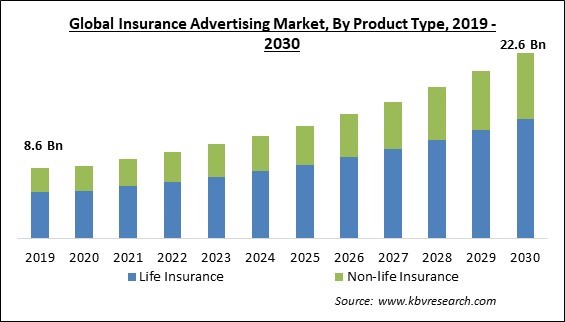

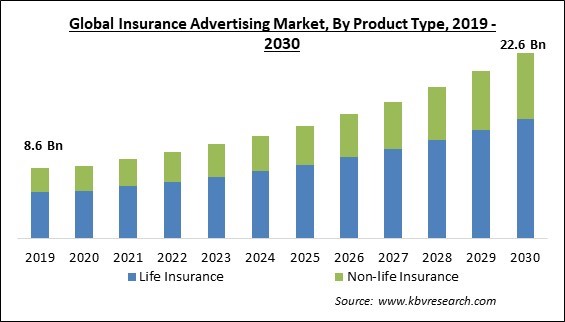

The Global Insurance Advertising Market size is expected to reach $22.6 billion by 2030, rising at a market growth of 10.2% CAGR during the forecast period.

The convenience of online comparison platforms has increased the number of customers seeking insurance, thereby accelerating advertising efforts. Insurers have adopted innovative strategies such as personalized advertisements, retargeting, and collaborations with these platforms to expand their reach. Therefore, the Email segment generated $2468.5 million revenue in the market in 2022. Now, insurance companies invest more in digital advertising to secure prominent positions on these platforms and effectively promote their offerings. Due to the increased competition, companies are creating more interesting and targeted adverts to attract customers' attention. Some of the factors impacting the market are utilizing social media and influencer alliances, increasing penetration of insurance in emerging markets, and complex and variable regulatory environments.

The market for insurance advertising has benefited significantly from leveraging social media and influencer partnerships. Social media platforms provide expansive, highly targeted environments for engaging potential consumers. Insurance firms can increase brand awareness by partnering with influencers with a substantial following and established credibility. In essence, combining social media's expansive reach and influencers' relatability opens up new advertising channels for the insurance industry, capturing previously unexplored markets and establishing an innovative brand. Due to the above factors, the market will grow significantly in the coming years. The expansion of the insurance advertising market is fueled by rising insurance penetration in emergent markets. As more individuals in these regions recognize the significance of insurance coverage, insurance companies are utilizing advertising to attract this expanding consumer base. Increasing awareness about financial security and risk management has increased the proportion of the population with insurance policies or insurance penetration. By effectively communicating the value of insurance, businesses can attract a more extensive consumer base, resulting in increased insurance advertising market growth.

However, the demand for insurance advertising is hampered by complex and diverse regulatory frameworks that vary among regions and countries. These regulations govern the marketing, communication, and sale of insurance products to consumers. In addition, the possibility of noncompliance can result in hefty penalties and reputational harm for a business. These obstacles discourage innovation and originality in insurance advertising. As a result, the market for insurance advertising struggles to adapt rapidly to shifting consumer preferences and technological advancements, limiting its growth potential.

Based on advertising channels, the market is fragmented into television, email, sales calls, and others. The sales call segment garnered a significant growth rate in the market 2022. Insurance sales call advertising promotes insurance products and services through outbound sales calls. This approach involves contacting potential customers by phone to generate leads, offering insurance quotes, and converting leads into policyholders. Effective insurance sales call advertising requires a well-trained and motivated sales team, compliance with regulations, and a focus on delivering value to prospects.

On the basis of product type, the market is segmented into life insurance and non-life insurance. In 2022, the life insurance segment dominated the market with the maximum revenue share. This is because of its inherent relationship to long-term financial planning and security. Life insurance provides an insurance plan for loved ones in the event of an unanticipated loss, making it an integral part of estate planning and assuring the family's well-being. Online advertising and digital marketing have become essential as the insurance industry becomes increasingly digitized. Insurance companies utilize websites, networking sites, email advertising, and SEO to reach a larger audience. The advertising for life insurance is marked by competition, digitalization, targeted marketing, regulatory compliance, and an emphasis on establishing trust and brand recognition.

By application, the market is categorised into direct marketing, network marketing, mobile marketing, and others. In 2022, the direct marketing segment registered the highest revenue share in the market. The reason for direct marketing is its targeted approach and personalized communication. Direct marketing enables insurers to directly communicate with prospective clients, tailoring their messages to individual requirements and preferences, thereby increasing the probability of engagement and conversion. This targeted approach results in efficient resource allocation and a higher return on investment, contributing to the segment’s dominant position.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 10.5 Billion |

| Market size forecast in 2030 | USD 22.6 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 10.2% from 2023 to 2030 |

| Number of Pages | 247 |

| Number of Table | 360 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Product Type, Advertising Channels, Application, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the market is analysed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the North America region witnessed the largest revenue share in the market. Several factors contribute to this, including the region's robust insurance industry, the mature industry with high insurance penetration, and the risk mitigation culture. The presence of well-established insurance companies, coupled with North American consumers' awareness of the significance of insurance, has fueled a consistent demand for insurance products, which will expand the insurance advertising market.

Free Valuable Insights: Global Insurance Advertising Market size to reach USD 22.6 Billion by 2030

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include American International Group, Inc. (AIG), Zurich Insurance Group Ltd., Chubb Limited, Ping An Insurance (Group) Company of China, Ltd., AXA SA, MetLife, Inc., The Progressive Corporation, Allianz Group, Allstate Insurance Company, and Berkshire Hathaway, Inc.

By Product Type

By Advertising Channels

By Application

By Geography

This Market size is expected to reach $22.6 billion by 2030.

Utilizing social media and influencer alliances are driving the Market in coming years, however, Complex and variable regulatory environments restraints the growth of the Market.

American International Group, Inc. (AIG), Zurich Insurance Group Ltd., Chubb Limited, Ping An Insurance (Group) Company of China, Ltd., AXA SA, MetLife, Inc., The Progressive Corporation, Allianz Group, Allstate Insurance Company, and Berkshire Hathaway, Inc.

The expected CAGR of this Market is 10.2% from 2023 to 2030.

The Television segment is leading the Market, By Advertising Channels in 2022; thereby, achieving a market value of $8.9 billion by 2030.

The North America region dominated the Market, By Region in 2022, and would continue to be a dominant market till 2030; thereby, achieving a market value of $7.6 billion by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.