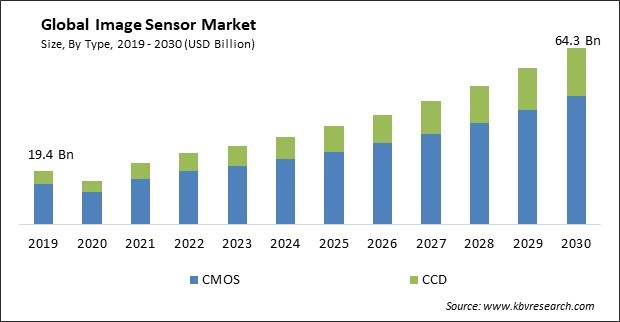

The Global Image Sensor Market size is expected to reach $64.3 billion by 2030, rising at a market growth of 12.2% CAGR during the forecast period. In the year 2022, the market attained a volume of 6,43,550.2 thousand units, experiencing a growth of 16.1% (2019-2022).

Closed-circuit television (CCTV) and IP cameras are commonly used in security and surveillance systems. Image sensors in these cameras capture high-resolution images and videos, allowing for real-time monitoring, recording, and remote access to surveillance footage. Therefore, the security & surveillance segment captured $3,860.0 million revenue in the market in 2022. These are integrated into license plate recognition (LPR) systems, which are employed for automated toll collection, parking management, and law enforcement. These systems capture license plate images for identification and tracking. Video management systems use these to store, manage, and retrieve video footage from multiple cameras. These systems are essential for centralized surveillance control and data storage.

The major strategies followed by the market participants are Product Launches as the key developmental strategy to keep pace with the changing demands of end users. For instance, in September, 2023, OmniVision Technologies, Inc. launched the OX08D10 8-megapixel (MP) CMOS image sensor with 2.1-micron (µm) TheiaCel technology. The OX08D10 8-megapixel (MP) CMOS image sensor has the features of low light performance and low power consumption within a compact size. In May, 2023, Sony Electronics Inc., a subsidiary of Sony Corporation, launched the Xperia 1 V, a smartphone with the provision of a CMOS image sensor and a Transistor Pixel of two layers. The Xperia 1 V offers the cutting-edge technology of Sony while also meeting the requirements of the creators.

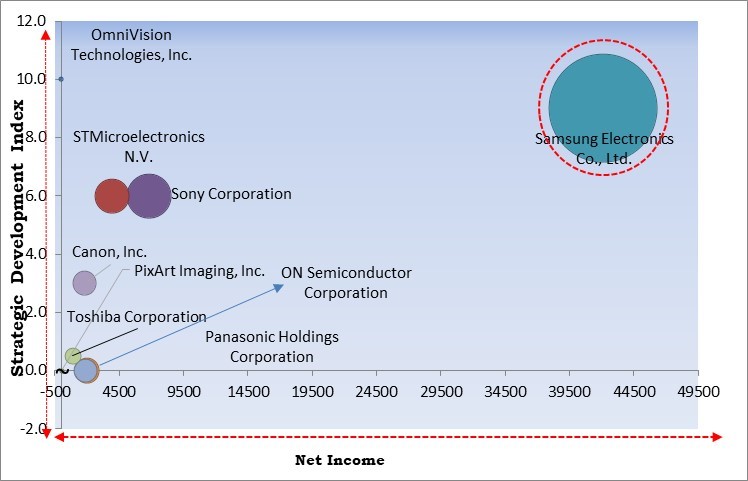

Based on the Analysis presented in the KBV Cardinal matrix; Samsung Electronics Co., Ltd. is the forerunners in the market. In November, 2023, Samsung Electronics Co., Ltd. unveiled the ISOCELL GNK, which is an image sensor with the capability of producing images in a dynamic range of 102dB. The new product has the features of a 1.2-micron pixel size and a 50 MP camera in a 1/1.3" sensor format similar to its predecessor, the ISOCELL GN1, and at the same time provides a dynamic range with three different ISO modes. Additionally, the ISOCELL GNK captures 14-bit RAW images in Pro mode. Companies such as Sony Corporation, STMicroelectronics N.V., Canon, Inc. are some of the key innovators in market.

Integrating image sensors into IoT devices and connected systems has expanded their applications. IoT devices, such as smart home cameras and environmental sensors, use these for data collection and monitoring. IoT-enabled devices in smart homes use these for security, surveillance, and automation. Smart cameras, video doorbells, and home monitoring systems rely on these to capture and transmit video data to homeowners' devices, enhancing convenience and security. The market is expanding significantly due to the integration of IoT and connectivity image sensors.

Biometric identification and facial recognition are enabled by 3D imaging technologies, including ToF sensors and structured light. These sensors provide a more secure and accurate way to identify individuals, essential in security applications, access control, and mobile devices. 3D imaging enables touchless gesture control in various applications, including gaming, automotive infotainment systems, and human-machine interfaces. Users can interact with devices and systems without physical contact, enhancing user experience and safety. As a result of the growing advancements in 3D imaging technologies, the market is anticipated to increase significantly.

