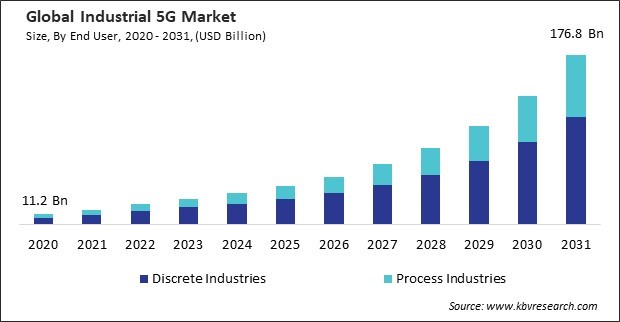

“Global Industrial 5G Market to reach a market value of 176.8 Billion by 2031 growing at a CAGR of 27.2%”

The Global Industrial 5G Market size is expected to reach $176.8 billion by 2031, rising at a market growth of 27.2% CAGR during the forecast period.

In 2023, the Asia Pacific region generated 43% revenue share in the industrial 5G market in 2023. This region is characterized by rapid industrialization, urbanization, and a growing emphasis on technological advancements. Countries such as China, Japan, and South Korea are leading the way in adopting 5G technology to enhance their manufacturing capabilities and improve supply chain management.

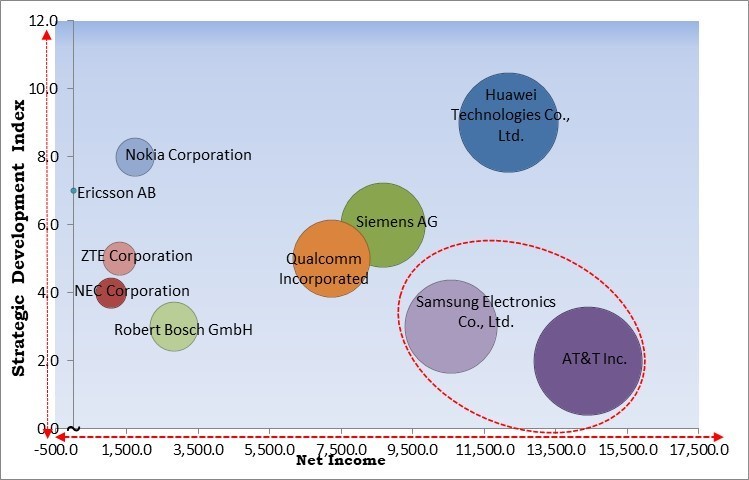

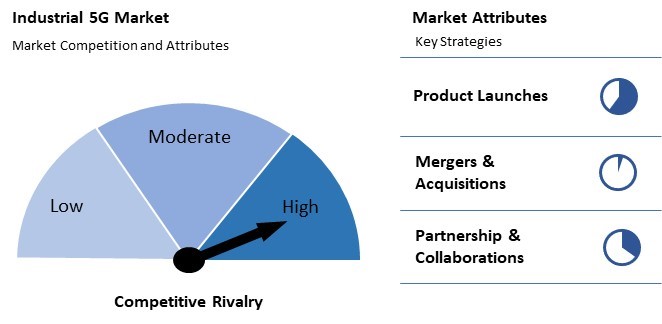

The major strategies followed by the market participants are Product Launches as the key developmental strategy to keep pace with the changing demands of end users. For instance, In September, 2024, Huawei Technologies Co., Ltd. hosted the optical summit themed "Accelerate F5G-A, Amplify Intelligence," and unveiled new F5G Advanced products based on the "3 In 3 Out" trends to enhance industrial intelligence. Huawei's initiatives include Fiber-in Copper-out, fgOTN-in SDH-out, and Optical-sensing-in Hard-work-out, urging industry collaboration for smarter, faster connectivity solutions. Moreover, In November, 2023, ZTE Corporation unveiled a 5G-based Industrial Field Network Whitepaper at the 2023 Analyst Conference. This document addresses low latency and high-reliability needs in production and manufacturing, offering solutions for network integration and self-service capabilities while promoting the intelligent transformation of factories amid challenges posed by isolated information silos.

Based on the Analysis presented in the KBV Cardinal matrix; AT&T Inc. and Samsung Electronics Co., Ltd. are the forerunners in the Industrial 5G Market. In December, 2022, Samsung Electronics Co., Ltd. unveiled a 16-gigabit DDR5 DRAM using the first 12-nanometer process technology, enhancing performance and efficiency for next-gen computing and AI. The product is compatible with AMD’s platforms, showcasing the importance of collaboration in advancing memory technology for sustainable operations, according to executives from both companies. Companies such as Huawei Technologies Co., Ltd., Siemens AG, and Qualcomm Incorporated are some of the key innovators in Industrial 5G Market.

The increasing reliance on real-time data processing and the need for seamless communication across various industries has significantly driven the demand for high-speed and low-latency connectivity. As manufacturing, logistics, and healthcare industries embrace digital transformation, the requirements for faster and more reliable network connections have surged, paving the way for adopting this technology. In conclusion, rising demand for high-speed and low-latency connectivity drives the market's growth.

Additionally, Industries are increasingly adopting automation technologies to enhance efficiency and reduce labour costs. They facilitates remote monitoring and control of automated systems, enabling operators to manage processes from afar. The proliferation of Internet of Things (IoT) devices in industrial settings requires reliable, high-speed connectivity to enable real-time data transmission and monitoring. Thus, the increasing need for remote monitoring and control capabilities drives the market's growth.

