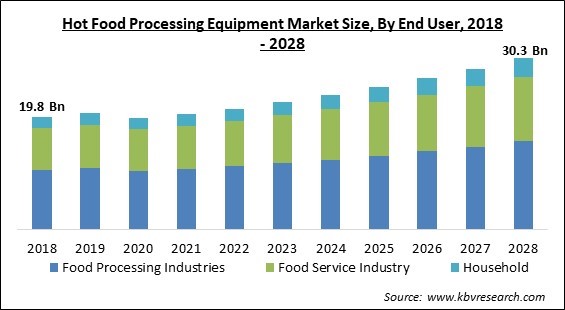

The Global Hot Food Processing Equipment Market size is expected to reach $30.3 billion by 2028, rising at a market growth of 6.0% CAGR during the forecast period.

The components, processing devices, and systems that are used to prepare handle prepare, cook, store, and pack food and food products are referred as food processing equipment. Although most of this equipment is used for food transformation or preservation, some items are also used for preliminary or auxiliary duties like handling, preparation, and packaging.

Hot food processing equipment is one of the most vital instruments in the food processing industry. In the food processing industry, hot food processing equipment is vital. The benefits include the inactivation of food-borne viruses and toxic elements, as well as better bioavailability, taste, and flavor, as well as improved functional qualities such as increased antioxidant levels. During the forecast period, the hot food processing equipment market is expected to rise due to the rising demand for food and drinks. The market for processed foods is also anticipated to be driven by rising disposable incomes along with a growing younger population with increased purchasing power, assisting the industry's expansion. Preference for nutritious meals and the development of veganism among the youth demographic is expected to boost the industry's prospects, as food producers will be able to benefit from the increased demand.

Food preparation equipment is used in a variety of industries, such as the dairy industry, poultry farm, industrial bakery, fish and shellfish, chocolate, confectionery, drinks, milk, fruits, nuts, and vegetable sectors. One of the most commonly utilized materials in the food sector is stainless steel. The two most prevalent stainless-steel alloys utilized in food processing equipment are 304SS and 316SS.

The majority of food processing equipment has identical automation and motion control requirements, such as material movement and positioning, heating, blanching, cooking, pasteurization, sterilization, evaporation, freezing, thawing, and drying. Gentle treatment, purity, and exact control of temperature, treatment time, pressure, and other processing parameters are also required for such equipment.

The COVID-19 outbreak caused severe harm to all the economies across the world. The COVID-19 pandemic has caused a huge shift in consumer demand away from fast food, bars, cafes, and restaurants and toward meals consumed at home, demanding major changes in the food supply chain. As a result, the demand for processed meals has increased, prompting food manufacturers to invest in food processing equipment to accommodate the increased demand. Due to the COVID-19 pandemic, the hot food processing equipment market is undergoing a shift, with businesses in this arena making strategic acquisitions and expanding capacity to satisfy the rising need for food.

Growing urbanization and rising disposable incomes are changing lifestyles in various urban areas in emerging countries. This is causing a large portion of the human population to become reliant on processed foods. According to UN predictions, approximately two-thirds of the world's population would be living in cities by 2050. As the percentage of the working population increases, there is a significant shift toward processed foods. In urban areas, sales of morning cereals, canned vegetables, cheese, savory snacks, bakery & confectionery, milk pouches, and meat items are increasing.

Advances in computerized food processing technology have reinforced automation and autonomous equipment as essential components of the food production and processing business. Automation is helping to reduce production time while increasing output as demand and costs continue to rise. Food processors are increasingly becoming aware of the value of data-driven insights in maximizing raw material utilization, improving food quality and safety, and ensuring transparency and support for constant improvements. The robotic butchery machine, which helps speed up the slaughtering process, is one of the most common types of automation gear. This automated equipment also makes the facility safer since they reduce the influence on personnel who are handling potentially harmful tools and apparatus.

For small and medium-sized food processors, the high cost of food processing equipment remains a subject of major concern. Small and medium-sized food processors have budget limitations. These restricted budgets of small and medium food processing companies have resulted in a preference for less expensive items with semi-automatic and manual functions. The high cost of equipment has also led to a lack of knowledge about new technologies and a reliance on old equipment. In addition, in several under-developed countries, it is becoming a challenging task for market players to deploy hot food processing equipment in their facilities.

