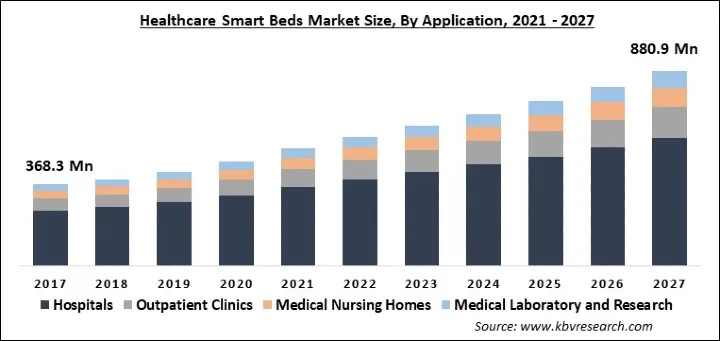

The Global Healthcare Smart Beds Market size is expected to reach $880.9 Million by 2027, rising at a market growth of 8.8% CAGR during the forecast period. Smart beds and mattresses are easily movable & flexible and are totally different from traditional bed functionality. To provide better facilities like comfort, sleep, and health, a variety of technology applications are fixed in the healthcare smart beds.

These beds comprise built-in biometric sensors, which help in tracking heart rate, breathing pattern, sleep duration, and body movement while sleeping. Smart beds are capable to study data based on the information of the user’s sleep quality. This examined data is later utilized by smart beds to adjust themselves to the changing positions at the time when the patient is sleeping. Many beds are also fixed with anti-snoring devices. The patient has the choice to connect with their most preferred digital application to manage the temperature and scheduled exercise time. Many of the smart beds can be operated by phones while some of the smart beds are unmanageable by phones for which patients need to get up and change the adjustments & settings.

The growth of the healthcare smart beds market is witnessing a significant surge in its demand from the hospital sector as they are helpful in monitoring the patients from distant locations. In addition, the healthcare sector of the emerging nations is investing a huge amount for deploying smart beds, which is giving rise to the demand for healthcare smart beds. Additionally, the growing number of aging population is accountable to contribute to the demand for smart beds and mattresses in several big hospitals. In the evolving world, hospitals are choosing smart beds instead of traditional beds as they are able to examine data of the patient, which helps in enhancing the quality of care provided to the patient.

The negative impact of COVID-19 is witnessed across all industries. The pandemic compelled people to stay at their homes as it was a rapidly spreading virus. Also, governments across the world imposed stringent regulations, which restricted the movement. Various industries witnessed a slowdown in the manufacturing and productivity of the products. In addition, the supply chain of products was disrupted as traveling was banned in most of the countries.

Besides this, significant growth was seen in the demand for essential products and medical products & devices. Similarly, the demand for healthcare smart beds witnessed gradual growth in its demand. Around the world, many people were infected by COVID-19 due to which, hospitals were overburdened with an increased number of patients, which has also expanded the need for smart beds during the pandemic. Moreover, it is anticipated that the demand for healthcare smart beds will rapidly rise around the world in the upcoming years.

The cases of chronic diseases are constantly rising across the world. The major factors contributing to surging the common and costly long-term health problems are changes in societal behavior and an aging population. Also, the middle class is growing due to which regions are getting urbanized and people are inclining towards a sedentary lifestyle. This has resulted in an increasing rate of obesity and cases of diseases like diabetes.

Latest scientific achievements and technology improvements have introduced a number of new & advanced medical devices, aided with highly developed embedded-control functions and interactivity. Healthcare smart beds comprise integrated devices for patient assistance, care, and monitoring, based on an inclusive, multidisciplinary design approach. Smart beds are integrated into the healthcare system and comprise a unique opportunity in enabling more efficient efforts for caregivers and more responsive environments for patients.

