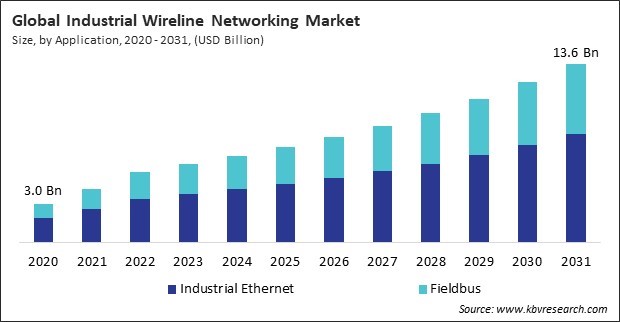

“Global Industrial Wireline Networking Market to reach a market value of 13.6 Billion by 2031 growing at a CAGR of 10.9%”

The Global Industrial Wireline Networking Market size is expected to reach $13.6 billion by 2031, rising at a market growth of 10.9% CAGR during the forecast period.

The rapid industrialization, urbanization, and expansion of manufacturing activities in countries like China, Japan, South Korea, and India have contributed to this strong growth. The region is witnessing increasing adoption of Industry 4.0 initiatives, with smart factories and automated industrial processes becoming more prevalent. Consequently, the Asia Pacific region would acquire nearly 28% of the total market share by 2031.

The substantial demand for more sophisticated networking infrastructures that can accommodate the vast number of connected devices has been generated by the extensive adoption of the Internet of Things (IoT) across industrial sectors. One of the key advantages of wireline networks in IoT setups is their ability to provide low-latency, high-bandwidth communication, which is essential for real-time data exchange. Hence, as IoT continues to expand, the role of wireline networking in ensuring the efficiency, security, and continuity of industrial operations will only become more significant.

Industrial environments, including manufacturing plants, energy grids, and utilities, are becoming prime targets due to their reliance on interconnected networks and automated systems. Given the stakes, there is a growing emphasis on securing data and communication channels within these industrial networks. Thus, as industries continue to expand their digital operations and integrate more connected devices, the demand for secure networking solutions like wireline networks is expected to grow, driven by the need to mitigate the ever-present risk of cyber threats.

However, Wireline systems require extensive physical infrastructure, including cables, conduits, and specialized equipment, unlike wireless networks. The costs are further exacerbated by the logistical challenges associated with deploying wireline networks in remote locations, such as offshore oil platforms or isolated mining operations. Hence, the high costs involved in wireline network installation and maintenance create a significant barrier to widespread adoption.

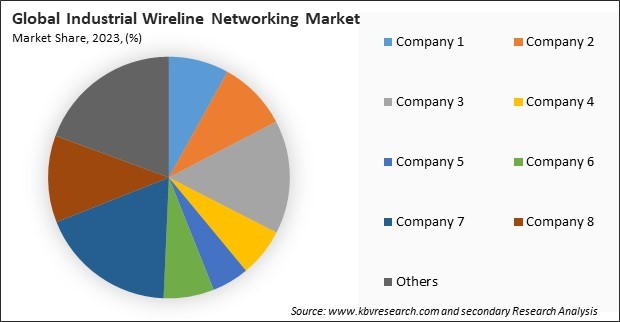

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Acquisitions, and Partnerships & Collaborations.

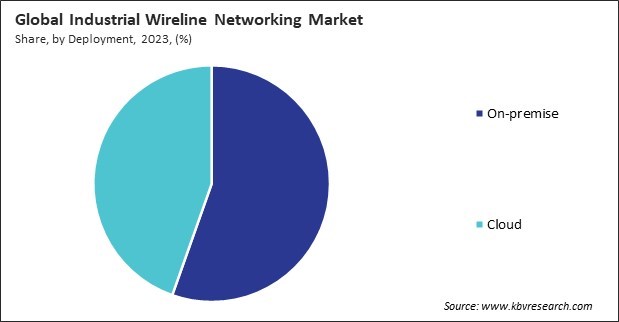

On the basis of deployment, the market is classified into on-premise and cloud. The cloud segment recorded 45% revenue share in the market in 2023. Cloud-based networking solutions have been gaining traction due to their scalability, flexibility, and cost-efficiency. These solutions allow companies to remotely manage their networking infrastructure and data without extensive on-site hardware.

Based on application, the market is bifurcated into industrial Ethernet and fieldbus. The fieldbus segment procured 38% revenue share in the market in 2023. Fieldbus is a well-established technology used in industries where legacy systems still play a crucial role in operations. This technology provides reliable and cost-effective communication solutions, particularly in processes that require stable, low-bandwidth connections.

Free Valuable Insights: Global Industrial Wireline Networking Market size to reach USD 13.6 Billion by 2031

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America segment procured 38% revenue share in the market in 2023. The region's sophisticated industrial infrastructure, high adoption rates of automation, and substantial investments in technologies such as IoT, AI, and smart manufacturing are all contributing factors to its dominance.

| Report Attribute | Details |

|---|---|

| Market size value in 2023 | USD 6.03 Billion |

| Market size forecast in 2031 | USD 13.6 Billion |

| Base Year | 2023 |

| Historical Period | 2020 to 2022 |

| Forecast Period | 2024 to 2031 |

| Revenue Growth Rate | CAGR of 10.9% from 2024 to 2031 |

| Number of Pages | 174 |

| Number of Tables | 239 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Market Share Analysis, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Application, Deployment, Region |

| Country scope |

|

| Companies Included | BCE Inc., Hitachi, Ltd. (Hitachi Energy Ltd.), Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.), Larsen & Toubro Limited, Viavi Solutions, Inc., Amphenol Corporation, Intel Corporation, Siemens AG and Broadcom, Inc. |

By Application

By Deployment

By Geography

This Market size is expected to reach $13.6 billion by 2031.

Growing adoption of the Internet of Things (IoT) are driving the Market in coming years, however, High installation and maintenance costs restraints the growth of the Market.

BCE Inc., Hitachi, Ltd. (Hitachi Energy Ltd.), Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.), Larsen & Toubro Limited, Viavi Solutions, Inc., Amphenol Corporation, Intel Corporation, Siemens AG and Broadcom, Inc.

The expected CAGR of this Market is 10.9% from 2024 to 2031.

The Industrial Ethernet segment led the Market by Application in 2023; thereby, achieving a market value of $8.2 Billion by 2031.

The North America region dominated the Market by Region in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $5 Billion by 2031.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.

Drivers

Drivers

Restraints

Restraints

Opportunities

Opportunities

Challenges

Challenges