Transitioning from previous generations of mobile technology (such as 4G) to 5G often requires substantial upgrades to existing infrastructure, including base stations, antennas, and transmission lines. This can involve high capital expenditures, particularly for industries with limited budgets. 5G networks require a denser network of small cells to provide adequate coverage, especially in urban and industrial areas. Hence, high infrastructure costs associated with 5G deployment hamper the market's growth.

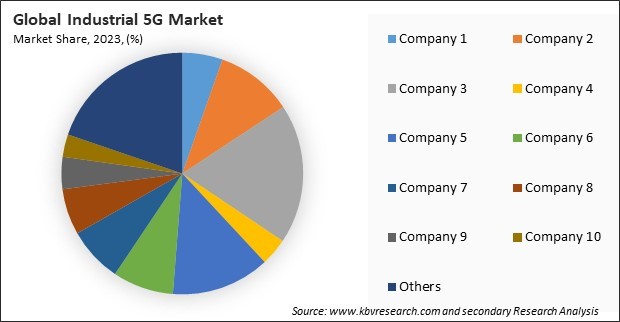

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Product Launches and Product Expansions.

Based on offering, this market is divided into hardware, software, and services. The software segment attained 18% revenue share in the industrial 5G market in 2023. As industries adopt 5G technology, sophisticated software solutions are required to manage and analyze the enormous quantities of data produced by connected devices. Applications such as network management, data analytics, and automation software are becoming increasingly critical for optimizing operations and ensuring seamless connectivity.

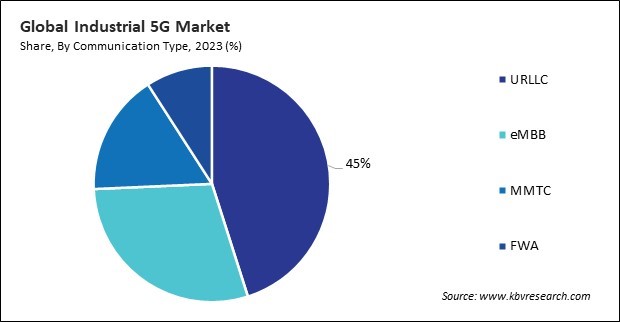

By communication type, this market is divided into eMBB, URLLC, MMTC, and FWA. The eMBB segment procured 29% revenue share in the industrial 5G market in 2023. eMBB primarily delivers high data rates and enhanced mobile connectivity, making it ideal for applications that require substantial bandwidth, such as high-definition video streaming, augmented reality AR, and VR applications.

Based on enterprise size, this market is bifurcated into large enterprises and small & medium enterprises. In 2023, the small & medium enterprises segment procured 29% revenue share in the industrial 5G market. SMEs increasingly recognize the importance of adopting 5G technology to remain competitive. The growing availability of affordable 5G solutions and the increasing need for enhanced connectivity to support remote work, automation, and digital services have driven SMEs to invest in 5G capabilities.

On the basis of end user, this market is segmented into process and discrete industries. In 2023, the process industries segment attained 33% revenue share in the industrial 5G market. Process industries include sectors such as oil and gas, chemicals, and pharmaceuticals, where production involves continuous processes rather than discrete assembly. Implementing 5G technology in process industries supports the need for real-time monitoring and control, predictive maintenance, and enhanced safety measures.

Free Valuable Insights: Global Industrial 5G Market size to reach USD 176.8 Billion by 2031

Region-wise, this market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America region witnessed 27% revenue share in the industrial 5G market in 2023. The region's strong emphasis on technological innovation, coupled with significant investments in digital infrastructure, has propelled the adoption of 5G technology across various industries. North American countries, particularly the United States and Canada, are at the forefront of integrating advanced technologies such as IoT, artificial intelligence, and big data analytics into their industrial operations.

The industrial 5G market sees increased competition among smaller and emerging companies. These players focus on niche applications, innovative solutions, and regional market dominance. Partnerships and collaborations with technology providers are common, with firms leveraging 5G’s potential for IoT, automation, and smart manufacturing solutions.

| Report Attribute | Details |

|---|---|

| Market size value in 2023 | USD 27.1 Billion |

| Market size forecast in 2031 | USD 176.8 Billion |

| Base Year | 2023 |

| Historical Period | 2020 to 2022 |

| Forecast Period | 2024 to 2031 |

| Revenue Growth Rate | CAGR of 27.2% from 2024 to 2031 |

| Number of Pages | 444 |

| Number of Tables | 723 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Market Share Analysis, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Offering, Communication Type, Enterprise Size, End User, Region |

| Country scope |

|

| Companies Included | AT&T Inc., Ericsson AB, Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.), NEC Corporation, Nokia Corporation, Qualcomm Incorporated (Qualcomm Technologies, Inc.), Samsung Electronics Co., Ltd. (Samsung Group), ZTE Corporation, Siemens AG, and Robert Bosch GmbH |

By End User

By Enterprise Size

By Offering

By Communication Type

By Geography

This Market size is expected to reach $176.8 billion by 2031.

Rising Demand For High-Speed And Low-Latency Connectivity are driving the Market in coming years, however, High Infrastructure Costs Associated With 5g Deployment restraints the growth of the Market.

AT&T Inc., Ericsson AB, Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.), NEC Corporation, Nokia Corporation, Qualcomm Incorporated (Qualcomm Technologies, Inc.), Samsung Electronics Co., Ltd. (Samsung Group), ZTE Corporation, Siemens AG, and Robert Bosch GmbH

The expected CAGR of this Market is 27.2% from 2024 to 2031.

The Discrete Industries segment captured the maximum revenue in the Market by End User in 2023, thereby, achieving a market value of $112.9 billion by 2031.

The Asia Pacific region dominated the Market by Region in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $77,494.5 million by 2031.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.

Drivers

Drivers

Restraints

Restraints

Opportunities

Opportunities

Challenges

Challenges