The sales of healthcare smart beds are still at a low rate due to which, the demand for smart beds is declining. Various developing and underdeveloped nations do not have a robust economy, this is the major factor hampering the growth of the healthcare smart beds market. Smart beds are embedded with a lot of the latest technologies, sensors, automation devices, artificial intelligence, real-time system devices, and others that help in better treatment procedures but this integration leads to an increase in the cost of the smart beds.

Based on Application, the market is segmented into Hospitals, Outpatient Clinics, Medical Nursing Homes and Medical Laboratory and Research. The hospitals segment acquired the maximum revenue share of the market in 2020. This surge in the segment is witnessed due to the growing number of chronic diseases like kidney failure, heart diseases, and cancer, which is giving rise to the number of patients.

| Report Attribute | Details |

|---|---|

| Market size value in 2020 | USD 470.4 Million |

| Market size forecast in 2027 | USD 880.9 Million |

| Base Year | 2020 |

| Historical Period | 2017 to 2019 |

| Forecast Period | 2021 to 2027 |

| Revenue Growth Rate | CAGR of 8.8% from 2021 to 2027 |

| Number of Pages | 121 |

| Number of Tables | 180 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Application, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

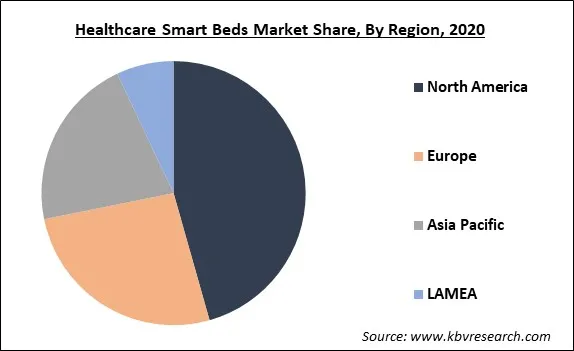

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. North America acquired the largest revenue share in 2020. Factor such as the increased usage of healthcare smart beds for long-term or acute care facilities are responsible for the massive share of the regional market. Healthcare Smart beds assist medical teams and professionals by providing continuous monitoring of the patient’s health in a non-invasive way. In addition, these beds automatically transfer the real-time data through a wireless network, which enables the doctor to review the data and monitor the patient’s vitals in real-time, this helps in increasing the safety of the patient.

Free Valuable Insights: Global Healthcare Smart Beds Market size to reach USD 880.9 Million by 2027

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Stryker Corporation, Hill-Rom Holdings, Inc., Invacare Corporation (Johnson & Johnson Private Limited), Paramount Bed Co., Ltd. (Paramount Bed Holdings Co., Ltd.), LINET spol. s r.o. (WIBO Holdings GmbH), Joerns Healthcare LLC, Stiegelmeyer GmbH & Co. KG (Joh. Stiegelmeyer & Co. GmbH), Arjo AB, Völker GmbH, and Favero Health Projects SpA.

By Application

By Geography

The global healthcare smart beds market size is expected to reach $880.9 Million by 2027.

Growing prevalence of chronic diseases are driving the market in coming years, however, the high production cost of healthcare smart beds limited the growth of the market.

Stryker Corporation, Hill-Rom Holdings, Inc., Invacare Corporation (Johnson & Johnson Private Limited), Paramount Bed Co., Ltd. (Paramount Bed Holdings Co., Ltd.), LINET spol. s r.o. (WIBO Holdings GmbH), Joerns Healthcare LLC, Stiegelmeyer GmbH & Co. KG (Joh. Stiegelmeyer & Co. GmbH), Arjo AB, Volker GmbH, and Favero Health Projects SpA.

The expected CAGR of the healthcare smart beds market is 8.8% from 2021 to 2027.

Yes, Many people were infected by COVID-19 due to which, hospitals were overburdened with an increased number of patients, which has also expanded the need for smart beds during the pandemic.

.Europe would witness the fastest growth rate during the forecast period. Based on the article circulated by Hospital Healthcare Europe in January 2020, it is stated that hospitals should work efficiently, which will lead to an increase in the productivity in the upcoming years.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.