Production delays of these may result from disturbances in the supply chain. Component shortages, transportation interruptions, and factory closures can all impact manufacturing timelines, causing delays in product availability. The scarcity of critical components or materials due to supply chain disruptions can increase costs. Manufacturers pay higher prices to secure necessary inputs, which can ultimately affect the pricing of these. Thus, adverse effects of supply chain disruptions can slow down the growth of the market.

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Product Launches and Product Expansions.

Under CMOS type, the market is segmented into front side illuminated (FSI) and back side illuminated (BSI). In 2022, the front side illuminated (FSI) segment witnessed the largest revenue share in the market. FSI image sensors are designed to maximize their sensitivity to incoming light. This results in better low-light performance, making FSI sensors ideal for applications where adequate illumination is a challenge. Enhanced light sensitivity is particularly beneficial in low-light photography and videography, surveillance, and medical imaging. FSI image sensors have a proven track record of reliability and performance, which makes them a trusted choice for many industries.

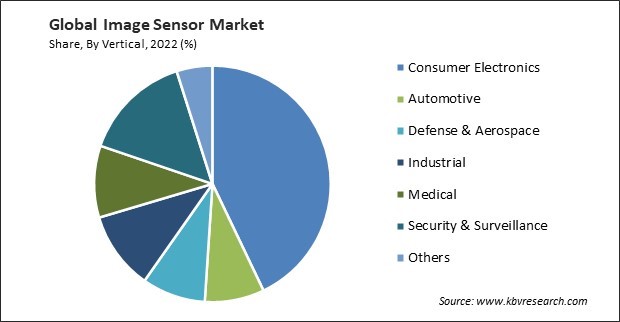

Based on vertical, the market is classified into consumer electronics, defense & aerospace, medical, industrial, automotive, security & surveillance, and others. In 2022, the consumer electronics segment dominated the market with maximum revenue share. The popularity of action cameras, used for capturing adventures and sports activities, has led to increased demand for compact, high-performance image sensors. These sensors need to deliver excellent image quality and handle various environmental conditions. Internet of Things (IoT) devices, such as smart doorbells and security cameras, use these for monitoring and surveillance.

By type, the market is bifurcated into CMOS and CCD. The CCD segment covered a considerable revenue share in the market in 2022. CCD sensors typically exhibit low read noise and dark current, which leads to clean and noise-free images, even in low-light conditions. This low noise performance is advantageous for applications that require long exposure times, such as astrophotography and microscopy. CCD sensors are well-suited for applications that require long exposure times, such as capturing faint astronomical objects, studying chemical reactions, or imaging bioluminescent phenomena.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 25.9 Billion |

| Market size forecast in 2030 | USD 64.3 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 12.2% from 2023 to 2030 |

| Number of Pages | 394 |

| Number of Table | 733 |

| Quantitative Data | Volume in Thousand Units, Revenue in USD Billion, and CAGR from 2019 to 2030 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Market Share Analysis, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Type, Vertical, Region |

| Country scope |

|

| Companies Included | Sony Corporation, Samsung Electronics Co., Ltd. (Samsung Group), OmniVision Technologies, Inc., STMicroelectronics N.V., ON Semiconductor Corporation, Panasonic Holdings Corporation, Canon, Inc., GalaxyCore Shanghai Limited Corporation, PixArt Imaging, Inc., and Toshiba Corporation |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the market is analysed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the Asia Pacific region led the market by generating the highest revenue share. The Asia Pacific region is a prominent player in the global automotive sector. These are used in vehicles for ADAS, rearview cameras, and in-cabin monitoring. The growing demand for safe and smart vehicles propels the adoption of image sensors. Agriculture in Asia Pacific benefits from these for precision agriculture and crop monitoring. Drones and agricultural machinery use these sensors for tasks such as crop health assessment and yield optimization.

Free Valuable Insights: Global Image Sensor Market size to reach USD 64.3 Billion by 2030

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Sony Corporation, Samsung Electronics Co., Ltd. (Samsung Group), OmniVision Technologies, Inc., STMicroelectronics N.V., ON Semiconductor Corporation, Panasonic Holdings Corporation, Canon, Inc., GalaxyCore Shanghai Limited Corporation, PixArt Imaging, Inc., and Toshiba Corporation.

By Type (Volume, Thousand Units, USD Billion, 2019 to 2030)

By Vertical (Volume, Thousand Units, USD Billion, 2019 to 2030)

By Geography (Volume, Thousand Units, USD Billion, 2019 to 2030)

This Market size is expected to reach $64.3 billion by 2030.

Integration of IoT and connectivity image sensors are driving the Market in coming years, however, Adverse effects of supply chain disruptions restraints the growth of the Market.

Sony Corporation, Samsung Electronics Co., Ltd. (Samsung Group), OmniVision Technologies, Inc., STMicroelectronics N.V., ON Semiconductor Corporation, Panasonic Holdings Corporation, Canon, Inc., GalaxyCore Shanghai Limited Corporation, PixArt Imaging, Inc., and Toshiba Corporation.

In the year 2022, the market attained a volume of 6,43,550.2 thousand units, experiencing a growth of 16.1% (2019-2022).

The Asia Pacific region is generating the highest revenue in the Market, By Region in 2022, and would continue to be a dominant market till 2030; thereby, achieving a market value of $27.4 billion by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.