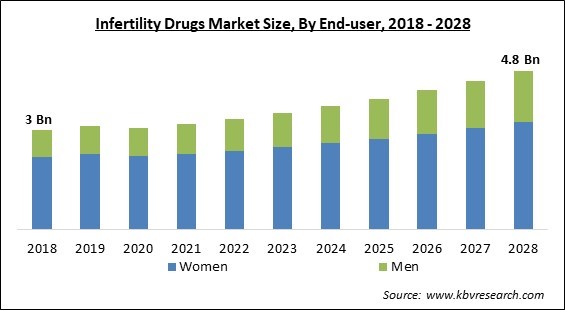

The Global Infertility Drugs Market size is expected to reach $4.8 billion by 2028, rising at a market growth of 6.2 % CAGR during the forecast period.

Medicines used to cure infertility and improve a person's reproductive health are referred to as infertility drugs. They may be ingested or administered intravenously. Gonadotrophins, aromatase inhibitors, selective oestrogen receptor modulators (SERMs), biguanides, dopamine agonists, ovulatory stimulants, and tricyclic antidepressants are a few of the regularly prescribed infertility medications.

Women function by promoting ovulation and ovarian follicle formation, while males support the recovery of testosterone levels and enhance the quality of sperm to promote conception. Infertility medications have been more popular among couples who are not able to conceive current history. The market participants are working to introduce cutting-edge medications for the treatment of infertility.

For example, major firms like Oxolife are now working on the development of the first-in-class product candidate, OXO-001, which enhances the binding to the uterine endometrium's inner lining in order to optimize the embryo implantation process. The creation of such items fills a medical necessity that affects women throughout the globe who undertake assisted reproduction because there is no replacement to enhance the endometrium's circumstances for embryo implantation.

The development of the market may be adversely affected by the availability of potent substitutes for drugs and the rising rate of their adoption. Over 2.5 million IVF operations would reportedly be carried out yearly globally in November 2021, according to a study that was published in the journal Reproductive Biomedicine. Many IVF treatments are fully funded in the majority of European nations. As a result, throughout the projection period, the danger of replacements is anticipated to be significant.

The market was negatively affected by the COVID-19 pandemic. The market for infertility medications was negatively impacted by the supply chain disruption caused by COVID-19 and the delay in the delivery of crucial goods needed for infertility drug manufacturing. Additionally, the global stoppage or postponement of reproductive treatments during COVID-19 hampered the market's expansion. During April 2020 and March 2022, the number of patients seeking infertility treatments at 228 hospitals across 48 states decreased by 83%. The American Society for Reproductive Medicines (ASRM) issued a directive to stop all diagnostic and therapeutic operations, including infertility, in March 2020.

The growing prevalence of infertility or the difficulty of bringing a baby to term throughout the world is what fuels the market for infertility medications. Infertility may be brought on by a number of illnesses that affect both men and women, including diabetes, cystic fibrosis, testicular failure, hormonal imbalances, menopausal disorders, urinary tract infections, pelvic inflammatory disease (PID), endometriosis, ovarian cysts, among others. Smoking, using anabolic steroids, stress, obesity, and other poor lifestyle choices are to blame for the rise in instances of these problems, which also contributes to the need for infertility medications.

Due to growing research and development studies for more efficient treatments to induce conception and deliver live babies, the market for infertility medications is anticipated to expand significantly. For example, a group of researchers at the Eunice Kennedy Shriver National Institute of Child Health and Human Development (NICHD) of the National Institutes of Health (NIH) discovered in 2014 that women treated with letrozole have higher rates of ovulation and live births than women treated with the standard medication, Clomiphene.

Whether women choose to have intrauterine insemination (IUI), in vitro fertilization (IVF), or other types of treatments, fertility medications are a critical component of the treatment process. These drugs are used to encourage the body to produce certain hormones and to balance the levels of other substances. Gonadotropins are administered to encourage a woman's eggs to release once they are mature. The possibility of multiple births, including twins and triplets, ovarian hyperstimulation syndrome (OHSS), and ectopic pregnancy (eggs implanting on the fallopian tubes rather than in the uterus), are all possible adverse effects of this (enlargement of the ovaries).

