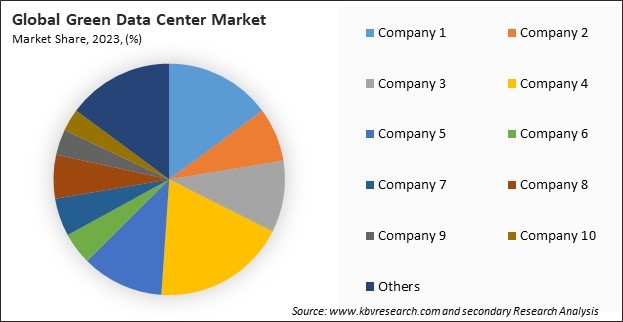

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Product Launches and Product Expansions.

Based on component, the market is divided into solutions and services. In 2023, the services segment procured 33% revenue share in the market. This segment includes a range of professional services such as consulting, design, implementation, and maintenance, all aimed at optimizing the performance and sustainability of green data centers. The substantial revenue share of the services segment indicates a growing demand for expertise in planning, deploying, and managing eco-friendly data center operations. Businesses increasingly recognize the value of professional services to help them navigate the complexities of green data center technologies and best practices.

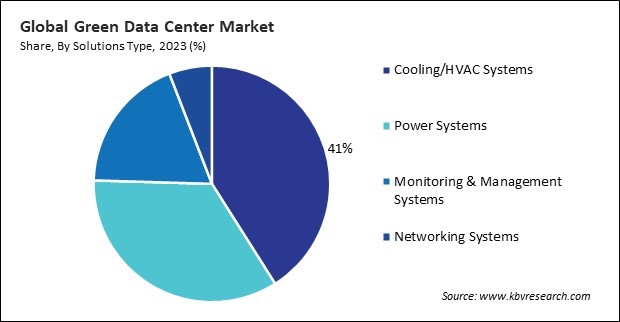

The solutions segment is further subdivided into cooling/HVAC systems, power systems, monitoring & management systems, and networking systems. In 2023, the cooling/HVAC systems segment attained 41% revenue share. Cooling and HVAC (heating, ventilation, and air conditioning) systems are critical components for maintaining optimal operating conditions in various environments, especially in sectors like data centers, industrial facilities, and commercial buildings. The rising demand for energy-efficient and sustainable cooling solutions has driven significant investments in advanced HVAC technologies. These systems not only ensure the proper functioning of equipment but also contribute to reducing energy consumption and minimizing environmental impact.

By user, the market is segmented into enterprises, and colocation providers. In 2023, the enterprises segment attained 45% revenue share in the market. This segment includes various businesses and organizations that operate their own data centers to manage their IT infrastructure. Enterprises invest heavily in data center solutions to ensure secure, efficient, and reliable operations. The growing demand for digital transformation, cloud services, and data storage has propelled enterprises to enhance their data center capabilities, contributing significantly to the market revenue.

On the basis of data center size, the market is segmented into large data centers and small & medium data centers. In 2023, the small & medium data centers segment attained 32% revenue share in the market. Small and medium-sized enterprises (SMEs) increasingly recognize the benefits of green data center practices, such as reduced energy consumption and lower carbon footprints. This segment includes a wide range of data centers, from those operated by smaller businesses to regional colocation facilities. The growing awareness of environmental sustainability and advancements in affordable green technologies have enabled smaller data centers to implement eco-friendly solutions.

By vertical, the market is divided into IT & telecom, government & defense, BFSI, healthcare, manufacturing, and others. The healthcare segment held 10% revenue share in the market in 2023. Healthcare organizations increasingly rely on data centers to manage electronic health records (EHRs), telemedicine services, and other digital health applications. The need for secure, efficient, and sustainable data storage and processing solutions is crucial in this sector. As a result, healthcare providers are investing in green data center technologies to enhance patient care, streamline operations, and reduce energy consumption.

Free Valuable Insights: Global Green Data Center Market size to reach USD 269.79 Billion by 2031

The Green Data Center Market is highly competitive, driven by the increasing demand for energy-efficient and sustainable IT infrastructure. Key players focus on innovations in renewable energy integration, advanced cooling technologies, and efficient resource utilization to differentiate themselves. The market also sees growing investments in eco-friendly facilities to comply with strict environmental regulations. Competition is intensified by the rising adoption of edge computing, AI-driven energy management solutions, and the pursuit of operational cost reductions through green initiatives.

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America region witnessed 42% revenue share in the green data center market in 2023. This dominance can be attributed to several factors, including major technology companies and data center operators, robust infrastructure, and supportive regulatory frameworks that encourage sustainable practices. The region's focus on innovation and environmental sustainability has led to significant investments in energy-efficient data center solutions, renewable energy integration, and advanced cooling technologies. North America's growing demand for cloud services and data-intensive applications further drives the need for green data centers.

| Report Attribute | Details |

|---|---|

| Market size value in 2023 | USD 70.03 Billion |

| Market size forecast in 2031 | USD 269.79 Billion |

| Base Year | 2023 |

| Historical Period | 2020 to 2022 |

| Forecast Period | 2024 to 2031 |

| Revenue Growth Rate | CAGR of 19.2% from 2024 to 2031 |

| Number of Pages | 392 |

| Number of Tables | 376 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Market Share Analysis, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Component, User, Data Center Size, Vertical, Region |

| Country scope |

|

| Companies Included | Dell Technologies, Inc., Cisco Systems, Inc., ABB Group, Schneider Electric SE, Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.), Delta Electronics, Inc., Eaton Corporation plc, Hewlett Packard Enterprise Company, IBM Corporation, NEC Corporation |

By Component

By User

By Data Center Size

By Vertical

By Geography

The Market size is projected to reach USD 269.79 billion by 2031.

Increasing Demand for Energy-Efficient Data Storage Solutions are driving the Market in coming years, however, High Initial Capital Investment for Green Data Center Infrastructure restraints the growth of the Market.

Dell Technologies, Inc., Cisco Systems, Inc., ABB Group, Schneider Electric SE, Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.), Delta Electronics, Inc., Eaton Corporation plc, Hewlett Packard Enterprise Company, IBM Corporation, NEC Corporation

The expected CAGR of this Market is 19.2% from 2023 to 2031.

The Large Data Centers segment is leading the Market by Data Center Size in 2023; thereby, achieving a market value of $177,479.4 million by 2031.

The North America region dominated the Market by Region in 2023; thereby, achieving a market value of $107.63 billion by 2031.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.

Drivers

Drivers

Restraints

Restraints

Opportunities

Opportunities

Challenges

Challenges