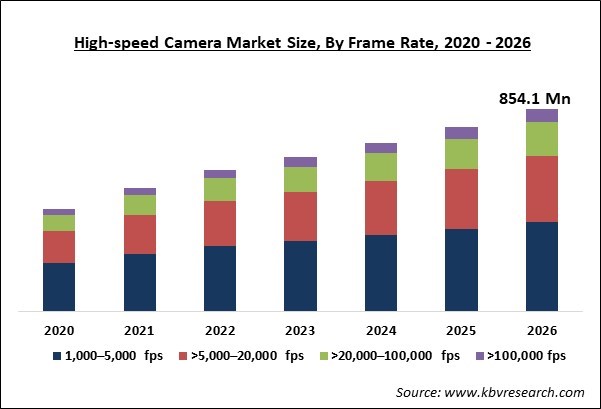

The Global High-Speed Camera Market size is expected to reach $854.1 Million by 2026, rising at a market growth of 11.9% CAGR during the forecast period. High-Speed Cameras are widely used as a research and media tool that helps in analyzing the high-speed processes that cannot be detected by the human eye. It captures and records a repeated arrangement of pictures at high frame rates and later the video can be played in slow motion. This enables the viewer to see and measure events that happened at a fast speed which is difficult for the human eye to comprehend. There are many features that affect the quality of high-speed cameras such as frame rate, resolution, image processors, sensor size, memory size, fans, and cooling systems with other semiconductor components

In the sports sector also, the demand for high-speed cameras is high due to their improved capabilities such as frame rate, high resolution, and image processing. In addition to it, the automotive and transportation industry has increased the demand for small, light-weight high-speed cameras, and the surge in usage of high-speed cameras in thermal imaging applications are some of the major factors driving the market. Though, the higher cost of high-speed cameras is likely to impede the market growth across the globe. Moreover, applications of high-speed cameras have been increased in intelligent transportation system (ITS), as well as increasing adoption of high-speed cameras in the aerospace & defense industry offer growth opportunities for the high-speed camera market across the globe.

Based on Frame Rate, the market is segmented into 1,000–5,000 fps, >5,000–20,000 fps, >20,000–100,000 fps and >100,000 fps. Applications like combustion research, spray analysis, and vibration analysis in the scientific research, design, and testing laboratories necessitate high-speed cameras leveraged with a high resolution to an efficient analysis of events.

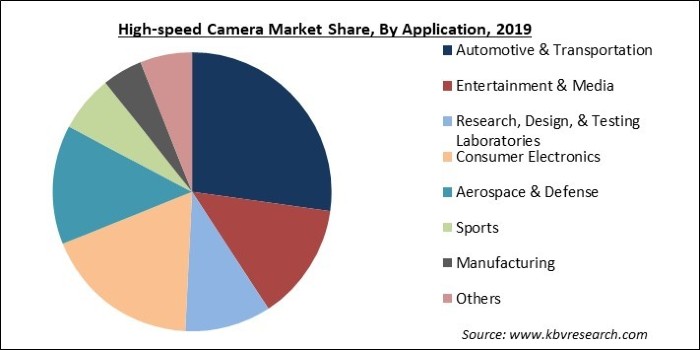

Based on Application, the market is segmented into Automotive & Transportation, Entertainment & Media, Research, Design, & Testing Laboratories, Consumer Electronics, Aerospace & Defense, Sports, Manufacturing and Others. On the basis of application, the automotive and transportation segment had the highest revenue in the global high-speed camera market in the year 2019. Applications such as production line maintenance, monitoring, and troubleshooting require high-speed cameras. These cameras produce images with high-quality that are good enough to detect errors and are able to monitor production lines in industrial manufacturing plants. These cameras are more cost-efficient and have a resolution of >5 MP.

