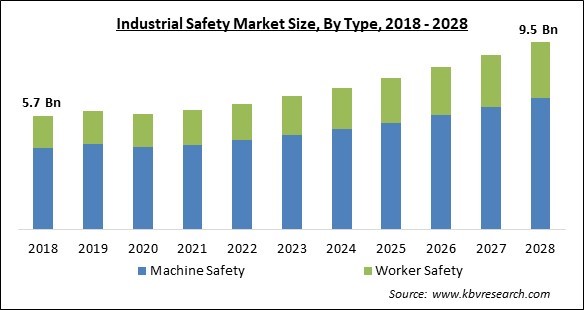

The Global Industrial Safety Market size is expected to reach $9.5 billion by 2028, rising at a market growth of 6.9% CAGR during the forecast period.

The management of all activities and events inside the industry to protect its personnel and assets by avoiding risks, hazards, accidents, and near misses is known as industrial safety. Governmental bodies keep a check on it through various laws & rules. Millions of occupational or industrial accidents occur every year, resulting in significant lost production time, making it critical to invest in industrial safety. Additionally, people who are truly injured lose a significant amount of production time owing to temporary & permanent disability, as well as those who assist those who are injured. As a result, industrial safety laws must be followed to attain production efficiency.

The Occupational Safety and Health Act of 1970 was a watershed moment in industrial safety laws. The Act was the first comprehensive federal industrial safety legislation, and it was near full favor vote passed by both chambers of Congress. The surge in the number of work-related fatalities in the 1960s, particularly the Farmington, West Virginia mine tragedy of 1968, which killed many miners, was one of the variables contributing to a solid support for the act. The act was notable for putting a greater emphasis on preventing rather than compensating for occupational accidents & illnesses. The Occupational Safety and Health Administration (OSHA) & the National Institute of Occupational Safety and Health were established as a result of the act (NIOSH). The act included requirements such as developing obligatory safety & health standards, enforcing those standards, and establishing uniform record-keeping and reporting methods.

Workers' compensation laws vary greatly from state to state, although they always have the same basic goals. Employers must pay disability benefits, medical expenses, and compensation for lost work hours in the event of a work-related injury or illness. Workers, on the other side, are generally forbidden from filing a lawsuit against their employers, safeguarding corporations from costly liability settlements. "Workmen's compensation legislation has done much more to promote safety than all other measures combined," argues David Colling in his book Industrial Safety: Management and Technology. "Employers found that focusing on safety was more cost-effective than compensating employees for injury or death."

The COVID-19 pandemic has wreaked havoc on the oil & gas industry, with oil prices plummeting. In 2021, a massive imbalance between supply & demand arose as a result of a significant drop in oil and gas demand because of several limitations implemented by governments around the world. One of the most important sectors, oil, and gas, necessitates the use of safety systems & components. Chemicals and the energy and power industries are two other major end-users of industry safety products, both of which saw a drop in demand as a result of the global pandemic. Therefore, this led a slowdown in the industrial safety market. Due to the closure of international borders, non-operational distribution methods, and many precautionary measures implemented for public health & safety, foreign trade was restricted. However, development in the energy & power sector is predicted to enhance the industrial safety market for the energy & power end-use industry in the upcoming years.

The expansion of the industrial safety industry is mostly due to mandates for safety laws. The US government & governments in Europe are working to prevent mishaps by enforcing regulations relating to people and process safety and putting certified equipment in hazardous locations, such as switches, explosion-proof sensors, and actuators. Safety standards & regulatory measures have been implemented by organizations like as the Occupational Safety & Health Administration (OSHA), the International Standard Organization (ISO), the International Electro technical Commission (IEC), and the American National Standards Institute (ANSI) to monitor and improve the efficiency of industrial processes. Machine safety laws, like the EU Machinery Directives and OSHA regulations in North America, have aided the expansion of the industrial safety product industry.

The Internet of Things is opening up new possibilities for integrated safety & compliance services. Sensors that measure pressure, flow, level, temperature, & vibration can be used by the IIoT to collect data and communicate it to monitoring systems. The data is sent across wired & wireless networks, allowing for real-time analysis, alarms, and potential solutions in the event of an emergency. Companies can combine their operations with safety systems and monitor them in real-time using the IIoT. IIoT allows for quick monitoring, analysis, & control, as well as virtual administration of physical systems, resulting in improved performance.

Overall machine guarding necessitates a risk assessment that includes input from machine operators, maintenance workers, supervisors, engineers, safety specialists, machine guarding experts, & original equipment manufacturer (OEM) representatives, in addition to guard designers. It's hard for a designer to foresee all the dangers involved with equipment setup, operation, inspection, & maintenance on their own. When personnel needs to reach locations inside machine guards, meticulous planning & execution are required. Inadequate risk assessment can also lead to the omission of important requirements for the design and performance of interlock devices and monitoring components like relays and safety-rated programmable logic controllers, which are used for safety while performing substitute safeguarding measures.

