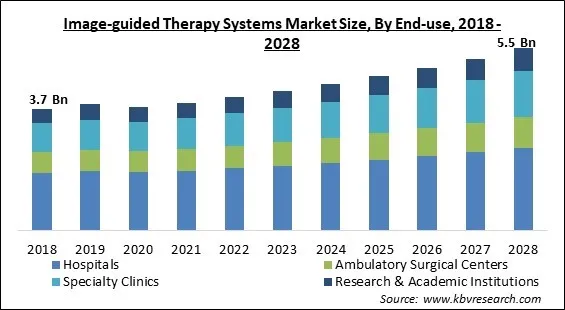

The Global Image-guided Therapy Systems Market size is expected to reach $5.5 billion by 2028, rising at a market growth of 5.4% CAGR during the forecast period.

In radiation therapy, frequent imaging is used to guide treatment, position the patient, and compare the imaging to the pre-therapy imaging from the treatment plan. Before or during a treatment fraction, the patient is located in the treatment room in the same position as intended from the reference imaging dataset. Cone beam computed tomography (CBCT) data acquired on the treatment machine and planning-related computed tomography (CT) data comparison is an illustration of IGRT.

In addition, digitally reconstructed radiographs (DRRs) from the planning CT would be matched with planar megavoltage (MV) or kilovolt age (kV) images. The use of any type of medical imaging to plan, carry out, and assess therapeutic interventions and surgical operations is known as image-guided therapy, and it is a key idea in 21st-century medicine. Surgery can be made less invasive and more exact with the aid of image-guided treatment techniques, which can result in shorter hospital stays and fewer repeat procedures.

Even though there are increasingly more specific procedures that use image guidance, these procedures fall into one of two broad categories: older techniques that use imaging to improve their accuracy and more recent techniques that use imaging and specialized instruments to treat conditions of internal organs and tissues without making an incision. The two most often used cross-sectional digital imaging modalities for image-guided therapy are computed tomography (CT) and magnetic resonance imaging (MRI). Additionally, surgical navigation technology, tracking tools, and integration software are used to support these procedures.

IGT (Image Guided Therapy) creates medical tools for the treatment of cancer. The medical world has recently given new cancer therapy methods based on local tumor ablation a lot of attention. A very promising method for treating localized cancer is thermal ablation therapy, which works on the theory that the tumor is not removed, but rather eliminated in place by increasing the temperature within the tumorous tissues to a deadly threshold. Patients tolerate thermal ablation procedures extremely well, and they spend less time in the hospital as a result. IGT creates image-guided ablation devices that are non-invasive, patient-friendly, and based on focused ultrasound in this situation also known as FUS or HIFU.

The continuous study expands upon the research approach to ensure the incorporation of fundamental COVID-19 concerns and prospective future possibilities. The new report, which considers the market impact of COVID-19, offers insights, analyses, projections, and forecasts. Over the forecast period, COVID-19 will be likely to influence industry growth in a long-term manner due to its unprecedented public health emergency. In addition to expanding the research approach, continuous study ensures that basic COVID-19 concerns and potential future directions are included. In this updated study, which accounts for COVID-19's market impact, insights, analyses, projections, and forecasts are included.

Cancer affects people of various racial backgrounds, sexual orientations, and socioeconomic standings. Although there have been advancements in both cancer prevention and treatment, the incidence of cancer diagnosis appears to be rising. Cancer is a general term used to describe any illness that can affect any part of the body. Malignant tumors and neoplasms are alternative terms used to describe cancer. One aspect of cancer is the rapid emergence of abnormal cells that spread past their normal boundaries, invade other bodily parts, and eventually invade other organs. The term "metastasis" refers to this action. Widespread metastases are the primary cause of cancer patient death.

The demands therapeutic methods are rising as cancer incidence rises quickly year after year. Image-guided systems are widely employed in both the diagnosis and treatment of complex disorders. These elements set the stage for expansion in the market for image-guided treatment systems. Oncologists and radiologists must view the affected area while treating cancer. Systems for image-guided therapy are useful in this situation. The use of image-guided therapy systems is anticipated to increase in the upcoming years due to early detection and an increase in the number of patients seeking treatment. A further factor driving demand for image-guided therapeutic systems is technological advancement.

The tools used in image-guided surgical procedures, which are typically minimally invasive procedures with limited or absent direct visibility, include catheters, micro-instruments, biopsy needles, endoscopes, and lasers. Installation costs for the MR unit, navigation system, and MR-compatible devices typically range from million to dollars. The additional annual operating expenses, which are comparable to those of a typical OR, would also be about millions of USD. Each treatment would cost at least an additional thousands of USD per year, even if the MR machine provided 1,000 treatments annually.

On the basis of product, the Image-guided Therapy Systems Market is divided into Computed Tomography (CT) Scanners, Ultrasound Systems, Magnetic Resonance Imaging (MRI), Endoscopes, X-ray Fluoroscopy, Positron Emission Tomography (PET), and Single Photon Emission Computed Tomography (SPECT). The endoscopes segment acquired the highest revenue share in the Image-guided Therapy Systems Market in 2021. It is due to the rising use of robot-assisted endoscopic operations and the cost of the equipment. Its growth has also been aided by the widespread use of endoscope-guided surgery for various procedures.

