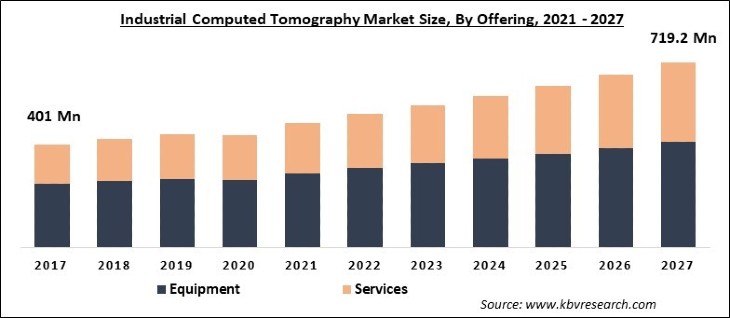

The Global Industrial Computed Tomography Market size is expected to reach $719.2 Million by 2027, rising at a market growth of 6.9% CAGR during the forecast period. In the field of clinical diagnostics, x-ray computed tomography has been popular for quite a long. Moreover, x-ray computed tomography is increasingly becoming prevalent in industrial NDT (nondestructive testing). However, the primary principles are the same for both domains; a medical CT scanner needs a complicated system of a rotating X-ray source and detection system - the so-called gantry - to keep the patient in a stable position, while the object itself can be easily rotated by a turntable in an industrial CT system.

A high number of industries are realizing the fact that X-ray CT scanning is a crucial device in order to ensure maximum product quality. Flaw detection, assembly analysis, metrology, failure analysis, and reverse engineering applications are a few of the major uses for industrial CT scanning. With the help of high-powered x-rays, Industrial CT scanning can penetrate the internal parts of an object, developing an ideal inspection device for high-value parts where destructive testing is financially banned.

Industrial CT scanners are deployed to examine the strength and abilities of the designs/structures created with the help of the additive manufacturing process. These scanners are useful for the makers to examine and calculate the capabilities/features of the complicated structures without damaging the product. Thus, the industrial computed tomography market would witness new avenues for growth due to the massive demand for 3D printing technology across healthcare, automotive, electronics, and other industries.

The market has witnessed different kinds of challenges due to the global outbreak of the COVID-19 pandemic. The demand for industrial CT scanners has been reduced due to the disruptions in the supply chain, along with the decrease in manufacturing abilities of several companies. On the other hand, the global industrial computed tomography would witness gradual growth due to the relaxations in the lockdown norms around the world, and the rising dissemination of coronavirus vaccines. In addition, organizations are adopting strategic changes in their mode of operations to be ready for the same kind of future uncertainties, which would revive the market growth in the next few years.

Industrial CT scanning takes the help of radiographic technology in order to generate multiple 2D pictures of an object. Due to this non-destructive factor of industrial CT scanning, it becomes a viable and ideal choice for advanced analysis, reverse engineering, and quality inspection for parts and assemblies with complicated geometry and hard to evaluate features.

The results of industrial CT scanning enable users to examine the internal and external geometries of an object. These results can be utilized for various kinds of applications such as coordinate measurement and GD&T programming. In addition, an industrial CT scan can also be utilized to assess internal errors like cracks, structural integrity, and variations from the initial design.

The possibility of artifacts in the data is one of the major limitations of CT imaging. An artifact refers to anything in the image that does not precisely display the real geometry in the part being scanned. As they are not real, artifacts restrict the ability of the user to quantitatively obtain dimensional, density, or other data from the image. Few of the image artifacts can be decreased or ruined with CT scanning by enhanced scanning procedures.

Based on Application, the market is segmented into Flaw Detection & Inspection, Failure Analysis, Assembly Analysis, Dimensioning & Tolerancing Analysis and Others. The flaw detection & inspection segment acquired the biggest revenue share of the industrial computed tomography market in 2020. Factor that is responsible for the massive share of this segment includes a surge in the requirement for inspection of the items to identify any fault, crack, or deviation from the manufactured product. By deploying industrial CT systems for product inspections, manufacturers can substantially decrease the cost of production or manufacturing.

Based on Offering, the market is segmented into Equipment and Services. The services segment would be the fastest-growing segment during the forecast period. The massive growth of the segment is due to the high amount of investment required for industrial CT scanners. Organizations are more willing to outsource the CT services to the vendors in the market because of the low cost, thereby substantially lowering down their capital investment.

