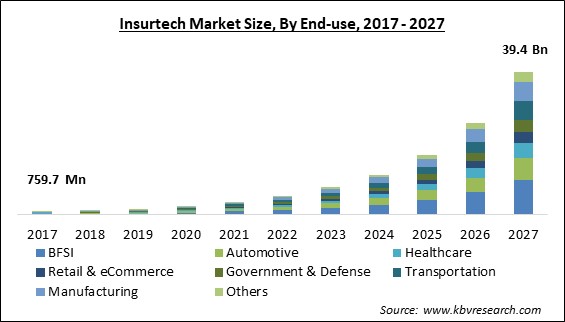

The Global Insurtech Market size is expected to reach $39.4 billion by 2027, rising at a market growth of 48.9% CAGR during the forecast period.

The use of technology in the design, distribution, and administration of insurance products and services is referred to as InsurTech (Insurance Technology). In addition, Insurtech is developing solutions like ultra-customized policies, social insurance, and dynamically pricing premiums utilizing new streams of data from Internet-enabled devices. Insurtech assists insurers in collecting and analyzing consumer data that may be used to target the proper client at an affordable price. Insurtech also aids in creating better projections of consumer demands, purchasing quantities, and decision-making and insurance planning through the usage of machine learning, artificial intelligence, and cloud computing.

One of the primary trends in the industry is the rising number of insurance claims around the world. The most prevalent insurance claims filed by people all across the world are for auto, life, and house. According to the Insurance Barometer's 2021 survey, 36% of American respondents planned to get life insurance in 2021. Moreover, insurance companies are progressively investing in digital technologies to cut costs, increase productivity, and improve the overall client experience.

The worldwide insurance market is predicted to increase significantly over the forecast period as a result of factors such as claim process simplification, improved client communication, and automation capabilities. The health insurance industry is predicted to develop at the fastest rate in the future years, as Insurtech adoption is much higher than in other insurance sectors including property and casualty, car, and others. Companies like Lemonade and Zhong An dominate the insurance market in the property and liability insurance industry. The industry's differentiating elements include its innovations and one-of-a-kind solutions to strengthen the insurance value chain, which are attracting capital from legacy companies and investors throughout the world.

The outbreak of the COVID-19 pandemic had a favorable impact on the Insurtech business, as the importance of insurance plans has skyrocketed among customers. In addition, customers can choose from a variety of insurance policies, including health insurance, home insurance, personal insurance, and more. As a result of the rising demand for insurance policies, insurance carriers' use of advanced technology solutions has expanded fast in the market, allowing them to offer advanced tech-based services to their consumers. As a result, during the global health crisis, demand for Insurtech solutions has skyrocketed.

In 2021, the pandemic of COVID-19 is considered to have a positive impact on market growth. As COVID-19 and its effects have expedited the installation of online platforms and new mobile applications to satisfy consumer expectations, many insurance companies are evaluating their long-term goals and short-term needs. To improve their offerings, a number of insurance companies are forming collaborations with digital solution providers.

Insurance is one of the most conservative sectors, but insurtech firms are bringing transformation in the industry globally. According to Accenture, a consulting and professional services firm, roughly 86 percent of insurers plan to innovate and enhance existing business models in order to meet rising insurance demand and maintain a competitive position by 2020. In addition, as business models change, insurance companies all over the world are turning to innovative digital solutions to expand their operations and provide a more tailored consumer experience. Digital technology is disrupting business after industry. The majority of insurers, on the other hand, do not have innovation in their Genes. Regulators have hampered incumbents' capacity to experiment, while a lack of competition has made it unnecessary for them to do so.

The new wave of "Insurtech" solution providers is attempting to alter the insurance industry by using Big Data, Machine Learning, and AI capabilities. When insurance companies use the massive libraries of Big Data at their disposal and combine it with machine learning and AI skills, they may create new plans that appeal to new audiences. The majority of traditional insurance businesses do not use a lot of data when developing their policies. They rely on demographic data that is at least 40 years old. In addition, they are having difficulty appropriately pricing policies, and many may miss out on significant financial gains. To adapt to shifting customer demographics and tastes, insurance businesses must develop.

Different laws establish different norms and rules in different countries, with financial centers adopting a more uniform approach to regulation. This becomes a critical issue for insurtech businesses to develop solutions across several regulations like MiFID II, GDPR, and others, which causes inter-regulation conflict, thereby posing a major challenge for the solutions vendors. Moreover, vendors have to be conscious of the existing as well as the current norms and regulations while innovating new solutions. Failing to meet these regulations can impose a heavy penalty on these vendors which is a big threat to the market growth.

Based on Component, the market is segmented into Solution and Services (Managed Services, Consulting, and Support & Maintenance). In 2020, the Managed Services segment obtained the highest revenue share of the Insurtech Market. By combining experience and talent with new technologies, managed services providers may provide insurers with a methodical path to change. Insurers can also benefit from the best processes, practices, and regulatory concerns of managed services providers. Simultaneously, managed services help insurers to solve IT and operations challenges and possibilities. Moreover, insurers have begun to recognize and embrace the value of better business models, resulting in chances for the managed services industry to grow.

Based on End-use, the market is segmented into BFSI, Automotive, Healthcare, Retail & eCommerce, Government & Defense, Transportation, Manufacturing, and Others. The Automotive segment collected a significant revenue share of the Insurtech Market in 2020. Insurance companies are embracing digital transformation to address the challenges that claimants frequently face in filing their claims. Vehicle insurance is one of the most expensive insurance industries, and as a result, numerous Insurtech firms are devising strategies to reduce overall costs. Startups that provide Insurtech services are reinventing the entire insurance process and developing solutions that increase transparency between insurers and customers.

