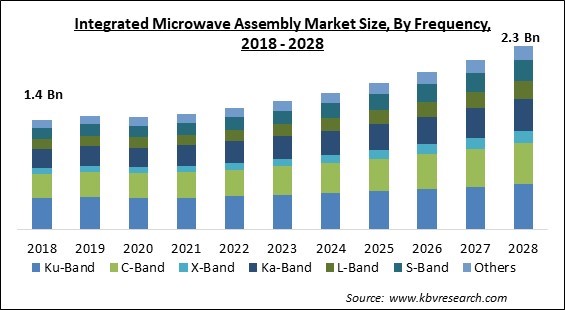

The Global Integrated Microwave Assembly Market size is expected to reach $2.3 billion by 2028, rising at a market growth of 7.1% CAGR during the forecast period.

Microwave components like attenuators, oscillators, switches, amplifiers, filters, couplers, and mixers, as well as the supporting electrical circuitry, are all combined into one overall assembly in these devices. The growth in data volumes and diversification of the variety of application domains would require 5G capability in mobile as well as wireless communication systems. 5G systems are based on the advancement of existing technologies, as well as novel radio concepts that are built to satisfy new and challenging needs.

Essential services like e-banking, e-learning, and e-health would continue to grow in popularity and become more convenient to use on mobile devices. Interactive television, Video on Demand, and broad wireless internet content, which would gradually be supplied over mobile and wireless technologies, have been the subject of evolutionary research. These advancements can result in a tidal wave of mobile and wireless traffic, which is expected to multiply 1,000-fold during the coming years. Additionally, some applications would place extra and highly diversified demands on mobile and wireless communication systems, which 5G must accommodate.

For a long period, numerous countries have embraced four generations of cellular communication systems, with each new generation appearing every 10 years or so. Existing base station designs must support many bands with numerous cell sites, with each site having multiple base stations.

With the International Telecommunications Union (ITU) ratifying the IMT-Advanced (IMT-A) standards and IMT-A, i.e., the fourth generation, wireless communication systems being deployed around the world, the 5G mobile and wireless communication technologies are finding their applications in a number of research fields. With the continued increase of Internet traffic, unprecedented numbers of heterogeneous and smart wireless devices will access forthcoming 5G wireless and mobile communication systems on the basis of the Internet Protocol Architecture of fourth-generation communication systems. As a result, contrasted to 4G communications networks, 5G communication systems are anticipated to have much greater wireless transmission speeds, like 10 Gbps peak data rates with 810 bps/Hz/cell.

The COVID-19 pandemic caused a severe impact on various economies all over the world. Several businesses were significantly devastated as a result of the outbreak of the COVID-19 infection. In addition, the governments of several countries were forced to impose lockdowns in their nations. As a result, the manufacturing units of numerous goods were temporarily shut down. Moreover, these lockdowns also caused a major disruption in the supply chain of various goods. Further, the COVID-19 led the worldwide healthcare industry to a significant failure due to the shortage of beds and oxygen in hospitals.

The growing tension among two or more than two countries, such as the oil price war between Russia and Saudi Arabia and the drawdown of US military forces across Afghanistan, the global political environment is likely to remain unpredictable for a long time. To address this issue, regulatory agencies in several countries are requesting increased resources from their respective governments. Although defense expenditure around the world fell during the COVID-19 pandemic as governments focused their efforts on containing the virus and offering emergency aid, they may see a significant increase in the post-pandemic period.

The defense sector is expanding due to the rising usage of network-centric warfare, or NCW, technologies. In order to obtain complete situational awareness and perfect synchronization between responders and sensors in a fast-paced environment, NCW was developed by the US military and needs a thorough integration of communication networks, sensors, command centers, and associated platforms. The integration of the bare minimum of information that must be transmitted is the objective of NCW.

Despite all the advantages that are being offered by integrated microwave assembly, there are a few drawbacks that can hamper the overall operation and final outcome of the product. One of the major hurdles in the operation of integrated microwave assembly is the complexities that incur in devices. In electronic circuits, the integrated microwave assembly is made up of active components such as transistors and tubes, as well as passive components like resistors, isolators, and filters. As a result, architectural intricacy also generates complexities in comprehending the process of the operation of microwave goods, resulting in inefficient final outcomes.

Based on Frequency, the market is segmented into Ku-Band, C-Band, X-Band, Ka-Band, L-Band, S-Band, and Others. In 2021, the Ku-band segment acquired the highest revenue share of the integrated microwave assembly market. The Ku-band, also called Kurz beneath, covers the frequency range of 12 to 18 GHz in the mid-frequency spectrum. It is utilized for satellite communication, particularly direct broadcast for television, the space shuttle, and marine and industrial control systems. The ability to modify the uplink and downlink, as well as the lower cost, is anticipated to augment the employment of integrated microwave assembly devices with Ku-band frequencies. The benefits of this band, like faster connection speeds, more bandwidth, and clearer images and audio, make it an excellent choice for satellite communication.

