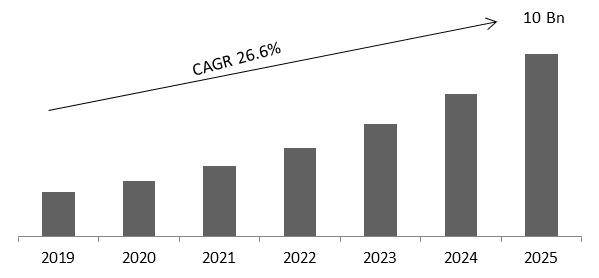

The Global Insurance Fraud Detection Market size is expected to reach $10 billion by 2025, rising at a market growth of 26.6% CAGR during the forecast period.

Insurance fraud takes place when an insurance company, adjuster, agent, or consumer commits a measured fraud to get an unlawful gain. Frauds can also occur when the process of buying, using, selling or underwriting insurance are ongoing. An insurance fraud can be categorized under different kinds of frauds, for example, from fraud against consumers to fraud against insurance companies. Insurance fraud has been evaluated at over a hundred billion dollars every year. It imposes costs on insurance companies and threatens their competitiveness along with financially destroying the customers, economy, and society as a whole.

Insurance Fraud Detection Market Size

The introduction of big data analytics and cloud computing services and the rapid increase in mobile banking are key factors that drive the growth of the fraud detection and prevention market. Cloud infrastructure allows organizations to meet cloud security compliance requirements for encryption, separation of duties, and access control of protected data. In addition, an increase in the generation of enterprise data and its complexity, high industry-specific requirements, and an increase in the incidence of fraud further supplement the fraud detection and prevention market growth.

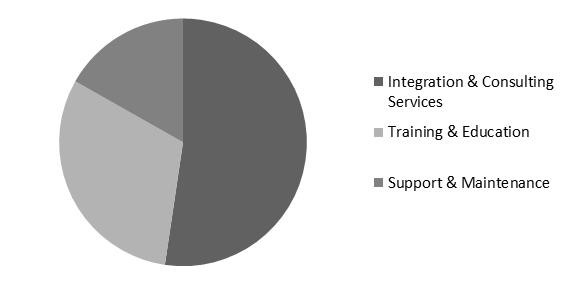

Insurance Fraud Detection Market Share

Based on Component, the market is segmented into Solution and Services. Solution segment is further segmented into Fraud Analytics, Authentication, Governance, and Risk, and Compliance and others. Authentication solution segment is bifurcated into Multi Factor Authentication, Single Factor Authentication and Risk-Based Authentication. Services segment is segmented into Integration and Consulting Services, Training and Education, and Support and Maintenance. Based on Organization Size, the market is segmented into Large Enterprises and Small and Medium Enterprises. ?Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East and Africa.

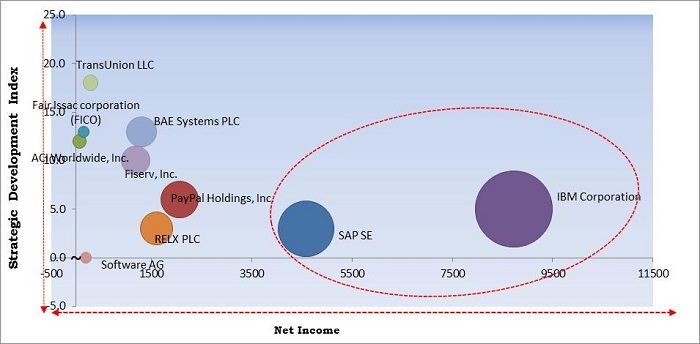

KBV Cardinal Matrix

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include IBM Corporation, Fair Issac Corporation (FICO), SAP SE, PayPal Holdings, Inc., BAE Systems PLC, RELX PLC, Fiserv, Inc., Software AG, ACI Worldwide, Inc. and TransUnion LLC. The major strategies followed by the market participants are Product launches and Partnerships and Collaborations. Based on the Analysis presented in the Cardinal matrix, IBM Corporation, and SAP SE are some of the forerunners in the Insurance Fraud Detection market.

Market Segmentation

By Component

By Organization Size

By Geography

Companies Profiled

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.