Based on Technology, the market is segmented into Cloud Computing, IoT & Machine Learning, Blockchain, Robo Advisory, and Others. In 2020, the Cloud Computing segment garnered the largest revenue share of the Insurtech Market. With its efficiency, ease of deployment, and flexibility, cloud computing has revolutionized the insurance sector. The expansion is projected to be fueled by the universal popularity of Bring Your Own Device (BYOD) rules, as well as the growing amount of data that insurance companies collect. Benefits like rapid deployment, cost-effectiveness, and scalability are driving insurance businesses to use cloud computing technologies. Moreover, partnerships between cloud computing solution vendors and insurance firms, on the other hand, are assisting companies in improving their insurtech products, which is projected to boost the market growth.

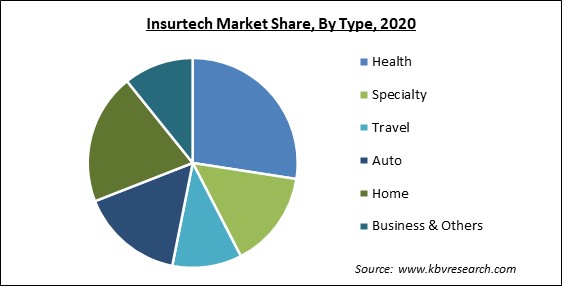

Based on Type, the market is segmented into Health, Specialty, Travel, Auto, Home, and Business & Others. The Home segment collected a significant revenue share of the Insurtech Market in 2020. This is due to the fact that several home insurance companies are developing new products for commercial and residential real estate agents, as well as their renters and residents. For a speedier list-to-lease time, these companies are implementing insurtech solutions. Without the need for insurance brokers, these solutions leverage AI technology to build and provide customized insurance policies as well as quickly handle claims for customers. Farmers Insurance, for example, incorporated Zesty.ai's wildfire risk score algorithm into their homeowner insurance underwriting processes in June 2021. The former company hopes to use this relationship to take an innovative strategy to manage its wildfire risk by assessing individual wildfire hazards to homes.

| Report Attribute | Details |

|---|---|

| Market size value in 2020 | USD 2.4 Billion |

| Market size forecast in 2027 | USD 39.4 Billion |

| Base Year | 2020 |

| Historical Period | 2017 to 2019 |

| Forecast Period | 2021 to 2027 |

| Revenue Growth Rate | CAGR of 48.9% from 2021 to 2027 |

| Number of Pages | 339 |

| Number of Tables | 623 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Component, End-use, Technology, Type, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. In 2020, North America emerged as the leading region in the overall Insurtech Market by obtaining the highest revenue share. The massive revenue share of the regional market can be attributed to the high customers are spending on insurance-related products. In addition, these solutions provide customizable and adaptable property and health insurance options. Moreover, the regional market is home to many existing and emerging insurance companies that are leaning towards the utilization of advanced technologies to provide seamless customers and reduce manual work.

Free Valuable Insights: Global Insurtech Market size to reach USD 39.4 Billion by 2027

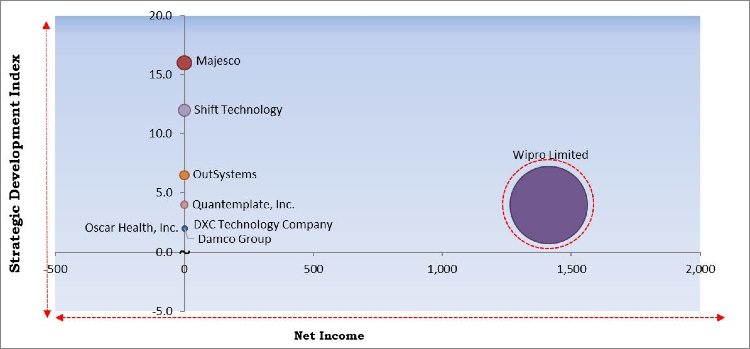

The major strategies followed by the market participants are Partnerships. Based on the Analysis presented in the Cardinal matrix; Wipro Limited is the major forerunner in the Insurtech Market. Companies such as Majesco, OutSystems, Shift Technology are some of the key innovators in the Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Wipro Limited, DXC Technology Company, Oscar Health, Inc., Majesco, Insurance Technology Services, OutSystems, Shift Technology, Quantemplate, Inc., and Damco Group.

By Component

By End-use

By Technology

By Type

By Geography

The global insurtech market size is expected to reach $39.4 billion by 2027.

Growing digitalization and emerging trends among insurance companies are driving the market in coming years, however, changes in the legal and regulatory environment have limited the growth of the market.

Wipro Limited, DXC Technology Company, Oscar Health, Inc., Majesco, Insurance Technology Services, OutSystems, Shift Technology, Quantemplate, Inc., and Damco Group.

Yes, COVID-19 and its effects have expedited the installation of online platforms and new mobile applications to satisfy consumer expectations, many insurance companies are evaluating their long-term goals and short-term needs.

The Solution segment acquired the maximum revenue in the Global Insurtech Market by Component in 2020, thereby, achieving a market value of $22.8 billion by 2027.

The North America market dominated the Global Insurtech Market by Region in 2020, and would continue to be a dominant market till 2027; thereby, achieving a market value of $13.2 billion by 2027.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.