Based on End User, the market is segmented into Food Processing Industries, Food Service Industry, and Household. Based on Food Service Industry Type, the market is segmented into Restaurant, Cafes & Bars, Fast food solutions, Caterers, Cloud kitchens, and Vending Machine & Others. In 2021, the food processing industries segment acquired the largest revenue share of the hot food processing equipment market. The constantly booming growth of this segment of the market is majorly owing to the increased worldwide food consumption, as well as the desire for high-quality food and sustainability. Moreover, consumers are increasingly opting for high-value edibles that fit a variety of criteria, including flavor, time efficiency, and convenience. At the same time, rising living standards and urbanization are likely to increase the demand for higher-value food. This factor would also expedite the growth of the segment.

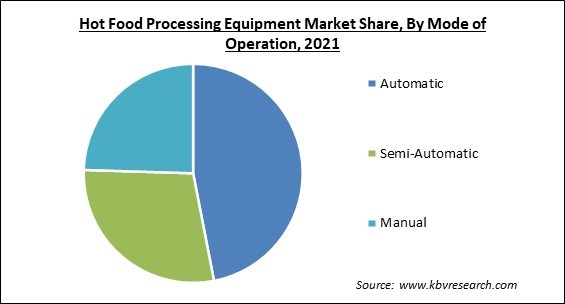

Based on Mode of Operation, the market is segmented into Automatic, Semi-Automatic, and Manual. In 2021, the semi-automatic segment acquired a significant revenue share of the hot food processing equipment market. Semi-automated manufacturing lines manually transfer raw food ingredients from a specified preparation unit to the production line while automatically preparing processed food. Line flexibility and the possibility to avoid shutting down the entire processing equipment in the event of repair are two advantages of semi-automatic processing. Semi-automatic goods are less expensive upfront and easier to install and maintain than automatic products. Continuous improvement is achievable in a semi-automated process, which provides the possibility to adjust the process as needed.

Based on Type, the market is segmented into Baking Equipment, Evaporation Equipment, Pasteurization Equipment, Dehydration Equipment, Roasting & Grilling Equipment, Frying Equipment, Sterilization Equipment, Blanching Equipment, and Others. In 2021, the Heat sterilization segment garnered a significant revenue share of the hot food processing equipment market. The increasing growth of this segment is attributed to the surge in the demand for healthy packaged food. Steam sterilization, and irradiation are all examples of sterilization equipment. Processors of sterilization equipment companies are focusing on delivering automation solutions to various processed food manufacturers in order to fulfil their evolving requirements, resulting in a considerable increase in equipment demand around the world.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 20.4 Billion |

| Market size forecast in 2028 | USD 30.3 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 6% from 2022 to 2028 |

| Number of Pages | 327 |

| Number of Tables | 516 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Type, Mode of Operation, End User, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. In 2021, Asia Pacific accounted for the largest revenue share of the hot food processing equipment market. The rising middle-class population and their increasing per capita disposable income, millennials' increasing demand for processed food products, greater health consciousness, and increased interest from foreign investors in the region are all expected to benefit the industry's expansion in the Asia Pacific.

Free Valuable Insights: Global Hot Food Processing Equipment Market size to reach USD 30.3 Billion by 2028

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Alfa Laval AB, John Bean Technologies Corporation, GEA Group AG, Marel Ltd., Tetra Laval International S.A. (Delaval), SPX Flow, Inc., Buhler Group, Marlen International (Duravant LLC), Heat and Control, Inc., and TNA Australia Pty Limited.

By End User

By Mode of Operation

By Type

By Geography

The hot food processing equipment market size is projected to reach USD 30.3 billion by 2028.

Integration of automation in the industry are increasing are driving the market in coming years, however, rigorous regulations regarding food safety growth of the market.

Alfa Laval AB, John Bean Technologies Corporation, GEA Group AG, Marel Ltd., Tetra Laval International S.A. (Delaval), SPX Flow, Inc., Buhler Group, Marlen International (Duravant LLC), Heat and Control, Inc., and TNA Australia Pty Limited.

The Automatic segment has acquired maximum revenue share in the Global Hot Food Processing Equipment Market by Mode of Operation in 2021, thereby, achieving a market value of $14.3 billion by 2028.

The Baking Equipment segment is leading the Global Hot Food Processing Equipment Market by Type in 2021, thereby, achieving a market value of $7.71 billion by 2028.

The Asia Pacific market dominated the Global Hot Food Processing Equipment Market by Region in 2021, and would continue to be a dominant market till 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.