Based on the Application, the Image-guided Therapy Systems Market is segmented into Cardiac Surgery, Neurosurgery, Orthopedic Surgery, Urology, Oncology Surgery, Gastroenterology, and Others. The Gastroenterology segment witnessed a substantial revenue share in the Image-guided Therapy Systems Market in 2021. Gastroenterology is the branch of medicine that focuses on digestive system issues. This specialty focuses on illnesses that affect the gastrointestinal tract, which includes the organs from the mouth into the esophagus along the alimentary canal.

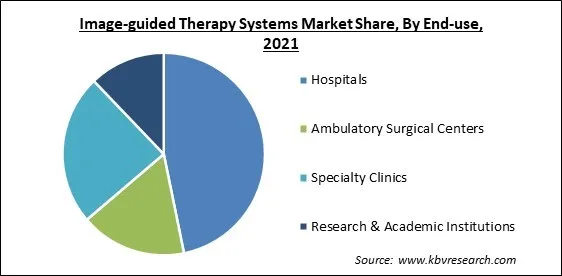

By End-use, the Image-guided Therapy Systems Market is classified into Hospitals, Ambulatory Surgical Centers, Specialty Clinics, and Research & Academic Institutions. The Ambulatory Surgical Centers segment recorded a substantial revenue share in the Image-guided Therapy Systems Market in 2021. It is because of the benefits that these healthcare venues provide, including shorter wait times and significant financial savings. The segment is also being driven by a high preference for minimally invasive procedures and shorter hospital stays in ASCs.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 3.8 Billion |

| Market size forecast in 2028 | USD 5.5 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 5.4% from 2022 to 2028 |

| Number of Pages | 285 |

| Number of Tables | 432 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Product Type, Application, End Use, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region wise, the Image-guided Therapy Systems Market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America region acquired the largest revenue share in the Image-guided Therapy Systems Market in 2021. It is because the market includes improved healthcare infrastructure, technological breakthroughs, and rapid acceptance of sophisticated radiation therapy. The regional market is expanding as a result of the rising number of chronic diseases and the aging population. In the upcoming years, favorable measures launched by private businesses in the realm of minimally invasive interventional and surgical procedures are anticipated to promote market expansion.

Free Valuable Insights: Global Image-guided Therapy Systems Market size to reach USD 5.5 Billion by 2028

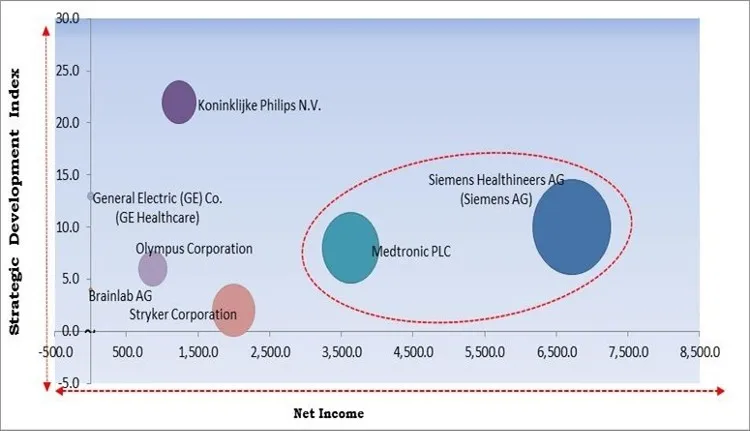

The major strategies followed by the market participants are Partnerships. Based on the Analysis presented in the Cardinal matrix; Medtronic PLC and Siemens Healthineers AG (Siemens AG) are the forerunners in the Image-guided Therapy Systems Market. Companies such as Koninklijke Philips N.V., Olympus Corporation, Stryker Corporation are some of the key innovators in Image-guided Therapy Systems Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Koninklijke Philips N.V., Medtronic PLC, Siemens Healthineers AG (Siemens AG), Analogic Corporation, General Electric (GE) Co. (GE Healthcare), Brainlab AG, Olympus Corporation, and Stryker Corporation.

By Application

By End-Use

By Product

By Geography

The global Image-guided Therapy Systems Market size is expected to reach $5.5 billion by 2028.

Increasing Cancer Incidence Rates Worldwide are driving the market in coming years, however, The Poor Uptake Of Image-Guided Therapy In Low-Income Nations restraints the growth of the market.

Koninklijke Philips N.V., Medtronic PLC, Siemens Healthineers AG (Siemens AG), Analogic Corporation, General Electric (GE) Co. (GE Healthcare), Brainlab AG, Olympus Corporation, and Stryker Corporation.

The expected CAGR of the Image-guided Therapy Systems Market is 5.4% from 2022 to 2028.

The Hospitals segment is leading the Global Image-guided Therapy Systems Market by End-use in 2021 thereby, achieving a market value of $2.5 billion by 2028.

The North America market dominated the Global Image-guided Therapy Systems Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $2 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.