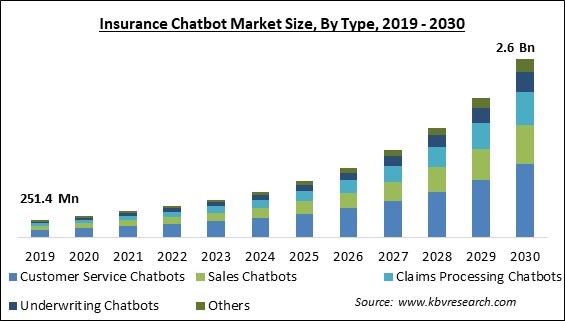

The Global Insurance Chatbot Market size is expected to reach $2.6 billion by 2030, rising at a market growth of 24.9% CAGR during the forecast period.

Text-Based Interface is the mostly used interface of insurance chatbot thus, several businesses have implemented virtual assistants that make use of AI and predictive analytics to let customers communicate via text and speech, hence, Text-based Interface is expected to generate more than 70% share in the market by 2030. With chatbots, organizations can streamline processes and enhance customer experiences at every stage of the relationship with the client, which is becoming increasingly important in providing better customer service. They help users make payments, save money, transfer money, and monitor account balances, all of which raise the standard of services given to customers. Some of the factors impacting the market are growing acceptance of NLP and AI technologies, rising customer demand for automated services, and inaccurate and less capable in cases of managing complex issues.

The insurance industry is increasingly utilizing technologies for artificial intelligence (AI) and natural language processing (NLP). The usage of chatbots for automating an array of insurance-related processes is a logical development of these technologies. When handling their insurance needs, many clients employ self-service solutions like chatbots. Customers may perform simple tasks like submitting a claim or verifying their policy status using chatbots to get quick and easy responses to their questions. As a result of this factor, the market is witnessing growth. However, while chatbots thrive at addressing frequently asked questions and resolving straightforward issues, they may struggle with more complicated issues. The pre-programmed knowledge and practiced facts are what chatbots rely on. A chatbot might be unable to give an appropriate or pertinent response if its knowledge base does not cover the particular problem it is dealing with. As a result, they could offer oversimplified or insufficient solutions to complicated problems.

By user interface, the market is fragmented into text-based interface, and voice-based interface. The test-based interface segment dominated the market with the maximum revenue share. This is attributable to the reason that text-based user interfaces have been developed to handle different languages, enabling insurance companies to provide services to a worldwide clientele. To give users a more interesting and customized experience, firms are also increasingly integrating emoticons and GIFs.

Based on type, the market is segmented into customer service chatbots, sales chatbots, claims processing chatbots, underwriting chatbots, and others. The claims processing chatbots segment garnered a significant revenue share in the market in 2022. One of the most vital tasks an insurance firm performs is processing claims. An insurance company's reputation is significantly impacted by how quickly and easily this process may be completed. Claims made using a chatbot in Messenger are quickly responded to with any delays, and data is kept in predefined document types.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 456.2 Million |

| Market size forecast in 2030 | USD 2.6 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 24.9% from 2023 to 2030 |

| Number of Pages | 189 |

| Number of Table | 270 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Type, User Interface, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region wise, the market is analysed across North America, Europe, Asia Pacific, and LAMEA. The North America region led the market with the maximum revenue share in 2022. This is credited to a surge in individual user demand brought on by a growth in mobile & wireless consumers. Additionally, a rise in the use of BYOD (bring your own device) trends has fuelled the development of remote working in the region and increased demand for insurance chatbots.

Free Valuable Insights: Global Insurance Chatbot Market size to reach USD 2.6 Billion by 2030

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include IBM Corporation, Amazon Web Services, Inc. (Amazon.com, Inc.), Oracle Corporation, Nuance Communications, Inc. (Microsoft Corporation), Verint Systems, Inc., LivePerson, Inc., Inbenta Technologies, Inc., AlphaChat, Botsify and 200 Labs, Inc. (Chatfuel).

By Type

By User Interface

By Geography

The Market size is projected to reach USD 2.6 billion by 2030.

Rising customer demand for automated services are driving the Market in coming years, however, Inaccurate and less capable in cases of managing complex issues restraints the growth of the Market.

IBM Corporation, Amazon Web Services, Inc. (Amazon.com, Inc.), Oracle Corporation, Nuance Communications, Inc. (Microsoft Corporation), Verint Systems, Inc., LivePerson, Inc., Inbenta Technologies, Inc., AlphaChat, Botsify and 200 Labs, Inc. (Chatfuel).

The Customer Service Chatbots segment is leading the Market by Type in 2022 thereby, achieving a market value of $1.1 billion by 2030.

The North America region dominated the Market by Region in 2022 and would continue to be a dominant market till 2030; thereby, achieving a market value of $958.5 million by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.