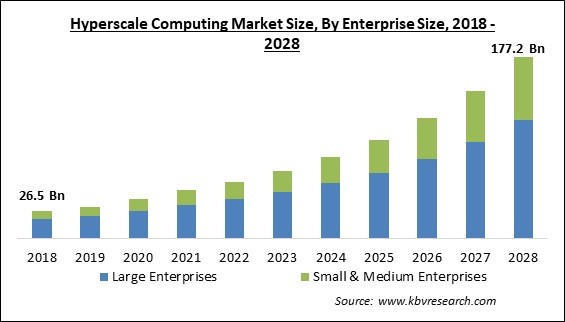

The Global Hyperscale Computing Market size is expected to reach $177.2 billion by 2028, rising at a market growth of 21.4% CAGR during the forecast period.

The potential of an infrastructure to scale effectively as system demand rises is known as hyperscale in computing. In a larger computing, grid computing, or distributed computing environment, this often involves the flexibility to seamlessly offer and increase computation, networking, storage resources, and memory to a specific node or set of nodes. Building a strong and scalable cloud, map reduce, distributed storage system or big data requires hyperscale computing, which is frequently related to the infrastructure needed to support large distributed sites like Google, Amazon, Microsoft, Huawei Cloud, IBM Cloud, or Oracle.

Hyperscale is essentially a distributed computing infrastructure that may grow to thousands of servers. It thus refers to the entire combination of hardware and facilities. Hyperscale is about obtaining large computational scale, usually for cloud computing or big data. In order to achieve high levels of throughput, performance, and redundancy to provide high availability and fault tolerance, hyperscale infrastructure is intended for horizontal scalability. Therefore, virtual networking and massively scalable server configurations are frequently used in hyperscale computing.

There are numerous reasons why a company could choose to use hyperscale computing. The best or only means to achieve a business objective, such as offering cloud computing services, may be through hyperscale. Hyperscale solutions typically offer the most economical means of tackling difficult criteria. For instance, the hyperscale's scale and computational density might be the most cost-effective way to handle a big data analytics project.

Large-scale use of computing technologies in businesses is required in the modern world due to developments in the constantly expanding field of IT and the digitization of several operational and business operations. When there is a significant amount of data and accompanying workload, hyperscale computing means establishing a distributed computing system scaling from a few servers to hundreds of servers in an economical manner. Application software like cloud computing and big data frequently use hyperscale computing.

During the pandemic, cloud computing technology was vital in assisting individuals and organizations by providing a variety of technologies to help research and development efforts for vaccines, treatments, and testing. The data science community led the struggle against the pandemic using AI and ML techniques. However, because complex algorithms typically needed considerable processing ability, they frequently used cloud computing. By offering services, free tools, and financial responsibilities throughout the crisis, many hyperscale computing companies responded to this demand and supported international initiatives. Therefore, the growing use of AI/ML throughout the COVID-19 pandemic increased the need for strong computing technologies, which positively impacted the hyperscale computing market.

Companies that provide hyperscale computing use cutting-edge hardware and software to guarantee high responsiveness and reliability to consumer demand. In addition, visibility will increase as CO2 emissions decrease as more unmanned hyperscale installations are made possible by virtual monitoring technologies and the Internet. Hyperscale computing's scalable architecture can handle high demand levels. In addition, high-speed data center interconnects (DCIs) enable dispersed computing, which seamlessly spreads the network globally to access resources when data centers reach their capacity constraints. Therefore, these factors are facilitating the use of hyperscale computing by more enterprises and, as such, aid in expanding the market.

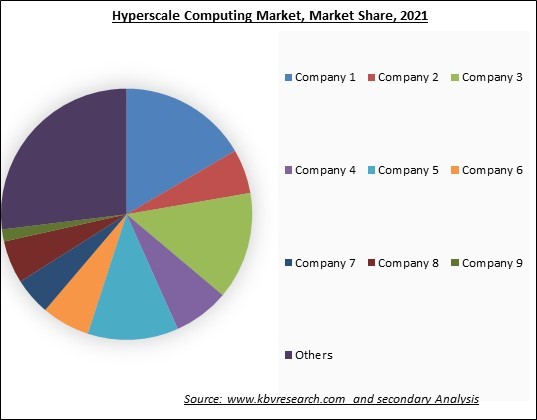

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Partnerships & Collaborations.

The increased use of technology and consumer preference for the cloud drive demand for cloud-based solutions. The user can receive the data from a distance owing to this technology. In addition, the demand for cloud-based solutions is driven by businesses' growing awareness of how important it is to save money and resources by transferring their data to the cloud. Due to these advantages, major corporations and SMEs embrace cloud-based solutions more frequently. Globally, businesses and government agencies are shifting from using test environments to using the cloud more frequently for mission-critical workloads and compute instances. Hence, in the coming years, the expansion of cloud computing services is enabling market growth.

Hyperscale computing has given businesses less control of their data. Also, it is not possible to add more server or memory space due to the possibility of faults. Employee responsibility and internal management requirements are higher with hyperscale computing, which is a short-term negative. Consumers become reliant on their hyperscale provider's price policy. Each service provider's user interface is unique. Businesses can opt for a hybrid solution to weigh the benefits and drawbacks, using the cloud only to store exceptionally large backups or data that isn't needed frequently. Their own data center has more room for storage as a result. These exorbitant installation costs could limit market demand.

