The Global Healthcare Architecture Market size is expected to reach $11.9 billion by 2030, rising at a market growth of 5.2% CAGR during the forecast period.

Long-term care facilities and nursing homes are a crucial segment within the healthcare architecture market thereby, the Long-term care facilities and Nursing Home segment registered $883.4 million revenue in the market in 2022. Green building design principles are integral to sustainable healthcare architecture. Architects focus on energy-efficient building envelopes, advanced insulation, and sustainable materials to minimize energy consumption and reduce greenhouse gas emissions. This includes using materials with low embodied carbon and considering the life-cycle impact of building materials. In addition, healthcare facilities are energy-intensive due to their round-the-clock operations and the need for specialized equipment. Sustainable healthcare architecture includes energy-saving lighting, HVAC systems, renewable energy sources, and geothermal heating and cooling. Energy-efficient design reduces operational costs and lowers the facility's carbon footprint. Some of the factors impacting the market rapid advances in medical technology, shifting trends towards patient-centered care models, and stringent regulatory requirements and compliance standards.

Telemedicine has revolutionized healthcare delivery, allowing remote consultations, monitoring, and diagnosis. Healthcare architects design spaces within healthcare facilities that accommodate telemedicine technology. This includes creating telehealth rooms with high-quality cameras, audiovisual equipment, and secure data connections. These rooms facilitate virtual consultations between patients and healthcare providers while ensuring patient privacy. Additionally, healthcare architects design facilities with patients’ needs in mind. This involves creating intuitive layouts that minimize confusion and promote ease of navigation within the healthcare facility. Clear signage, well-marked entrances and exits, and logical flow pathways contribute to a positive patient experience. Waiting areas are often the first point of contact for patients. Architects focus on making waiting areas comfortable and welcoming, with ample seating, natural light, and soothing colors. The arrangement of furniture and design elements fosters a sense of calm and relaxation, reducing patient stress. These factors will increase the demand for healthcare architecture in the upcoming years.

The pandemic highlighted the critical importance of infection control in healthcare settings. Healthcare architects were tasked with designing facilities that minimize the risk of disease transmission. Moreover, COVID-19 underscored the need for healthcare facilities to adapt and respond to unexpected healthcare crises. Architects focused on designing flexible spaces that can be quickly converted to accommodate surges in patients, isolation needs, and changes in patient flow. Modular designs and temporary structures gained prominence to provide scalable solutions. The pandemic increased the adoption of telehealth services, prompting healthcare architects to design spaces that support virtual care delivery. This included the creation of telehealth suites and the integration of technology infrastructure to facilitate remote consultations.

However, Healthcare architecture is subject to a complex web of regulations and standards at the local, national, and international levels. These regulations include building codes, healthcare facility guidelines, fire safety regulations, accessibility requirements, and healthcare-specific patient safety and infection control regulations. The evolving nature of these regulations means that architects must stay constantly updated to ensure that their designs comply with the latest requirements. These factors can hamper the expansion of the market in the future.

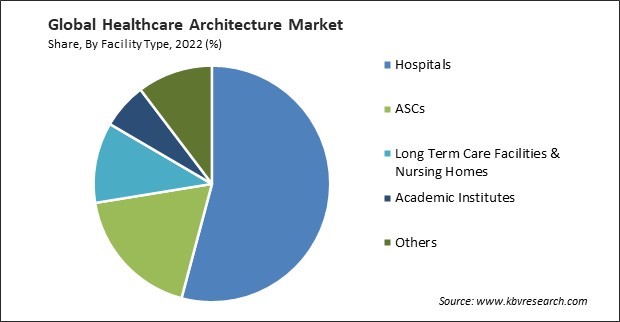

Based on facility type, the market is divided into hospitals, ASCs, long-term care facilities & nursing homes, academic institutes, and others. The hospitals segment acquired the largest revenue share in the market in 2022. Hospitals are essential components of healthcare infrastructure, and the need for more and larger hospitals is evident. Architects are tasked with designing hospitals that can accommodate larger patient populations and provide specialized care for the elderly. Rapid advancements in medical technology have revolutionized healthcare delivery. Modern hospitals require state-of-the-art facilities for advanced diagnostic and treatment equipment, such as MRI machines, robotic surgery systems, and telemedicine technology.

On the basis of service type, the market is bifurcated into new construction and refurbishment. In 2022, the refurbishment segment procured a substantial revenue share in the market. Refurbishing existing healthcare facilities can often be more cost-effective than constructing new ones from the ground up. It can involve upgrading and repurposing existing spaces, which can save on construction costs, reduce the time required for implementation, and minimize disruptions to ongoing patient care. Moreover, healthcare delivery models are evolving, emphasizing outpatient care, telehealth services, and preventive medicine.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 8 Billion |

| Market size forecast in 2030 | USD 11.9 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 5.2% from 2023 to 2030 |

| Number of Pages | 197 |

| Number of Table | 270 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Service Type, Facility Type, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

By region, the market is segmented into North America, Europe, Asia Pacific, and LAMEA. The North America segment recorded the maximum revenue share in the market in 2022. North America, particularly the United States and Canada, has witnessed substantial investments in healthcare infrastructure. The expansion and modernization of existing healthcare facilities and the construction of new hospitals, clinics, and specialized treatment centers have driven the demand for architectural services. Many healthcare facilities in North America are aging and need renovation or replacement to meet modern healthcare standards.

Free Valuable Insights: Global Healthcare Architecture Market size to reach USD 11.9 Billion by 2030

The market research report covers the analysis of key stakeholders of the market. Key companies profiled in the report include HDR, Inc., Stantec, Inc., Perkins+Will (Dar Al-Handash Consultants), NBBJ L.P., Perkins Eastman, SmithGroup Companies, Inc., CannonDesign, Jacobs Engineering Group, Inc., HKS, Inc., and HOK Group, Inc.

By Service Type

By Facility Type

By Geography

This Market size is expected to reach $11.9 billion by 2030.

Rapid advances in medical technology are driving the Market in coming years, however, Stringent regulatory requirements and compliance standards restraints the growth of the Market.

HDR, Inc., Stantec, Inc., Perkins+Will (Dar Al-Handash Consultants), NBBJ L.P., Perkins Eastman, SmithGroup Companies, Inc., CannonDesign, Jacobs Engineering Group, Inc., HKS, Inc., and HOK Group, Inc.

The expected CAGR of this Market is 5.2% from 2023 to 2030.

The New Construction segment is leading the Market, By Service Type in 2022 thereby achieving a market value of $7.3 billion by 2030.

The North America market dominated the Market, By Region in 2022, and would continue to be a dominant market till 2030; thereby, achieving a market value of $3,890.2 million by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.