Based on Type, the market is segmented into Machine Safety and Worker Safety. The machine safety segment acquired the highest revenue share in the industrial safety market in 2021. Machine safety technologies currently provide greater safety in the processing sectors. Machine safety requirements are becoming increasingly stringent. Stringent safety requirements, high demand for safety systems in the energy & power, oil & gas, and food & beverage industries, and increased demand for reliable safety systems for machine protection are the primary driving drivers of the machine safety market.

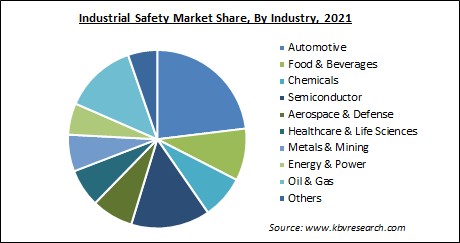

Based on Industry, the market is segmented into Automotive, Food & Beverages, Chemicals, Semiconductor, Aerospace & Defense, Healthcare & Life Sciences, Metals & Mining, Energy & Power, Oil & Gas, and Others. The oil & gas segment garnered a significant revenue share in the industrial safety market in 2021. Drilling and servicing oil & gas wells necessitates the use of a wide range of materials and equipment. To avoid injuries & deaths, it is vital to recognize and control dangers. Transporting workers and equipment to and from well locations safely is essential. Wells are frequently located in remote regions, necessitating lengthy-distance travel to reach them.

Based on Component, the market is segmented into Presence Sensing Safety Sensors, Safety Controllers/ Modules/ Relays, Programmable Safety Systems, Safety Interlock Switches, Emergency Stop Controls, Two-Hand Safety Controls, and Others. The presence sensing safety sensors segment acquired the largest revenue share in the industrial safety market in 2021. This occurred due to the need for security requirements for protecting workers & production units from any mishaps mandated by severe industrial safety rules based on national & international standards. In addition, factors like the growth of the fourth industrial revolution, the rising demand for safety light curtains in the packaging industry powered by robotics, and the rising number of industrial accidents are propelling the demand for presence sensing safety sensors in the industrial safety market.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 6 Billion |

| Market size forecast in 2028 | USD 9.5 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 6.9% from 2022 to 2028 |

| Number of Pages | 300 |

| Number of Tables | 453 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Type, Component, Industry, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. The Asia Pacific region acquired the largest revenue share in the industrial safety market with the in 2021. China & India have already implemented industrial safety in a variety of activities, including oil and gas extraction and electricity generation. With rising industrialization, the acceptance of safety automation solutions in manufacturing industries in this area is increasing rapidly, adding to market growth.

Free Valuable Insights: Global Industrial Safety Market size to reach USD 9.5 Billion by 2028

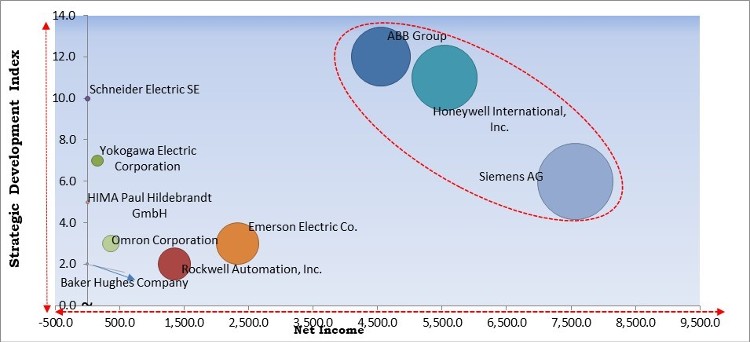

The major strategies followed by the market participants are Partnership. Based on the Analysis presented in the Cardinal matrix; ABB Group, Honeywell International, Inc. and Siemens AG are the forerunners in the Industrial Safety Market. Companies such as Baker Hughes Company, Rockwell Automation, Inc., HIMA Paul Hildebrandt GmbH are some of the key innovators in the Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Omron Corporation, Yokogawa Electric Corporation, HIMA Paul Hildebrandt GmbH, Baker Hughes Company, Emerson Electric Co., Siemens AG, Rockwell Automation, Inc., ABB Group, Honeywell International, Inc., and Schneider Electric SE.

By Type

By Industry

By Component

By Geography

The global Industrial Safety market size is expected to reach $9.5 billion by 2028.

Growing utilization of the Industrial Internet of Things are driving the market in coming years, however, difficult to deal with any machinery-related dangers growth of the market.

Omron Corporation, Yokogawa Electric Corporation, HIMA Paul Hildebrandt GmbH, Baker Hughes Company, Emerson Electric Co., Siemens AG, Rockwell Automation, Inc., ABB Group, Honeywell International, Inc., and Schneider Electric SE.

The expected CAGR of the Industrial Safety market is 6.9% from 2022 to 2028.

The Automotive segment acquired maximum revenue share in the Global Industrial Safety Market by Industry in 2021 thereby, achieving a market value of $1.9 billion by 2028.

The Asia Pacific is the fastest growing region in the Global Industrial Safety Market by Region in 2021, and would continue to be a dominant market till 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.