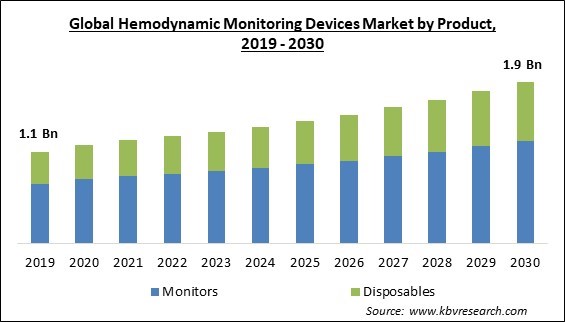

The Global Hemodynamic Monitoring Devices Market size is expected to reach $1.9 billion by 2030, rising at a market growth of 5.4% CAGR during the forecast period. In the year 2022, the market attained a volume of 3184.1 thousand Units, experiencing a growth of 7.1% (2019-2022).

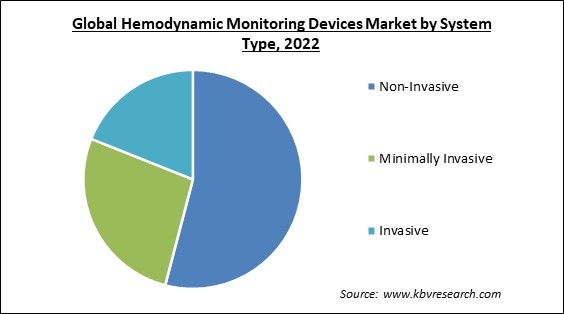

Systems for non-invasive hemodynamic monitoring allow for painless diagnosis and lower patient risk for infections transmitted by blood. Hence, the non-invasive segment is anticipated to capture approximately 50% share of the market by 2030. Additionally, a nurse can control these systems without a specialist or doctor, and they are simpler to use (than invasive devices). This benefit allows for the simultaneous monitoring of the hemodynamic status in many patients, which lowers staff costs and treatment expenditures. In the upcoming years, these benefits are expected to grow the sector for non-invasive systems. Non-invasive hemodynamic monitoring entails measuring blood pressure continuously using finger cuffs and cardiac output for critically ill patients using the pulse contour approach. Some of the factors impacting the market are rapid development of healthcare infrastructure globally, increase in diabetes and cardiovascular diseases, and cost and budget issues with hemodynamic monitoring.

Healthcare infrastructure development has a profoundly positive impact on the market. Moreover, healthcare infrastructure development often includes training and education programs, ensuring that healthcare professionals are well-equipped to use and interpret data from hemodynamic monitoring devices effectively. Therefore, as healthcare infrastructure continues to evolve, the market is poised to expand, benefiting patients and healthcare providers by enhancing cardiovascular care standards and outcomes. Furthermore, the increase in diabetes and cardiovascular diseases is influenced by a complex interplay of various factors, including lifestyle, genetics, environmental factors, and healthcare practices. The optimal glucose management tool will change as technology develops and depends on individual tastes. The prevalence of cardiovascular illnesses and diabetes will increase hospital demand for hemodynamic monitoring systems and equipment, expanding the market for these devices. All these factors will contribute to higher demand in the market in the future.

However, Cost and budget constraints are significant challenges in the adoption and use of hemodynamic monitoring devices in healthcare settings. It may need periodic upgrades or replacements to stay current and compliant with market standards. These costs must be factored into long-term budgets. In some healthcare systems, reimbursement policies may not adequately cover the costs associated with hemodynamic monitoring. Thus, the cost and budget issues associated with hemodynamics monitoring can hamper the expansion of the market.

Additionally, the market experienced a conflicted response to the COVID-19 pandemic. Due to monitoring of the hemodynamic parameters among COVID-19 patients, the COVID-19 pandemic favorably influenced the growth of the market. Additionally, COVID-19 individuals were more likely to develop diseases like sepsis, acute lung damage, and acute respiratory syndrome. According to NCBI, pulmonary artery catheters (PACS) showed empirical performance, which increased monitoring capacities and decreased inpatient healthcare costs. Deltex Medical also claimed that esophageal Doppler monitoring offered real-time cardiac output (CO) from the patient's aorta, an essential measure for medical specialists. Therefore, the medical conditions during the COVID-19 pandemic had a mixed impact on the market.

