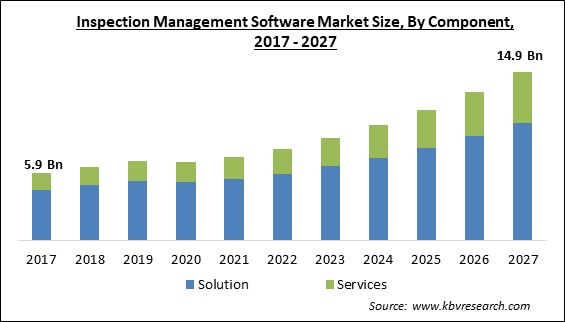

The Global Inspection Management Software Market size is expected to reach $14.9 billion by 2027, rising at a market growth of 12.5% CAGR during the forecast period.

Inspection management software is a digital tool that consists of work order management systems, checklists, and reporting & analytics dashboards. This software is utilized in order to assure the safety of a company's facilities. Inspection management software enables customers to digitalize their inspection process completely or partially, which includes tasks like scheduling checklists, inspections, developing and storing, and monitoring documents. They help enterprises in adhering to health and safety regulations set forth by government agencies such as OSHA.

In addition, Inspections are most essential for an organization for preserving product quality in all organizations. It necessitates a lot of documentation, including recording nonconformances of defective material, checklists, and much more. Moreover, the latest and advanced inspection management software is more efficient and effective than various traditional inspection methods. Organizations must migrate to a cloud-based Inspection management process in order to standardize their inspection processes and achieve applicable regulatory compliance while avoiding product quality and supplier risks at the beginning phases of production to comply with the rapidly evolving trends across the industry. In addition, it allows a user to save a lot of costs, time, and resources while maintaining product quality.

The two wheels on which a firm is balanced are customer safety and satisfaction. Any defect that dissatisfies customers or puts them at risk in any manner can result in product recalls brand erosion and revenue loss. Businesses may personalize the inspection workflow with inspection management software to help identify quality concerns as well as non-conformance, conduct CAPA or Root Cause Analysis as appropriate, and effect continuous operation improvement through a data-driven and collaborative approach.

In addition, inspection management software also connects with the remaining EQMS, resulting in a collaboration system that makes it easier to enlist the help of relevant stakeholders intending to deal with inspection findings.

The COVID-19 outbreak severely impacted various economies across the world. The pandemic significantly demolished all the businesses, including the private and public sectors. In addition, governments all over the world were forced to impose lockdowns in their countries in order to regulate the spread of the novel coronavirus. The lockdown resulted in an industrial shutdown which majorly devastated various manufacturing units across the world. Moreover, Transportation concerns arose as a result of the pandemic, affecting the worldwide supply chain business. In addition, the end-user within the supply chain is looking for suppliers who can deliver high-quality items on time and at a fair price.

Simple forms and checklists are available in inspection management software. Following up on measures such as remedial actions, the inspection management software analyses the results using a robust reporting engine. In addition, inspection management software can also perform various jobs such as creating inspection checklists, assigning inspection frequency and responsibility, tracking in-progress, missed as well as completed inspections, identifying results along with conducting corrective actions and allowing the user to conduct inspections offline as well as online via mobile apps. This software helps in decreasing costs, increasing productivity and efficiency, reducing risks, managing compliances, and standardizing reporting by scheduling inspections, recording results, and tracking corrective actions to completion.

Inspectors and auditors benefit from AR and IoT because they can complete their tasks faster and more correctly. They can look through task instructions, checklists, and troubleshooting methods, as well as seek real-time video help from remote specialists. Inspection management software can be established in as little as one day using no-code workflows or connected into prevailing systems for a complete digital record. AR technology, which provides hybrid, on-premises, and SaaS solutions and establishes a closed-loop in between the real and digital worlds, is used by organizations to transform engineering, production, and servicing.

The entire installation process of inspection management software is costly and can drive organizations into financial difficulties in order to deploy the software. Various factors, such as the utilization of correct materials, work sequences, certain types of equipment, periodic inspections, as well as a higher quality of design, also increases the costs of the entire process. In addition, the installation of inspection management software requires expert services. In addition, inspection software can only be installed by a supplier, manufacturer, or mechanical subcontractor. Moreover, the deployment must adhere to the manufacturer's recommendations as well as the design documentation, code requirements, quality assurance.

Based on Component, the market is segmented into Solution and Services. In 2020, the services segment registered a significant revenue share of the inspection management software market. All of the documents required to complete the inspection procedure are provided by the tool. Inspection management service companies offer a wide range of services, including advice, installation, support, and maintenance. Inspection management software creation, as well as smooth installation, implementation, and maintenance of existing solutions, are provided by these services to end-users. Certain service providers help end-users in developing bespoke solutions for their businesses.

