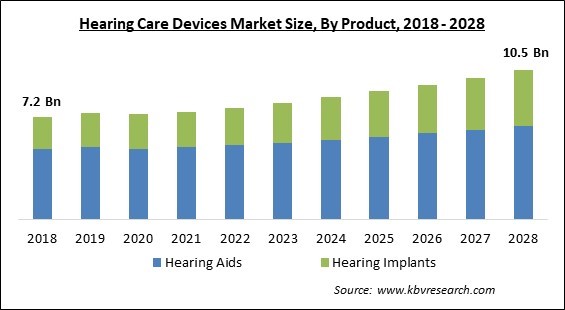

The Global Hearing Care Devices Market size is expected to reach $10.5 billion by 2028, rising at a market growth of 5.0% CAGR during the forecast period.

A hearing aid is a small electronic device worn in or behind the ear that helps patients in hearing better. It amplifies certain sounds in order to allow a patient with hearing loss to listen, speak, and fully engage in daily activities. Hearing aids are used to help people with temporary or permanent hearing loss enhance or regain their hearing senses. Theearing care equipment market is estimated to develop as the geriatric population becomes more sensitive to hearing problems, the prevalence of hearing loss rises, and the rate of binaural fitting rises. In addition, the market's growth is aided by an increase in the usage of technologically advanced hearing aids such as cochlear implantsHearing implants are surgically implanted hearing devices that help completely or partially deaf patients in hearing voices and sounds around them.

As per the National Institute on Deafness and Other Communication Disorders (NIDCD), around 2 to 3 out of 1,000 new-borns in the United States will be born with a detectable level of hearing loss in 2021. The market is expected to develop as the incidence of hearing loss rises and the number of geriatric people grows.

The increasing burden of hearing disorders, as well as increased awareness & activities concerning hearing assist devices, are important drivers propelling the expansion of the hearing aids industry. As per the World Health Organization's (WHO) April 2021 study, nearly 2.5 billion people will have some degree of hearing loss by 2050, with around 700 million people requiring hearing rehabilitation. Additionally, according to the same source, around 1 billion young individuals are in danger of permanent, preventable hearing loss as a result of poor listening habits. The WHO data demonstrates the existence of hearing loss and risk all around the world.

The Belgian government spends a significant amount each year on hearing aid reimbursements for several devices, as per the National Institute for Health and Disability Insurance. Reimbursement in Belgium is based on a fixed lump sum payment for unilateral implants and bilateral implants.

The COVID-19 pandemic has had a negative impact on the healthcare industry. Hospitals around the world are becoming overburdened with patients in need for immediate attention, and many healthcare facilities are running out of resources. To reallocate resources to care for COVID-19 patients, a number of elective procedures are being postponed or cancelled. This has harmed the medical device industry as well. The negative trend can be seen in the demand for orthopaedic implants, intraocular lenses, heart valves, and audiology testing instruments. Due to this, the production as well as the demand for hearing aids is being reduced.

The sector has benefited from increasing funding schemes by private banks & financial institutions to cover operations and other medical-related expenditures. Various developed countries, run healthcare reimbursement schemes, creating significant growth prospects for the market players in the sector. A client base has been created to serve in forecast period because of widening knowledge of programs and better transparency about the terms & circumstances. Moreover, technical developments in the healthcare sector of many LMICs, undeveloped, and developing countries have created new market opportunities by expanding their reach and attracting new clients.

Due to increased connectivity, high efficiency, and ease of use, the behind-the-ear (BTE) hearing aid devices are in higher demand. In addition, these devices are also considered ideal for most people with hearing problems, as it is best suited for people of all ages and any type of hearing impairment, which expands the device's patient pool. As per a Mayo Clinic article published in October 2021 titled Hearing aids: How to choose the right one, behind-the-ear hearing aids are the most common type of hearing aid, have more amplification power than other hearing aids, & also have a directional microphone that improves their efficiency.

The high cost of hearing aids such as cochlear implants & bone-anchored devices is a major factor limiting market growth, especially in price-sensitive regions like Asia Pacific, Africa, and Latin America. Healthcare providers, particularly in developing nations like Brazil & Mexico, have limited financial means to invest in advanced technology. Furthermore, employees must get intensive training in the proper handling & maintenance of cochlear implants & bone-anchored systems. To build technologically sophisticated hearing aids, extensive research and development are required.

