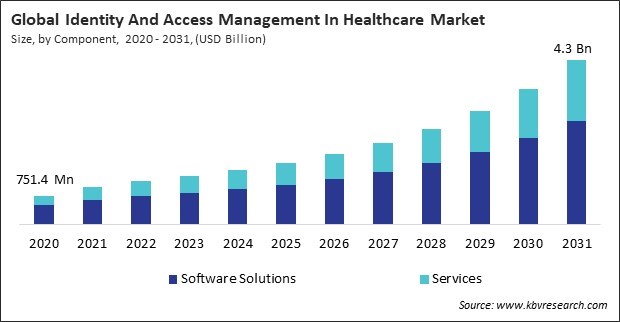

“Global Identity And Access Management In Healthcare Market to reach a market value of USD 4.3 Billion by 2031 growing at a CAGR of 17.2%”

The Global Identity And Access Management In Healthcare Market size is expected to reach $4.3 billion by 2031, rising at a market growth of 17.2% CAGR during the forecast period.

Passwords alone are often insufficient for protecting sensitive information, especially given the prevalence of weak or reused passwords. This multifaceted approach provides a higher level of assurance that only authorized individuals can access systems and data. Therefore, the multifactor authentication segment witnessed 1/5th revenue share in the market by the year 2031. MFA addresses these weaknesses by combining something the user knows (password), something they have (security token or mobile device), and something they are (biometric factor).

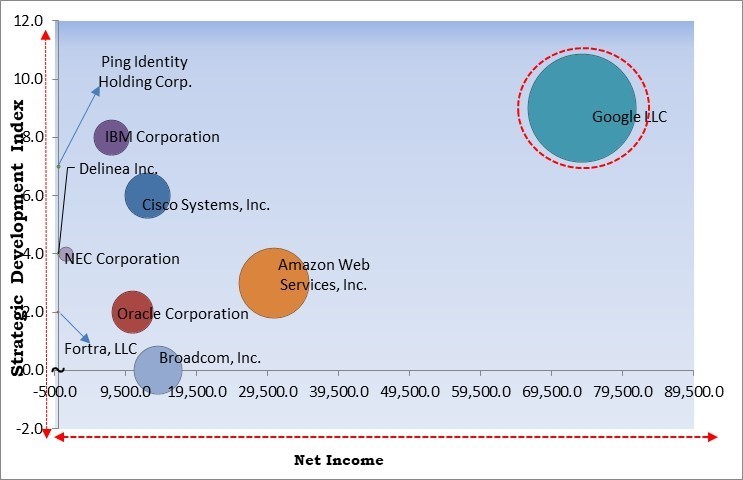

The major strategies followed by the market participants are Partnerships as the key developmental strategy to keep pace with the changing demands of end users. For instance, In June, 2024, IBM Corporation came into partnership with ID Data, an access management solutions provider, to integrate IBM Security Verify with ID Data's identity verification workflows. Additionally, In June, 2024, Cisco Systems, Inc. announced a partnership with WALLIX, an access management solutions provider, to enhance industrial cybersecurity, integrating WALLIX’s PAM4OT OT. Security and Cisco Cyber Vision solutions. This partnership provides centralized, secure access management for OT environments, ensuring compliance and asset protection.

Based on the Analysis presented in the KBV Cardinal matrix; Google LLC are the forerunners in the Identity And Access Management In Healthcare Market. In June, 2023, Google LLC partnered with Mayo Clinic to integrate generative AI tools, including the Generative AI App Builder and Enterprise Search, to improve healthcare. Companies such as Amazon Web Services, Inc., Cisco Systems, Inc., IBM Corporation are some of the key innovators in Identity And Access Management In Healthcare Market.

Many healthcare organizations had to postpone or cancel planned IAM implementation projects due to the sudden shift in priorities. The focus on managing the immediate healthcare crisis led to the diversion of resources away from IT projects, including IAM systems, causing delays in deployment and upgrades. IAM systems faced unprecedented strain as they had to adapt quickly to secure remote access for many healthcare professionals, often leading to gaps in security and increased risks of breaches. This disruption affected the timely implementation and scaling of IAM solutions in healthcare facilities, slowing the market’s growth. Thus, the COVID-19 pandemic had a negative impact on the market.

Healthcare professionals, including doctors, nurses, and administrative staff, interact daily with multiple systems and applications. Managing multiple usernames and passwords can be cumbersome and time-consuming, impacting overall efficiency. IAM solutions that streamline access through Single Sign-On (SSO) and unified credential management simplify the user experience by allowing healthcare workers to log in once and gain access to all necessary systems and data. IAM systems that facilitate seamless access contribute to improved service delivery and overall patient satisfaction. Thus, the demand for improved user experience and simplified access drives the market's growth.

The rise of telemedicine has led to a significant increase in remote access needs. Healthcare providers, patients, and administrative staff require secure methods to authenticate their identities from various locations. IAM systems that offer robust remote authentication solutions, such as multifactor authentication (MFA) and biometric verification, are crucial for ensuring that access to sensitive health information is secure outside traditional healthcare settings. By providing comprehensive access controls, audit trails, and secure authentication methods, IAM systems help healthcare organizations adhere to regulatory standards in remote care. In conclusion, the growth of telemedicine and remote access drives the market's growth.

Implementing IAM systems often requires a substantial upfront capital investment. This includes software licenses, hardware, and infrastructure costs necessary to support the IAM solution. These initial costs can be prohibitive for many healthcare organizations, particularly smaller practices or those with limited budgets. The high financial outlay required to set up IAM systems may deter organizations from adopting these solutions. Additionally, scaling IAM systems to accommodate new users, applications, or regulatory demands can involve additional expenses as organizations grow or their requirements change. Thus, the high implementation and maintenance costs impede the market's growth.