Based on end-user, the infertility drugs Market is divided into Men and Women. The women segment led the market with the largest revenue share in the market during 2021. This dominance may be related to the widespread accessibility of female infertility medications. In the United States, 11% of women and 9% of males of reproductive age have infertility, according to the U.S. Department of Health and Human Services.

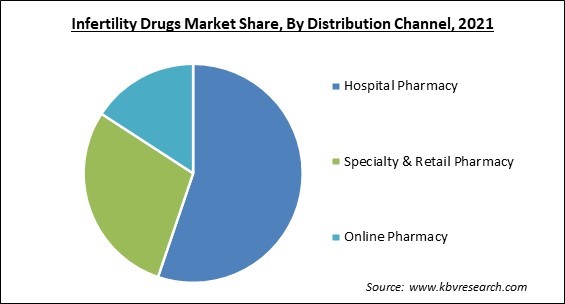

Based on distribution channel, the Infertility Drugs Market is divided into Hospital Pharmacy, Specialty & Retail Pharmacy, and Online Pharmacy. Online Pharmacy generated the significant revenue share during 2021 in the market. The emergence of online clinical chains, which provide patients with scheduled medication deliveries and promote patient discretion owing to the social stigma connected with the ailment, might be credited with the segment's rise.

Based on drug class, the infertility drugs market is classified into Gonadotropins, Aromatase Inhibitors, Selective Estrogen Receptor Modulators (SERMs), Dopamine Agonists, and Others. The gonadotropins segment accounted for the highest revenue share in the market in 2021. This may be ascribed to the expensive nature of the goods and the greater efficacy's effect on increasing consumption. The gonadotropins Gonal-F, Follitism, Menopur, and Bravelle, are some of the most often prescribed for treating infertility in patients.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 3.2 Billion |

| Market size forecast in 2028 | USD 4.8 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 6.2% from 2022 to 2028 |

| Number of Pages | 217 |

| Number of Tables | 360 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Drug Class, Distribution Channel, End-user, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on region, the Infertility Drugs Market is divided into North America, Europe, Asia Pacific, and LAMEA. North America dominated the Infertility Drugs Market in 2021 with the highest revenue share due to the introduction and quick adoption of several infertility medications. It is anticipated that rising infertility research activity in the area would provide additional job possibilities. For instance, Ferring B.V. and Igenomix signed a four-year research agreement in June 2020 to collaborate on the development of innovative therapeutic solutions for the care of patients with disorders associated with pregnancy.

Free Valuable Insights: Global Infertility Drugs Market size to reach USD 4.8 Billion by 2028

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Abbott Laboratories, Bayer AG, Novartis AG, Merck & Co., Inc., Pfizer, Inc., Teva Pharmaceuticals Industries Ltd., Sanofi S.A., Ferring Holdings SA, Organon & Co. and Mankind Pharma Ltd.

By End User

By Distribution Channel

By Drug Class

By Geography

The global Infertility Drugs Market size is expected to reach $4.8 billion by 2028.

Factors Increasing Infertility Cases in Men and Women are driving the market in coming years, however, Possibility of any adverse effects restraints the growth of the market.

Abbott Laboratories, Bayer AG, Novartis AG, Merck & Co., Inc., Pfizer, Inc., Teva Pharmaceuticals Industries Ltd., Sanofi S.A., Ferring Holdings SA, Organon & Co. and Mankind Pharma Ltd.

The Hospital Pharmacy market is leading the segment in the Global Infertility Drugs Market by Distribution Channel in 2021; thereby, achieving a market value of $2.6 billion by 2028.

The North America market dominated the Global Infertility Drugs Market by Region in 2021; thereby, achieving a market value of $1.8 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.