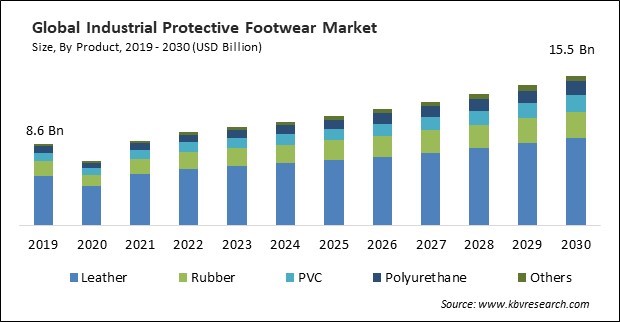

The Global Industrial Protective Footwear Market size is expected to reach $15.5 billion by 2030, rising at a market growth of 6.2% CAGR during the forecast period. In the year 2022, the market attained a volume of 2,16,129.8 thousand units, experiencing a growth of 6.1% (2019-2022).

The food segment places a high emphasis on hygiene and cleanliness. Consequently, the food segment captured $620.3 revenue in the market in 2022. There is a risk of spills and wet surfaces in food processing facilities, kitchens, and restaurants. The footwear with slip-resistant outsoles is essential to prevent slips. It falls, ensuring the safety of workers in environments where surfaces may be slippery due to water, oils, or food substances. These footwears designed with features such as smooth surfaces, easy-to-clean materials, and antimicrobial properties supports food safety measures, reducing the risk of contamination and ensuring a sanitary working environment. Some of the factors impacting the market are technological integration for smart safety, growing innovations in design and ergonomics and stringent regulatory compliance.

The advent of Industry 4.0 and the Internet of Things (IoT) is influencing the market. Smart technologies, such as embedded sensors and connectivity features, are being explored for real-time monitoring of environmental conditions and worker health. This data-driven approach adds a layer of intelligence to safety protocols, contributing to a more proactive and adaptive safety ecosystem. Smart safety features in these footwears often include real-time monitoring capabilities. Embedded sensors can track environmental conditions like temperature, humidity, and hazardous substances. The integration of ergonomic design principles is a notable trend driving growth. Manufacturers focus on creating protective footwear that offers top-notch protection and prioritizes wearer comfort. Traditional perceptions of heavy protective footwear are evolving with the introduction of lightweight materials and construction techniques. Innovations in design focus on reducing the overall weight of the footwear without compromising safety standards. Anti-fatigue features improve comfort and contribute to workers' overall well-being and productivity. As a result of the growing innovations in design and ergonomics, the market is anticipated to increase significantly.

However, adhering to constantly evolving and stringent regulatory standards can be challenging for manufacturers. Meeting various safety standards and certifications in different regions adds complexity to the production process and may increase costs. Safety standards are subject to updates and revisions to address emerging risks and incorporate technological advancements. Manufacturers need to stay abreast of these changes, invest in research and development, and update their products accordingly, which can be time-consuming and costly. Compliance costs and administrative burdens can be disproportionately burdensome for SMEs, potentially limiting their competitiveness. Ensuring consistent quality control to meet regulatory standards across all batches of these footwears is crucial. Maintaining this consistency is challenging, especially for manufacturers with large-scale production facilities. Thus, stringent regulatory compliance can slow down the growth of the market.

Based on application, the market is classified into construction, manufacturing, chemicals & pharmaceuticals, oil & gas, food, mining, transportation, and others. In 2022, the construction segment witnessed the largest revenue share in the market in 2022. These footwears with reinforced toe caps and metatarsal protection is crucial in mitigating the impact and compression hazards that construction workers may encounter. Construction sites often involve working on uneven surfaces with potential risks of punctures from nails, sharp objects, or debris. Protective footwear designed with puncture-resistant features, such as midsoles made of Kevlar or steel, provides essential protection for construction workers.

By product, the market is categorized into leather, PVC, polyurethane, rubber, and others. The PVC segment recorded a remarkable revenue share in the market in 2022. PVC is known for its durability and resistance to abrasion, chemicals, and harsh environmental conditions. Industrial environments often expose workers to challenging conditions, and PVC footwear can withstand these conditions, providing long-lasting protection. PVC is inherently water-resistant, making it suitable for industries where workers may be exposed to liquids or wet conditions. PVC boots provide a waterproof barrier, keeping the feet dry and comfortable.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 9.7 Billion |

| Market size forecast in 2030 | USD 15.5 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 6.2% from 2023 to 2030 |

| Number of Pages | 360 |

| Number of Table | 650 |

| Quantitative Data | Volume in Units, Revenue in USD Billion, and CAGR from 2019 to 2030 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Product, Application, Region |

| Country scope |

|

| Companies Included | Honeywell International, Inc., VF Corporation, ELTEN Gmbh, Uvex Group, Rock Fall Ltd., Wolverine World Wide, Inc. (Sure-loc Landscape Edging Corporation), Bata Corporation, Rahman Group, COFRA Holding AG and Dunlop Protective Footwear. |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the market is analysed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the Europe region led the market by generating the highest revenue share. The Europe region is witnessing a surge in construction projects, including infrastructure development, residential and commercial construction, and urbanization initiatives. There is a growing recognition of the importance of worker well-being in the Europe region. Various European industries have a heightened awareness of occupational health and safety practices. The diverse range of industrial sectors in Europe, such as manufacturing, construction, healthcare, and agriculture, means varied workplace hazards exist.

Free Valuable Insights: Global Industrial Protective Footwear Market size to reach USD 15.5 Billion by 2030

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Honeywell International, Inc., VF Corporation, ELTEN Gmbh, Uvex Group, Rock Fall Ltd., Wolverine World Wide, Inc. (Sure-loc Landscape Edging Corporation), Bata Corporation, Rahman Group, COFRA Holding AG and Dunlop Protective Footwear.

By Product (Volume, Thousand Unit, USD Billion, 2019-30)

By Application (Volume, Thousand Unit, USD Billion, 2019-30)

By Geography (Volume, Thousand Unit, USD Billion, 2019-30)

This Market size is expected to reach $15.5 billion by 2030.

Technological integration for smart safety are driving the Market in coming years, however, Stringent regulatory compliance restraints the growth of the Market.

Honeywell International, Inc., VF Corporation, ELTEN Gmbh, Uvex Group, Rock Fall Ltd., Wolverine World Wide, Inc. (Sure-loc Landscape Edging Corporation), Bata Corporation, Rahman Group, COFRA Holding AG and Dunlop Protective Footwear.

In the year 2022, the market attained a volume of 2,16,129.8 thousand units, experiencing a growth of 6.1% (2019-2022).

The Leather market dominated the Market, by Product in 2022; thereby, achieving a market value of $9,037.3 Million by 2030.

The Europe region dominated the Market, by Region in 2022, and would continue to be a dominant market till 2030; thereby, achieving a market value of $5,033.6 Million by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.