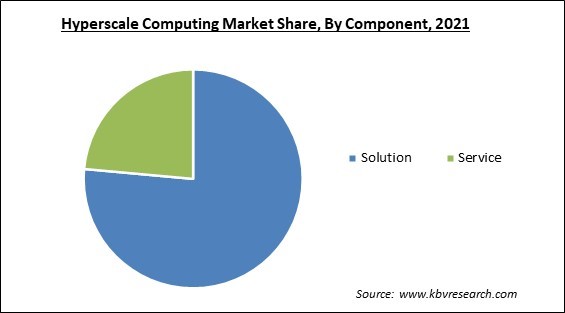

Based on component, the hyperscale computing market is bifurcated into solution and service. The solution segment garnered the highest revenue share in the hyperscale computing market in 2021. The segment is expanding due to the rising need for scalable computing infrastructure solutions. This is a result of an increase in the use of IoT as well as other digitalization solutions by organizations to gain a strategic and competitive edge along with a healthy customer base over their rivals. Furthermore, these solutions utilize current data investments, save time and money, and enhance image analysis capabilities with just one solution.

On the basis of enterprise size, the hyperscale computing market is divided into large enterprises and small & medium enterprises. The small and medium enterprises (SMEs) segment recorded a significant revenue share in the hyperscale computing market in 2021. To improve business processes and save costs, small and medium-sized businesses are increasingly implementing hyperscale innovations, including micro-segmentation, software-defined networking (SDN), and converged infrastructure. Improvements to financial and operational plans, creating and implementing modular infrastructures, and providing centralized distributed data centers to boost agility are a few examples of uses of hyperscale architecture in SMEs.

Based on application, the hyperscale computing market is segmented into cloud computing, big data, IoT, and others. The cloud computing segment witnessed the maximum revenue share in the hyperscale computing market in 2021. The segment's dominance can be due to businesses adopting cloud infrastructure faster. Due to the current business and economic climate, prominent IT and business leaders intend to boost their engagement in cloud-based services. This market's growth is anticipated to be fueled by a rising trend toward using high-performance computing products using the cloud for processing massive amounts of data quickly, accurately, and with the least latency possible.

On the basis of end-use, the hyperscale computing market is categorized into BFSI, IT & telecom, media & entertainment, retail & e-commerce, healthcare, and others. The BFSI segment acquired a substantial revenue share in the hyperscale computing market in 2021. Growth is attributable to the increased use of digital technology, online banking, and hybrid cloud computing to enhance customer experience, secure sensitive data, and streamline company processes. In addition, high-performance computer technology use is also anticipated to increase, further boosting this segment's revenue growth.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 46.7 Billion |

| Market size forecast in 2028 | USD 177.2 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 21.4% from 2022 to 2028 |

| Number of Pages | 281 |

| Number of Table | 464 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Market Share Analysis, Companies Strategic Developments, Company Profiling |

| Segments covered | Component, Enterprise Size, Application, End-Use, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region wise, the hyperscale computing market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America region witnessed the largest revenue share in the hyperscale computing market in 2021. The region's market is expanding due to elements like significant research and development (R&D) spending, an established IT services sector, and multiple cloud service providers. Also, the region has a sophisticated technology infrastructure that supports market expansion.

Free Valuable Insights: Global Hyperscale Computing Market size to reach USD 177.2 Billion by 2028

The major strategies followed by the market participants are Partnerships. Based on the Analysis presented in the Cardinal matrix; Google LLC is the forerunner in the Hyperscale Computing Market. Companies such as Microsoft Corporation, Intel Corporation, and Amazon Web Services, Inc. are some of the key innovators in Hyperscale Computing Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Amazon Web Services, Inc. (Amazon.com, Inc.), Hewlett Packard Enterprise Company (HP Development Company L.P.), Intel Corporation, Microsoft Corporation, Google LLC (Alphabet, Inc.), Oracle Corporation, Dell Technologies, Inc., Alibaba Cloud (Alibaba Group Holding Limited), Viavi Solutions, Inc., and Server Technology, Inc. (Legrand Group).

By Application

By Enterprise Size

By Component

By End-Use

By Geography

The global Hyperscale Computing Market size is expected to reach $177.2 billion by 2028.

Known benefits of hyperscale computing increasing reliability are driving the market in coming years, however, Higher capital expenditure costs and lack of data control restraints the growth of the market.

Amazon Web Services, Inc. (Amazon.com, Inc.), Hewlett Packard Enterprise Company (HP Development Company L.P.), Intel Corporation, Microsoft Corporation, Google LLC (Alphabet, Inc.), Oracle Corporation, Dell Technologies, Inc., Alibaba Cloud (Alibaba Group Holding Limited), Viavi Solutions, Inc., and Server Technology, Inc. (Legrand Group).

The Large Enterprises segment acquired maximum revenue share in the Global Hyperscale Computing Market by Enterprise Size in 2021 thereby, achieving a market value of $115 billion by 2028.

The IT & Telecom segment is leading the Global Hyperscale Computing Market by End-Use in 2021 thereby, achieving a market value of $43.1 billion by 2028.

The North America market dominated the Global Hyperscale Computing Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $61.8 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.