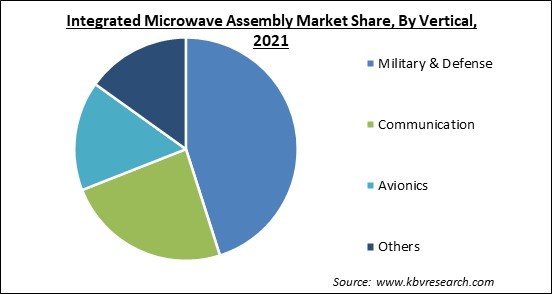

Based on Vertical, the market is segmented into Military & Defense, Communication, Avionics, and Others. In 2021, the communication segment garnered a substantial revenue share of the integrated microwave assembly market. The rapidly surging growth of this segment is attributed to the increasing demand for enhanced and effective communication technologies in the telecommunication and IT organizations. In addition, governments across various developing and developed countries all over the world are increasing their investment in the IT and telecommunication sector, which would propel the growth of the integrated microwave assembly market in this vertical.

Based on Product, the market is segmented into Amplifiers, Frequency Converters, Oscillators, Frequency Synthesizers, Transceivers, and Others. In 2021, the amplifiers segment procured the largest revenue share of the integrated microwave assembly market. Amplifiers are in high demand due to rapid changes in the infrastructure of the telecom sector as the industry shifts to 5G technology while also expediting the penetration of 4G/LTE connectivity. For new technologies like 5G and LTE to gain traction, more cell sites are required, resulting in a surge in the demand for base stations as well as backhaul equipment to serve these sites. This factor is majorly responsible for the increasing growth of the segment.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 1.5 Billion |

| Market size forecast in 2028 | USD 2.3 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 7.1% from 2022 to 2028 |

| Number of Pages | 266 |

| Number of Tables | 434 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Product, Frequency, Vertical, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. In 2021, Asia-Pacific held a significant revenue share of the integrated microwave assembly market. The growth of the regional market is expediting due to various factors, including higher adoption rate of smartphones, the increasing requirement for high-speed mobile technologies including 5G, higher usage of social media as well as e-commerce platforms, and growing military expenditures by various regional countries across Asia-Pacific, such as India, China, and Japan.

Free Valuable Insights: Global Integrated Microwave Assembly Market size to reach USD 2.3 Billion by 2028

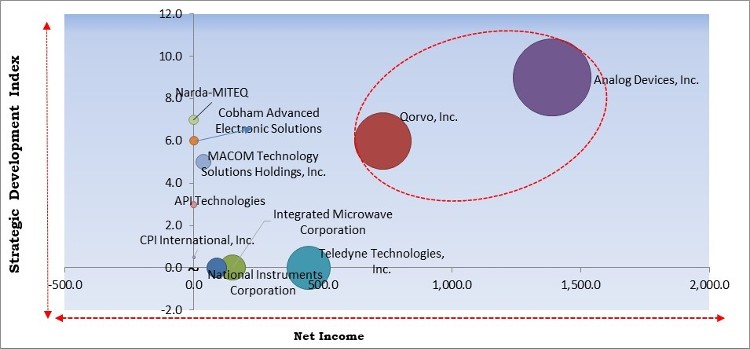

The major strategies followed by the market participants are Partnerships. Based on the Analysis presented in the Cardinal matrix; Analog Devices, Inc. and Qorvo, Inc. are the forerunners in the Integrated Microwave Assembly Market. Companies such as MACOM Technology Solutions Holdings, Inc., Cobham Advanced Electronic Solutions, Teledyne Technologies, Inc. are some of the key innovators in the Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Analog Devices, Inc., Teledyne Technologies, Inc., National Instruments Corporation, Qorvo, Inc., MACOM Technology Solutions Holdings, Inc., Cobham Advanced Electronic Solutions, CPI International, Inc., API Technologies, Integrated Microwave Corporation (Knowles Precision Devices) (Knowles Corporation), and Narda-MITEQ (J.F.Lehman & Company).

By Frequency

By Vertical

By Product

By Geography

The global integrated microwave assembly market size is expected to reach $2.3 billion by 2028.

Growing investment in the defense and military sector are increasing are driving the market in coming years, however, complexities in the operation of these devices growth of the market.

Analog Devices, Inc., Teledyne Technologies, Inc., National Instruments Corporation, Qorvo, Inc., MACOM Technology Solutions Holdings, Inc., Cobham Advanced Electronic Solutions, CPI International, Inc., API Technologies, Integrated Microwave Corporation (Knowles Precision Devices) (Knowles Corporation), and Narda-MITEQ (J.F.Lehman & Company).

The expected CAGR of the integrated microwave assembly market is 7.1% from 2022 to 2028.

The Military & Defense segment acquired maximum revenue share in the Global Integrated Microwave Assembly Market by Vertical in 2021, thereby, achieving a market value of $1.0 billion by 2028.

The North America is the fastest growing region in the Global Integrated Microwave Assembly Market by Region in 2021, and would continue to be a dominant market till 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.