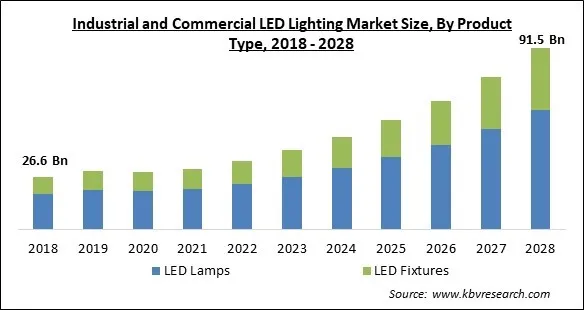

The Global Industrial and Commercial LED Lighting Market size is expected to reach $91.5 billion by 2028, rising at a market growth of 17.6% CAGR during the forecast period.

A semiconductor light source called a light-emitting diode (LED) transforms electrical energy immediately into light energy. These components are frequently utilized in lamps to substitute incandescent light sources. In comparison to conventional lighting technologies, LED lights run for a longer time, have a higher level of durability, and provide greater lighting quality.

The rise in demand for affordable and energy-efficient LED lighting, the increase in government programmes to adopt LEDs, and the rising necessity to replace conventional lighting systems are the major aspects positively driving the industrial and commercial LED lighting market. Owing to heat losses from the typical and most prevalent lighting fixtures in industrial and commercial settings, such as fluorescent and high-intensity discharge (HID) lights, industrial operators frequently experience difficulties with maintenance costs.

The demand for LED lights has increased significantly over the past few years due to their increased energy and cost savings as well as their reduced maintenance requirements. Players in the industry are discovering interesting growth potential with the introduction of new options to brighten the work space. For example, Emerson Appleton published a cost-effective and secure method in August 2020 for replacing an old HID lighting system in a facility with a modern LED one.

Due to postponed development projects, the industrial and commercial LED lighting market revenue saw a reduction in its growth rate, which had a significant influence. But, the pandemic has increased demand for industrial and commercial LED lighting in the medical sector. Due to a rise in global governmental initiatives, market participants have also been spending in the research and development of smart lighting systems. This would create more demand for industrial & commercial lighting across different regions in the recovery phase of the pandemic.

In comparison to conventional lighting, industrial and commercial LED lighting offers a number of advantages including greater outstanding performance and dependability, longer shelf life, reduced energy waste, compact and sturdy qualities. Conventional lighting needs a glass bulb to retain the essential coatings and/or gases, and its energy consumption is significant. For instance, high-intensity discharge (HID) lamps employ an electric arc discharge, while incandescent lamps rely on a heated filament to create light.

Owing to its enhanced characteristics, consumers are becoming more likely to choose LEDs over traditional compact fluorescent lamps (CFLs), which has further influenced the market. Additionally, it is a budget-friendly option for all lights as well as other uses including large-screen display backlighting, non-backlighting, and displays (OLED). Moreover, the market for industrial and commercial light-emitting diode (LED) lighting is positively impacted by expanding urbanization, lifestyle modifications, investments, and rising consumer expenditure.

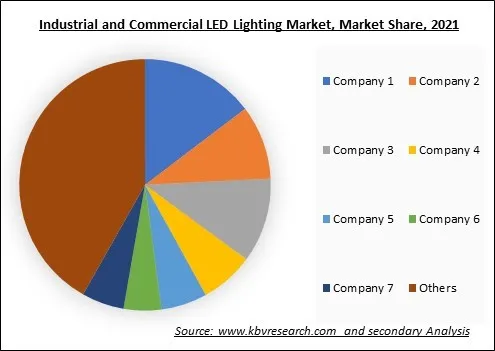

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The below illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Product Launches.

In comparison to competing light sources in various applications using criteria like "dollars-per-lumen," LEDs are more expensive. While simultaneously boosting the light brightness of their products, LED producers continue to strive to lower their production costs. But, decreased energy consumption, cheaper maintenance costs, and other aspects more than make up for the hefty initial cost of LED-based systems.