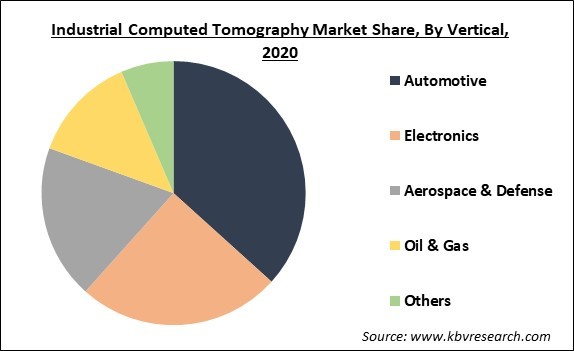

Based on Vertical, the market is segmented into Automotive, Electronics, Aerospace & Defense, Oil & Gas and Others. The electronics segment would display the fastest growth rate during the forecast period. CT scanning is a non-destructive testing mode for inspection which is highly utilized in the electronics sector in order to examine the internal parts & assemblies, molded circuits, and check whether the electronic components are showing the ideal functioning.

| Report Attribute | Details |

|---|---|

| Market size value in 2020 | USD 435.1 Million |

| Market size forecast in 2027 | USD 719.2 Million |

| Base Year | 2020 |

| Historical Period | 2017 to 2019 |

| Forecast Period | 2021 to 2027 |

| Revenue Growth Rate | CAGR of 6.9% from 2021 to 2027 |

| Number of Pages | 247 |

| Number of Tables | 384 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Application, Offering, Vertical, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. The Asia Pacific would exhibit the fastest growth rate during the forecast period. Factor such as the massive acceptance of industrial CT systems for testing and inspection purposes among several industries, like aerospace & defense, electronics, and automotive is responsible for the growth of this region. The region is increasingly becoming a hub for automotive and electronics manufacturing organizations.

Free Valuable Insights: Global Industrial Computed Tomography Market size to reach USD 719.2 Million by 2027

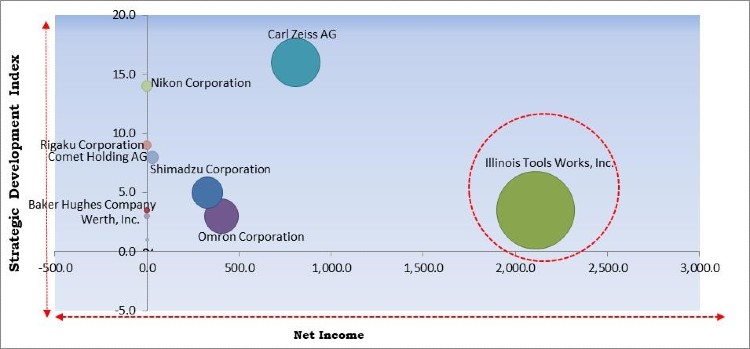

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; Illinois Tools Works, Inc. is the forerunner in the Industrial Computed Tomography Market. Companies such as Omron Corporation, Nikon Corporation, and Shimadzu Corporation are some of the key innovators in the market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Omron Corporation, Carl Zeiss AG, Shimadzu Corporation, Baker Hughes Company, Comet Holding AG (YXLON International), VJ Group, Inc., Werth, Inc. (Werth Messtechnik GmbH), Rigaku Corporation, Illinois Tools Works, Inc. (North Star Imaging, Inc.), and Nikon Corporation (Nikon Metrology NV).

By Application

By Offering

By Vertical

By Geography

The global industrial computed tomography market size is expected to reach $719.2 Million by 2027.

The growing number of applications of industrial CT scanning are driving the market in coming years, however, some technological limitations will hamper the market growth limited the growth of the market.

Omron Corporation, Carl Zeiss AG, Shimadzu Corporation, Baker Hughes Company, Comet Holding AG (YXLON International), VJ Group, Inc., Werth, Inc. (Werth Messtechnik GmbH), Rigaku Corporation, Illinois Tools Works, Inc. (North Star Imaging, Inc.), and Nikon Corporation (Nikon Metrology NV).

Yes, The global industrial computed tomography would witness gradual growth due to the relaxations in the lockdown norms around the world, and the rising dissemination of coronavirus vaccines.

The equipment segment procured the maximum revenue share of the industrial computed tomography market in 2020.

The North America garnered the maximum revenue share of the industrial computed tomography market in 2020. The region will showcase a promising growth rate during the forecast period.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.