Based on Deployment Mode, the market is segmented into On-premise and Cloud. In 2020, the on-premise segment witnessed the largest revenue share of the inspection management software market. The growth of this segment is attributed to the fact that this method allows the user to track the condition of the site on their own desktops or other systems. The on-premise inspection management systems enable the user to fully control or manage their inspection management software as the software is deployed on the premises of the company.

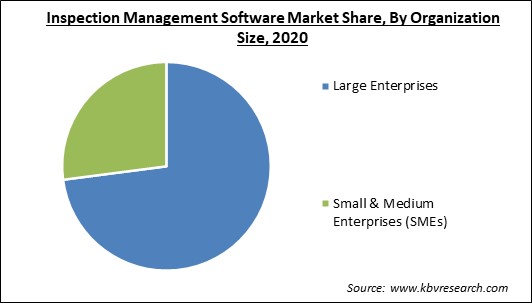

Based on Organization Size, the market is segmented into Large Enterprises and Small & Medium Enterprises (SMEs). In 2020, the large enterprises segment procured the maximum revenue share of the inspection management software market. Change control management, CAPA, market compliance, investigation, audit management, risk management, and training management are included in large organizations' EQMS. This provides all stakeholders with real-time business data, electronic records, as well as signatures.

Based on Vertical, the market is segmented into Healthcare & Lifesciences, Consumer goods & Retail, Transport & Logistics, Manufacturing, Telecom, Aerospace & Defense, and Others. In 2020, the consumer goods and retail segment held a substantial revenue share of the inspection management software market. The increasing growth of the segment is owing to the increasing demand for various goods and services for the consumer goods industry. Due to the rising per capita disposable income of people across the world, the demand for premium and best-in-class products or solutions is growing. In order to meet the demand for high-quality products, numerous companies are deploying inspection management software.

| Report Attribute | Details |

|---|---|

| Market size value in 2020 | USD 6.9 Billion |

| Market size forecast in 2027 | USD 14.9 Billion |

| Base Year | 2020 |

| Historical Period | 2017 to 2019 |

| Forecast Period | 2021 to 2027 |

| Revenue Growth Rate | CAGR of 12.5% from 2021 to 2027 |

| Number of Pages | 290 |

| Number of Tables | 453 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Component, Deployment Mode, Organization Size, Vertical, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. In 2020, Europe procured a significant revenue share of the inspection management software market. The increasing growth of the segment is owing to the rapid growth of the consumer goods sector of the region. Various companies are widely deploying inspection management software in order to fulfill the rising customer demand across the region, hence the regional market is flourishing.

Free Valuable Insights: Global Inspection Management Software Market size to reach USD 14.9 Billion by 2027

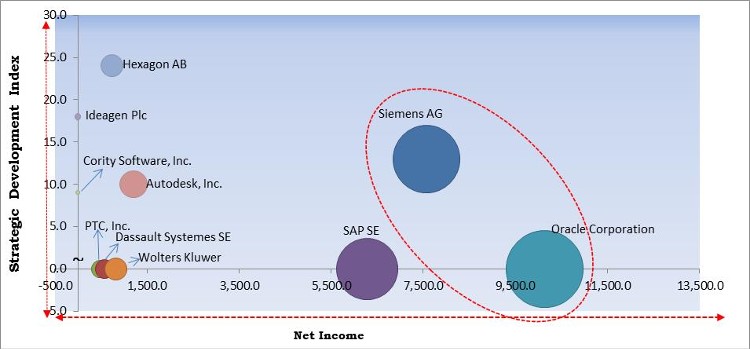

The major strategies followed by the market participants are Product Launches and Partnerships. Based on the Analysis presented in the Cardinal matrix; Siemens AG and Oracle Corporation are the forerunners in the Inspection Management Software Market. Companies such as SAP SE, Hexagon AB and Autodesk, Inc. are some of the key innovators in the Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include SAP SE, Oracle Corporation, Siemens AG, Dassault Systemes SE, Hexagon AB, Wolters Kluwer, Ideagen Plc, Autodesk, Inc., PTC, Inc., and Cority Software, Inc.

By Component

By Deployment Mode

By Organization Size

By Vertical

By Geography

The global inspection management software market size is expected to reach $14.9 billion by 2027.

Increasing penetration of IoT, AR, and cloud technologies across operations are driving the market in coming years, however, high installation cost along with the requirement of expert installation limited the growth of the market.

SAP SE, Oracle Corporation, Siemens AG, Dassault Systemes SE, Hexagon AB, Wolters Kluwer, Ideagen Plc, Autodesk, Inc., PTC, Inc., and Cority Software, Inc.

The Solution segment acquired maximum revenue share in the Global Inspection Management Software Market by Component 2020; thereby, achieving a market value of $10.3 billion by 2027.

The Healthcare & Life sciences segment is leading the Global Inspection Management Software Market by Vertical 2020, thereby, achieving a market value of $4.0 billion by 2027.

The North America is the fastest growing region in the Global Inspection Management Software Market by Region 2020, and would continue to be a dominant market till 2027.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.