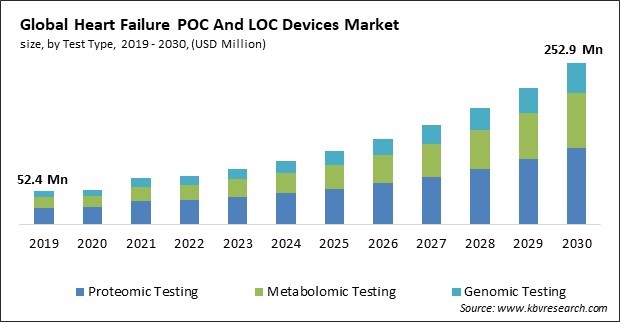

The Global Heart Failure POC And LOC Devices Market size is expected to reach $252.9 million by 2030, rising at a market growth of 16.4% CAGR during the forecast period.

Laboratories are essential in establishing and maintaining quality control measures for POC and LOC devices. Consequently, the Laboratories segment captured $13,632.5 thousands revenue in the market in 2022. Laboratories utilize LOC devices for in-depth profiling of cardiac biomarkers, allowing for a more comprehensive understanding of a patient's cardiac status. This information is valuable for risk stratification, treatment planning, and ongoing monitoring. Standardization of procedures, calibration, and quality assurance processes are critical to providing the accuracy and reliability of results obtained from these devices. Some of the factors impacting the market are Continuous advancements in technology, Growing prevalence of heart failure and Lack of standardized procedures and regulatory frameworks.

Technological advancements have led to the developing more sensitive and specific biosensor technologies. This improvement in detection capabilities allows for the accurate measurement of cardiac biomarkers, facilitating early and precise diagnosis of heart failure. Advances in microfluidic technologies and miniaturized systems have enabled smaller, portable POC and LOC device designs. These compact devices are suitable for use in various healthcare settings, including clinics, ambulances, and remote locations, enhancing accessibility and convenience. According to WHO, Cardiovascular diseases (CVDs) are the leading reason of death globally, taking an estimated 17.9 million lives each year. As the prevalence of heart failure rises, there is a growing recognition of the importance of early diagnosis. Aging populations often experience a higher prevalence of heart failure. POC and LOC devices, designed for ease of use and quick results, are well-suited to address the diagnostic needs of elderly patients, promoting better management of heart failure in this demographic. Thus, the above-mentioned factors will drive the market growth.

The pandemic spurred a surge in the adoption of telehealth and remote monitoring solutions to reduce the risk of exposure to the virus in healthcare settings. Expedited approvals and streamlined regulatory processes had facilitated the introduction of new POC and LOC devices into the market. This regulatory responsiveness is expected to be had long-term implications, creating a more agile framework for approving innovative medical technologies. The heightened awareness of health risks and the importance of proactive healthcare management had led to increased patient engagement. Patients are more open to leveraging technology to monitor their health, creating a conducive environment for adopting POC and LOC devices for managing heart failure. Thus, the COVID-19 pandemic positively impacted the market.

However, the absence of standardized procedures can lead to variations in manufacturing processes and product quality. Inconsistent manufacturing practices may result in variability in the performance of POC and LOC devices, affecting their reliability and accuracy in diagnosing heart failure. Without standardized device design and communication protocol procedures, interoperability becomes a challenge. POC and LOC devices may face difficulties integrating seamlessly with existing healthcare systems, including electronic health records (EHRs) and laboratory information systems (LIS). The absence of clear regulatory frameworks creates uncertainty for manufacturers, clinicians, and end-users. Without well-defined regulatory pathways, it may be challenging for companies to navigate the approval process, leading to delays in bringing innovative POC and LOC devices. Due to the above factors, market growth will be hampered in the coming years.