Based on Product, the market is segmented into Hearing Aids and Hearing Implants. The Hearing aids segment acquired the highest revenue share in the hearing care devices market in 2021, due to the growing existence of hearing loss, technical developments in hearing aids, and increased awareness. A hearing aid is an electronic device used to improve hearing in people who have hearing loss or injury to their auditory nerves. Hearing aid adoption is predicted to increase as the prevalence of hearing loss rises.

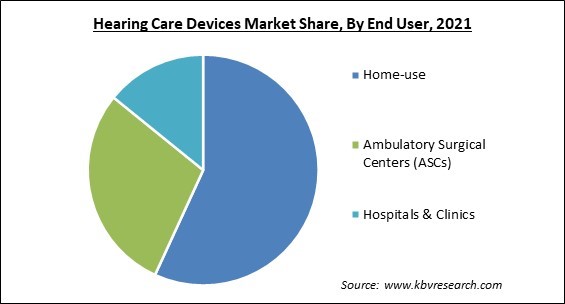

Based on End User, the market is segmented into Home-use, Ambulatory Surgical Centers (ASCs), and Hospitals & Clinics. The ambulatory surgical centres segment garnered a significant revenue share in the hearing care devices market in 2021, due to an increase in outpatient surgeries which does not need a hospital stay. The availability of ambulatory surgery centres is assisting in the transformation of healthcare facilities and the medical equipment sector. The increasing number of ASCs in emerging nations is likely to boost the market's growth. Moreover, increased use of ophthalmic treatment in these settings is likely to contribute to the market growth due to lower costs & shorter wait times. Furthermore, the growth is bolstered by the fact that therapy is offered quickly in customized settings.

Based on Type of hearing loss, the market is segmented into Conductive Hearing Loss and Sensorineural Hearing Loss. The Conductive hearing loss segment acquired the highest revenue share in the hearing care devices market in 2021, due to technical advancements in medical treatments such as earwax extraction, antibiotics, and surgical procedures. Conductive hearing loss happens when sound energy is not transmitted to the cochlea, the inner ear's hearing component. Blockage of the ear canal, a hole in the eardrum, difficulties with three little bones in the ear, or fluid in the area between the eardrum and cochlea are all common causes of conductive hearing loss. The majority of cases of conductive hearing loss, can be treated or improved.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 7.5 Billion |

| Market size forecast in 2028 | USD 10.5 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 5% from 2022 to 2028 |

| Number of Pages | 191 |

| Number of Tables | 329 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Product, Type of hearing loss, End User, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. North America emerged as the leading region in the hearing care devices market with the largest revenue share in 2021, due to the rising prevalence of nasal & hearing disorders, the high adoption rate of technologically advanced devices, the presence of highly sophisticated healthcare infrastructure, favourable reimbursement framework, & higher patient awareness about the availability of treatment options for hearing disorders.

Free Valuable Insights: Global Hearing Care Devices Market size to reach USD 10.5 Billion by 2028

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include WS Audiology, Cochlear Ltd., Intricon Corporation, Starkey laboratories, Inc., GN Store Nord A/S (GN Hearing A/S), Sonova Holding AG, William Demant Holding A/S, Amplifon SpA (Ampliter N.V.), and MED-EL GmbH.

By Product

By End User

By Type of hearing loss

By Geography

Related Reports:

North America Hearing Care Devices Market Report 2022-2028

Europe Hearing Care Devices Market Report 2022-2028

Asia Pacific Hearing Care Devices Market Report 2022-2028

LAMEA Hearing Care Devices Market Report 2022-2028

The global hearing care devices market size is expected to reach $10.5 billion by 2028.

Increased demand for Behind the Ear devices are driving the market in coming years, however, a shortage of stable contracts, expensive hearing aids and shortage of trained professionals growth of the market.

WS Audiology, Cochlear Ltd., Intricon Corporation, Starkey laboratories, Inc., GN Store Nord A/S (GN Hearing A/S), Sonova Holding AG, William Demant Holding A/S, Amplifon SpA (Ampliter N.V.), and MED-EL GmbH.

Due to COVID-19 negative trend can be seen in the demand for orthopaedic implants, intraocular lenses, heart valves, and audiology testing instruments. Due to this, the production as well as the demand for hearing aids is being reduced.

The Home-use segment acquired maximum revenue share in the Global Hearing Care Devices Market by End User in 2021, and would continue to be a dominant market till 2028.

The North America is the fastest growing region in the Global Hearing Care Devices Market by Region in 2021, and would continue to be a dominant market till 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.