On the basis of product type, the Industrial and Commercial LED Lighting Market is bifurcated into LED Lamps and LED Fixtures. LED Lamps segment garnered the maximum revenue share in the industrial and commercial LED lighting market in 2021. This is attributed to the growing use of LED lighting in emerging economies. Since LED lamps are more durable, energy-efficient, and have the proper temporal stability, they have several advantages over incandescent bulbs.

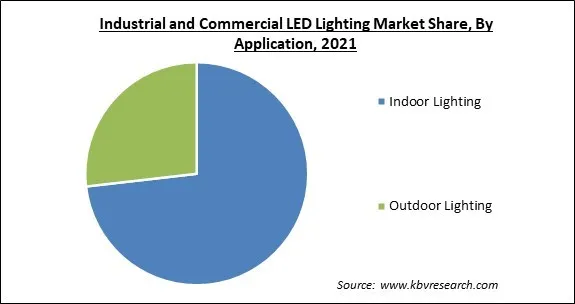

Based on application, the Industrial and Commercial LED Lighting Market is classified into Indoor Lighting and Outdoor Lightning. Outdoor lighting segment recorded a significant revenue share in the industrial and commercial LED lighting market in 2021. It is because a variety of products are readily available and have greater durability. Airports, office buildings, hospitals, public buildings, freeways, and other locations frequently use LED lighting.

By end-user, the Industrial and Commercial LED Lighting Market is fragmented into Industrial and Commercial. The commercial segment garnered the maximum revenue share in the industrial and commercial LED lighting market in 2021. Retail, hospitality, office, educational, and warehouse storage applications are also included in the commercial section. As a replacement for HID, fluorescent, and incandescent lighting, the market has seen significant adoption.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 30.7 Billion |

| Market size forecast in 2028 | USD 91.5 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 17.6% from 2022 to 2028 |

| Number of Pages | 200 |

| Number of Tables | 324 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Market Share Analysis, Companies Strategic Developments, Company Profiling |

| Segments covered | Product Type, Application, End User, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the Industrial and Commercial LED Lighting Market is analyzed across North America, Europe, Asia Pacific and LAMEA. Asia Pacific procured the highest revenue share in the industrial and commercial LED lighting market in 2021. The high rate of construction, renovation of the current outdoor infrastructure, and government subsidies for energy-efficient building lighting are the causes.

Free Valuable Insights: Global Industrial and Commercial LED Lighting Market size to reach USD 91.5 Billion by 2028

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; General Electric (GE) Co. is the major forerunner in the Industrial and Commercial LED Lighting Market. Companies such as Dialight PLC, Signify N.V. and Syska LED Lights Private Limited are some of the key innovators in Industrial and Commercial LED Lighting Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Dialight PLC, Eaton Corporation, General Electric (GE) Co., Signify N.V., AMS AG (OSRAM Licth AG), Syska LED Lights Private Limited, Toshiba Corporation, Zumtobel Group AG, Deco Lighting, Inc., and Wolfspeed, Inc.

By Product Type

By Application

By End User

By Geography

The global Industrial and Commercial LED Lighting Market size is expected to reach $91.5 billion by 2028.

Growing Popularity Of The Led Lighting Among Industries are driving the market in coming years, however, High Initial Cost Of Led Lighting Would Hinder The Market Growth restraints the growth of the market.

Dialight PLC, Eaton Corporation, General Electric (GE) Co., Signify N.V., AMS AG (OSRAM Licth AG), Syska LED Lights Private Limited, Toshiba Corporation, Zumtobel Group AG, Deco Lighting, Inc., and Wolfspeed, Inc.

The expected CAGR of the Industrial and Commercial LED Lighting Market is 17.6% from 2022 to 2028.

The Indoor Lighting segment acquired maximum revenue share in the Global Industrial and Commercial LED Lighting Market by Application in 2021 thereby, achieving a market value of $65.4 billion by 2028.

The Asia Pacific market dominated the Global Industrial and Commercial LED Lighting Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $33.7 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.