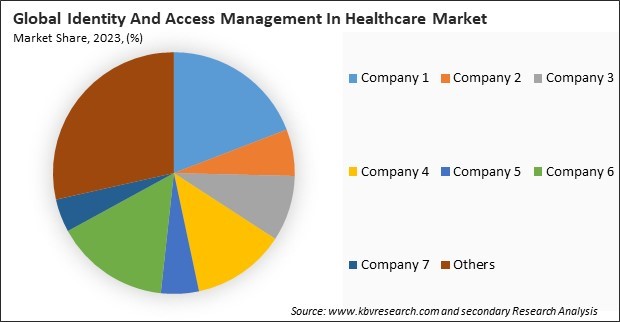

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Partnerships & Collaborations.

Based on type, the market is categorized into single sign on (SSO), multifactor authentication, provisioning, directory service, and audit & compliance management. In 2023, the provisioning segment held 29% revenue share in the market. Provisioning refers to creating and managing an organization's user accounts and access rights. In healthcare, where staff turnover can be high, and roles can be complex, efficient provisioning is essential.

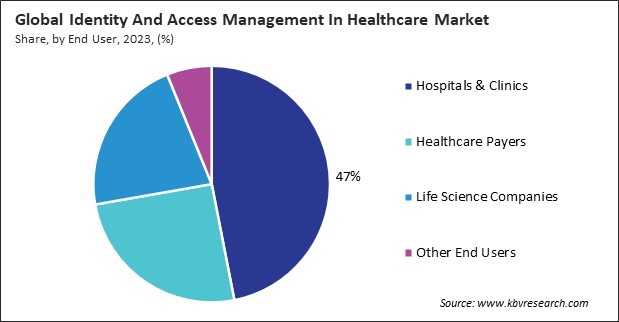

By end use, the market is segmented into healthcare payers, hospitals & clinics, life science companies, and others. In 2023, the hospitals & clinics segment registered 47% revenue share in the market. Hospitals and clinics handle vast amounts of sensitive patient data, including medical records, personal information, and billing details. IAM solutions ensure that only authorized personnel have access to this sensitive data. By managing user identities and controlling access based on roles and responsibilities, IAM helps protect patient information from unauthorized access and breaches.

Based on component, the market is divided into software solutions and services. The services segment attained 35% revenue share in the market in 2023. Healthcare organizations often have diverse and complex IT environments, including electronic health records (EHRs), clinical applications, and administrative systems. IAM service providers offer customized implementation and integration services that ensure seamless interoperability between IAM solutions and existing healthcare systems, enhancing the overall efficiency and effectiveness of identity and access management.

On the basis of deployment, the market is segmented into on-premise and cloud. The on-premise segment recorded 33% revenue share in the market in 2023. On-premises IAM solutions offer healthcare organizations enhanced control over their identity and access management processes. Healthcare providers can implement stringent security measures tailored to their needs by hosting IAM systems on their servers. This control protects sensitive patient data from unauthorized access and cyber threats.

Free Valuable Insights: Global Identity And Access Management In Healthcare Market size to reach USD 4.3 Billion by 2031

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America region witnessed 38% revenue share in the market in 2023. Healthcare organizations in North America handle a substantial volume of sensitive data, including Electronic Health Records (EHRs), personal health information, and financial details. IAM solutions are essential for managing this data information and that only authorized personnel can access and handle sensitive information and protecting against data breaches and unauthorized access.

The identity and access management (IAM) market in healthcare is growing rapidly due to the increasing need for data security, regulatory compliance, and protection against cyber threats. As healthcare organizations digitize and handle sensitive patient data, robust IAM solutions are critical for ensuring secure access to medical records and systems. The market is competitive, with a focus on compliance with healthcare regulations like HIPAA, multi-factor authentication, and secure access for remote healthcare services.

| Report Attribute | Details |

|---|---|

| Market size value in 2023 | USD 1.3 Billion |

| Market size forecast in 2031 | USD 4.3 Billion |

| Base Year | 2023 |

| Historical Period | 2020 to 2022 |

| Forecast Period | 2024 to 2031 |

| Revenue Growth Rate | CAGR of 17.2% from 2024 to 2031 |

| Number of Pages | 308 |

| Number of Tables | 453 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Market Share Analysis, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Component, Type, Deployment, End User, Region |

| Country scope |

|

| Companies Included | IBM Corporation, Google LLC, Cisco Systems, Inc., Oracle Corporation, Broadcom, Inc., Amazon Web Services, Inc. (Amazon.com, Inc.), NEC Corporation, Fortra, LLC (HGGC), Ping Identity Holding Corp. (Thoma Bravo, L.P.), Delinea Inc. (TPG Inc.) |

By Component

By End User

By Deployment

By Type

By Geography

This Market size is expected to reach $4.3 billion by 2031.

Demand for Improved User Experience and Simplified Access are driving the Market in coming years, however, HHigh Costs of Implementation and Maintenance restraints the growth of the Market.

IBM Corporation, Google LLC, Cisco Systems, Inc., Oracle Corporation, Broadcom, Inc., Amazon Web Services, Inc. (Amazon.com, Inc.), NEC Corporation, Fortra, LLC (HGGC), Ping Identity Holding Corp. (Thoma Bravo, L.P.), Delinea Inc. (TPG Inc.)

The expected CAGR of this Market is 17.2% from 2024 to 2031.

The Cloud segment is leading the Market by Deployment in 2023; thereby, achieving a market value of $2.9 billion by 2031.

The North America region dominated the Market by Region in 2023; thereby, achieving a market value of $1.6 billion by 2031.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.

Drivers

Drivers

Restraints

Restraints

Opportunities

Opportunities

Challenges

Challenges