By system type, the market is divided into invasive, minimally invasive, and non-invasive. The minimally invasive segment held a substantial revenue share in the market in 2022. The minimally invasive technologies provide dynamic data on fluid responsiveness and assist in continually monitoring stroke volume. While some methods emphasize the continuous monitoring of central venous saturation using specialized catheters, others focus on assessing volumetric preload factors. Improved hemodynamic tracking is provided by these factors of cardiac output and minimally invasive techniques. As a result, the segment is expected to grow in the upcoming years.

On the basis of product, the market is bifurcated into disposables and monitors. The monitors segment acquired the highest revenue share in the market in 2022. The monitors are the most critical component of the monitoring system since they show all the parameters that the medical personnel are evaluating. The demand for hemodynamic monitors is also fueled by key market players increasing investments in patient-centered care and the introduction of cutting-edge products. Therefore, these factors will boost the demand in the segment.

Based on end-use, the market is segmented into hospitals, catheterization labs, and others. The hospitals segment held the largest revenue share in the market in 2022. This growth results from the increasing prevalence of cardiovascular illnesses and the requirement for accurate hemodynamic assessment in hospital settings. Technological advances in hemodynamic monitoring systems, such as data analytics, the integration of wireless connectivity, and remote monitoring capabilities, enhance their adoption in hospital settings and drive the growth of the hospital segment. There is a rising number of hospital admissions due to cardiovascular diseases, surgeries, and critical illnesses. Therefore, the hospital segment will witness an increased demand in the coming years.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 1.3 Billion |

| Market size forecast in 2030 | USD 1.9 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 5.4% from 2023 to 2030 |

| Number of Pages | 316 |

| Number of Table | 590 |

| Quantitative Data | Volume in Thousand Units, Revenue in USD Million, and CAGR from 2019 to 2030 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Product, System Type, End-use, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on region, the market is divided into North America, Europe, Asia Pacific, and LAMEA. The North America segment held the maximum revenue share in the market in 2022. The share is attributed to the high frequency of cardiovascular diseases, quick technological developments, increased healthcare expenditures, and an increasing older population. The adoption of advanced hemodynamic monitoring systems in the region is driven by the existence of a highly developed healthcare infrastructure, high healthcare spending, the availability of a well-established R&D sector, technological advancements in hemodynamic monitoring systems, strict regulatory guidelines, and reimbursement policies.

Free Valuable Insights: Global Hemodynamic Monitoring Devices Market size to reach USD 1.9 Billion by 2030

The market research report covers the analysis of key stakeholders of the market. Key companies profiled in the report include Edwards Lifesciences Corporation, GE HealthCare Technologies, Inc., Baxter International, Inc., ICU Medical, Inc., Masimo Corporation, Deltex Medical Group Plc., Sramek BioDynamics, Inc., Osypka Medical GmbH, Medtronic PLC, and Koninklijke Philips N.V.

By Product (Volume, Thousand Units, USD Million, 2019-2030)

By System Type (Volume, Thousand Units, USD Million, 2019-2030)

By End-use (Volume, Thousand Units, USD Million, 2019-2030)

By Geography (Volume, Thousand Units, USD Million, 2019-2030)

This Market size is expected to reach $1.9 billion by 2030.

Rapid development of healthcare infrastructure globally are driving the Market in coming years, however, Cost and budget issues with hemodynamic monitoring restraints the growth of the Market.

Edwards Lifesciences Corporation, GE HealthCare Technologies, Inc., Baxter International, Inc., ICU Medical, Inc., Masimo Corporation, Deltex Medical Group Plc., Sramek BioDynamics, Inc., Osypka Medical GmbH, Medtronic PLC, and Koninklijke Philips N.V.

In the year 2022, the market attained a volume of 3184.1 thousand Units, experiencing a growth of 7.1% (2019-2022).

The Non-Invasive segment is leading Market by System Type in 2022; thereby, achieving a market value of $1.0 Billion by 2030.

The North America region dominated the Market by Region in 2022 and would continue to be a dominant market till 2030; thereby, achieving a market value of $768.1 Million by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.