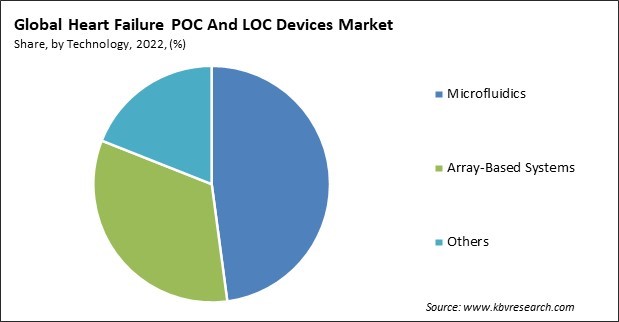

Based on technology, the market is fragmented into microfluidics, array-based systems, and others. In 2022, the microfluidics segment held the highest revenue share in the market. The increasing nervousness regarding the mortality and morbidity rates associated with cardiovascular diseases (CVD) has stimulated the market for biosensing devices that are rapid, portable, and cost-effective to detect cardiovascular events. The adoption rate of microfluidic biosensors has increased recently due to their ability to integrate and miniaturize functional protocols utilized in central laboratories onto a portable chip. Additionally, it provides numerous advantages, including reduced reagent/sample consumption and a swift turnaround time.

On the basis of test type, the market is segmented into proteomic testing, metabolomic testing and genomic testing. In 2022, the proteomic testing segment dominated the market with maximum revenue share. The investigation of cardiovascular events through the lenses of genomics, proteomics, and metabolomics has been spurred by technological developments in omics. As a result, novel biomarkers and assays that can predict the risk of a myocardial infarction before the onset of symptoms are identified. As an illustration, a blood test developed by scientists at SomaLogic Inc. in April 2022 can forecast an individual's imminent mortality from heart attack, stroke, failure, and these conditions.

By end use, the market is classified into clinics, hospitals, home, assisted living healthcare facilities, and laboratory. The home segment projected a prominent growth rate in the market in 2022. Individuals with rudimentary training can observe a few user-friendly, high-tech innovations. People can utilize these devices at home or anywhere and obtain instant results. The integration of user-friendly devices, such as Philips' Minicare I-20, designed for non-laboratory personnel, catalyzes the adoption of testing products in residential environments. Home self-testing facilitates prompt clinic visits and enhances ambulatory care, stimulating segment expansion.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 76.4 Million |

| Market size forecast in 2030 | USD 252.9 Million |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 16.4% from 2023 to 2030 |

| Number of Pages | 262 |

| Number of Tables | 370 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Test Type, Technology, End Use, Region |

| Country scope |

|

| Companies Included | Abbott Laboratories, Siemens Healthineers AG (Siemens AG), Danaher Corporation, F. Hoffmann-La Roche Ltd., BioMerieux S.A., QuidelOrtho Corporation, Trinity Biotech Plc, Jant Pharmacal Corporation, Abaxis, Inc. (Zoetis Services LLC) and Werfen, S.A. |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the market is analysed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the North America region witnessed the largest revenue share in the market. The has experienced substantial organic revenue growth due to the significant participation of American companies. For example, Quidel Corporation and Ortho Clinical Diagnostics Holdings plc executed a business combination agreement in December 2021. Enhanced patient access is being extended to point-of-care diagnostics, immunohematology, immunoassay, molecular diagnostics, clinical chemistry, and donor screening products.

Free Valuable Insights: Global Heart Failure POC And LOC Devices Market size to reach USD 252.9 Million by 2030

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Abbott Laboratories, Siemens Healthineers AG (Siemens AG), Danaher Corporation, F. Hoffmann-La Roche Ltd., BioMerieux S.A., QuidelOrtho Corporation, Trinity Biotech Plc, Jant Pharmacal Corporation, Abaxis, Inc. (Zoetis Services LLC) and Werfen, S.A.

By Test Type

By End Use

By Technology

By Geography

This Market size is expected to reach $252.9 million by 2030.

Continuous advancements in technology are driving the Market in coming years, however, Lack of standardized procedures and regulatory frameworks restraints the growth of the Market.

Abbott Laboratories, Siemens Healthineers AG (Siemens AG), Danaher Corporation, F. Hoffmann-La Roche Ltd., BioMerieux S.A., QuidelOrtho Corporation, Trinity Biotech Plc, Jant Pharmacal Corporation, Abaxis, Inc. (Zoetis Services LLC) and Werfen, S.A.

The expected CAGR of this Market is 16.4% from 2023 to 2030.

The Clinics segment is leading the Market by End Use in 2022; thereby, achieving a market value of $88.7 Million by 2030.

The North America region dominated the Market by Region in 2022 and would continue to be a dominant market till 2030; thereby, achieving a market value of $98.1 Million by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.