Based on Spectrum, the market is segmented into Visible RGB, Infrared and X-ray. The high-speed infrared cameras are also used in high-speed scanning of people to detect Covid-19, and the increasing use of these cameras in sports industries and entertainment & media, are the major factors boosting the growth of the high-speed camera market. The increased adoption of high-speed infrared cameras and the growing need to assess the health of people are some factors driving the growth of the high-speed camera market.

Based on Component, the market is segmented into Image Sensors & Processors, Memory Systems, Battery and Lens & Others. On the basis of components, the image sensors segment made the highest revenue share in the global high-speed camera market in 2019.

| Report Attribute | Details |

|---|---|

| Market size value in 2019 | USD 460 Million |

| Market size forecast in 2026 | USD 854.1 Million |

| Base Year | 2019 |

| Historical Period | 2016 to 2018 |

| Forecast Period | 2020 to 2026 |

| Revenue Growth Rate | CAGR of 11.9% from 2020 to 2026 |

| Number of Pages | 297 |

| Number of Tables | 514 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling, Competitive Analysis |

| Segments covered | Frame Rate, Application, Spectrum, Component, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Free Valuable Insights: Global High-speed Camera Market to reach a market size of $854.1 million by 2026

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. Also, Asia-Pacific is leading the market owing to the increasing use of machine vision and robot techniques in both manufacturing and service sector to improve productivity. North America is expected to show major growth in high-speed camera industry. This is accredited to the high industry-standard as well as the presence of major key players such as Vision Research, Inc., Fastec Imaging Corporation, and Motion Capture Technologies in this region.

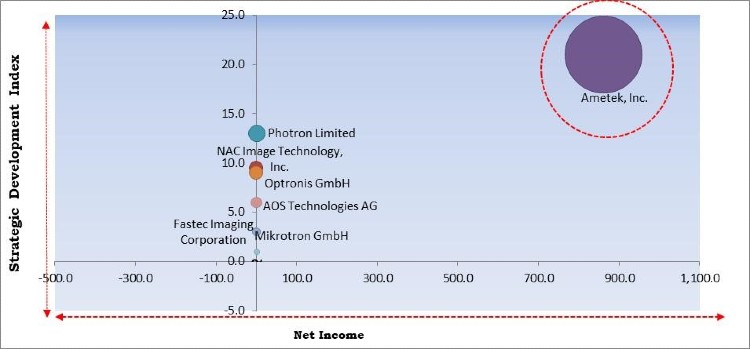

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; Ametek, Inc. is the major forerunner in the High-Speed Camera Market. Companies such as Photron Limited, NAC Image Technology, Inc., Optronis GmbH, AOS Technologies AG, and Fastec Imaging Corporation are some of the key innovators the market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include of Ametek, Inc. (Vision Research), Photron Limited (IMAGICA Group, Inc.), Baumer Holding AG, NAC Image Technology, Inc., Mikrotron GmbH (Tattile Srl), Optronis GmbH, DEL Imaging Systems LLC, AOS Technologies AG (ConvergeOne Holdings Corp), Fastec Imaging Corporation and Xcitex, Inc.

By Frame Rate

By Application

By Spectrum

By Component

By Geography

Companies Profiled

The high-speed camera market size is projected to reach USD 854.1 million by 2026.

The Automotive & Transportation market dominated the Global High-speed Camera Market by Application 2019.

The Asia-Pacific is one of the fastest-growing market of high-speed cameras owing to increased adoption of these cameras in numerous industries including healthcare, food & beverages, automotive, and consumer electronics.

There are several reason that cause high demand of this market one of them is rising adoption of high-speed cameras in transportation and automotive.

Ametek, Inc. (Vision Research), Photron Limited (IMAGICA Group, Inc.), Baumer Holding AG, NAC Image Technology, Inc., Mikrotron GmbH (Tattile Srl), Optronis GmbH, DEL Imaging Systems LLC, AOS Technologies AG (ConvergeOne Holdings Corp), Fastec Imaging Corporation and Xcitex, Inc.

The expected CAGR of high-speed camera market is 11.9% from 2020 to 2026.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.